Selecting the best investing books 2026 is a transformative step for anyone looking to build a secure financial future. In a rapidly shifting economy, these books provide the foundational knowledge and psychological fortitude needed to navigate volatile markets. Whether you are a beginner or a seasoned professional, the right literature can shift your perspective from working for money to making money work for you.

The current financial landscape emphasizes the importance of both technical strategy and behavioral discipline. The best investing books 2026 offer a mix of timeless classics and modern insights that address the unique challenges of the post-digital age. By studying these expert perspectives, you can develop a personalized roadmap to financial independence and long-term wealth.

Selection Criteria For Our Final Rankings

Our team evaluated hundreds of titles to identify the most impactful books for modern investors. we prioritized works that offer actionable strategies, historical context, and a focus on long-term growth. The following table explains the weighting used to determine our final list of recommendations for the current year.

These criteria ensure that the selected books are not just theoretical but provide practical value that can be applied to real-world portfolios. We also considered the accessibility of the writing style to ensure the concepts are digestible for all readers. This balanced approach helps bridge the gap between financial theory and successful execution.

| Criterion | Weighting |

| Practicality | 35% |

| Historical Accuracy | 25% |

| Readability | 20% |

| Modern Relevance | 20% |

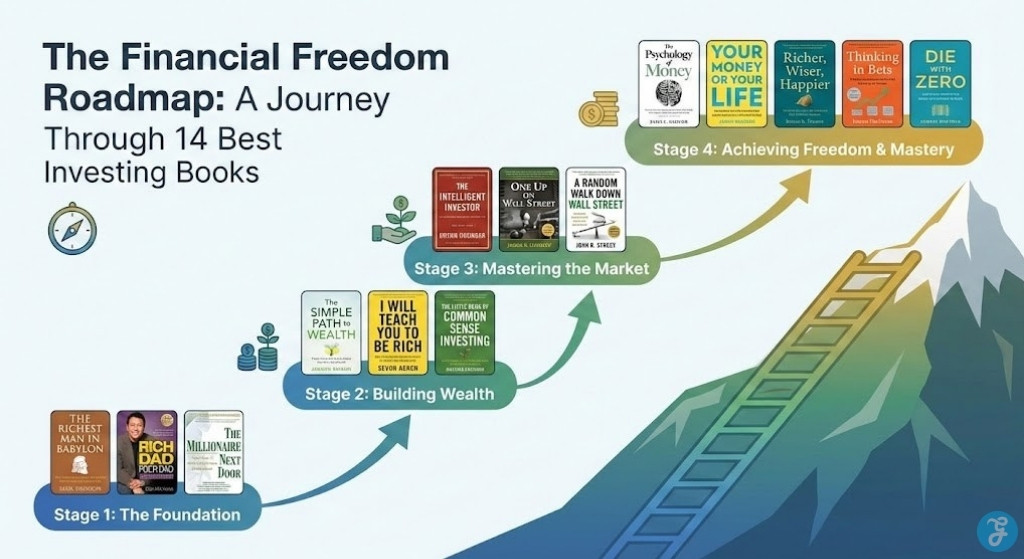

Discovering The 14 Best Investing Books 2026 For Success

The following list represents the gold standard of financial education for the modern era. Each entry has been vetted for its ability to provide clear and actionable insights that lead to financial freedom. These selections will help you build a robust foundation for your investment journey.

1. The Intelligent Investor

Benjamin Graham’s masterpiece remains the definitive text on value investing more than 75 years after its original publication. It teaches the vital concept of “margin of safety” and the importance of treating a stock as a part ownership in a real business. The 2026 75th anniversary edition includes updated commentary that applies Graham’s timeless wisdom to modern market conditions. This is an essential resource for anyone looking to build a disciplined and rational approach to the stock market.

Special Features:

-

In-depth analysis of “Mr. Market” and how to ignore emotional volatility

-

Detailed frameworks for distinguishing between speculation and true investing

-

Updated commentary by Jason Zweig for the 2026 anniversary edition

Things To Consider:

-

Some of the technical examples from the early 20th century can be dense

-

The focus is on capital preservation rather than rapid growth

Best For: Serious investors seeking a rock-solid philosophical foundation

2. The Psychology of Money

Morgan Housel explores the emotional and behavioral side of financial success in this modern classic. He argues that doing well with money has little to do with how smart you are and everything to do with how you behave. The book uses short and engaging stories to illustrate why patience and consistency are more important than complex spreadsheets. It simplifies the bridge between technical knowledge and real-world financial results.

Special Features:

-

20 short chapters covering different behavioral biases and traps

-

Insights into why “wealth is what you don’t see”

-

Practical advice on how to build a healthy relationship with money

Things To Consider:

-

It does not provide specific stock picks or technical chart analysis

-

Focuses more on mindset than on individual asset allocation

Best For: Everyone from beginners to pros who want to master their mindset

3. The Little Book of Common Sense Investing

Written by John Bogle, the founder of Vanguard, this book is the ultimate guide to low-cost index fund investing. Bogle argues that trying to beat the market is a “loser’s game” and that owning the entire market through an index is the only way to guarantee success. The 2026 market continues to validate his theory as low-cost funds outperform active managers. It remains a reliable staple for those focused on efficient and hands-off wealth building.

Special Features:

-

Clear data showing the long-term outperformance of index funds

-

Explanation of how high fees can destroy your investment returns

-

Simple instructions for building a diversified “Boglehead” portfolio

Things To Consider:

-

The strategy is simple and may feel “boring” to active traders

-

It discourages individual stock picking which some investors enjoy

Best For: Passive investors and those who value simplicity and low costs

4. The Simple Path to Wealth

JL Collins originally wrote this material as letters to his daughter to help her manage her money without stress. It advocates for a high savings rate and a single investment in a total stock market index fund. The book is famous for its “F-You Money” concept which provides a powerful motivation for reaching financial independence. It simplifies the bridge between research and practical wealth creation.

Special Features:

-

A direct and no-nonsense approach to debt and saving

-

Detailed look at the “4% Rule” for safe retirement withdrawals

-

Clear guidance on how to ignore market noise and “stay the course”

Things To Consider:

-

The advice is extremely focused on a US-based total market strategy

-

Very little coverage of alternative assets like real estate or crypto

Best For: Young professionals seeking a clear and easy roadmap to freedom

5. I Will Teach You to Be Rich

Ramit Sethi offers a 6-week program designed for millennials and Gen Z to automate their finances and spend guilt-free. He focuses on “Big Wins” like negotiating a higher salary and optimizing your credit cards rather than cutting back on lattes. The 2026 edition includes updated advice on modern fintech tools and automated investing platforms. It provides a great user experience for everyday financial management.

Special Features:

-

Tactical scripts for negotiating better rates and higher pay

-

Detailed guide to automating your monthly money flow

-

Philosophy of “Conscious Spending” to enjoy your money today

Things To Consider:

-

The tone is very bold and may be polarizing for some readers

-

Focuses heavily on the lifestyle aspects of personal finance

Best For: Millennials and Gen Z who want to build a “Rich Life”

6. Your Money or Your Life

This foundational text of the FIRE movement encourages readers to view money as “life energy” that they trade their time for. It offers a 9-step program to track every dollar and reach a “crossover point” where your investments cover your living expenses. The book is a must-read for those seeking meaning and autonomy rather than just a high net worth. It helps bridge the gap between search volume and human purpose.

Special Features:

-

Practical exercises for calculating your true hourly wage

-

Strategies for eliminating unnecessary expenses through values-aligned spending

-

Visionary framework for reaching financial independence at any income level

Things To Consider:

-

The 9-step program requires meticulous tracking and dedication

-

Some concepts like tracking to the penny may feel outdated to some

Best For: Minimalists and those seeking a deep lifestyle transformation

7. Rich Dad Poor Dad

Robert Kiyosaki’s classic challenges conventional notions of wealth and encourages readers to prioritize financial education over traditional employment. He explains how his “rich dad” taught him the importance of building assets that put money in his pocket. The book is responsible for introducing millions to the concepts of passive income and cash flow. It is a solid choice for those starting their entrepreneurial journey.

Special Features:

-

Simple diagrams explaining the difference between assets and liabilities

-

Focus on the importance of “minding your own business”

-

Inspiring stories that challenge the “work for a paycheck” mindset

Things To Consider:

-

Some of the specific tax and legal advice is dated and should be verified

-

The writing style is repetitive to emphasize its core points

Best For: Beginners looking for a major shift in their financial perspective

8. One Up On Wall Street

Peter Lynch, one of the most successful mutual fund managers in history, argues that regular people can beat the pros by “investing in what they know.” He encourages investors to keep their eyes open for great businesses in their daily lives. The book provides a practical framework for identifying “ten-bagger” stocks that can transform a portfolio. It makes complex stock analysis easy for everyday people to use.

Special Features:

-

The “Lynch Categories” for classifying different types of stocks

-

Guidance on how to research companies using simple observations

-

Timeless advice on when to sell a stock and when to hold

Things To Consider:

-

Individual stock picking requires more time than index investing

-

Some of the company examples are from the 1980s and 1990s

Best For: Individual stock pickers and retail investors

9. Thinking in Bets

Annie Duke, a former poker champion, provides a groundbreaking look at how to make decisions under uncertainty. She argues that we should judge our decisions by the process rather than the outcome. This mindset is vital for investors who often suffer from “resulting” after a market correction. It is a futuristic addition to any modern investor’s digital library.

Special Features:

-

Strategies for identifying and neutralizing cognitive biases

-

The concept of “backcasting” to plan for various future scenarios

-

Practical tools for improving decision-making in high-stakes environments

Things To Consider:

-

Not a traditional finance book with charts or investment data

-

Requires a high degree of self-reflection to apply the lessons

Best For: Advanced investors and decision-makers seeking an edge

10. The Millionaire Next Door

This book is the result of a decades-long study into the habits of America’s wealthy. It reveals that most millionaires live well below their means and do not look like the stereotypes often seen in the media. The authors highlight the importance of “playing great defense” with your money. It reveals the intent behind true wealth through extensive sociological data.

Special Features:

-

Detailed comparisons between “Under Accumulators” and “Prodigious Accumulators”

-

Insights into why high-income earners are often not wealthy

-

Practical data on the daily habits and spending of the truly rich

Things To Consider:

-

The data is primarily based on the US market in the late 20th century

-

The focus on extreme frugality may not appeal to everyone

Best For: People who want to understand the reality of wealth building

11. Richer, Wiser, Happier

William Green profiles the world’s greatest investors—including Warren Buffett and Charlie Munger—to find the common threads of their success. He explores how these icons think not just about money but about life and risk and happiness. The book provides a sophisticated look at the “meta-skills” required for long-term excellence. It provides a historical perspective on the masters of the game.

Special Features:

-

Exclusive interviews and stories from legendary investment figures

-

Exploration of how great investors use “cloning” and simplification

-

Focus on how to live a meaningful life while building wealth

Things To Consider:

-

The focus is more on high-level philosophy than tactical day trading

-

Some of the investors profiled manage billions which can feel distant

Best For: Serious students of investing and high-level thinkers

12. The Richest Man in Babylon

George Clason uses a series of parables set in ancient Babylon to teach fundamental lessons on money management. The book is famous for its simple rules such as “pay yourself first” and “make thy gold multiply.” Despite being written in the 1920s, the lessons remain entirely relevant to the 2026 economy. It is the gold standard for high-stakes financial wisdom delivered simply.

Special Features:

-

Memorable parables that make financial rules easy to remember

-

A focus on the “Seven Cures for a Lean Purse”

-

Short and easy-to-read format that can be finished in an afternoon

Things To Consider:

-

The ancient prose style may be off-putting for some modern readers

-

It covers very basic principles rather than advanced strategies

Best For: Beginners and young adults looking for a simple starting point

13. Die with Zero

Bill Perkins challenges the traditional “save as much as possible” mindset by encouraging readers to optimize their life for experiences. He argues that the goal should be to maximize your life enjoyment while your health and age allow for it. The book provides a refreshing and controversial perspective on when to spend versus when to save. It is a modern entry for those re-evaluating their relationship with work.

Special Features:

-

The concept of “Memory Dividends” and the value of early experiences

-

Practical guidance on how to calculate your personal “Survival Number”

-

Strategies for giving money to children and charities when it’s most needed

Things To Consider:

-

The advice requires a secure financial baseline to implement safely

-

It may feel reckless to those with a very conservative risk profile

Best For: Mid-career professionals and those nearing retirement

14. A Random Walk Down Wall Street

Burton Malkiel’s classic provides a comprehensive look at the history of the stock market and various investment theories. In the 50th anniversary edition, he analyzes modern trends like meme stocks and cryptocurrencies through the lens of the “Efficient Market Hypothesis.” The book is an excellent technical foundation for understanding how markets function. It makes complex market data easy for serious students to use.

Special Features:

-

A deep dive into the “Firm Foundation” and “Castle in the Air” theories

-

Practical advice on asset allocation based on your life cycle and age

-

Updated analysis of the latest financial bubbles and manias

Things To Consider:

-

Some of the academic theories can be challenging for total beginners

-

The book is quite long and covers a vast amount of historical data

Best For: Technical students and investors who want a deep market education

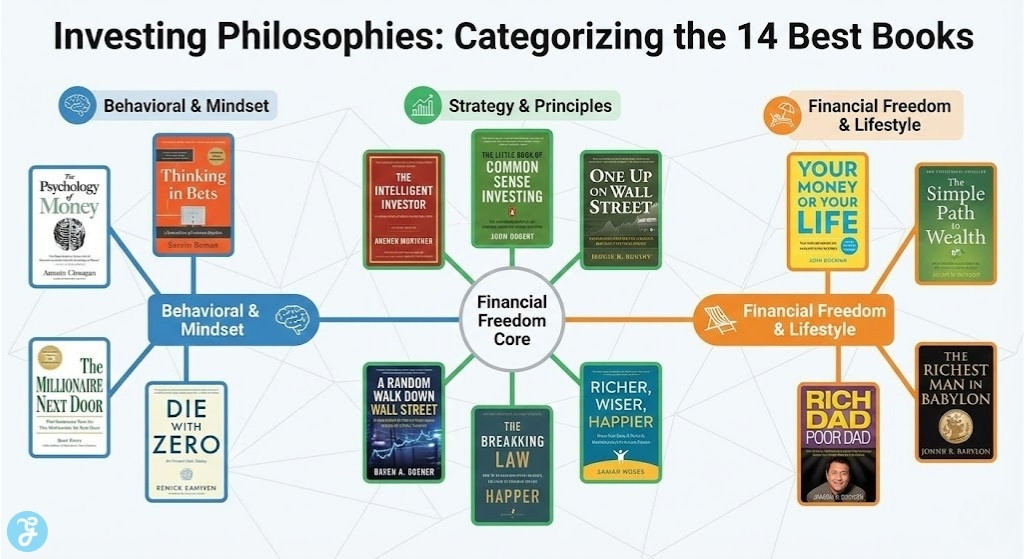

2026 Financial Literature Market Overview

The market for investing books has evolved toward a focus on investor psychology and automated wealth building. Most high-performing readers now look for titles that combine classic value investing principles with modern digital asset trends. This comparison shows how the leading categories of financial literature stack up in the 2026 environment.

These segments represent the diverse paths to wealth available to the modern reader. Understanding the focus of each category allows you to select the books that best align with your current financial goals. The following data points reflect the current trends in reader interest and critical acclaim.

| Category | Primary Focus | Best For |

| Behavioral Finance | Mindset & Habits | Long-Term Success |

| Passive Investing | Indexing & Fees | Hands-Off Growth |

| Value Investing | Intrinsic Worth | Bargain Hunters |

How To Choose The Right Financial Book

Selecting a book depends on whether you need a major mindset shift or a technical manual for your portfolio. You should prioritize the area where you currently feel the most uncertainty—be it behavioral habits or technical stock analysis. This comparison matrix helps you align your specific financial goals with the most appropriate literature.

| Investment Goal | Preferred Book | Primary Benefit |

| Mindset Shift | Psychology of Money | Behavioral Health |

| Simple Strategy | Simple Path to Wealth | Freedom & Ease |

| Technical Depth | Intelligent Investor | Rational Strategy |

| Rapid Growth | I Will Teach You | Automated Systems |

Final Thoughts On Financial Literacy

Winning in the markets during 2026 means using the collective wisdom of history’s greatest minds to inform your decisions. The best investing books 2026 are the ones that provide you with the confidence to stay the course during difficult times. Implementing the lessons from these titles will ensure that your financial foundation is built on truth and discipline.