B2B SaaS is entering an “Accountable ROI” era in 2026 because budgets are growing—but scrutiny is, too. CFOs want proof, AI spend is rising, and retention is harder. Founders who can’t tie product value to measurable outcomes will lose renewals, expansions, and board confidence.

How We Got Here: From “Growth At All Costs” To “Prove It” Growth

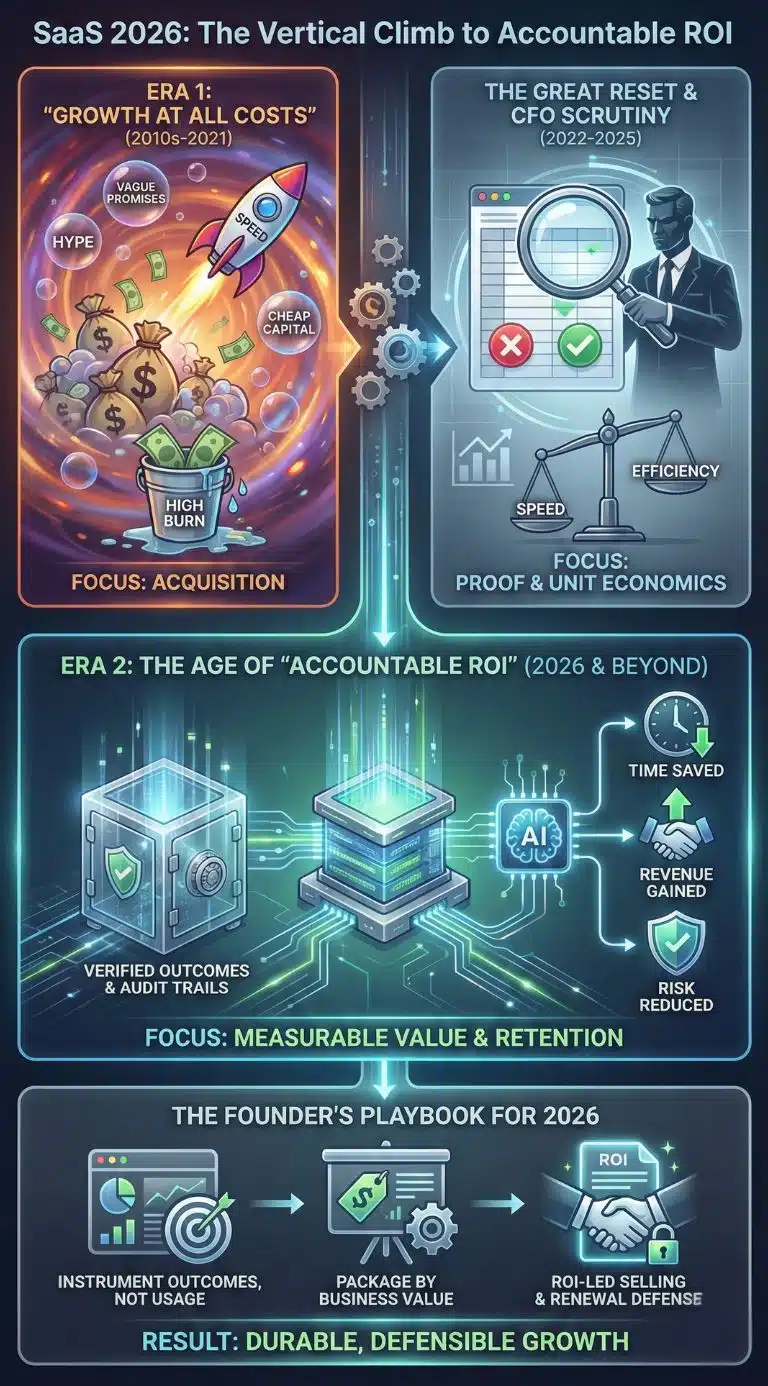

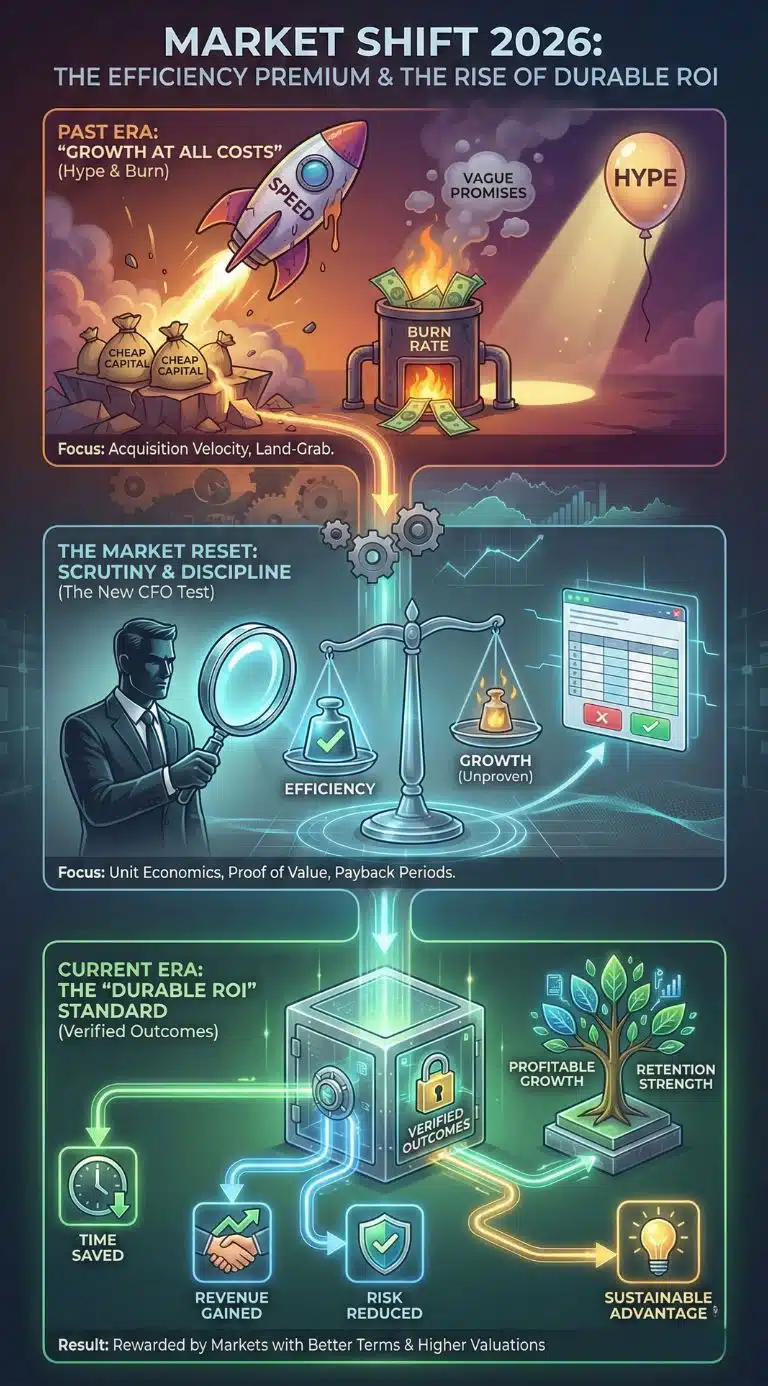

For most of the 2010s—and especially during the 2020–2021 boom—B2B SaaS rewarded speed. Capital was cheap, expansion was easier, and founders could justify aggressive acquisition with the promise of future scale. That playbook cracked when rates rose, public SaaS multiples reset, and boards started asking the uncomfortable question: What are we getting back for every dollar we spend?

By late 2025, the “new normal” was visible in benchmarks: growth didn’t disappear, but the tolerance for inefficient growth did. Many private SaaS operators entered 2026 expecting two things at once: (1) a more constructive demand environment than the worst of 2022–2024, and (2) a permanent reset in what investors and buyers consider “healthy.” The result is a market where the winners aren’t simply the loudest or fastest—they’re the ones who can defend their economics in a spreadsheet and their value in an executive review.

At the same time, macro-level tech spend is not collapsing. Forecasts for global IT spending indicate a continued climb in 2026, crossing the $6 trillion mark with strong year-over-year growth. That matters because it punctures the simplistic “buyers stopped spending” narrative. Buyers are spending—but they are spending differently. In practice, the money is moving toward initiatives that can be justified with clear business cases, especially in AI-related infrastructure and software.

That combination—spending growth + measurement pressure—is exactly why 2026 looks like the moment B2B SaaS founders must pivot from “hype ROI” (promised efficiency) to Accountable ROI (verified outcomes).

Key Statistics That Explain The Pivot

- $6.08T: Forecast global IT spending in 2026, roughly +9.8% year over year (Gartner forecast).

- AI infrastructure demand: Data-center and compute-related spending has been a major growth driver, reflecting accelerated AI buildouts.

- Private SaaS profitability expectations: Many private SaaS firms expect profitability to improve into 2026, while AI monetization is increasingly common in packaging and pricing.

- Retention/expansion pressure: Multiple benchmark datasets show net revenue retention hovering close to ~100–101% for many cohorts—meaning expansion is no longer reliably offsetting churn and contraction.

- Enterprise genAI budget normalization: Enterprise AI spending has surged, but is increasingly treated as a standard budget line that must justify ROI like everything else.

Accountable ROI Is Not A Buzzword—It’s A Buying Standard In 2026

“Accountable ROI” is a shift in how ROI is defined and enforced:

- Old ROI (Sales-Led Narrative): “This will save time.” “This will improve productivity.”

- Accountable ROI (Finance-Led Proof): “This reduced cycle time by X%, cut cost by $Y, improved conversion by Z points, and we can audit it.”

Three forces are converging:

- CFO governance is expanding. Finance leaders are taking a stronger role in tech value realization, performance management, and controls. Even when departments initiate purchases, renewal approval often requires finance-grade evidence.

- AI raises the bar. It increases expectations (automation, better decisions) but also adds costs (compute, data, implementation complexity, governance). Many organizations report gaps between pilots and scaled, material impact.

- SaaS differentiation is compressing. AI features are copied faster; switching costs are lower for “nice-to-have” point tools; buyers demand measurable outcomes and switching-proof value.

Accountable ROI is the language of this new buying reality. It’s not just “being ROI-focused.” It’s making ROI measurable, reviewable, and repeatable.

The New CFO Test: “Show Me The Unit Economics And The Payback”

A defining feature of 2026 is that finance leaders are less willing to fund vague transformation stories. Even when overall IT budgets rise, CFOs increasingly want:

- Payback periods, not just annual savings estimates

- Implementation and adoption proof, not just deployment dates

- Outcome instrumentation, including baselines and audit trails

- Renewal justification aligned with business KPIs

This also reflects the reality that acquisition has been expensive in recent years. When CAC is higher and payback is stretched, companies can’t afford tools that merely feel useful. They need tools that can be defended under scrutiny—particularly during quarterly budget cycles or when cost optimization returns to the agenda.

| What Buyers Tolerated In 2021 | What Buyers Demand In 2026 |

| ROI claims in decks | ROI tracked in-product and in finance reports |

| Feature checklists | Outcome-based evaluation (time saved, revenue gained, risk reduced) |

| “Land now, expand later” | Renewal-first value with fast time-to-impact |

| Multi-year commitments on trust | Shorter commitments unless ROI is evidenced |

| AI as a differentiator | AI as expected—measured for cost and impact |

Implication: Founders must treat ROI as a product capability, not a marketing promise.

Retention Reality: Expansion Isn’t Free Money Anymore

If 2021 rewarded customer acquisition, 2026 rewards customer economics. Many SaaS operators are finding that expansion is harder: net revenue retention is closer to ~100% for broad cohorts than it was in the boom years. That is an enormous shift in the “SaaS math,” because a lot of growth models quietly assumed:

- new logo growth slows over time, but expansion accelerates.

When expansion stalls, the math breaks. The company must either (a) find new distribution, (b) dramatically improve retention and expansion with stronger value realization, or (c) accept lower growth and optimize for profitability.

| Metric Pressure Point | What It Signals In 2026 | Founder Move |

| NRR closer to ~100% | Expansion is tougher; customers are optimizing spend | Shift to verified outcomes + better packaging |

| GRR softness in cohorts | Buyers downgrade or churn more readily | De-risk renewals with adoption + exec alignment |

| Longer payback / higher CAC | Acquisition is expensive relative to value | Invest in ROI-led sales + partner motion |

| Faster competition via AI | Features commoditize quickly | Differentiate with data, workflow lock-in, compliance |

Implication: Accountable ROI becomes a retention strategy. If customers can’t prove value internally, they can’t defend renewal during budget reviews—especially when procurement is searching for cost takeout.

AI’s ROI Paradox: Spending Is Rising, But Patience Is Shrinking

AI is simultaneously a tailwind and a trap for SaaS founders.

- Tailwind: Buyers are actively funding AI when it increases productivity and speed—especially in software development, customer support, analytics, and workflow automation.

- Trap: Many AI deployments struggle to produce measurable impact at scale. Pilots look impressive, but adoption, governance, and workflow redesign determine whether value actually lands.

In practice, 2026 procurement asks sharper questions about AI features than it did in 2023–2024:

- What workflow step is eliminated?

- What human time is displaced or redeployed?

- What’s the accuracy threshold and cost per output?

- What governance exists (privacy, audit, policy)?

- What is the incremental compute cost, and who pays it?

| AI Capability Type | Buyer Question In 2026 | Risk If You Can’t Answer |

| Copilot/assistant | “What KPI moves and how fast?” | Seen as a “nice-to-have” |

| Automation/agents | “What process cost disappears?” | Blocked by compliance/finance |

| Analytics/insights | “Is it trusted and auditable?” | Rejected by risk teams |

| Gen content | “Is it unique or commoditized?” | Price compression |

Implication: “AI-first” messaging won’t win renewals. Measurable impact + controllable cost will.

Markets Are Rewarding Efficiency Again—Even If Funding Improves

VC markets can warm up while still demanding discipline. Venture reports show selective risk appetite: capital remains available, but it flows toward companies with credible unit economics, durable retention, and clear pathways to profitable growth.

Meanwhile, public comps still influence private expectations. Market commentary through 2025 highlighted a split environment: top-performing SaaS companies held stronger multiples, while weaker growth or less efficient businesses saw compressions. Even if equity markets stabilize, the “growth without proof” era is not coming back in the same form.

| Era | Board Priority | What Wins |

| 2018–2021 | Growth velocity | Land-grab, category creation |

| 2022–2024 | Survival efficiency | Burn discipline, focus |

| 2025–2026 | Durable ROI | Retention strength + measurable outcomes |

| 2027+ (likely) | Compounding advantage | Data moats, platforms, ecosystem control |

Implication: Founders who build ROI verification into product and GTM will raise and exit on better terms than those selling stories.

GTM Rewiring: ROI-Led Selling Is Replacing Feature-Led Selling

Accountable ROI changes how founders should sell, market, and onboard.

What changes in 2026 sales cycles

- More stakeholders: finance, security, ops, procurement

- Higher demand for: baselines, pilots, outcome commitments

- More pressure for: shorter time-to-value

In product-led motions, the same shift appears as buyers demand immediate value realization—because there’s less tolerance for long adoption arcs. “Try it and see” still exists, but the expectation is that a product should prove itself quickly with measurable progress, not just enthusiastic usage.

| Sales Motion | Works Best When | Weakness Under Accountable ROI |

| Traditional enterprise | High ACV, complex workflows | Longer time-to-value unless tightly managed |

| Product-led | Fast time-to-value, clear usage signals | Harder in regulated, multi-stakeholder deals |

| Hybrid PLG + Sales | Strong instrumentation + guided rollout | Requires excellent lifecycle analytics |

| Partner-led | Clear ROI story + validated use cases | Needs enablement + proof assets |

Implication: ROI is no longer a “later-stage” refinement. It becomes the wedge to win deals and defend renewals.

Winners And Losers In The 2026 Accountable ROI Reset

| Likely Winners | Why | Likely Losers | Why |

| Workflow owners (systems of action/record) | Direct KPI linkage and stickiness | Feature tools | Easy to replace, hard to justify |

| Products with ROI dashboards | Finance-friendly renewal defense | “AI add-ons” with unclear value | Seen as cost inflation |

| Vertical SaaS with unique data | Defensible differentiation | Horizontal SaaS without moat | Price pressure |

| Platforms with governance & audit | Procurement-ready | Tools without compliance posture | Blocked late-stage |

| Companies with fast onboarding | Short time-to-value | Heavy services dependency | ROI diluted by implementation drag |

This isn’t moral judgment—it’s purchase logic. In a measured environment, buyers prefer what they can defend.

Expert Perspectives And Counterpoints: Is “Accountable ROI” Overcorrecting?

To maintain neutrality, it’s worth acknowledging pushback:

Counter-argument 1: ROI measurement can undervalue strategic software.

Some benefits—resilience, optionality, innovation speed—are harder to quantify. Over-indexing on near-term ROI can cause underinvestment in foundational capabilities.

Counter-argument 2: Too much ROI gating slows transformation.

If every project needs immediate proof, organizations may avoid bold moves. Research and surveys on AI adoption suggest many firms are still learning how to scale AI value; rigid scorekeeping too early can reduce experimentation and learning.

Counter-argument 3: AI adoption is still expanding despite imperfect returns.

Even with measurement pressure, enterprises are continuing to allocate budgets to AI. The debate is increasingly about governance, data readiness, and rollout strategy—not whether to invest.

Synthesis: Accountable ROI doesn’t mean “only short-term wins.” It means clarity: what value is expected, what proof will be used, and what milestones justify continued spend.

What Founders Should Do Now: The 2026 Accountable ROI Playbook

- Instrument outcomes, not usage.

Usage is a leading indicator; CFOs want business results. Map product events to cost, time, risk, or revenue. - Package offers around measurable jobs-to-be-done.

Stop selling “features included.” Sell “X days to value” and “Y KPI moved.” - Build ROI evidence into onboarding.

If customers can’t capture proof during onboarding, they won’t have proof at renewal. - Align pricing with value delivery and cost-to-serve.

AI features often raise compute costs—ensure packaging and contracts reflect that reality. - Create renewal defense kits.

One-page KPI improvement summary, adoption narrative, and executive-ready ROI report that mirrors how finance teams speak. - Treat finance as a product stakeholder.

The buyer is increasingly a committee. Make the CFO’s job easier with auditability, baselines, and measurable milestones.

What Happens Next In 2026: Milestones To Watch

These are forward-looking projections based on observable shifts in budgets, benchmarks, and procurement behavior:

- Shorter proof cycles become standard. Expect more buyers to require 30–90 day value validation before expanding footprint.

- ROI dashboards become expected. SaaS categories competing for enterprise dollars will increasingly need built-in outcome reporting.

- Pricing pressure intensifies for tools that cannot differentiate beyond “AI features,” because buyers will compare cost per outcome.

- Procurement playbooks mature for AI. Expect tighter governance requirements (audit, data handling, model risk), especially in regulated sectors.

- M&A favors measurable value. Acquirers will prefer products with durable retention, efficient GTM, and finance-grade outcomes over “story assets.”

The larger point: 2026 is not the end of growth. It’s the end of unaccountable growth.

Final Thoughts

Accountable ROI is the defining SaaS posture for 2026 because it aligns three realities: CFO scrutiny, harder expansion, and AI economics. Tech spending is still rising, but capital is concentrating around what can be justified with evidence, not optimism. For B2B SaaS founders, the pivot is straightforward but demanding: make ROI measurable, defensible, and repeatable—then sell that.