In a landmark January 2026 move, Apple has officially selected Google’s Gemini as the foundational intelligence for its next-generation Siri, sidelining early partner OpenAI. This multi-year, multi-billion dollar agreement doesn’t just rescue Apple’s delayed AI roadmap; it reshapes the Silicon Valley hierarchy, propelling Alphabet to a $4 trillion valuation and signaling a mature phase of “pragmatic AI” where infrastructure and scale trump first-mover advantage.

Why This Matters

This deal effectively ends the “experimental” phase of mobile AI. By choosing Google over OpenAI, Apple has acknowledged that reliability, infrastructure ownership, and massive context windows (Gemini’s forte) are more critical for a phone OS than pure chatbot popularity. It cements Google as the “utility provider” for the AI era, powering the two largest mobile operating systems on Earth (Android and iOS), while leaving OpenAI to fight for relevance without default access to 2 billion iPhone users.

Key Takeaways

- The Shift: Apple replaces OpenAI as its primary foundation partner for Siri; OpenAI remains an optional “plugin.”

- The Valuation Flip: Alphabet’s market cap surged past $4 Trillion, briefly overtaking Apple, as investors view this as the ultimate monetization of their AI capex.

- The Tech: The deal is built on Gemini 3, which benchmarks suggest has surpassed GPT-5.2 in reasoning and multimodal processing.

- Privacy Compromise: Apple utilizes a “Private Cloud Compute” hybrid model to scrub data before it hits Google’s servers, attempting to maintain its privacy brand while using a rival’s tech.

Contextual Background

To understand the magnitude of this deal, one must look at the trajectory of the last three years. When OpenAI launched ChatGPT in late 2022, it caught Apple flat-footed. While Cupertino focused on the Vision Pro, the industry pivoted to Generative AI. By 2024, Apple had announced “Apple Intelligence” with a tentative partnership with OpenAI to handle “world knowledge” queries.

However, throughout 2025, cracks appeared in this strategy. Apple’s internal models (codenamed “Ajax” and later “Ferret”) struggled with hallucinations and latency on mobile silicon. Simultaneously, users reportedly found the ChatGPT integration in iOS 18 “disjointed”—a plugin rather than a core system brain. Meanwhile, Google aggressively iterated, releasing Gemini 3 in late 2025. Facing a delay of the “new Siri” to 2026, Apple needed a reliable, scalable infrastructure partner immediately. This deal is that lifeline.

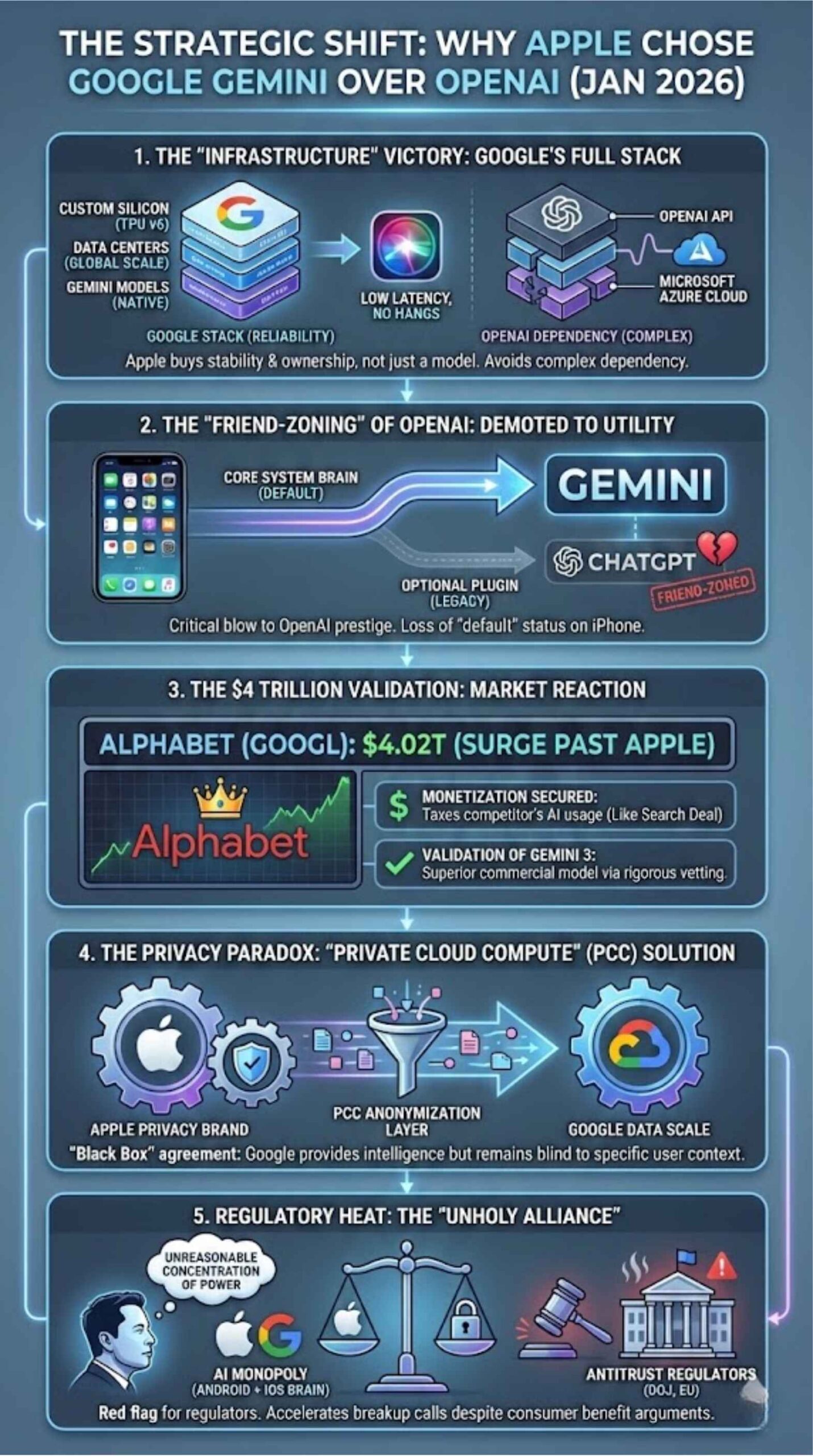

The Strategic Shift: Why Apple Choose Google Gemini Over OpenAI

1. The “Infrastructure” Victory: Why Gemini Won

The decision to go with Google over deepening ties with OpenAI is fundamentally an infrastructure play. Apple isn’t just buying a model; it’s buying stability. OpenAI relies heavily on Microsoft’s Azure, creating a complex dependency chain for Apple (Apple -> OpenAI -> Microsoft). Google owns the entire stack: the TPU chips, the data centers, and the Gemini model family.

- Reliability: Google’s massive custom silicon (TPU v6) capacity ensures that when 2 billion iPhone users ask Siri a question, the service won’t hang—a plague that has haunted OpenAI’s API during peak times.

- Edge-Cloud Hybrid: Gemini Nano and Gemini Flash are optimized for the precise “hybrid” approach Apple favors—processing sensitive data on-device and offloading complex reasoning to the cloud.

2. The “Friend-Zoning” of OpenAI

While Apple has stated the ChatGPT integration will “remain active” for now, this deal effectively demotes OpenAI from a potential core partner to a legacy utility. The “Next-Gen Siri” will not default to ChatGPT; it will be built on top of Gemini.

This is a critical blow to OpenAI’s valuation and prestige. The “Apple Seal of Approval” was a major driver of OpenAI’s consumer adoption. Losing the “default” status on the world’s most valuable real estate (the iPhone Home Screen) to its arch-rival Google suggests that OpenAI’s “moat” was shallower than investors believed.

3. The $4 Trillion Validation

The market reaction was immediate and telling. Following the announcement, Alphabet’s market cap briefly surged past $4 trillion, overtaking Apple itself. Investors view this as the ultimate validation of Sundar Pichai’s AI strategy:

- Monetization secured: Google now effectively taxes the AI usage of its biggest mobile competitor, mirroring the lucrative Search deal (worth ~$20B/year) that keeps Google as the default search engine on Safari.

- Validation of Gemini 3: Apple’s rigorous vetting process is legendary. By choosing Gemini after “careful evaluation” of Anthropic, OpenAI, and Meta’s Llama, Apple has effectively declared Gemini the superior commercial model for 2026.

4. The Privacy Paradox

Apple’s brand is built on privacy; Google’s is built on data. Reconciling these is the deal’s biggest friction point. The solution appears to be “Private Cloud Compute” (PCC).

Apple claims that while Gemini powers the reasoning, the data is anonymized before it hits Google’s servers. Google likely cannot use Apple user queries to train future Gemini models—a concession Google rarely makes but likely accepted to secure the contract. This creates a “black box” where Google provides the intelligence but remains blind to the specific user context, preserving Apple’s privacy marketing.

5. Regulatory Heat and the “Unholy Alliance”

This partnership is a red flag for antitrust regulators in the US (DOJ) and EU. Elon Musk has already publicly criticized the deal as an “unreasonable concentration of power,” noting that Google now controls the AI brain of both Android and iOS.

With Google already under fire for its Search monopoly, adding the “AI monopoly” on mobile devices could accelerate breakup calls. However, Apple can argue that not partnering with Google would have left them with an inferior product, harming consumers.

Data & Visualization

Strategic Winners & Losers (2026 Analysis)

| Entity | Status | Why? |

| Alphabet (Google) | Big Winner | Secures distinct revenue stream; validates Gemini tech; hits $4T valuation; blocks OpenAI from iOS dominance. |

| Apple Users | Winner | Finally get a Siri that works (low latency, high accuracy) without waiting for Apple to invent its own LLM. |

| OpenAI | Loser | Demoted to “optional” status; loses access to default iPhone user behaviors; perceived loss of technical leadership. |

| Microsoft | Loser | Its proxy war (via OpenAI) to capture mobile failed; Bing remains sidelined on iOS. |

| Apple (Corporate) | Mixed | Pro: Fixes product crisis. Con: Admits defeat in building its own foundational model; increases reliance on rival Google. |

Technical Benchmark Comparison (Reported Jan 2026)

A comparison of the models driving the decision.

| Metric | Google Gemini 3 (Pro/Flash) | OpenAI GPT-5.2 (Turbo) | Apple Advantage |

| Context Window | 2 Million Tokens | 128k Tokens | Gemini allows Siri to “read” your entire email history at once. |

| Multimodal | Native (Audio/Video/Text) | Hybrid (Stitches models together) | Gemini handles Siri’s voice/vision input faster. |

| Reasoning (MMLU) | 91.8% | 89.6% | Better logic for complex commands (“Plan my trip”). |

| Latency | <500ms (Flash) | ~1.2s (Avg) | Siri feels “snappy” rather than laggy. |

Evolution of Apple’s AI Partnerships

| Year | Primary Partner | Integration Type | Outcome |

| 2011-2023 | Nuance / Internal | Legacy Siri | Stagnation; fell behind Alexa/Assistant. |

| 2024-2025 | OpenAI | Plugin (Surface Level) | “Apple Intelligence” launch; plagued by latency. |

| 2026-Future | Google Gemini | Core (OS Level) | “Next-Gen Siri”; deep system integration. |

Expert Perspectives

“This is a bridge strategy, not a destination.”

— Dr. Elena Rosas, AI Market Analyst at Forrester.

“Apple is buying time. They are paying Google ~$1B a year today so they can build ‘Ferret-3’ in peace for 2028. Do not mistake this partnership for a permanent marriage; Apple hates depending on Google.”

“The death of the ‘Model-as-a-Product’ era.”

— Sridhar Ramaswamy, Industry Veteran.

“This deal proves that Foundation Models are becoming utilities like electricity. Apple didn’t want to build a power plant; they just wanted to buy the best electricity. Google is now the utility company of the AI age.”

“A privacy nightmare waiting to happen.”

— Privacy International Watchdog Group.

“Despite assurances of ‘Private Cloud Compute,’ handing the keys of the iPhone’s brain to the world’s largest advertising company creates an unprecedented vector for data inference, even if the raw data is masked.”

Future Outlook: What Comes Next?

The “Agentic” Siri (Late 2026):

With Gemini’s reasoning capabilities, Siri will move beyond “QA” (Question Answering) to “Action.” Expect the release of iOS 20 to feature “Siri Agents” that can book flights, edit photos, and manage subscriptions autonomously. This was the promise of the “Rabbit R1” and “Humane Pin,” but Apple will actually deliver it at scale.

The Inevitable Apple Breakup (2028-2029):

Apple is aggressively hiring former Google DeepMind researchers. The “Gemini Deal” likely has a 3-year term. By 2028, expect Apple to debut a fully proprietary model that runs exclusively on the “M7” or “A21” chips, allowing them to cut the cord with Google once their internal tech catches up.

OpenAI’s Pivot:

Forced out of the OS layer, OpenAI will likely pivot harder into “Hardware” (potentially with Jony Ive, as rumored) or specialized enterprise agents. They can no longer rely on consumer “chat” dominance as their primary growth engine.

The “Androidification” of iPhone AI:

Ironically, the iPhone experience will feel more like the Google Pixel. Features like “Magic Editor” and “Circle to Search” will likely arrive on iPhone under Apple branding, homogenizing the feature sets of the two dominant mobile platforms.

Final Thoughts

The “Apple-Gemini” deal of January 2026 is a masterclass in pragmatism over pride. Apple swallowed the bitter pill of relying on its arch-rival to save its most critical product, Siri. For Google, it is a crowning victory that cements its transition from a “Search” company to an “AI Infrastructure” company. For the rest of the industry, it is a stark warning: the giants have aligned, and the window for startup disruption in the foundational model space is closing fast.