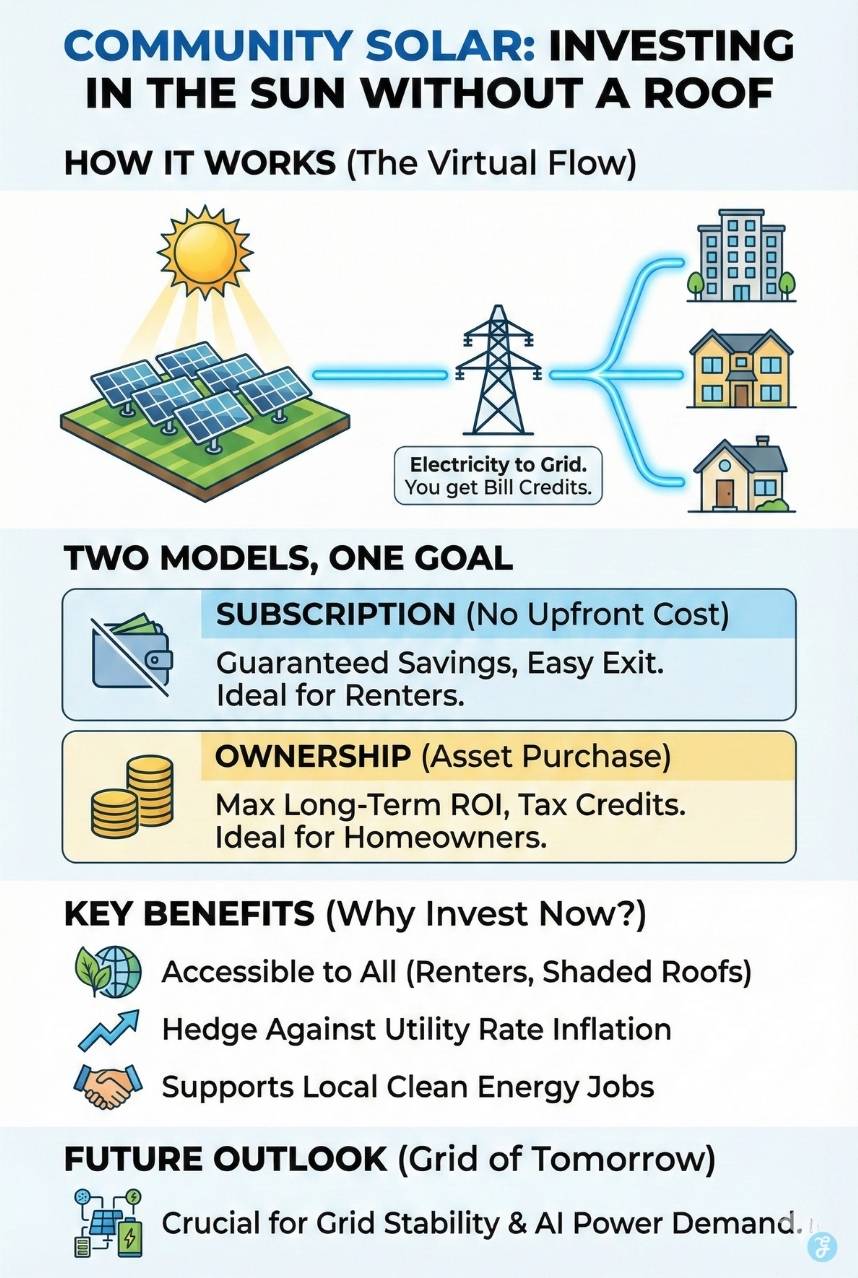

For decades, the “green energy revolution” came with a strict entry requirement: you needed a roof, a high credit score, and roughly $20,000 in upfront capital. This effectively locked out over 50% of U.S. households, renters, apartment dwellers, and homeowners with shaded or older roofs- from participating in the solar economy. In 2026, however, the paradigm has shifted. Solar energy is no longer just a piece of hardware you bolt to your shingles; it has evolved into a sophisticated financial product.

This is the era of Community Solar Investment, a mechanism that allows you to “decouple” ownership from location, effectively letting you invest in the sun without ever owning a roof. The solar market is navigating a complex transition. Following a significant dip in installation volume during the high-interest rate environment of 2025, the industry is stabilizing under the new tax regimes of the Inflation Reduction Act. We are moving away from the simple adoption phase into a financial maturity phase.

Today, a community solar subscription is not merely a utility program to save a few dollars; it is a potential inflation hedge, a portfolio diversifier, and for some, a legitimate asset class with tax advantages previously reserved for property owners.

Why Community Solar Investment Matters?

As utility rates continue to outpace general inflation, energy strategy has become a financial imperative rather than just an environmental choice. Community solar represents a pivotal market shift, effectively turning a monthly liability (your electric bill) into a potential asset class. But does the math actually work? This guide analyzes whether community solar is a viable inflation hedge for your portfolio or simply a utility savings tool.

We will dissect the mechanics of Virtual Net Metering, compare the “Subscription” vs. “Ownership” models with updated 2026 ROI data, and expose the hidden risks, from interconnection bottlenecks to predatory “teaser rates”, that every consumer must vet before signing a contract.

The Mechanics: How “Virtual” Solar Actually Works

To understand the investment potential, one must first grasp the technical architecture that makes “remote” solar possible. It relies on a regulatory framework known as Virtual Net Metering (VNM), which effectively turns the electric grid into a giant accounting ledger.

Concept 1: The “Solar Garden” Structure

Physically, a community solar project, often called a “solar garden,” is a mid-sized photovoltaic farm, typically rated between 1 MW and 5 MW. Unlike massive utility-scale projects located in remote deserts, these are “distributed generation” assets. They are situated locally, often on brownfields (repurposed industrial land), warehouse rooftops, or unused agricultural edges near the communities they serve.

In 2026, the trend has shifted toward “dual-use” development. We are seeing agrivoltaics (farming under panels) and pollinator-friendly ground cover becoming standard to meet stricter local zoning laws. When you “join” a project, you are effectively subscribing to a specific slice of this array’s output.

Concept 2: Virtual Net Metering [VNM]

VNM is the “killer app” of the industry. It solves the physical disconnect between where energy is produced and where it is consumed.

- The Generation: Your share of the solar farm produces electricity (measured in kilowatt-hours, or kWh).

- The Grid Injection: This electricity is not wired to your house. Instead, it is fed directly into the local utility grid.

- The Credit: The utility company measures exactly how much power your share contributed. They then apply a monetary bill credit to your monthly electricity statement.

Key Insight: You are not receiving “green electrons” directly. You are receiving a financial credit that offsets your bill. If your share produces $150 worth of power, your utility bill is reduced by $150. This distinction is vital because it means your “return” is tied to the local utility rate. If electricity prices rise (as they historically do), the value of your credit rises, preserving your purchasing power.

Concept 3: The “Anchor Tenant” vs. You

A crucial, often overlooked component of project finance is the Anchor Tenant. Developers rarely build a multi-million dollar solar farm relying solely on hundreds of individual households. Instead, they secure a large commercial off-taker, like a local municipality, a hospital, or a corporate giant like Amazon or Target, to subscribe to 40% of the project’s capacity.

- The Benefit to You: This anchor tenant provides the guaranteed revenue stream banks require to finance the project. Their presence “de-risks” the development, allowing the remaining 60% of capacity to be offered to residential subscribers (you) often without credit checks or long-term contracts.

- The Stability Factor: In 2026, projects with blue-chip anchor tenants are significantly less likely to face operational defaults, making them a safer “subscription” bet for residential users.

The Two Models: Subscription vs. Ownership [The Core Comparison]

When entering the Community Solar Investment space, you will encounter two distinct financial products. Choosing the wrong one can lock you into a 20-year liability or leave thousands of dollars in tax incentives on the table.

Model A: The Subscription [The “No-Risk” Path]

This is the most common model, dominating roughly 80-90% of the market. It is structured as a service, not an investment.

- How it works: You sign a contract to purchase the power generated by a specific number of panels (or a kW block). You do not own the hardware.

- The Discount Mechanism: The provider typically sells you the power at a fixed discount relative to the credit value.

Example: Your share produces $100 worth of utility credits. The provider charges you $90 for that share. You keep the $10 difference.

- ROI Profile: The return is immediate monthly savings, typically guaranteed at 10-15% below standard utility rates.

- Pros:

- Zero Upfront Capital: Entry is free.

- Liquidity/Portability: If you move within the same utility territory, you can usually transfer your subscription. Cancellation policies have improved, with many providers in 2026 offering 90-day exit windows without penalties.

- Simplicity: No maintenance, no insurance, and no tax filings.

- Cons:

- Lower Lifetime Value: You are essentially splitting the savings with the developer.

- No Tax Benefits: Since you don’t own the asset, you cannot claim the federal tax credits.

Model B: The Ownership [The “Asset” Path]

This model is for the serious investor looking for an inflation hedge and tax equity.

- How it works: You purchase a specific number of panels or a kW share of the farm upfront. This is a real asset purchase, similar to buying a condo in a building.

- Capital Requirement: In 2026, a typical 5kW share (enough for an average home) costs between $12,000 and $18,000.

- The Return: You own the hardware, so you keep 100% of the bill credits. There is no “middleman” taking a cut of the generation value.

- Pros:

- Tax Incentives: As the owner, you are eligible for the 30% Federal Investment Tax Credit (ITC) under Section 48E (more on this in the Economics section).

- Higher ROI: Internal Rate of Return (IRR) can range from 10% to 14%, significantly beating conservative market indices.

- Inflation Hedge: You effectively prepay for 25 years of electricity at today’s cost. If utility rates triple in 15 years, your “dividends” (credits) triple in value, but your cost basis remains zero (since you already paid).

- Cons:

- Illiquidity: Selling your panels if you move out of the utility zone can be difficult. You may have to sell them back to the developer at a depreciated rate.

- Risk: You bear the risk of system underperformance (though warranty insurance usually covers this).

Comparison Table: Subscription vs. Ownership

| Feature | Subscription Model | Ownership Model |

| Upfront Cost | $0 | $12,000 – $18,000 |

| Federal Tax Credit | No | Yes (30% of purchase price) |

| Annual Savings | 10-15% of bill (approx. $150-$300) | 100% of generation value (approx. $1,500+) |

| Payback Period | Immediate | 7 – 9 Years |

| Contract Length | Flexible (Month-to-month or 1-year) | Long-term (25 years / Life of system) |

| Maintenance | Included | Included (via management fee) |

| Best Profile | Renters, transient residents, low capital | Homeowners, long-term investors, and high tax liability |

The Economics: ROI and Tax Incentives in 2026

The financial landscape for community solar has been radically altered by the long-term rollout of the Inflation Reduction Act (IRA). As we settle into 2026, the specific tax codes have shifted, creating new opportunities for yield.

The Shift to Section 48E [Tech Neutral Credits]

Previously, solar relied on the specific Solar Investment Tax Credit (ITC). As of 2025/2026, the market is transitioning toward the Section 48E technology-neutral tax credit. For the ownership model investor, the base credit remains at 30%, provided the project meets prevailing wage and apprenticeship requirements (which almost all commercial developers now do).

However, the real “alpha” in 2026 comes from the “Adders”:

- Energy Communities: If the solar farm is located in a “brownfield” or a community historically dependent on fossil fuels (e.g., closed coal mine regions), the tax credit can jump by 10%.

- Low-Income Economic Benefit: Projects serving low-income subscribers can qualify for another 10-20% boost.

- Domestic Content: Using US-made steel and panels adds another 10%.

Investor Note: While you, as a residential panel owner, might not claim all these adders directly, they reduce the developer’s CapEx. In a competitive market, these savings are often passed down as a lower price-per-watt for your ownership share.

ROI Analysis: A 2026 Case Study

Let’s run the numbers for a hypothetical investor in Massachusetts (a mature market) with an average monthly electric bill of $200.

Scenario A: Subscription (The Saver)

- Utility Rate: $0.28/kWh

- Annual Cost: $2,400

- Subscription Discount: 15%

- Net Annual Savings: $360

- 10-Year Total Savings: $3,600 (assuming rates stay flat, which they won’t).

Scenario B: Ownership (The Investor)

- System Cost (5kW share): $16,000

- Federal Tax Credit (30%): -$4,800

- Net Investment: $11,200

- Annual Bill Credits Generated: $2,400 (offsets 100% of bill)

- Management Fee (Admin/Insurance): -$200/year

- Net Annual Cash Flow: $2,200

- Payback Period: 5.1 Years

- 10-Year Total Value: $22,000 in credits – $11,200 cost = $10,800 Profit.

- 25-Year Total Profit: ~$50,000+ (factoring in utility rate inflation).

The Inflation Hedge Argument

This is the most compelling argument for the ownership model in 2026. Utility rates in the US have historically risen by roughly 3-4% annually. In recent years, volatility has pushed this higher in certain regions. By owning your generation, you are “locking in” your cost of power. Every time the utility announces a rate hike, the value of your solar credits increases proportionally. Your “dividend” effectively grows with inflation, preserving the real value of your money in a way that a static savings account cannot.

Market Landscape: The “Interconnection” Reality

Before you rush to invest, you must understand the macro-environment. The community solar market is currently recovering from a “dip” in 2025 caused by high interest rates and, more importantly, the Interconnection Bottleneck.

The 2025 Dip and Recovery

Q2 and Q3 of 2025 were difficult quarters. Installations slowed as developers grappled with higher costs of capital. However, 2026 is seeing a rebound, driven by the stabilization of interest rates and the maturity of the IRA incentives. The market is bifurcated:

- Saturated Markets: States like Minnesota, Massachusetts, and New York are “mature.” Projects here are plentiful, but subscriber lists fill up fast.

- Growth Markets: The new frontiers for 2026 are New Mexico, Maryland, Virginia, and New Jersey. These states have recently enacted aggressive community solar legislation, creating a “gold rush” of new projects with open availability.

The Grid Bottleneck: Data Centers vs. Solar

The biggest constraint in 2026 is not the sun; it’s the wire. The US electric grid is congested.

- The Conflict: Community solar projects are competing for grid capacity with the explosive growth of AI Data Centers. Both demand massive interconnection access.

- The Consequence: In some regions, a solar farm might be physically built but sit idle for 12-18 months waiting for the utility to upgrade the local substation to handle the power.

- Investor Warning: If you are buying into a project “under construction,” explicitly ask about the Interconnection Service Agreement (ISA) status. Do not put money down on a project that hasn’t secured its queue position.

Risks and “The Fine Print”

The industry has attracted bad actors and confusing contracts. Here are the specific traps to avoid in 2026.

Some subscription providers offer an enticing “20% discount” for the first year, which then converts to a fixed rate per kWh that escalates annually.

- The Risk: The contract might include a “2.9% annual escalator” on the price you pay for solar power. If utility rates only rise by 1% that year, you could end up paying more for your solar power than you would have paid the utility.

- The Fix: Always demand a contract that guarantees savings relative to the utility rate, not a fixed price.

2. The Credit Score Barrier

Historically, developers required FICO scores of 700+ to join. While this is fading due to “LMI” (Low-to-Moderate Income) incentives, some “Ownership” projects still have strict credit requirements because you are effectively financing an asset.

3. The Portability Trap [Geography]

Community solar is tied to the utility load zone.

- Scenario: You live in Upstate New York (National Grid territory) and buy a $15,000 ownership share. Two years later, you move to Westchester (ConEd territory).

- The Problem: You cannot move your credits to a different utility. You must sell your share or transfer it to the new homeowner. If the market is soft, you might sell at a loss.

- Subscription Advantage: In the subscription model, you simply cancel with 30-90 days’ notice.

4. REC Ownership [The “Green” Fine Print]

Do you actually use green energy? Technically, no. In many community solar contracts, the Renewable Energy Certificates (RECs), the legal proof that energy is “green,” are sold by the developer to corporations to boost revenue.

The Reality: You are getting the financial benefit of solar, but you cannot legally claim your home is “powered by 100% renewable energy” if the RECs were stripped. For most financial investors, this is acceptable, but for eco-purists, it is a dealbreaker.

How to Vet a Provider [Actionable Guide]

If you are ready to proceed, use this checklist to diligence any offer:

For Subscribers:

- Guaranteed vs. Target Savings: Does the contract say “Guaranteed 10% discount” (Good) or “Targeted 10% savings” (Bad)?

- Exit Clauses: Look for “No Cancellation Fees” or a maximum 90-day notice period. Avoid contracts with $200+ termination fees.

- Bill Consolidation: Does the provider offer “Unified Billing”? In the past, you received two bills (one from the utility, one from the solar). In 2026, the best providers integrate this into a single bill for simplicity.

For Owners:

- Production Guarantee: Does the contract include a performance guarantee? (e.g., “If the system produces less than 90% of projected output, we pay the difference”).

- Insurance & O&M: Is the Operations & Maintenance (O&M) fee fixed, or can it skyrocket? It should be clearly capped in the contract.

- Developer Reputation: Stick to established players with track records. Companies like Nexamp, Arcadia, SunPower, and Bluewave have historically performed well. Avoid “LLC” developers with no prior completed projects.

Market Horizon: The Era of Distributed Power

As we look toward 2027, community solar is transcending simple bill savings to become a critical component of national infrastructure. Three major macro-trends are reshaping the value of these projects:

The “Load Shock” Reality

The US energy grid is facing a perfect storm created by the rapid electrification of transport (EVs) and the insatiable power demands of AI data centers. In this high-demand environment, grid capacity is becoming the new gold.

The Mesh Network Shift

We are moving away from the centralized model of the 20th century, where massive power plants pushed electricity one way, toward a decentralized “mesh” network. Distributed generation assets like community solar farms are now premium real estate because they produce power exactly where it is consumed, bypassing congested transmission lines.

Asset Scarcity

For the investor, this suggests that “Ownership” shares in community solar projects may appreciate in value. As land near substations becomes harder to secure, early entrants who lock in their position in 2026 are effectively securing a stake in the critical infrastructure of the future digital economy.

Wrapping Up: Democratizing the Energy Economy

Community Solar investment has transformed green energy from a luxury construction project into an accessible financial instrument. Whether you are a renter, a student, or a homeowner with a shaded roof, the choice now comes down to your financial mobility.

Choose Subscription if you need flexibility. It offers immediate, risk-free savings with no debt and easy cancellation. Choose Ownership if you seek wealth preservation. It is a unique vehicle to prepay for decades of energy at today’s prices, offering a powerful hedge against inflation.

The sun shines on everyone, but in 2026, only those with the right contract get paid for it.