Are you curious to learn about a credit card that offers fantastic rewards and exclusive perks? You have found the right information with the Belk Credit Card. But what is so special about Belk credit card?

The Belk Credit Card offers many benefits, including generous rewards, access to special savings events, flexible payment options, and exclusive perks for cardholders. Its rewards program lets you earn points on future purchases and get discounts on select products.

Do you want to learn more about Belk credit cards? Read on to uncover the details in this article.

Does Belk Have a Credit Card?

Yes, Belk does offer a credit card to its customers. The Belk Rewards Credit Card lets you earn rewards and enjoy exclusive benefits when shopping at Belk stores or online. You earn points on every purchase and receive special offers, discounts, and access to cardholder events.

What is a Belk Credit Card?

The Belk® Rewards Credit Card is a credit card offered by Belk, a department store chain. It gives rewards to shoppers who make regular purchases at Belk. The card features a tiered rewards system that lets you earn up to 5% back in Belk Reward Points based on your annual spending.

The card has an annual fee of $0 and an APR of 25.49% as of June 2023. Also, cardholders at higher tiers get perks like the Belk Rewards Flex Pay Plan, invitation-only savings days, and special birthday coupons.

New cardholders may get a signup bonus with a discount on their first purchase and bonus Belk Reward Points.

How Does a Belk Credit Card Work?

The Belk Rewards Mastercard® helps shoppers who frequent the store. This rewards card has a flexible system that responds to your spending habits. You earn extra points on everyday items like gas and groceries. That makes routine purchases more rewarding.

The upgraded rewards system means you earn points as you use your Mastercard®. Points can be exchanged for various rewards and savings. Because the system can grow with you, your ability to earn rewards improves. Loyal shoppers enjoy increasing benefits over time.

What Bank Does Belk Credit Card Use?

Belk credit cards are issued by Synchrony Bank. Synchrony Bank manages the Belk credit card program. When you sign up, you enter an agreement with Synchrony Bank. This link helps you enjoy rewards, discounts, and easy payment options.

Is It Hard to Get a Belk Credit Card?

Getting a Belk credit card usually is simple. The card has varied credit criteria. Approval depends on your credit history and income. A good credit score improves your chances.

How to Apply for a Belk Credit Card?

You have two options to apply. You can apply online or in-store. Phone applications are not offered.

When you apply for the Belk Credit Card, you might also be considered for the Belk Store Card. This depends on your credit score and other factors.

- Online Application: Visit the official Belk Credit Card website. Click on the “Apply Today” button. Fill out the form with your personal details such as your Social Security number, name, phone number, and mailing address.

- In-Store Application: Go to your nearest Belk store and speak with a cashier about applying. They will give you an application form to complete. Once approved, you can use your credit line on the same day.

After you submit your application, you typically get an instant decision. Sometimes, it may take up to four weeks. If you do not see a decision in that time, call Synchrony Bank at 800-530-6886 for help.

How Long Will It Take to Get Approved for Belk Credit Card?

Approval is usually instant. Sometimes, it can take up to four weeks. If you do not receive a decision within that time, call Synchrony Bank at 800-530-6886 for help.

Once approved, you get your full credit card number and credit line details by mail. Delivery takes about 7-10 business days after approval.

On rare occasions, there may be a delay. If you have questions about your application status, contact Synchrony Bank.

How to Cancel Belk Credit Card?

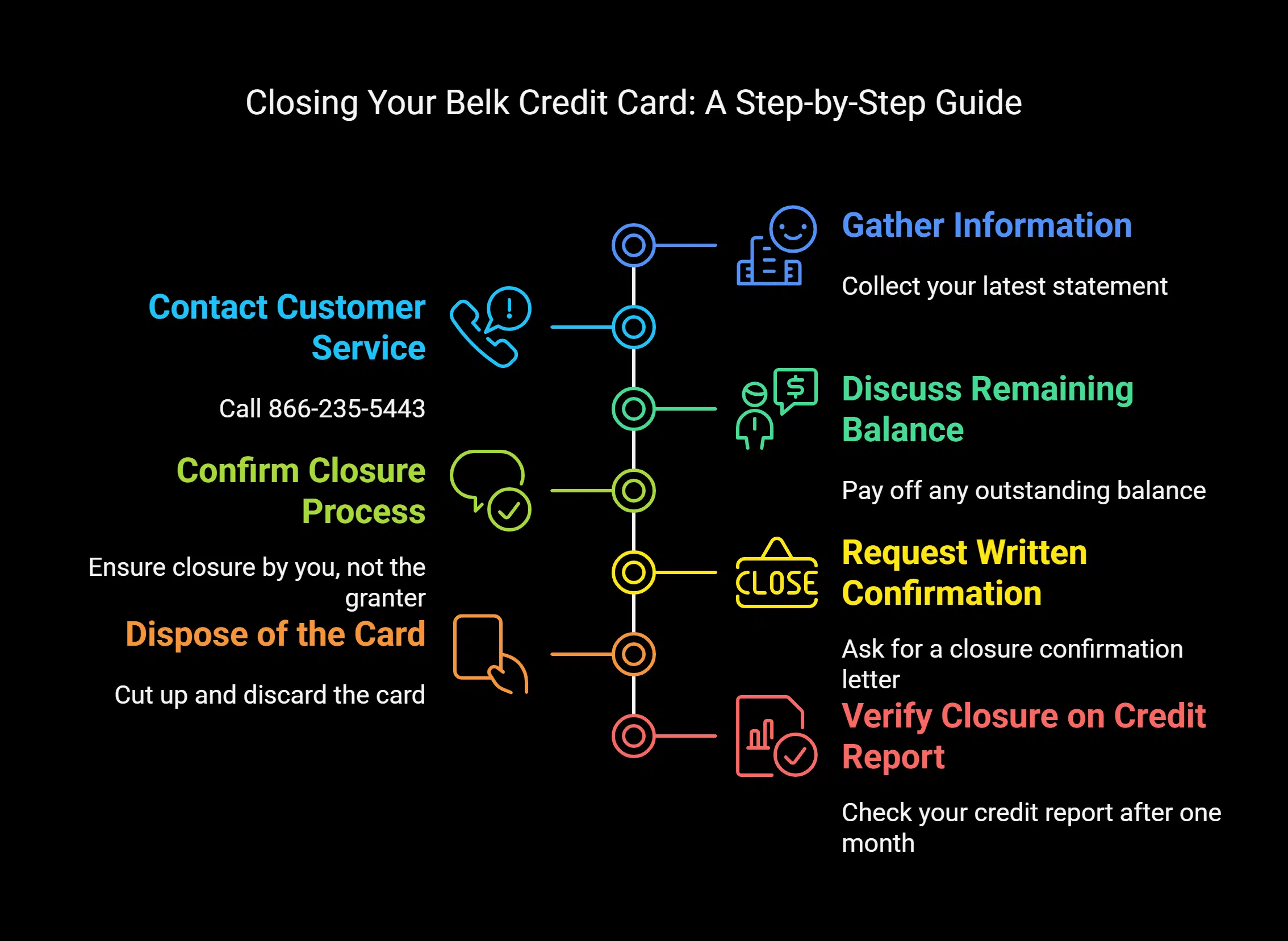

Canceling a store credit card such as the Belk credit card is a step many consider for different reasons. Department store credit cards help when used well. Sometimes you must close an account. Here is a guide on how to do it:

Step 1: Gather Information

Get your latest credit card statement. It has your account number, payment history, and any remaining balance. If you do not have your account number, use your Social Security number to access your account.

Step 2: Contact Customer Service

Call Belk’s customer service at 866-235-5443. You cannot cancel the card online. Enter your account number or Social Security number when asked. Follow the instructions until you speak with a representative. Tell them you want to close your account.

Step 3: Discuss Remaining Balance

Talk about paying off any balance. This step is important because an unpaid balance may block the closure.

Step 4: Confirm Closure Process

Make sure your account is closed by you, not by the credit granter. This keeps your credit record safe.

Step 5: Request Written Confirmation

Ask for a letter that confirms your account closure. Note the representative’s name and any confirmation numbers provided.

Step 6: Dispose of the Card

Cut up and safely discard your Belk credit card. Keep any statements or records for your files, or shred them securely.

Step 7: Verify Closure on Credit Report

After about one month, check your credit report. Confirm that the account is shown as closed and that all details are correct.

Various Methods to Submit Your Belk Credit Card Payment

You have many ways to submit a payment for your Belk credit card. Try one of these methods:

Online Payment

- Log in to your Belk account at SynchronyCredit.com or BelkCredit.com.

- Follow the steps to complete your payment securely.

Mobile App Payment

- Open the Belk mobile app.

- Go to the payment section and complete your transaction.

Phone Payment

- Call 800-669-6550 to pay by phone.

- Use the automated system or speak with a representative.

Mail-in Payment

- Write a check or money order to Belk.

- Include your Belk credit card account number on the payment.

- Mail it to the address on your billing statement.

In-store Payment

- Visit a Belk store.

- Speak with the customer service or payment desk to pay in person.

What Credit Score Do I Need for a Belk Card?

You need a minimum credit score of 700. This shows you have good credit or better. Check your credit for free on WalletHub. Also, factors like debt, payment history, and inquiries can affect approval.

What are the Benefits of Having a Belk Credit Card?

Below are the benefits of three types of Belk reward credit cards.

Benefits of Belk Rewards Credit Card

The Belk Rewards Card suits customers who spend up to $599 at Belk stores annually. It is an entry-level card with attractive perks. Once approved, you get 20% off all purchases on that day. Home goods and shoes get a 15% discount.

The card also gives you these extra benefits:

- You earn 3% back in rewards on purchases at Belk or Belk.com.

- You get 2% back on gas and grocery purchases.

- You earn 1% back on other purchases. Every 1,000 points can be redeemed for $10 in Belk reward dollars when using a Mastercard.

- You gain access to 20 exclusive savings events during the year. These events focus on specific departments or product categories.

- You can take advantage of receipt-free returns on purchases made with your card.

- You benefit from bonus reward events and special cardholder savings days each month.

The Belk Rewards Card helps you save while you shop.

Benefits of the Belk Premier Rewards Credit Card

The Belk Premier Rewards card offers extra perks for customers who spend between $600 and $1,499 each year. In addition to the benefits of the Rewards card, the Premier Rewards card gives you:

- Increased Rewards: Earn 4% back in rewards at Belk or Belk.com. The rate is higher than that of the Rewards card.

- Birthday Perk: Receive a special coupon during your birthday month.

- Flexible Payment Options: Get access to the Belk RewardsFlex Pay Plan. Enjoy the ease of varied payment choices.

- Exclusive Premier Savings Days: Attend invitation-only savings days for extra discounts on select products.

Exclusive Benefits of the Belk Elite Rewards Credit Card

The Belk Elite Rewards credit card serves customers who spend at least $1,500 each year. Besides the perks from the Premier Rewards card, it offers more advantages:

- Enhanced Rewards: Earn 5% back in rewards at Belk or Belk.com, which beats the Premier Rewards rate.

- Free Shipping: Enjoy free shipping for both in-store and online purchases at Belk.com.

- Quarterly Pick Your Own Sale Day: Select one day each quarter for a special sale. You get a 20% discount on that day.

- Exclusive Elite Savings Days: Take part in four invitation-only savings days each year for extra discounts on select products.

What are the Drawbacks of having a Belk credit card?

Below are some drawbacks of having a Belk Credit card.

- Limited Redemption Options: The rewards program is bound to Belk reward dollars. You cannot use them as a statement credit or at other stores. Other cards may offer more flexibility.

- Minimum Point Requirement: You must reach 1,000 points before rewards become active. This rule may slow down your reward benefits.

- Redemption Limitations: You can redeem up to $100 in Belk reward dollars per billing cycle. Extra points carry over to the next cycle.

- Rewards Expiration: Belk rewards expire after one year. If you do not use them, you lose your earned benefits.

What is the Interest Rate on Belk Credit Card?

The Belk® Rewards Credit Card works well for shoppers who pay in full each month. It offers savings when you avoid carrying a balance. High interest can occur with a 25.49% APR if you carry a balance. Use the card with care to avoid extra charges.

For tips on managing credit, you may check consumer finance guides that offer clear advice. Using a card wisely is important to reap the benefits.

Where Can I Use My Belk Credit Card?

The Belk Rewards Mastercard® works where Mastercard is accepted. This lets you make purchases online or at stores worldwide. In contrast, the Belk Rewards Card works only at Belk. It lets you shop at Belk stores or on the Belk website. Depending on your application, you may get either card.

Comparing Belk Credit Card with Others

If Belk is not the right choice for you, below is a comparison with two alternatives.

| Credit Card | Rewards | Credit Score Requirement | Annual Fee | Regular APR |

|---|---|---|---|---|

| Belk Credit Card | Every 1000 points equals $10 in Belk Reward Dollars | Bad credit is accepted | See terms | 25.49% |

| Macy’s Credit Card | Various discounts, rewards, and exclusive offers | Varies; typically fair to good credit | None | Variable, depending on creditworthiness |

| Kohl’s Credit Card | Kohl’s Cash rewards and exclusive discounts | Varies; typically fair to good credit | None | 24.99% (Variable, depending on creditworthiness) |

Frequently Asked Questions (FAQs)

Now let’s go through some common questions on this topic.

Can I pay my Belk bill with a credit card

Yes, you can pay your Belk bill with a credit card. Belk accepts credit card payments using several methods. For example, you can use online platforms like doxo. You may also use a debit card, Apple Pay, or a bank account. This choice makes managing your bill easier.

Can a Belk credit card be used anywhere?

Yes, a Belk credit card works wherever Mastercard is accepted. Since Belk store credit cards are Mastercards, they work like any other Mastercard.

Can you pay Belk credit card in store?

Yes, you can pay your Belk Credit card in the store. Just visit a nearby location and use your card to pay.

Where to find card number on Belk credit?

To check your Belk gift card balance, find the card number and access code on the back. The card number has 16 digits, and the access code has 4 digits. Use these details to verify your balance.

Bottomline

That is all the key details about the Belk credit card.

You can enjoy savings and rewards with the Belk Credit Card. Earning points on your purchases and accessing exclusive discounts can boost your shopping experience. This article explains how the card works and how to use it wisely.

Disclosure: The data in this article was verified using official bank reports and consumer finance guides. This content reflects a careful review of available sources. It is provided for informational purposes only and does not serve as professional financial advice.