Walk into any modern trading floor today, and you will still see humans. But the real action is happening inside machines. Orders are routed, optimized, and executed by algorithms that never sleep. Strategies are shaped by models that learn from oceans of data.

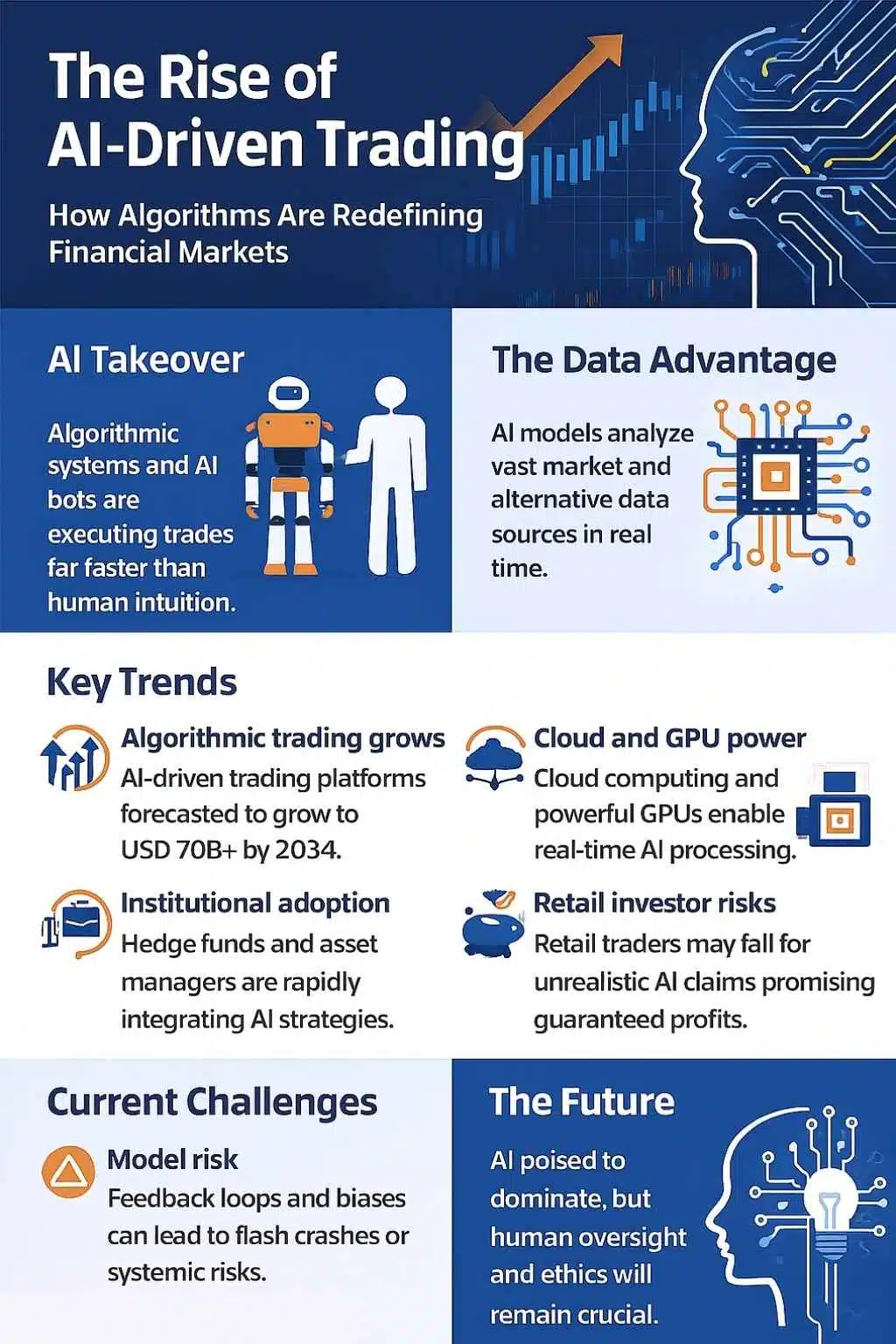

This shift is the rise of AI-driven trading. It goes beyond traditional algorithmic trading. Instead of hard-coded rules, markets are increasingly influenced by systems that use machine learning in the stock market, deep learning, and even generative AI in capital markets.

Over the next decade, these systems are set to move from powerful tools to the default operating layer of global trading. Human judgment will still matter. But it will sit on top of AI engines that process information at a speed and scale no person can match.

From Quant to GenAI: How Trading Became Data-First

Trading has been moving towards automation for decades. Early algorithmic trading systems in the 1990s and 2000s used simple rules. For example: “If the price falls by X%, buy Y shares.” These automated trading systems reduced emotional bias and made execution faster.

Then came quant funds. They built quantitative trading strategies that used statistics and factor models to find small, repeatable edges in the market. These strategies still relied heavily on human-designed rules, but they were more systematic and data-driven than traditional discretionary trading.

The real leap arrived with AI trading platforms built around machine learning. Instead of predefining every rule, quants began training models on huge data sets: prices, volumes, macro data, news, and increasingly alternative data such as web traffic or social activity.

Today, a new layer is emerging: generative AI. Large language models can:

- Summarize earnings calls and macro reports.

- Generate draft trading code for backtesting.

- Scan thousands of news items and flag relevant risks and opportunities.

We are moving from “automation as a tool” to “AI as the core brain” of the trading stack.

The Data Advantage: Why AI Outperforms Traditional Workflows

Modern markets generate staggering amounts of data every second. No human desk can realistically monitor it all. This is where AI-driven trading has a structural advantage.

Scale of data

AI models can ingest and analyze vast streams of market and alternative data — in real time. From tick-level prices to credit card spending trends, these systems search for patterns far too complex for human intuition.

Non-linear pattern recognition

Traditional analysis often assumes linear relationships: “If interest rates rise, stocks fall.” Machine learning models can capture subtle, non-linear relationships across many variables. They might detect that certain sectors react differently to rate hikes under specific volatility regimes, or that a currency pair predicts a commodity move only under certain conditions.

Constant adaptation

Markets change. Strategies that worked last year may fail next month. Many AI models can be retrained or updated continuously. They adapt more quickly than a human team rewriting research reports and rulesets.

Data-driven investing over narratives

AI shifts trading from story-driven decision-making to probability-driven choices. Instead of following a compelling narrative, data-driven investing uses models to estimate the likelihood and impact of events across multiple scenarios.

For big institutions, this edge compounds over time. Better data, better models, and better execution make AI risk management and strategy design difficult to match manually.

Market Momentum: AI Trading Is Scaling Fast

The momentum behind AI trading platforms is not just hype. Growth projections show that spending on AI-based trading and analytics systems is rising quickly across banks, asset managers, hedge funds, and fintech firms.

Several trends are driving this:

- Cost pressure and competition: Institutions face tight margins. AI tools promise improved execution quality and lower trading costs. Even a small reduction in slippage or transaction costs can translate into millions of dollars for large players.

- Investor demand for systematic strategies: Many institutional investors are allocating more capital to systematic and quant strategies, including those marketed as AI-enhanced.

- Cloud and GPU accessibility: Powerful computing resources are now widely available through the cloud. This lowers the barrier to entry for firms that want to implement complex AI models without building massive internal infrastructure.

- Fintech innovation: New trading apps and platforms are embedding AI into their core features, not as an add-on.

As AI adoption spreads, it becomes harder for traditional discretionary desks to compete on speed, cost, and breadth of information processed.

Inside an AI-Driven Trading Stack

To understand why AI will dominate, it helps to see how AI-driven trading actually works behind the scenes. A typical stack has several layers.

1. Data ingestion and preparation

- Market data: prices, volumes, order books.

- Fundamental data: balance sheets, income statements, macro indicators.

- Alternative data: web traffic, app usage, shipping data, sentiment signals.

This data is cleaned, normalized, and transformed into features that models can use.

2. Model development and training

Teams of quants and data scientists test different machine learning techniques:

- Supervised learning to predict returns or classify signals.

- Unsupervised learning for clustering regimes or anomaly detection.

- Reinforcement learning to optimize trade execution and order placement.

3. Backtesting and simulation

Before going live, strategies are tested on historical data and in simulated environments. This helps to identify overfitting, estimate drawdowns, and understand how the system behaves in stress scenarios.

4. Execution and order routing

Once decisions are made, orders are sent to the market through systems that manage high-frequency trading, smart order routing, and execution algorithms. These tools aim to minimize market impact and get the best price.

5. Monitoring and risk controls

Live strategies are continuously monitored for performance, exposure, and anomalies. If something looks wrong, risk systems or human overseers can adjust or shut down the strategy.

This end-to-end pipeline is complex. But when it is well built, it can outpace manual processes on almost every metric: speed, consistency, and information depth.

Where AI Is Already Winning in the Market

AI is not a general future idea. It is already embedded in several parts of the trading ecosystem.

Hedge funds and asset managers

Many quant funds now combine traditional factor models with advanced AI techniques. They use machine learning to uncover new signals, improve portfolio optimization, or refine risk models. AI in hedge funds and asset management is becoming standard rather than experimental.

Banks and brokers

Large banks use AI models to predict liquidity, choose the best trading venues, and optimize order slicing. Their algorithmic trading desks rely on machine learning to improve client execution quality.

Retail platforms and AI trading bots

Retail trading apps increasingly integrate AI trading bots for retail investors. Some offer automated strategies, others provide AI-generated trade ideas or risk alerts. While many of these tools are still basic, the direction is clear: AI is becoming part of everyday investing.

Robo-advisors and portfolio management

Robo-advisors and AI portfolio management systems automate tasks like portfolio rebalancing, risk profiling, and tax-loss harvesting. They use models to match investors to portfolios that fit their goals and risk tolerance.

Surveillance, compliance, and operations

AI is also used to monitor trades for suspicious patterns, detect possible market abuse, and automate middle- and back-office processes. This reduces operational risk and compliance costs.

Why AI-Driven Trading Is Likely to Dominate the 2030s

Several structural forces suggest that AI-driven trading will not just coexist with human trading — it will dominate the landscape.

- Efficiency becomes the norm: As AI reduces transaction costs and improves execution quality, firms that do not adopt it will struggle to match performance. Markets tend to reward efficiency and punish laggards.

- Arms race dynamics: When one major player gains an edge with AI, competitors must respond or lose market share. This creates an arms race where AI becomes table stakes rather than a differentiator.

- Infrastructure lock-in: Once a firm builds its core infrastructure around AI trading platforms, it is unlikely to go back to manual decision-making. Over time, more of the global trading infrastructure will be AI-first by design.

- Human-AI collaboration model: The winning model is unlikely to be AI replacing humans altogether. Instead, humans will design objectives, constraints, and governance frameworks. AI will handle pattern recognition, execution, and continuous optimization. That hybrid model is very hard to beat.

- Regulatory adaptation rather than rejection: Most regulators are moving towards managing risks from AI rather than banning it from markets. As rules mature, AI will become a regulated, accepted part of market infrastructure.

The Risks and Myths: AI Is Not a Magic Money Machine

For all the enthusiasm, it is important to recognize the limits and risks of AI in trading.

Overhype and unrealistic expectations

Many marketing pitches promise “guaranteed” profits from AI trading bots or automated trading systems. In reality, markets remain noisy and competitive. A model that looks perfect in backtests can fail in live trading. Overfitting, data snooping, and regime changes can destroy performance.

Model risk and feedback loops

If many firms rely on similar models trained on similar data, trades can become crowded. When conditions change, this can trigger rapid unwinding, sharp price moves, or even flash crashes. AI can amplify herding behavior instead of diversifying it.

Data quality and bias

AI models are only as good as their data. Poor-quality or biased data can lead to misleading signals, unfair outcomes, or hidden vulnerabilities. For example, models trained mostly on “calm” periods may underestimate risk during crises.

Lack of transparency

Many advanced models are complex and hard to explain. This makes it difficult for risk teams, regulators, and even senior management to fully understand their behavior. A key challenge for AI regulation in financial markets is demanding enough transparency without blocking innovation.

Retail investor risks

Retail traders are especially vulnerable to the illusion that AI makes trading “easy”. Overconfidence, leverage, and opaque bots can lead to rapid losses. Without proper education and controls, the spread of AI tools to retail audiences could create new problems rather than solving existing ones.

Regulators, Rules, and the New AI Market Framework

As AI moves deeper into trading, regulators are under pressure to keep up. Their core goals remain the same: fair markets, investor protection, and financial stability. But the tools must evolve.

Key areas of focus include:

- Model governance and accountability: Firms will increasingly need robust frameworks for model validation, stress testing, and documentation. Senior managers will still be accountable for outcomes, even if an AI made the decision.

- Transparency and explainability: Regulators are exploring how much explanation is needed for AI-driven decisions. Simple rule-based systems are easy to explain. Deep learning models are not. The balance between innovation and clarity will be an ongoing debate.

- Systemic risk monitoring: AI systems can create new forms of interconnected risk. Regulators may need better real-time market monitoring and data-sharing arrangements to detect emerging vulnerabilities.

- Protection for retail investors: Authorities are already looking at how AI trading platforms market their services to the public. Claims of “risk-free profits” or “guaranteed returns” are likely to face tighter scrutiny.

The direction is clear: AI is being integrated into the regulatory perimeter rather than pushed out of it.

For professional traders and portfolio managers

The role of the human trader is changing. Pure discretionary stock picking is giving way to a more hybrid role:

- Understanding and interpreting model outputs.

- Designing strategies and constraints.

- Overseeing risk and making judgment calls in unusual situations.

Traders who understand both markets and data science will be in strong demand. Basic literacy in statistics, coding, and model behavior will become essential.

For retail traders and long-term investors

Retail investors do not need to become data scientists. But they do need to understand what AI can and cannot do.

Practical guidelines include:

- Use AI-powered tools for research, diversification checks, and risk alerts.

- Avoid handing full control to unknown or opaque bots.

- Stay skeptical of performance claims that sound too good to be true.

- Focus on long-term, diversified portfolios instead of short-term speculation.

For exchanges, brokers, and fintechs

Trading venues and intermediaries will compete on their AI capabilities. Better analytics, smarter order routing, and personalized tools will be important differentiators. At the same time, they will carry greater responsibility for ensuring safe and fair access to AI-driven features.

For emerging markets

For many emerging markets, the future of trading technology offers both risk and opportunity. AI can help leapfrog old infrastructure and offer more efficient access to capital. But gaps in data quality, regulatory capacity, and digital literacy must be addressed to avoid widening inequalities.

How to Prepare for an AI-Dominated Trading Future

Whether you are an individual investor, a professional, or a policymaker, preparation is possible.

Action points for individual investors

- Educate yourself on basic concepts like algorithmic trading and AI-driven trading.

- Treat AI tools as assistants, not oracles.

- Keep core portfolios diversified and aligned with long-term goals.

- Use stop-losses and position limits to control risk when experimenting with AI-based strategies.

Action points for financial institutions

- Invest in robust data pipelines, MLOps, and infrastructure for AI deployment.

- Build multi-disciplinary teams that combine quants, technologists, and domain experts.

- Strengthen model risk management and governance frameworks.

- Engage early with regulators on AI-related issues to shape workable standards.

Action points for policymakers and educators

- Promote financial and digital literacy programs that cover AI in finance.

- Encourage responsible innovation through sandboxes and pilot projects.

- Develop guidelines that address both AI risk management and market competitiveness.

Final Thought: AI as the New Market Infrastructure

AI-driven trading is not a temporary trend. It is the logical result of markets becoming faster, more complex, and more data-rich. Algorithms and models are better suited than humans to crunch giant data sets and execute thousands of small decisions every second.

But dominance does not mean replacement. Human oversight, ethics, and judgment remain critical. The most powerful trading organizations of the next decade will be those that combine the strengths of humans and machines — using AI not as a magic shortcut to profits, but as a disciplined, well-governed engine inside a broader strategy.

For traders, investors, and policymakers, the question is no longer whether AI will reshape markets. It already has. The real question is how prepared each of us will be when AI is not just a tool on the desk, but the underlying fabric of global trading itself.