Compliance has traditionally been reactive, slow-moving, and human-driven. However, artificial intelligence is starting to flip the model.

As regulatory environments grow more complex and global, organizations face a new watchdog: AI-powered auditors. These automated systems promise to detect anomalies, flag risks in real-time, and even anticipate potential violations. But are businesses ready for this level of oversight? More importantly, are their internal systems prepared?

The Rise of Autonomous Oversight

AI auditors are no longer science fiction. Some regulatory bodies and large institutions already use machine learning models to monitor financial transactions, supplier networks, environmental metrics, and cybersecurity compliance. These systems can continuously scan for non-compliance indicators across large datasets at speeds no human team could match.

For instance, in financial services, natural language processing is used to comb through email communication to detect possible conflicts of interest or insider trading behaviors. AI is being applied to track unusual billing patterns or potential HIPAA violations in healthcare. Across sectors, technology is evolving faster than many organizations can adapt to.

Why This Shift Matters

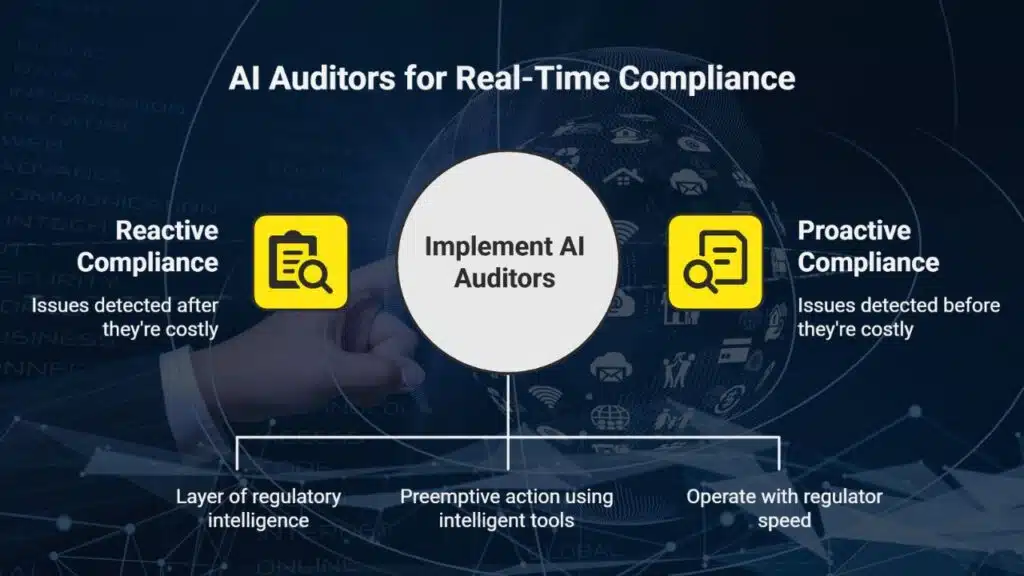

Most companies rely heavily on manual audits, annual risk reviews, and decentralized tracking systems. These traditional approaches often detect issues only after they’ve become costly. On the other hand, AI auditors introduce a real-time layer of regulatory intelligence. They also raise the bar for what counts as due diligence.

This shift introduces a paradigm where businesses will need to prove not just that they complied, but that they took preemptive action using intelligent tools. Internal compliance teams must operate with the same speed and precision as the regulators watching them.

Internal Systems Under Pressure

As AI oversight gains traction, internal compliance systems must become more agile, integrated, and data-rich. Systems that rely on siloed spreadsheets or manual policy checklists will no longer suffice. The new standard is continuous monitoring, real-time alerting, and actionable data.

This is where compliance management solutions come into play. Modern platforms offer dashboards, customizable workflows, and data integrations that serve as the nerve center of an organization’s compliance posture. These systems help meet current requirements and prepare companies for the next generation of automated scrutiny.

Ethical and Legal Questions Loom

While AI can reduce human bias and improve consistency, it is not without ethical concerns. Black-box algorithms, opaque decision-making, and over-reliance on automation pose their risks. Businesses must implement these tools and document and audit their usage. Transparency, explainability, and fairness must be built into every layer of their AI infrastructure.

Preparing for the Future

Being “AI audit-ready” will become a competitive differentiator. Forward-looking companies are already conducting internal reviews to identify blind spots in data quality, staff training, and system interoperability. Some are setting up internal AI governance councils to ensure responsible deployment.

Takeaway

You don’t need to wait for regulators to deploy AI. Internal adoption of intelligent compliance systems can offer a buffer and a springboard.

Whether businesses are ready or not, the age of AI-driven compliance oversight is coming. Organizations that take a proactive approach by investing in robust digital frameworks, fostering cross-functional collaboration, and cultivating transparency will meet regulatory expectations and outpace competitors stuck in the old paradigm.

If your compliance system still feels manual and fragmented, it may be time to ask a difficult question: Would your company pass an AI audit?