In a country like India, where a significant portion of the population falls under low-income groups, financial security remains a major concern. Unexpected expenses, medical emergencies, or job loss can throw a household into financial distress.

This is where microinsurance plays a crucial role. Designed specifically for individuals with limited income, microinsurance offers affordable financial protection against uncertainties.

Microinsurance serves as a bridge to financial inclusion, enabling marginalized communities to access essential services without worrying about high costs. With its low premiums, simplified claim process, and widespread accessibility, microinsurance has become a game-changer in securing financial stability for millions.

In this article, we will explore the top 7 benefits of microinsurance for low-income groups in India, shedding light on its significance, accessibility, and impact on financial well-being.

What is Microinsurance?

Microinsurance plays a critical role in providing financial protection to low-income individuals, ensuring that they have access to essential services without bearing a heavy financial burden. By offering affordable insurance options tailored to the needs of economically vulnerable communities, microinsurance bridges the gap between financial insecurity and stability.

This type of insurance empowers individuals by covering risks such as health emergencies, accidents, and property loss, thereby safeguarding their financial future.

Definition and Concept

Microinsurance is a type of insurance product tailored for low-income individuals who may not afford traditional insurance plans. It offers coverage against risks such as health issues, accidental death, crop failure, and property loss. The goal is to provide financial security through affordable premiums and simplified claim processes.

Key Features of Microinsurance

| Feature | Description |

| Low Premium Costs | Affordable for low-income individuals. |

| Simplified Process | Easy enrollment and claims settlement. |

| Coverage for Multiple Risks | Includes health, life, and livelihood protection. |

| Customizable Plans | Tailored policies to suit individual needs. |

| Government and NGO Support | Often backed by regulatory frameworks. |

The Growing Need for Microinsurance in India

India’s low-income groups often lack access to formal financial services, making them highly vulnerable to financial instability. The absence of a robust safety net leaves them exposed to medical emergencies, natural disasters, and unforeseen economic challenges. Microinsurance emerges as a powerful tool to mitigate these risks, providing financial support tailored to their needs.

Here’s why microinsurance is essential:

- High Out-of-Pocket Medical Expenses: Over 60% of India’s healthcare expenses are paid out-of-pocket, leading many to financial distress. Many families struggle to afford even basic healthcare, making microinsurance a critical solution.

- Vulnerability to Natural Disasters: Farmers and laborers face climate-related risks, making microinsurance crucial. Unpredictable monsoons, droughts, and floods can wipe out their entire livelihood without adequate protection.

- Lack of Financial Awareness: Many individuals remain uninsured due to limited knowledge. A significant portion of the population does not understand insurance benefits, requiring targeted awareness campaigns.

- Government Initiatives: Programs like PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana) and PMSBY (Pradhan Mantri Suraksha Bima Yojana) promote microinsurance. These schemes play a key role in expanding coverage and ensuring accessibility to financial protection for millions.

Top 7 Benefits of Microinsurance for Low-Income Groups in India

Microinsurance has proven to be a vital tool in ensuring financial stability for low-income groups in India. By offering affordable coverage for life, health, and livelihood protection, it safeguards individuals from unexpected economic hardships. Here, we discuss the most significant benefits of microinsurance and how it helps in empowering the financially vulnerable population.

1. Financial Protection Against Uncertainties

One of the biggest benefits of microinsurance for low-income groups in India is financial security. Life is unpredictable, and events like medical emergencies, property damage, or job loss can have devastating consequences.

How Microinsurance Helps:

- Covers unforeseen medical expenses.

- Provides compensation for accidental death or disability.

- Offers protection against natural disasters affecting livelihoods.

| Type of Coverage | Key Benefit |

| Health Insurance | Covers hospitalization and medical bills. |

| Life Insurance | Provides financial support to dependents in case of death. |

| Crop Insurance | Protects farmers from crop loss due to climate issues. |

2. Affordable Premiums for Low-Income Individuals

Unlike traditional insurance policies, microinsurance is designed to be budget-friendly. The premiums are low, making it accessible to daily wage earners and small-scale workers.

| Insurance Type | Average Premium Cost |

| Traditional Health Insurance | ₹5,000 – ₹15,000 per year |

| Microinsurance Health Plan | ₹200 – ₹500 per year |

This affordability ensures that more people can benefit from financial protection without sacrificing essential expenses.

3. Improved Access to Healthcare Services

A key benefit of microinsurance for low-income groups in India is better access to healthcare. Many policies cover hospital expenses, doctor visits, and even preventive healthcare services, ensuring that individuals can receive timely medical care without the stress of financial constraints.

By reducing the cost barrier to essential healthcare services, microinsurance significantly improves overall health outcomes, especially for marginalized communities in rural and semi-urban areas.

Impact:

- Reduces the burden of out-of-pocket medical costs, allowing families to allocate their limited resources to other essential needs.

- Encourages timely medical attention, reducing severe health risks and preventing minor conditions from escalating into critical illnesses.

- Supports maternal and child health programs in rural areas, leading to improved prenatal and postnatal care and reducing maternal and infant mortality rates.

- Covers emergency treatments and essential medications, providing comprehensive support to policyholders and ensuring their long-term well-being.

4. Enhanced Economic Stability for Families

Without financial protection, a single crisis can push a family below the poverty line. Microinsurance ensures economic stability by offering safety nets in critical situations, allowing families to recover without falling into severe financial hardship. It acts as a buffer against unexpected events such as job loss, health emergencies, or natural disasters, preventing families from slipping into debt traps.

Real-Life Example: A farmer in Maharashtra who lost his crops due to unexpected floods was compensated through a microinsurance scheme, preventing debt accumulation and financial distress. Thanks to this financial support, he was able to purchase new seeds and resume farming, securing his family’s livelihood and future prospects.

| Benefit | Description |

| Income Protection | Provides compensation in case of job loss or disability, ensuring continued financial stability. |

| Support for Families | Ensures financial security for dependents by covering essential expenses and maintaining household income. |

| Protection Against Natural Disasters | Offers financial relief to farmers and workers affected by climate-related adversities. |

| Business Continuity | Helps small business owners recover losses and reinvest in their enterprises. |

5. Simplified Claim Process with Minimal Documentation

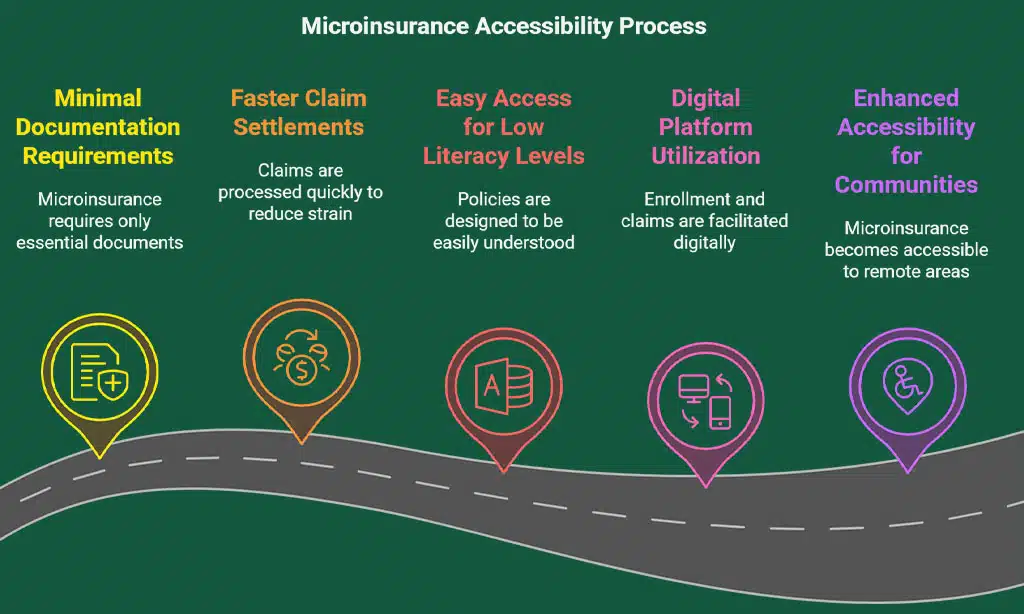

One of the biggest barriers to traditional insurance is the complex paperwork and long processing time. Many individuals from low-income backgrounds are discouraged from applying for insurance due to these hurdles. Microinsurance eliminates these challenges through a streamlined and user-friendly approach, ensuring that financial protection reaches those who need it the most.

- Minimal documentation requirements: Unlike traditional insurance policies that require extensive paperwork, microinsurance demands only essential identification and proof of income.

- Faster claim settlements: Simplified processing ensures that policyholders receive their claims in a timely manner, reducing financial strain during emergencies.

- Easy access for individuals with low literacy levels: The policies are designed to be easily understood, with assistance available through local agents and community organizations.

Additionally, many microinsurance providers use digital platforms and mobile applications to facilitate enrollment and claims, making it even more accessible for remote and rural communities. This simplicity makes microinsurance an attractive option for marginalized communities, providing them with much-needed financial security.

6. Encourages Savings and Financial Planning

Microinsurance policies often include savings components, enabling policyholders to accumulate funds for future needs. These savings can act as an emergency buffer, providing financial security during unforeseen circumstances.

Additionally, structured savings through microinsurance help individuals plan for future expenses such as children’s education, home repairs, or retirement.

Example: A micro-pension plan allows individuals to save small amounts over time, ensuring a steady income post-retirement. Many schemes also offer interest on accumulated savings, making them a viable option for long-term financial planning. This approach fosters a culture of saving among low-income groups, promoting financial independence and security.

7. Government and Private Sector Support for Microinsurance

Various government and private sector initiatives are promoting microinsurance:

- PMJJBY & PMSBY: These low-cost life and accident insurance schemes provide essential coverage for millions of individuals, ensuring financial stability in case of unforeseen events. PMJJBY covers life insurance, while PMSBY offers accident coverage at highly affordable premiums, making them accessible to low-income groups.

- Ayushman Bharat Yojana: This flagship health insurance program by the Indian government provides free health coverage to over 50 crore economically disadvantaged individuals, covering hospital expenses, surgeries, and critical illnesses. It has significantly improved healthcare access for marginalized communities.

- LIC Microinsurance Policies: The Life Insurance Corporation of India (LIC) offers various microinsurance policies designed to meet the needs of low-income individuals. These policies provide life coverage, savings benefits, and easy claim processes, ensuring financial security for the underprivileged.

The impact of these initiatives can be observed in the following table:

| Program | Coverage Type | Beneficiaries | Key Features |

| PMJJBY | Life Insurance | 10 crore+ individuals | Affordable premium, ₹2 lakh coverage |

| PMSBY | Accident Cover | 15 crore+ individuals | ₹12 per year premium, ₹2 lakh accident coverage |

| Ayushman Bharat | Health Insurance | 50 crore+ individuals | Free hospitalization up to ₹5 lakh |

| LIC Microinsurance | Life & Savings | Millions of policyholders | Customizable plans, long-term savings |

These government-backed programs and private sector contributions continue to drive financial inclusion, ensuring that microinsurance remains a vital tool for economic security and social welfare in India.

Takeaways

Microinsurance is a powerful financial tool that can transform the lives of low-income groups in India. By offering affordable, accessible, and comprehensive coverage, it provides a safety net against unforeseen risks. As more people become aware of its benefits, microinsurance will play a crucial role in strengthening financial inclusion and economic stability.

With continued government support, increased awareness, and technological advancements, microinsurance can bridge the gap between financial vulnerability and security, ultimately uplifting millions of individuals and their families.