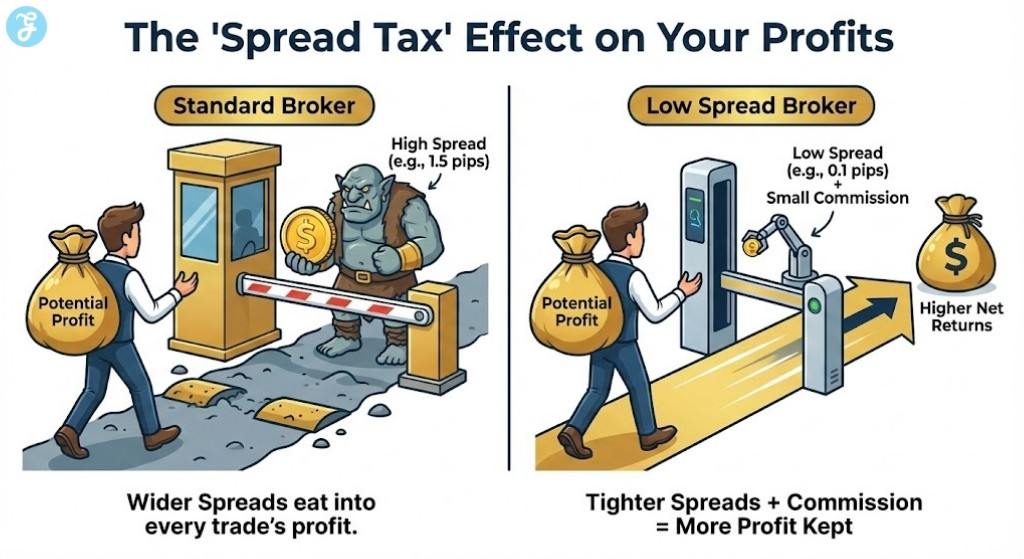

Selecting the right low spread forex brokers is the most critical factor for traders who want to minimize their overhead costs in 2026. These specialized platforms provide access to the market with minimal difference between the buy and sell price. Choosing a broker with tight spreads ensures that you reach the break even point on your trades much faster than on standard accounts.

The current financial landscape is dominated by high frequency trading and algorithmic strategies that require institutional grade liquidity. Using low spread forex brokers allows retail participants to compete on a level playing field with major banks and hedge funds. This strategic choice is particularly important for scalpers and day traders who execute dozens of positions every single day.

Selection Criteria For Our Top Rankings

We evaluated each brokerage based on a rigorous set of performance metrics to ensure they meet the demands of modern traders. Our team prioritized firms that offer genuine ECN or Raw Spread execution with consistent uptime during high volatility news events. The following weighting reflects the most important factors we considered during our evaluation process for this year.

This data driven approach helps us identify which brokers are actually delivering on their promises of tight pricing. We also took into account the quality of the regulatory oversight to ensure your capital remains secure at all times. These factors combined allow for a transparent and fair trading environment.

| Criterion | Weighting |

| Spread Tightness | 35% |

| Execution Speed | 25% |

| Regulatory Trust | 20% |

| Platform Variety | 20% |

Reviewing The 12 Low Spread Forex Brokers For High Profit

The following list contains the most reliable platforms currently available for traders seeking the lowest possible entry costs. Each selection has been vetted for its ability to provide stable pricing even during periods of extreme market movement. These brokers will help you maximize your net profit by keeping your transaction fees to an absolute minimum.

1. Exness

Exness is widely considered the overall leader for traders who require stable zero spreads on the world’s most liquid currency pairs. Its Zero Account is specifically designed to provide a 0.0 pip spread for 95% of the trading day on the top 30 instruments. The broker is also famous for its instant withdrawal system which processes payments in seconds without human intervention. This makes it an ideal choice for professionals who demand high liquidity and total financial flexibility.

Special Features:

-

Guaranteed 0.0 spreads on major pairs for the majority of the day

-

Instant automated withdrawals processed via electronic payment systems

-

Unlimited leverage options available for experienced and qualified traders

Things To Consider:

-

The zero spread accounts require a higher minimum deposit than standard types

-

High leverage can lead to rapid losses if not managed with strict discipline

Best For: Professional scalpers and high volume day traders

2. IC Markets

IC Markets is an Australian powerhouse that has built its reputation on providing ultra low latency execution for algorithmic traders. Its Raw Spread account connects directly to over 25 different liquidity providers to ensure the tightest possible pricing at all times. The broker is a favorite for users of Expert Advisors and automated scripts due to its server locations in New York and London. It provides one of the most stable and transparent trading environments in the industry today.

Special Features:

-

True ECN connectivity with spreads starting from 0.0 pips

-

Servers located in the Equinix NY4 and LD5 data centers for speed

-

No restrictions on trading styles including news trading and scalping

Things To Consider:

-

Customer support response times can vary during peak global sessions

-

The interface is more technical and geared toward experienced traders

Best For: Algorithmic traders and users of Expert Advisors

3. Pepperstone

Pepperstone is globally recognized for its Razor account which offers institutional grade spreads to retail clients around the world. The broker provides a vast array of third party tools such as Smart Trader Tools and Autochartist to help users find better setups. It is regulated by multiple top tier authorities including the ASIC and the FCA which ensures a high level of safety. The execution speeds are among the fastest in the world with most trades filling in under 30 milliseconds.

Special Features:

-

Razor account with raw spreads and low per lot commissions

-

Support for a wide range of platforms including TradingView and cTrader

-

Award winning customer service available 24 hours a day during the week

Things To Consider:

-

Inactivity fees may apply if the account remains dormant for too long

-

Spreads can widen more than competitors during low liquidity rollover periods

Best For: Active day traders and fans of the TradingView platform

4. XM

XM has adapted its service for the 2026 market by introducing the Ultra Low account which features significantly reduced trading costs. This account type allows traders to access spreads from 0.6 pips on majors without any additional commission charges. The broker is known for its extensive educational resources and live webinars that run throughout the trading day. It is an excellent middle ground for those who want low costs without the complexity of commission calculations.

Special Features:

-

Zero commission trading on the specialized Ultra Low account type

-

Massive selection of over 1000 financial instruments for diversification

-

Regular trading competitions and loyalty programs for active clients

Things To Consider:

-

Spreads are slightly wider than raw ECN accounts that charge commission

-

Not all account types are available in every geographic region

Best For: Intermediate traders and those who prefer no commission models

5. Fusion Markets

Fusion Marketsed has made it its mission to offer the lowest trading commissions in the entire forex industry. Their Zero account features spreads from 0.0 pips with a commission that is roughly 35% cheaper than the industry standard. The broker is regulated by the ASIC and maintains a very lean operation to pass those savings on to the users. This makes them a top contender for anyone whose primary concern is minimizing every single cent of trading cost.

Special Features:

-

Industry leading low commission rates of just $2.25 per side

-

No minimum deposit requirement to open a live trading account

-

Specialized copy trading platform for following successful strategies

Things To Consider:

-

The platform variety is limited mainly to MetaTrader 4 and 5

-

Fewer research and educational tools compared to larger global brands

Best For: Cost conscious traders and high frequency scalpers

6. FP Markets

FP Markets is a veteran broker that provides a robust Raw account with consistent 0.0 pip spreads on the EUR/USD pair. They utilize a diverse mix of liquidity from top tier banks to ensure that orders are filled at the best available price. The broker also offers access to the IRESS platform for those who want to trade direct market access equities. Their 24/7 customer support is one of the highest rated in the industry for technical assistance.

Special Features:

-

Raw accounts with institutional liquidity and low latency execution

-

Access to advanced charting via the IRESS and MetaTrader platforms

-

Free VPS hosting for traders who meet certain volume requirements

Things To Consider:

-

The IRESS platform requires a monthly fee if volume targets are missed

-

Withdrawals via bank wire can take several days to reach your account

Best For: Multi asset traders and those requiring 24/7 support

7. Tickmill

Tickmill is often cited as the most cost effective champion for professional traders who operate with high volume. Their Pro and VIP accounts offer spreads from 0.0 pips with some of the lowest commissions found in the European market. The broker is highly transparent about its execution statistics and slippage rates which builds a lot of trust. They also offer specialized accounts for those who require swap free trading due to religious beliefs.

Special Features:

-

Extremely low commissions for VIP account holders with high balances

-

Highly regulated by the FCA and CySEC for maximum fund protection

-

Specialized tools for one click trading and advanced risk management

Things To Consider:

-

The VIP account requires a high minimum balance of $50000

-

The web version of their platform lacks some of the desktop features

Best For: Professional high volume traders and European clients

8. Vantage Markets

Vantage Markets has invested heavily in its fibre optic network to provide lightning fast execution for its Raw ECN accounts. They offer a unique partnership with TradingView that allows for seamless analysis and execution directly from the world’s most popular charts. The broker provides a high level of leverage and a large variety of deposit methods including local bank transfers. Their mobile app is particularly well designed for managing trades while you are away from your desk.

Special Features:

-

Specialized Raw ECN account with spreads starting from 0.0 pips

-

ProTrader platform powered by TradingView for advanced technical analysis

-

Regular bonus programs and promotions for new and existing clients

Things To Consider:

-

Commissions can be slightly higher than those offered by Fusion Markets

-

Bonus terms can be complex and should be read carefully before joining

Best For: Mobile traders and fans of technical analysis via TradingView

9. FBS

FBS offers a unique Zero Spread account that features a fixed spread of 0 pips regardless of market conditions. This is particularly useful for news traders who want to avoid the massive spread widening that typically occurs during economic releases. Instead of a spread the broker charges a fixed commission per lot which allows for very precise profit calculations. They also provide a user friendly mobile app called FBS Trader for simplified access to the markets.

Special Features:

-

Fixed 0 pip spread that remains stable during high volatility news events

-

High leverage options up to 1:3000 for specific account types

-

Cashback programs that return a portion of your commissions every week

Things To Consider:

-

The commissions on fixed spread accounts can be high on some pairs

-

Extreme leverage poses a very high risk to your initial capital

Best For: News traders and those who want high leverage options

10. BlackBull Markets

BlackBull Markets is a New Zealand based broker that focuses on providing the fastest possible execution for its ECN Prime accounts. They recorded the fastest overall results in independent speed tests with average execution times around 72 milliseconds. The broker offers a wide range of tradable assets including thousands of global stocks alongside their forex pairs. They are a great fit for traders who rely on automation where small delays can lead to significant slippage.

Special Features:

-

Fastest measured execution speeds in the retail forex industry

-

Deep liquidity and raw spreads with no restrictions on scalping

-

Access to proprietary educational content and daily market analysis

Things To Consider:

-

Regulated by the FMA in New Zealand which has different rules than the FCA

-

The commission structure is slightly higher than some Australian rivals

Best For: High frequency traders and those using automated robots

11. Interactive Brokers

Interactive Brokers is the preferred choice for large scale professional traders who want an agency execution model. They aggregate pricing from 17 of the world’s largest liquidity providers to offer ultra tight spreads on over 100 currency pairs. While they charge a commission it is often offset by the better pricing and lack of markups found on their platforms. They are one of the most stable and financially sound companies in the entire financial world.

Special Features:

-

Institutional grade pricing and execution for high volume professionals

-

Integrated platform for trading stocks and options and forex in one place

-

Advanced risk management tools and professional grade reporting

Things To Consider:

-

The minimum commission of $2 can be expensive for very small trades

-

The Trader Workstation platform has a very steep learning curve

Best For: Professional investors and high net worth individuals

12. Axi

Axi is a broker that was founded by traders for traders and it shows in their commitment to low costs and high performance. Their Pro account features spreads from 0.0 pips with a competitive commission and no hidden fees. They offer a unique tool called PsyQuation which uses AI to analyze your trading performance and suggest improvements. The broker is very supportive of those who use Expert Advisors and provides free VPS services for active users.

Special Features:

-

PsyQuation AI tool for analyzing and improving your trading behavior

-

Free high quality educational courses through the Axi Academy

-

Reliable ECN execution with deep liquidity for all major currency pairs

Things To Consider:

-

The selection of exotic currency pairs is smaller than some competitors

-

Mobile trading is limited to the standard MetaTrader applications

Best For: Serious traders looking to improve their performance via data

2026 Forex Market Overview

The market for currency trading has shifted toward ultra low latency and deep liquidity pools provided by tier one banks. Most top tier brokers now offer specialized “Raw” or “Zero” accounts that pass market prices directly to the trader with a small commission. This table provides a quick look at the leading contenders and their primary strengths in the current environment.

As we progress through the year, the competition among brokers has led to a significant reduction in average costs for major currency pairs. These “Quick Picks” represent the best value for money based on our latest live testing results. Use this comparison to narrow down your choices based on your specific trading style.

| Broker Name | Account Type | Average Spread (EUR/USD) |

| Exness | Zero Account | 0.0 pips |

| IC Markets | Raw Spread | 0.1 pips |

| Pepperstone | Razor Account | 0.1 pips |

How To Choose The Right Low Spread Broker

Choosing a broker depends on whether your strategy prioritizes the absolute lowest commission or the fastest possible execution speed. If you are a scalper you should focus on the Raw or Zero accounts to ensure you keep more of each winning trade. This table helps you match your specific trading goals with the most appropriate broker technology.

| Trading Need | Recommended Broker | Primary Advantage |

| Zero Spread Stability | Exness | No spread on majors |

| Algorithmic Speed | IC Markets | Ultra low latency |

| Lowest Commission | Fusion Markets | Most affordable fees |

| News Trading | FBS | Fixed 0 pip spread |

Final Thoughts On Trading Costs

Maximizing your edge in 2026 requires a partner that understands the importance of low spreads and high quality execution. The low spread forex brokers on this list represent the best options for protecting your margins and growing your account. By selecting a broker that fits your style you can focus on the market instead of worrying about transaction fees.