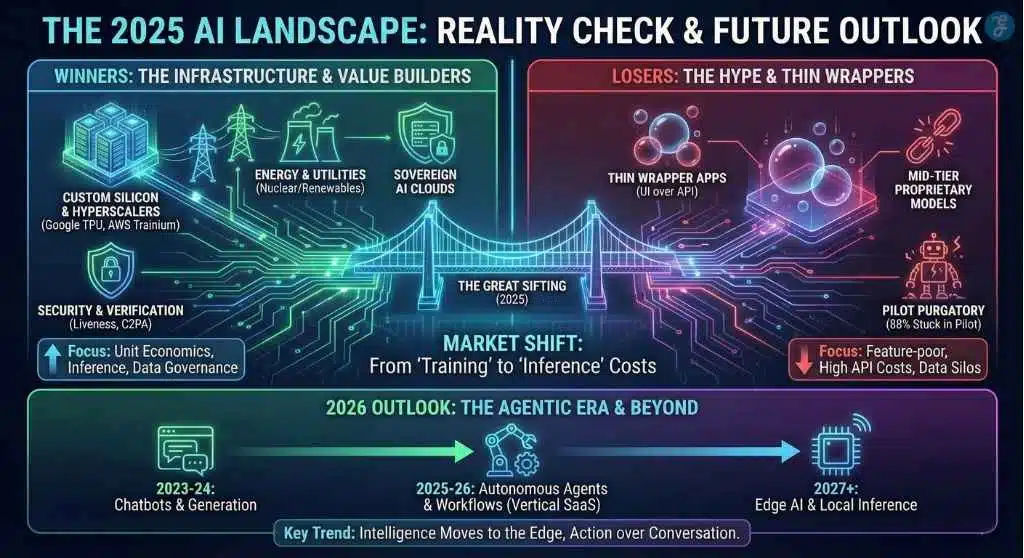

As the calendar turns to 2026, the technology sector is finally exhaling. If 2023 was the year of wild promises and 2024 was the year of frantic experimentation, 2025 will be remembered as the year of sober reality. The initial frenzy, where simply adding “.ai” to a domain name guaranteed venture capital funding, is officially over. The market has matured, the dust has settled, and we can now clearly identify the AI Winners and Losers 2025.

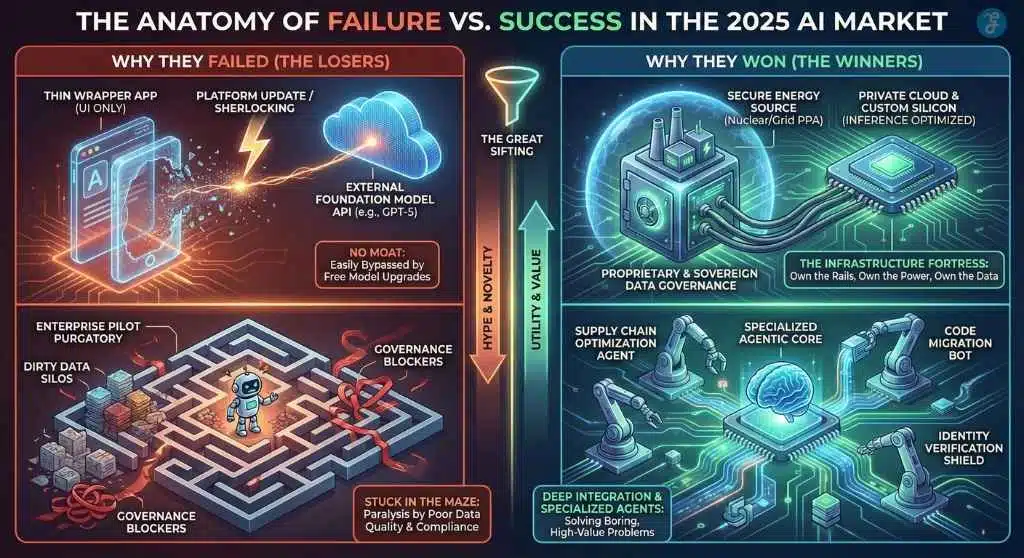

This past year wasn’t about who could make the flashiest demo video; it was about unit economics, scalability, and actual return on investment (ROI). The companies that thrived weren’t necessarily the ones making the loudest noise on social media. Instead, the victors were the organizations that built the essential “rails” the AI economy runs on, or the enterprises that managed to slog through the difficult work of deep integration.

Conversely, the losers were those relying on superficial innovation or those who underestimated the massive data governance challenges required to move AI from a fun pilot project to a production-ready tool.

Key Takeaways from the 2025 AI Landscape

-

Infrastructure is King: The safest bets remained in hardware, data centers, and energy. The demand for computing shows no sign of slowing.

-

No Moat, No Business: “Thin wrapper” applications that added only UI on top of foundation models were wiped out by platform upgrades.

-

Data > Models: For enterprises, success in 2025 was defined not by which model they used, but by the cleanliness and governance of their own internal data.

-

Vertical Wins Over Horizontal: Specialized AI tools built for specific industries outperformed generic “do-it-all” AI assistants in generating real revenue.

-

The Energy Crunch is Real: The primary constraint on AI scaling shifted from chip availability to power availability.

The Great Sifting: From Hype to Reality

To understand the winners of 2025, we first have to understand the “Great Sifting” that occurred in the first half of the year. For two years, the AI market operated on pure potential. Investors poured billions into any pitch deck that mentioned “Generative AI,” creating a rising tide that lifted every boat—seaworthy or not. But in early 2025, that tide went out.

Three critical realizations hit the market simultaneously, forcing a harsh correction:

-

The “Easy” Money Dried Up: Interest rates remained stubborn, and venture capital shifted from “growth at all costs” to “path to profitability.” Startups burning cash on API fees without a clear revenue model were left to starve.

-

The “Pilot” Cliff: As 2024’s pilot projects concluded, CFOs began asking for the ROI. When many pilots failed to show immediate productivity gains—often due to messy enterprise data rather than the AI itself—budgets for “experimental” AI were slashed.

-

The Commoditization of Intelligence: As the cost of intelligence (inference) dropped and open-source models approached the quality of proprietary ones, selling “access to a model” became a race to the bottom.

This sifting process didn’t kill the AI industry; it matured it. It cleared away the noise, revealing the bedrock companies that were building genuine value. The market didn’t stop spending on AI; in fact, spending increased, but it moved decisively from the “application layer” (chatbots and apps) to the “infrastructure layer” (the physical and digital rails).

The result? A starkly divided landscape where the “builders” feasted and the “wrappers” suffered famine.

The Winners: The “Pick and Shovel” Economy Returns

History repeated itself in 2025. During the gold rush of the 1800s, the reliable money wasn’t made by the miners; it was made by those selling picks, shovels, and denim jeans. In the 2025 AI boom, the “pick and shovel” providers—the infrastructure companies—consolidated massive power and profits.

While generative AI applications grabbed headlines, the underlying infrastructure providers saw unprecedented demand that outstripped supply for the entire year.

1. The Silicon Sovereigns and Custom Chips

Coming into 2025, many predicted NVIDIA’s grip on the GPU market would loosen significantly. While they did face new competition, their CUDA ecosystem provided a formidable moat. However, the real story of 2025 was the diversification of silicon.

The “winners” bracket expanded to include the major hyperscalers who successfully deployed their own custom silicon at scale. The reliance on general-purpose GPUs for specific workloads, particularly inference (running the models rather than training them), became economically unsustainable for many.

The 2025 Silicon Landscape:

| Company Type | The 2025 Outcome | Key Players/Products | Why They Won |

| The Incumbent Titan | Remained dominant in training massive foundation models and high-end research. | NVIDIA (H200, B100 series) | Unmatched software ecosystem (CUDA) and supply chain dominance. |

| The Hyperscalers | Shifted internal workloads to custom chips to control costs and optimize performance per watt. | Google (TPU v6), AWS (Trainium3/Inferentia3), Microsoft (Maia 200) | Vertical integration allowed for massive cost reduction at scale. |

| The Challengers | Gained significant ground in the mid-market and specialized inference hardware. | AMD, Various specialized AI hardware startups | Offered viable alternatives during peak GPU scarcity periods. |

2. The Surprise Victors: Utilities and Energy

Perhaps the most unexpected winners of the 2025 AI boom were not tech companies at all. They were the power providers.

By mid-2025, it became painfully clear that the world’s AI ambitions were colliding with energy reality. Training GPT-5 class models and running real-time agents required gigawatts of stable, 24/7 power that renewables alone couldn’t reliably provide.

Data center energy consumption skyrocketed, turning utility companies, grid modernization firms, and nuclear energy providers into hot commodities. Tech giants signed unprecedented long-term power purchase agreements (PPAs), effectively bankrolling the modernization of energy infrastructure to guarantee their AI future. If you owned the power grid in 2025, you held the keys to the AI kingdom.

3. The Deep Integrators (The Quiet Enterprise Winners)

Away from the silicon fabrication plants and power stations, another class of winners emerged in the corporate world. These were not the companies that launched flashy external chatbots for PR purposes.

The enterprise winners were those that focused on boring, back-office efficiency. They used AI to revolutionize supply chain predictive modeling, automate complex insurance claims processing, and assist developers with legacy code migration. These companies didn’t treat AI as a magic wand but as a complex engineering challenge requiring clean data and redesigned workflows.

4. The Geopolitical Winners: Sovereign AI Clouds

While US tech giants dominated the headlines, 2025 was quietly the year of “Sovereign AI.” Nations across Europe, the Middle East, and Asia realized that relying entirely on American data centers for their national intelligence and critical infrastructure was a national security risk.

Governments didn’t just regulate AI in 2025; they bought it.

-

The Trend: France, UAE, Japan, and Singapore poured billions into building state-owned “AI Clouds”—infrastructure physically located within their borders, subject only to their laws.

-

The Result: This created a massive secondary market for hardware. While NVIDIA sold chips to Microsoft and Amazon, they sold just as many to sovereign funds. The “Winner” here wasn’t just the hardware provider, but the local cloud operators (like France’s Scaleway or the UAE’s G42) who offered “data residency” guarantees that American hyperscalers struggled to match.

The Losers: When the Bubble Burst

The narrative that “AI lifts all boats” was shattered in 2025. As the market matured, customers and investors became discerning. The realization that not all “AI companies” possessed genuine intellectual property led to a severe market correction for specific business models.

1. The Death of the “Thin Wrapper”

The biggest losers of 2025 were the “thin wrapper” startups. These were companies whose entire product was essentially a sleek user interface built on top of someone else’s API (usually OpenAI’s or Google’s).

In 2023 and 2024, thousands of SaaS companies sprang up offering “AI for PDF summarizing,” “AI for specialized copywriting,” or “AI for basic coding tasks.” They charged subscriptions for functionality that the underlying foundation models eventually incorporated for free.

When Gemini 2.0 and GPT-4.5/5 launched with vastly improved native capabilities—including massive context windows, native file interpretation, and multi-modal inputs—the value proposition of these wrapper startups evaporated overnight. They had no “moat,” no proprietary data, and no unique model architecture. They were merely middlemen, and in 2025, the middlemen were cut out.

2. The “Mid-Tier” Model Collapse

It wasn’t just “Wrappers” that died; proprietary “mid-tier” models got squeezed out of existence. In 2025, the gap between top-tier open-source models (like Meta’s Llama 4 and Mistral’s latest) and proprietary models (like GPT-4o) effectively closed for 90% of use cases.

-

The Shift: CTOs asked a simple question: “Why pay API fees for a proprietary model when I can run an open-source model of equal quality on my own private cloud for a fraction of the cost?”

-

The Consequence: Companies selling “good enough” proprietary models found themselves in a death spiral. You either had to be the absolute best (OpenAI/Google) or free (Open Source). There was no room left in the middle.

3. The “Pilot Purgatory” Victims

The most expensive failures of 2025 occurred within large enterprises. Fooled by slick vendor demos, thousands of companies purchased expensive enterprise AI licenses, expecting immediate transformation.

Instead, they entered what industry analysts called “Pilot Purgatory.”

The Reality of Enterprise AI Adoption in 2025:

| Metric | The 2025 Reality |

| Companies in “Pilot Phase” | Over 85% of surveyed enterprises. |

| Companies with Positive ROI | Less than 40% reported tangible financial gains. |

| Primary Barrier to Success | Data Governance & Quality (Not technology capabilities). |

The primary culprit was data governance. AI models are only as good as the data they are fed. Enterprises discovered their internal data was siloed, unstructured, messy, and rife with privacy risks. An AI agent cannot be trusted to automate a workflow if it’s learning from outdated CRMs or contradictory internal wikis. The realization that they needed a two-year data cleanup project before they could have a successful AI project was a hard pill to swallow for many C-suites.

4. Generic Content Farms and SEO Spammers

In the media world, the losers were those relying on low-quality, high-volume content. “SEO heist” strategies—using AI to generate thousands of mediocre articles to capture search traffic—were decimated by search engine algorithm updates in late 2024 and throughout 2025 that prioritized human expertise and brand authority. Furthermore, as generative search experiences became the norm, users stopped clicking on generic “10 best links” articles altogether, opting for direct answers supplied by the AI engines.

The “Agentic” Shift: The 2025 Disappointment & Opportunity

The buzzword of 2025 was undoubtedly “Agentic AI.” The promise was that AI would move beyond a chatbot paradigm—where a human prompts and the AI replies—to a paradigm where the AI is given a goal and autonomously executes a series of steps to achieve it.

The Reality

General-purpose autonomous agents largely failed to deliver in 2025. They were unreliable, often got stuck in loops, and hallucinated during complex, multi-step processes. Trusting an autonomous agent with sensitive financial transactions or direct customer communications proved too risky for most compliance departments.

The Silver Lining

While general agents struggled, narrow agents succeeded. The winners in this space were vertical SaaS companies that built highly specialized agents for specific industries—such as a legal discovery agent that only operates within tight guardrails, or an architectural drafting agent constrained by local building codes.

Companies like Anthropic gained significant enterprise market share in 2025 by focusing intensely on steerability, interpretability, and safety, positioning their models as the reliable choice for building these complex agentic workflows, even if they weren’t always the “flashiest” on benchmarks.

The Dark Horse Industry: Identity & Verification

If 2025 had a villain, it was the Deepfake.

With video generation becoming indistinguishable from reality, 2025 saw a 3,000% explosion in “CEO fraud”, where AI-generated video avatars of executives joined Zoom calls to order fraudulent wire transfers.

This crisis birthed a new, highly profitable sector: “Identity Integrity.”

The Security Winners of 2025:

| Sector | The Problem | The 2025 Solution (Winners) |

| Corporate Security | Fake CEOs on video calls. | Real-time Liveness Detection: Software that analyzes micro-blood flow in video pixels to confirm a human is real. |

| Media & News | AI-generated propaganda. | C2PA / Watermarking Standards: Content credentials became mandatory for major news outlets, creating a boom for verification tech. |

| Voice Auth | Cloned voices bypassing bank security. | Multi-Factor Biometrics: Banks abandoned “voice ID” alone, pivoting to behavioral AI that tracks how you type and scroll. |

The Takeaway: In a world where you can’t believe your eyes, the companies selling “proof of reality” became indispensable.

Frequently Asked Questions about the 2025 AI Boom

1. Did the AI bubble burst in 2025?

It wasn’t a total systemic burst like the dot-com crash of 2000, but rather a severe bifurcation. The hype bubble around low-value startups and generic applications absolutely burst. However, funding and valuation for foundational infrastructure, energy, and companies with genuine proprietary AI technology continued to grow.

2. What is “Pilot Purgatory” and why was it so common in 2025?

Pilot Purgatory refers to the state where companies run endless small-scale AI tests (pilots) but never move them into full production. It was common in 2025 because companies severely underestimated the need for clean, organized data. They bought the engine (AI) before they refined the fuel (data).

3. Why did “wrapper” startups fail so quickly?

They failed because they were competing against their own suppliers. When OpenAI, Google, or Anthropic updated their core models to include features like file uploading, data analysis, or better coding, the wrapper apps lost their only selling point. They provided temporary utility, not lasting value.

4. Is NVIDIA still the dominant player?

Yes, but their operating environment changed in 2025. While they still dominate high-end training, their major customers (Google, Microsoft, Amazon) became their biggest competitors by developing their own chips for internal workloads, specifically cutting into NVIDIA’s share of the massive inference market.

5. What’s the outlook for 2026 based on the 2025 trends?

The focus will shift rapidly from training costs to inference costs. As businesses try to deploy agents at scale, the cost of running those models 24/7 becomes the critical metric. Expect 2026 to be the year of smaller, highly efficient models running on specialized hardware at the edge, rather than just massive models running in the cloud.

Final Thought: The End of Magic, The Beginning of Engineering

If the previous years were about watching a magician pull a rabbit out of a hat, 2025 was the year we had to examine the hat, feed the rabbit, and clean up the stage. The magic faded, replaced by the hard reality of engineering, supply chains, and unit economics.

The winners of the 2025 AI boom understood that AI is not a miracle cure; it is the most powerful industrial tool of our generation. And like any industrial tool, it requires massive infrastructure to run and skilled laborers to wield it effectively. The hype is dead. Long live the build.