In 2026, the economic climate has made aggressive debt management a necessity for millions of households. High interest rates on standard credit cards often exceed 24%, making it nearly impossible to lower the principal balance. Using the best balance transfer cards is the most effective way to halt this cycle. By moving high-interest debt to a card with a 0% introductory APR, you effectively freeze interest charges. This allow every dollar you pay to reduce your actual debt rather than just covering monthly interest.

Here’s an overview

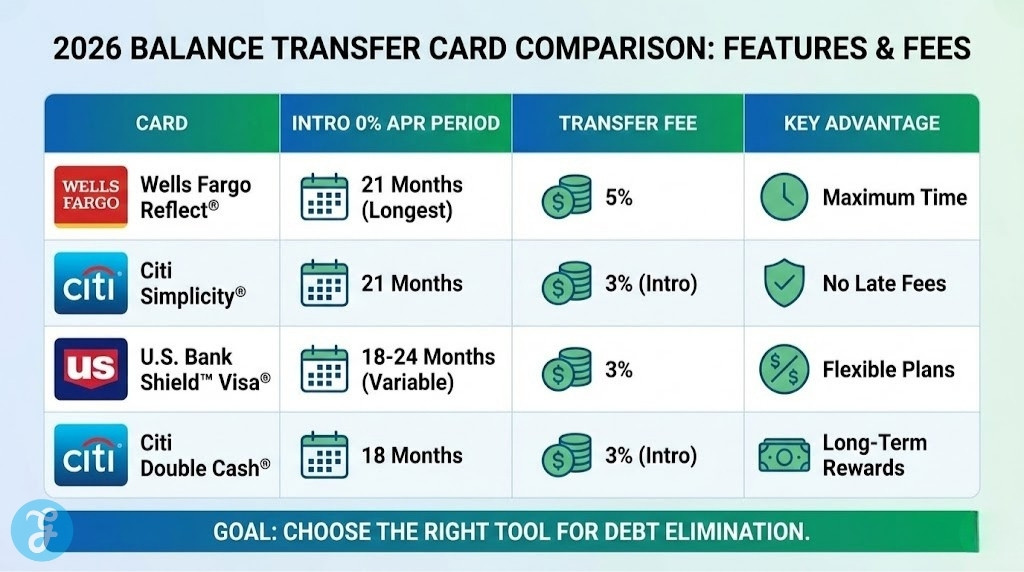

| Card Name | Intro 0% APR Period | Transfer Fee | Best For |

| Wells Fargo Reflect® | 21 Months | 5% | Longest Window |

| Citi Simplicity® | 21 Months | 3% (Intro) | No Late Fees |

| U.S. Bank Shield™ | 21 Months | 3% | Security Perks |

| BankAmericard® | 18 Months | 3% | Established Customers |

The 4 Best Balance Transfer Cards to Kill Debt in 2026

For individuals carrying significant balances, the length of the introductory period is the most important factor. These four cards are currently the best balance transfer cards because they offer the longest windows available in 2026. This extended time is vital for those who need nearly two years to reach a zero balance.

1. Wells Fargo Reflect® Card

The Wells Fargo Reflect® Card remains the top choice for those seeking the longest possible interest-free period. It offers a 21-month 0% introductory APR on both purchases and qualifying balance transfers. This long duration is a massive advantage. It allows you to spread out payments for nearly two years without a single cent of interest accruing. For many, this is the difference between staying in debt and finally becoming free.

The card also includes some helpful lifestyle perks. You get up to $600 in cell phone protection if you pay your monthly bill with the card. This adds value beyond just debt repayment. However, the primary draw remains the 21-month window. This is the current industry ceiling for 0% offers. It makes the Reflect a cornerstone in the list of the best balance transfer cards.

Best For: Individuals with large balances who need the maximum amount of time to pay them off.

Pros:

- Longest Period: 21 months of 0% interest is unrivaled in the 2026 market.

- Simplicity: No rewards program to distract from the goal of debt repayment.

- Extra Protection: Includes cell phone insurance which is a rare perk for this card type.

Cons:

- The balance transfer fee is 5% which is slightly higher than some introductory offers.

2. Citi Scimplicity® Card

The Citi Simplicity® Card is designed for those who want a worry-free repayment experience. It matches the top-tier 21-month 0% introductory APR on balance transfers. What makes it unique is its lenient fee structure. This card has no late fees and no penalty interest rates. If you accidentally miss a payment deadline, you will not be hit with a massive fee or lose your 0% rate. This safety net is invaluable for people managing complex finances.

It is important to note that the 0% APR on purchases is usually shorter than the transfer period. This reinforces the idea that this card should be used primarily for debt consolidation. By utilizing the 21-month window, you can systematically chip away at your debt. This makes it one of the best balance transfer cards for those who prioritize peace of mind over everything else.

Best For: People who want a safety net against late fees while paying down large debts.

Pros:

- No Penalties: No late fees or penalty APRs ever.

- Low Intro Fee: Often features a 3% fee for transfers made in the first four months.

- Extended Reach: 21 months provides ample time for aggressive repayment plans.

Cons:

- Does not offer any cash back or travel rewards.

3. U.S. Bank Shield™ Visa® Card

The U.S. Bank Shield™ Visa® Card has emerged as a powerhouse in the 2026 debt-repayment market. It offers a competitive 21-month 0% introductory APR on balance transfers and purchases. Beyond the interest-free window, it provides several high-tech security features. Users get access to their credit score and dark web monitoring. This helps you keep an eye on your financial health as you work toward your goal.

This card is particularly useful for those who want a modern digital experience. The U.S. Bank app allows for easy tracking of your repayment progress. It also offers “ExtendPay,” which lets you put large purchases into a separate payment plan. This versatility, combined with the long intro period, makes it one of the best balance transfer cards for tech-savvy consumers.

Best For: Users who want a long interest-free window along with modern security and tracking tools.

Pros:

- Dual Offer: 21 months of 0% interest on both transfers and new purchases.

- Security Perks: Includes identity theft protection and credit monitoring.

- No Annual Fee: Does not cost anything to keep in your wallet.

Cons:

- Requires a very high credit score for the best terms and limits.

4. BankAmericard® credit card

The BankAmericard® is a straightforward and reliable tool for debt reduction. It offers an 18-month 0% introductory APR on balance transfers. While this is slightly shorter than the 21-month cards, it often comes with a lower entry barrier for existing Bank of America customers. The card is designed to be a pure debt-repayment vehicle. It has no rewards and no distractions.

For those who already have an account with this bank, the application process is often faster. You can manage your debt alongside your checking and savings accounts in one app. This convenience is a major factor for many. Even with an 18-month window, it remains one of the best balance transfer cards for those who can pay off their debt in a slightly shorter timeframe.

Best For: Existing Bank of America customers who want a simple and integrated debt tool.

Pros:

- Lower Fees: Often features a 3% balance transfer fee which saves money upfront.

- Simple Interface: Easy to manage via a high-rated mobile app.

- No Penalty APR: Late payments will not automatically spike your interest rate.

Cons:

- The 18-month window is shorter than the 21-month industry leaders.

How to Maximize Your Balance Transfer

Moving your debt to one of the best balance transfer cards is only the first step. To ensure you actually kill the debt, you must have a technical strategy.

-

[ ] Calculate the Fee: A 3% to 5% fee is added to your balance. Make sure the interest you save is higher than this fee.

-

[ ] Check the Limit: Your new card might not have a high enough limit to cover your entire old balance.

-

[ ] Automate Payments: Set up auto-pay for a fixed amount that will result in a zero balance by the end of the intro period.

-

[ ] Hide the Card: Do not use the new card for daily spending. This only adds to the debt you are trying to clear.

Still can’t make up your mind?

| Debt Amount | Monthly Payment (21 Months) | Best Card Match |

| $2,000 | ~$95 | BankAmericard |

| $5,000 | ~$238 | U.S. Bank Shield |

| $10,000 | ~$476 | Wells Fargo Reflect |

| $15,000+ | ~$715+ | Citi Simplicity |

Wrap-Up: Reclaiming Your Financial Freedom

Using the best balance transfer cards is a powerful way to take control of your finances in 2026. By stopping interest for 18 to 21 months, you give yourself the breathing room needed to make real progress. Whether you choose the massive window of the Wells Fargo Reflect or the safety of Citi Simplicity, the goal remains the same. You must be disciplined and consistent. If you commit to a monthly plan today, you could be completely debt-free by 2028.