We often opt for a Personal Loan during a financial emergency or manage our unplanned expenses. However, it’s essential to learn about the repayment structure before applying for a Personal Loan. Typically, loans with a big repayment amount can add additional stress and make things challenging.

This is where a Personal Loan EMI calculator can help you. In this blog, we shall understand what a Personal Loan EMI calculator is and how it can help you manage your finances better.

What is a Personal Loan EMI calculator?

Before diving into the benefits, let’s understand how a Personal Loan EMI calculator works. An EMI calculator is designed to estimate the Equated Monthly Instalments (EMI, based on your loan amount, tenure, and interest rate. With the help of an EMI calculator, you get a clear idea of how much you will need to pay each month to plan your expenses better.

Top benefits of using an EMI Calculator for Personal Loans

Offers correct estimation

While you can manually calculate your EMI, there may be a chance of errors. Hence, it’s wise to avoid relying on manual calculations and instead use a Personal Loan EMI calculator for accurate and reliable results.

The process is simple. Just put the loan amount, interest rate, and the tenure and your job is done. This EMI calculator tool will instantly show the exact estimation based on the given information.

Let’s you plan your budget accurately

Using this EMI calculator tool helps you plan your expenses more accurately by estimating your repayment structure in advance. This allows you to assess whether the EMI is affordable to you.

For instance; if your monthly income is ₹1,00,000 and the EMI calculator shows that your repayment will be around ₹10,000, you can decide if taking the loan fits your financial capacity.

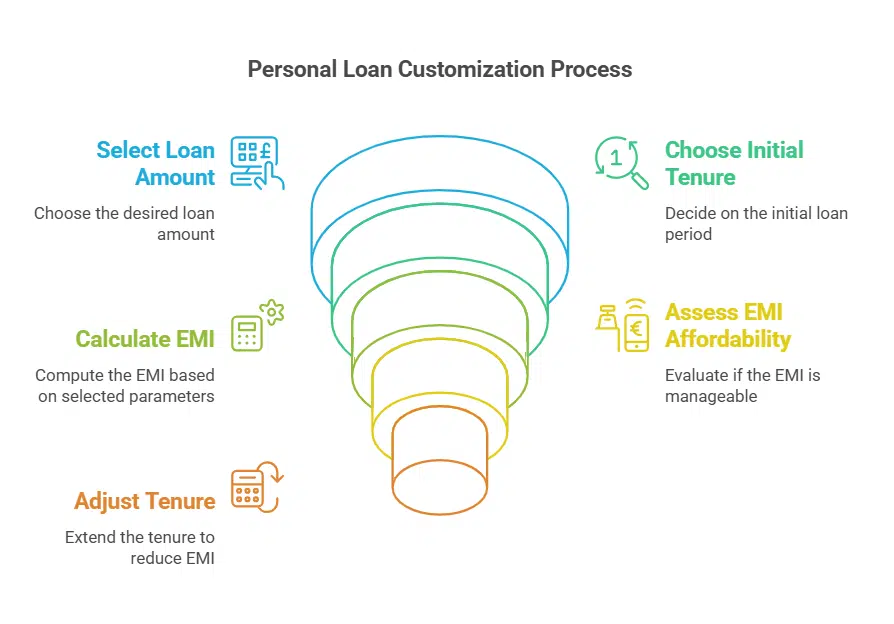

Allows loan customisation

This Personal Loan EMI calculator allows you to customise your loan’s amount and tenure according to your capability.

For example; if you realise that the EMI for a 1 year loan is too high, you can just alter the tenure and extend it up to 3 years and again check the EMI estimation. This might lower your EMI and make repayment a little more convenient for you.

Promotes financial literacy

By using an EMI calculator you can understand how the loan amount, tenure, and interest rate influences your EMI. This not only helps you make an informed decision but also spreads financial awareness.

Helps you choose the most suitable loan

As an EMI calculator allows you to estimate your repayment amount earlier, you have the choice to decide whether this loan suits your financial capability or not.

This way, you can select a loan tenure and amount that won’t burden your monthly budget and ensure a manageable and stress-free repayment process.

Saves a lot of time

Calculating your EMI manually is a time-consuming and complex process while a Personal Loan EMI calculator is overly simple and works faster.

So, by using this EMI calculator, you can save a lot of time and get accurate estimations faster.

Offers accuracy without financial expertise

To calculate your EMI amounts through an EMI calculator, you don’t need to be a financial expert. Most banks have user-friendly Personal Loan EMI calculators that offer accuracy without any financial expertise.

Final Thoughts

Today, calculating your EMI is easier than ever. Not only does it provide a clear estimate of your monthly payments, but it also streamlines the entire calculation process.

So, before submitting your loan application, always use this EMI calculator. It will help you plan your budget wisely and help you make an informed decision faster.