The most defining image of 2025 was not a photograph, but a graph. It was the vertical line that traced Elon Musk’s net worth as it pierced the stratosphere, crossing $638 billion in late November, a figure so large it ceases to be money and becomes gravity. To visualize this, consider that one man now commands a personal fortune roughly equivalent to the entire Gross Domestic Product of South Africa. But focusing solely on Musk would be a mistake. He is merely the tallest skyscraper in a city that suddenly shot up overnight.

The Billionaire Wealth Boom 2025 was not just a financial peak; it was the year global capitalism officially transitioned into a new “Oligarch Era,” where extreme wealth cemented itself into a permanent, dynastic power structure.

The Convergence of Forces

According to the latest data from Oxfam and UBS, 2025 was a historic anomaly. It was the year global billionaire wealth hit an all-time peak of $18.3 trillion, growing by over 16% in just twelve months, a rate three times faster than the average of the previous five years. It was the year that the “social contract”, the fragile, unspoken agreement that rising tides might eventually lift all boats, was arguably rescinded.

This boom wasn’t driven by the industrial production of the 20th century. It wasn’t about building railroads or drilling oil, though those old ghosts still linger. Instead, it was engineered by a convergence of three distinct forces: a speculative “AI Supercycle” that monetized the future, a massive intergenerational wealth transfer that resurrected the past, and a “Trump 2.0” deregulation wave that captured the state.

We have entered a period where the connection between “value creation” and “wealth accumulation” has severed. The winners of 2025 did not necessarily make more products or hire more workers; they simply owned the correct assets at the precise moment that the global financial system decided that reality was optional.

The Scorecard: 2025 By The Numbers

To understand the magnitude of what happened in 2025, we must first look at the raw data, which paints a picture of divergence so extreme it threatens the stability of the canvas.

The headline figure from the Oxfam Resisting the Rule of the Rich report (January 2026) is $18.3 trillion. This is the collective net worth of the world’s billionaires. To put that $18.3 trillion into perspective, it is greater than the combined GDPs of China and Germany. But the velocity of this accumulation is what should alarm policymakers. In 2025 alone, billionaires added approximately $2.5 trillion to their fortunes. This single-year gain is enough to eradicate extreme global poverty 26 times over.

While wealth at the top broke the sound barrier, the bottom half of humanity found itself running in quicksand. The World Bank and UN reports from late 2025 indicate that for the first time in a decade, extreme poverty rates in the Global South ticked upward, driven by a “cost of living” crisis that is essentially a crisis of margins. Food prices, energy costs, and housing rents have soared, not because of scarcity, but largely due to what economists are now calling “greedflation”, monopolistic price-setting by the very conglomerates owned by the people on the Forbes list.

The gap is no longer just economic; it is biological. Oxfam notes that while the billionaire class grew by 8.8%, global food insecurity rose to affect 1 in 4 people. We are witnessing the bifurcation of the species into two distinct groups: those who are insulated from the friction of the physical world (inflation, climate change, scarcity) and those who are crushed by it.

Historically, this level of inequality usually triggers a correction. In the Gilded Age of the 1890s, it triggered the Progressive Era and antitrust laws. In the 1920s, it triggered the Great Depression and the New Deal. But in 2025, the mechanism for correction, democracy, has been jammed. As Oxfam’s Amitabh Behar noted in Davos this month, “We are witnessing the creation of a global oligarchy that has the power to veto the will of the people.”

The Engine: How the “AI Supercycle” Minted a New Class

If you want to know where the money came from in 2025, you don’t look at bank accounts; you look at Graphical Processing Units (GPUs). The primary engine of the wealth explosion was the “AI Supercycle,” a frenzy of investment that bears a striking resemblance to the Dot-com bubble of 1999, but with vastly higher stakes.

The narrative of 2025 was dominated by “The Hardware Kings.” Jensen Huang, the CEO of Nvidia, saw his personal fortune stabilize around $162 billion, but the real story was the ecosystem that formed around him. The demand for AI infrastructure, chips, data centers, and the energy to run them turned obscure supply chain companies into gold mines.

According to i10x and Forbes data, 2025 minted over 50 new billionaires purely from the AI sector. This list includes the founders of companies like Anthropic, DeepSeek, and CoreWeave. These are not industrial titans in the traditional sense; many of their companies have yet to turn a significant profit. Instead, their wealth is “paper wealth,” derived from valuations based on the promise that Artificial General Intelligence (AGI) is imminent.

This is where the economic danger lies. The trillions added to billionaire net worths in 2025 are effectively a “long” bet on the replacement of human labor. Investors have poured money into these companies under the assumption that they will eventually capture the wages currently paid to knowledge workers. In this sense, the wealth boom of 2025 is a “pre-distribution” of the future earnings of the middle class, transferred to the balance sheets of tech founders before the technology has even fully matured.

Consider the case of Larry Ellison. The Oracle founder, who has been a billionaire for decades, saw his wealth explode in late 2025, briefly challenging Bezos for the number two spot. Why? Because Oracle successfully pivoted to becoming a cloud infrastructure provider for AI training. The market didn’t reward him for a new invention; it rewarded him for owning the “pipes” through which the future must flow. This rentier dynamic, wealth derived from ownership rather than production, is the hallmark of the 2025 economy.

The “Musk Economy”: A Case Study in Power

Elon Musk is no longer just a businessman; he is a geopolitical entity. In 2025, his trajectory decoupled from the rest of the billionaire class, moving him into a category of one. With a net worth fluctuating between $600 billion and $700 billion, Musk controls a portfolio that intersects with every critical node of modern civilization: energy/transport (Tesla), communication/media (X, formerly Twitter), space access/defense (SpaceX), and intelligence (xAI).

The surge in his wealth in 2025, roughly $187 billion added in a single year, was driven largely by the valuation of SpaceX, which is reportedly preparing for a $1.5 trillion IPO, and the aggressive repricing of Tesla as an AI robotics company rather than a car manufacturer. But the financials tell only half the story.

The true source of Musk’s 2025 dominance was the successful merger of his business interests with the American state. The “Department of Government Efficiency,” a quasi-governmental advisory role he assumed following the US election, effectively gave the world’s richest government contractor oversight over the agencies that regulate him.

This conflict of interest, or rather, this alignment of interest, fueled what analysts are calling the “Musk Premium.” Markets realized that betting against Musk was now betting against the US government itself. If regulations on autonomous driving are rolled back (as they were in late 2025), Tesla’s stock rises. If environmental reviews for rocket launches are expedited, SpaceX’s valuation rises.

Musk represents the archetype of the “State-Billionaire,” a figure more common in Russia or China than the West, but now fully Americanized. He has shown that in 2025, the ultimate product is not an electric car or a rocket; it is regulatory capture. The billions he made this year are the dividends of political equity.

The Shadow Boom: The Great Wealth Transfer

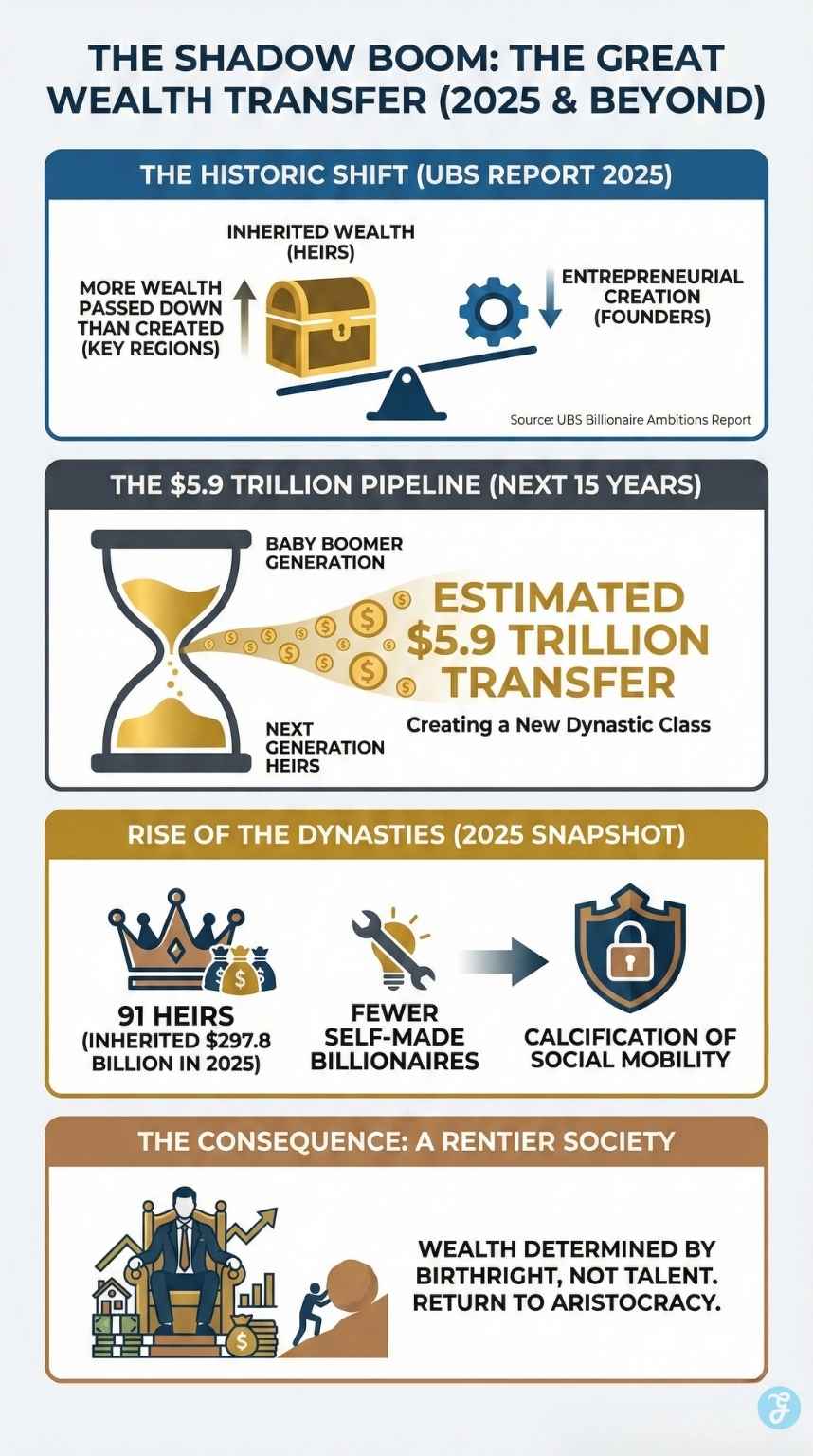

While Musk and the AI tycoons dominated the headlines, a quieter, perhaps more insidious shift was taking place in the background. The UBS Billionaire Ambitions Report 2025 highlighted a structural change in the nature of wealth: the return of the dynasty.

For the first time since the bank began tracking the data, 2025 saw heirs inherit more wealth than entrepreneurs created in key markets like Europe. We are in the early stages of the “Great Wealth Transfer,” where an estimated $5.9 trillion is expected to pass from the Baby Boomer generation to their heirs over the next 15 years.

In 2025 alone, 91 heirs inherited a record $297.8 billion. This is a profound shift. For the last thirty years, the billionaire list was dynamic, populated by dropouts who built tech giants in garages. Now, it is beginning to calcify. The new entrants to the billionaire club in 2025 included 22-year-olds who did nothing but win the genetic lottery.

This matters because inherited wealth behaves differently from entrepreneurial wealth. It tends to be more risk-averse, more focused on preservation, and more political. Dynastic wealth protects itself by buying influence to ensure tax codes remain favorable and trust laws remain porous.

The UBS data confirms we are sliding backward toward a “rentier society” reminiscent of 19th-century Europe, where one’s standard of living is determined not by talent or hard work, but by the womb from which one emerged. The “American Dream” of meritocracy is being statistically refuted by the reality of the 2025 Forbes list.

The Political Catalyst: Deregulation and “Trump 2.0”

It is impossible to discuss the billionaire boom of 2025 without addressing the elephant in the room: the return of Donald Trump to the White House. The “Trump 2.0” administration, inaugurated in January 2025, wasted no time in implementing what Oxfam has termed a “pro-billionaire agenda.”

Two specific policy levers were pulled in 2025 that acted as rocket fuel for the ultra-wealthy:

- The Extension of the Tax Cuts: The administration moved quickly to make the corporate tax cuts permanent and signaled further reductions in the capital gains tax. This triggered a massive wave of stock buybacks—companies using their cash piles to repurchase their own shares rather than investing in wages or R&D. This artificially inflated stock prices, directly enriching the executives and shareholders who own the vast majority of equities.

- The Death of Antitrust: The previous administration’s efforts to rein in Big Tech were effectively abandoned. Mergers that had been blocked were suddenly approved. The signal to the market was clear: Monopoly is back on the menu. This allowed the tech giants to consolidate their power in the AI sector without fear of intervention, securing their future profits and boosting their current valuations.

The political capture is self-reinforcing. As billionaires get richer, they have more capital to lobby for policies that make them richer still. Oxfam’s statistic that billionaires are 4,000 times more likely to hold political office than ordinary citizens is the metric of this capture. In 2025, the line between the “public sector” and the “private sector” blurred until it vanished. We are no longer governed by representatives; we are managed by stakeholders.

The Human Consequence: A “Two-Tier” Species

What does this wealth concentration actually do to the world? It distorts reality.

When $18.3 trillion is concentrated in 3,000 hands, the market stops responding to the needs of the many and starts responding exclusively to the whims of the few. This is why, in 2025, we saw massive investment in space tourism and luxury AI concierges, but a stalling of investment in affordable housing and antibiotics. The market builds what the money wants, and the money wants bunkers and rockets.

This distortion drives the “Cost of Living Crisis” that plagued the working class throughout 2025. When billionaires park their excess capital in real estate, housing prices decouple from local wages. When they speculate on energy futures, the price of heating a home in winter spikes. The inflation of 2025 was not caused by workers asking for too much; it was caused by asset bubbles inflated by the excess liquidity of the 0.01%.

Furthermore, there is a “Carbon Inequality.” The investments of these 3,000 billionaires, particularly in energy-intensive AI and private aviation, have a carbon footprint thousands of times higher than that of the average citizen. As the climate crisis deepened in 2025, with record heatwaves and crop failures, the rich were able to buy their way out of the consequences, insulating their estates and moving their assets, while the global poor were left to weather the storm.

The Fork in the Road

2025 was the best year in history for billionaires, but it may well be remembered as the worst year for capitalism’s legitimacy. The system has done exactly what it was designed to do: accumulate capital, but it has done so with such ruthless efficiency that it has consumed the social fabric upon which it rests. We are now standing at a distinct fork in the road. One path leads to the entrenchment of this new Oligarchy, where a class of “Techno-Feudalists” rules over a digital serfdom, their power secured by AI surveillance and dynastic wealth. The other path leads to correction—to a world where democracy reasserts its primacy over the economy.

Final Words: The Clarity of 2026

If there is a silver lining to the excesses of 2025, it is clarity. The pretense is gone. We can no longer pretend that the market will self-correct or that wealth will trickle down; the data is in, and it is irrefutable. As we look toward 2026, the policy solutions are already on the table, championed by nations like Brazil at the G20: a Global Minimum Tax on Billionaires to stop capital flight, vigorous enforcement of antitrust laws to break up the AI monopolies, and a ban on the seamless transition between corporate boardrooms and government cabinets. The wealth boom of 2025 was a failure of politics, not economics.

It was a choice. If 2025 was the year of the billionaire, 2026 must be the year of the citizen, or we may never get another chance to choose.