For the last five years, green hydrogen was sold as the “Swiss Army Knife” of the energy transition—a miracle fuel capable of powering everything from cargo ships to kitchen stoves. But as we settle into 2026, the broad, indiscriminate hype has collided with economic gravity. This year isn’t about the promise of hydrogen; it is the year of the “great sorting.”

The core promise remains vital: we cannot decarbonize the global economy with electricity alone. While electrons (batteries/wires) are winning the race for light transport and heating, we still need decarbonized molecules for heavy industry—steel, shipping, and chemicals. That is where green hydrogen shines.

However, 2026 has brought a stark reality check. Rising interest rates and stubborn inflation in 2024-2025 delayed dozens of mega-projects. The market is now bifurcating: “bankable” projects with secured buyers are moving forward, while speculative “powerpoint projects” are quietly fading.

In this guide, we cut through the noise to reveal what green hydrogen actually costs today, where the smart money is flowing, and why 2026 is the year this industry finally matures from a hype cycle into a real market.

What “Green Hydrogen” Really Means

Hydrogen itself isn’t a fuel source; it’s an energy carrier, similar to a battery. It doesn’t exist freely in nature—you have to make it. “Green” hydrogen is defined by how you make it.

Green Vs. Grey Vs. Blue (And Why Color Labels Can Mislead)

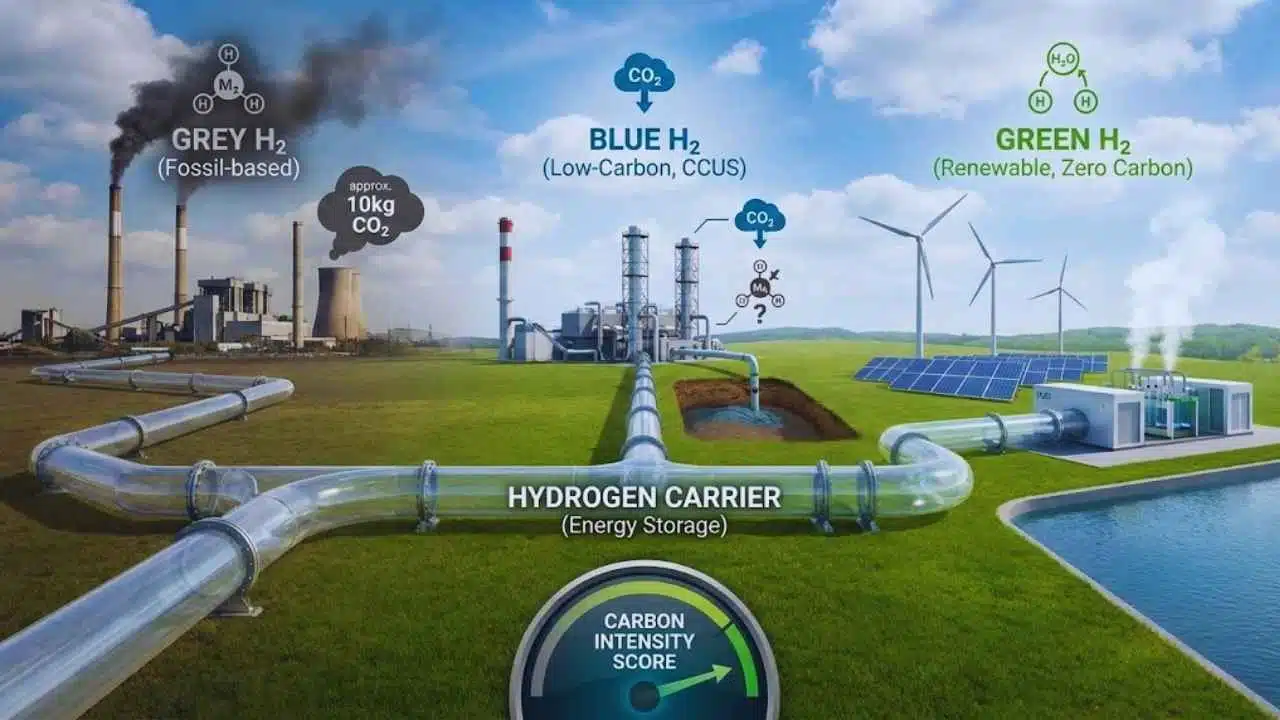

The industry uses a color wheel to describe production methods, but in 2026, regulators are moving toward “Carbon Intensity” (CI) scores rather than colors.

- Grey Hydrogen (The incumbent): Made from natural gas (methane) via steam methane reforming. It emits massive amounts of CO2 (approx. 10kg CO2 per 1kg H2). This is what we use today for fertilizer and refining. It is cheap (~$1.00–$1.50/kg) but dirty.

- Blue Hydrogen: Also made from natural gas, but the CO2 is captured and stored underground (CCUS). It’s “low carbon” if the capture rate is high and upstream methane leaks are low—a big “if.”

- Green Hydrogen (The goal): Made by splitting water (H2O) into hydrogen and oxygen using renewable electricity in a machine called an electrolyzer. If the power comes from wind or solar, the process emits zero carbon.

Key Distinction: “Clean Hydrogen” is a regulatory term (like in the U.S. 45V tax credit) that can include both Green and ultra-efficient Blue. “Renewable Hydrogen” specifically excludes fossil fuels.

How It’s Made (Electrolysis) And What Drives Cost

Producing green hydrogen is scientifically simple but economically difficult. The cost is driven by three massive levers:

- Electricity Price (60–75% of cost): You need cheap, abundant green power. If electricity costs $50/MWh, your hydrogen is already expensive. You need power closer to $20–$30/MWh to compete.

- Electrolyzer CAPEX: The cost of the equipment itself. While Chinese manufacturers have driven costs down significantly by 2026, Western equipment still commands a premium for efficiency and durability.

- Utilization Rate: You can’t run a billion-dollar factory only when the sun shines (20% of the day). You need high “capacity factors” (running 60%+ of the time), which requires a mix of wind and solar or expensive battery buffering.

Why The Hype Took Off (And What 2026 Changed)

Between 2020 and 2023, the world was awash in cheap capital and ambitious net-zero pledges. Hydrogen was framed as the “Champagne of the energy transition”—but many tried to sell it as table water.

The Big Claims

Advocates claimed hydrogen would fuel passenger cars, heat residential homes, and act as a massive grid battery for the world. Governments announced targets of millions of tons of production without securing anyone to actually buy it.

The Reality Check

Three things happened to deflate the bubble by 2026:

- Electrification Won the Easy Stuff: Heat pumps proved 3-5x more efficient than hydrogen boilers for heating homes. EVs dominated passenger cars. The “hydrogen for everything” narrative died a death of pure physics and economics.

- Inflation Spiked CAPEX: The cost to build renewable plants and electrolyzers jumped in 2024, killing the assumption that costs would only ever go down.

- The Offtake Gap: Producers realized they could make hydrogen, but few customers were willing to pay the “green premium” (3-4x the cost of grey hydrogen) without strict government mandates.

Now, we are in the “Slope of Enlightenment” (to use the Gartner Hype Cycle term). The projects surviving in 2026 are focused, industrial, and realistic.

The Economics In 2026: What Green Hydrogen Really Costs

Forget the aggressive “$1/kg by 2030” charts from five years ago. Here is the economic reality on the ground today.

LCOH Basics (Simple Explanation)

LCOH (Levelized Cost of Hydrogen) is the total lifetime cost of producing 1kg of hydrogen. It includes the cost of the solar/wind farm, the electrolyzer, the water, maintenance, and the cost of capital (interest rates).

The Cost Stack: Why Power Price Dominates

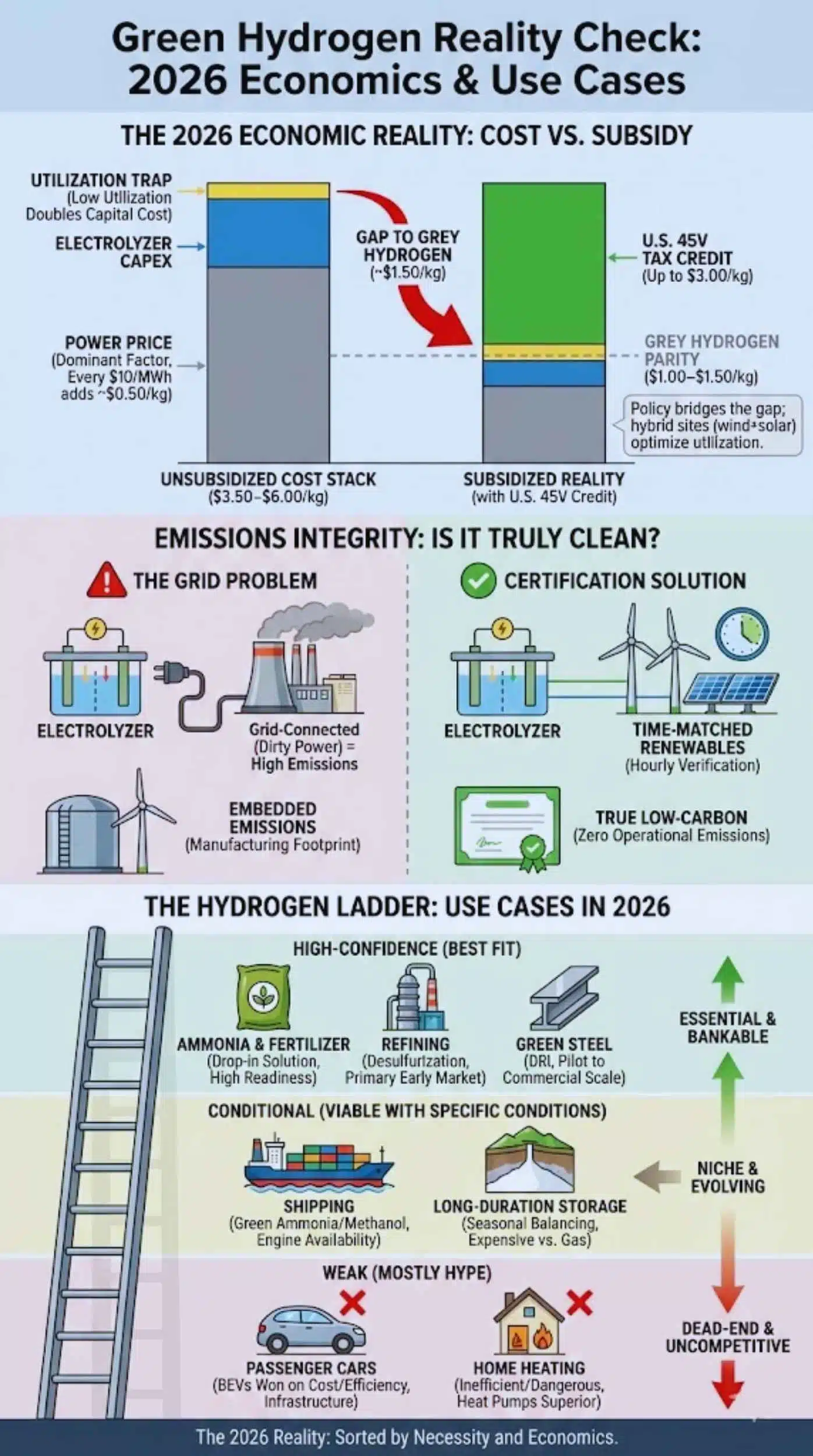

In 2026, the unsubsidized cost of green hydrogen generally sits between $3.50 and $6.00 per kg in Western markets.

- Cheap Power is Vital: Every $10/MWh increase in electricity price adds roughly $0.50/kg to the cost of hydrogen.

- The Utilization Trap: If you connect an electrolyzer directly to a solar farm, it sits idle at night. This doubles your capital cost per kg produced. The cheapest hydrogen now comes from “hybrid” sites (wind + solar) that can run the equipment 16–18 hours a day.

Subsidies Change The Map

The unsubsidized numbers look grim compared to Grey Hydrogen ($1.50/kg). That is why policy is the only thing keeping the market alive.

- The U.S. 45V Tax Credit: Offering up to $3.00/kg as a tax credit effectively bridges the gap. A project producing at $4.00/kg can sell at $1.00/kg (parity with grey) if they qualify for the full credit.

- Europe’s “Hydrogen Bank”: The EU uses auctions to pay the difference between production cost and what buyers can afford (CfDs).

The “Unsubsidized vs Subsidized” Reality

| Scenario | Location | Approx. Cost (Unsubsidized) | Cost After Incentives | Status |

| Best Case | Texas/Chile (High Wind+Solar) | $3.00 – $4.00 / kg | $0.50 – $1.50 / kg | Bankable / Competitive |

| Average Case | Northern Europe / Grid Connect | $5.50 – $8.00 / kg | $3.00 – $5.00 / kg | Needs heavy mandates |

Note: These figures are estimates based on 2026 market conditions. Actual costs vary wildly based on interest rates and specific equipment choices.

Emissions Integrity: Is Green Hydrogen Always Low-Carbon?

This is the biggest controversy of 2026. Just because you use an electrolyzer doesn’t mean the hydrogen is “clean.”

The Grid Problem

If you plug an electrolyzer into the standard grid (which may still burn coal or gas) to run it 24/7, you might generate more emissions than grey hydrogen. This is because the grid is inefficient at turning fossil fuels into power, which you then convert to hydrogen.

Embedded Emissions

Making the massive steel tanks, wind turbines, and electrolyzer stacks creates its own carbon footprint (“embedded emissions”). If an electrolyzer runs infrequently (low utilization), the emissions created to build the factory might outweigh the carbon saved by the hydrogen produced over its lifetime.

Certification And Standards

Buyers in 2026 are demanding “Time-Matched” certificates.

- Hourly Matching: Regulations (like the strict phase-in of U.S. 45V rules) increasingly require producers to prove they are using renewable energy in the same hour it is produced, ensuring they aren’t relying on coal power during the night.

Where Green Hydrogen Actually Makes Sense In 2026

The “Hydrogen Ladder” has sorted applications into winners and losers.

High-Confidence Use Cases (Best Fit)

These sectors use grey hydrogen today or have no other option.

- Ammonia & Fertilizer: The lowest hanging fruit. We already use millions of tons of dirty hydrogen here. Swapping it for green is a drop-in solution.

- Refining: Oil refineries use massive amounts of hydrogen to desulfurize fuels. This is the primary early market.

- Green Steel: Using hydrogen to remove oxygen from iron ore (DRI) is the only viable way to decarbonize primary steelmaking. Pilot plants in Europe are transitioning to commercial scale in 2026.

Conditional Use Cases

- Shipping: Batteries are too heavy for container ships. Green Ammonia or Methanol (made from hydrogen) are the leading contenders for marine fuel.

- Long-Duration Storage: Storing hydrogen in salt caverns for weeks when the wind doesn’t blow is viable, but expensive compared to gas peaker plants.

Weak Use Cases (Mostly Hype)

- Passenger Cars: Battery Electric Vehicles (BEVs) have won on cost, infrastructure, and efficiency. Hydrogen cars remain a niche anomaly.

- Home Heating: Pumping hydrogen into gas grids is dangerous (leaks) and inefficient. Heat pumps deliver 3x more heat per unit of electricity than hydrogen boilers.

Summary: The 2026 Use Case Table

| Use Case | Why Hydrogen? | 2026 Readiness | Key Blocker | Best Alternative |

| Fertilizer | Chemical necessity (NH3) | High | Cost premium | None (Grey H2) |

| Steel | Reduces iron ore | Medium | New furnaces needed | Coal (dirty) |

| Shipping | High energy density required | Medium | Engine availability | Biofuels |

| Cars | Fast refueling | Low (Dead) | Infrastructure & Cost | EV Batteries |

| Heating | Uses existing gas pipes | Low (Dead) | Inefficiency | Heat Pumps |

Infrastructure Reality: Production Is Only Step One

Making hydrogen is hard; moving it is a nightmare. Hydrogen is the lightest molecule in the universe—it leaks easily and embraces low energy density by volume.

Transport Options And Tradeoffs

- Pipelines: The cheapest option, but retrofitting natural gas pipelines is technically complex (embrittlement risks). New dedicated hydrogen pipelines are stuck in permitting hell in both the U.S. and EU.

- Trucking: prohibitively expensive for anything but short distances.

- Carriers (Ammonia): For export (e.g., from sunny Australia to hungry Japan), hydrogen is almost always converted into Ammonia (NH3). It’s easier to liquefy and ship. The trade-off is the energy lost converting it back to H2 at the destination.

The “Hydrogen Hubs” Logic

Because transport is so hard, 2026 sees the rise of Industrial Clusters. The logic is simple: Build the production right next to the steel mill or chemical plant. If you don’t have to move the hydrogen, the economics improve dramatically.

Policy In 2026: The Rules That Decide Winners

Technology didn’t decide the winners this year—policy did.

What Developers Need: Bankable Demand

The biggest bottleneck in 2026 isn’t supply; it’s demand. Governments are now implementing “Contracts for Difference” (CfDs). Essentially, the government promises to pay the difference between the cost of green hydrogen and the market price of grey hydrogen/gas, giving banks the confidence to lend money to projects.

The U.S. 45V Credit

The implementation of the Inflation Reduction Act’s 45V credit has shaped the global market. The debate over “Three Pillars” (Additionality, Time-matching, Geographic correlation) has largely settled into a phased approach, forcing developers to couple projects with new renewable assets rather than cannibalizing existing grid power.

Europe And Global Certification

The EU’s Carbon Border Adjustment Mechanism (CBAM) is now penalizing high-carbon imports (like dirty steel). This is the “stick” that makes green hydrogen steel competitive against cheaper, dirty alternatives from overseas.

So Is Green Hydrogen A Bubble Or A Tool?

A Practical Verdict

Green hydrogen is not a bubble—but the bubble of expectations has burst. It is not the fuel of the future for you and me (consumers); it is the fuel of the future for heavy industry. It is a specialized, expensive, necessary tool for the hardest 15% of global emissions.

What To Watch Next (12–24 Months)

- The “FID” Wave: Watch how many announced projects actually reach Final Investment Decision (FID). This conversion rate is the only metric that matters.

- Electrolyzer Performance: As large plants come online, we will finally see if real-world degradation and efficiency match the lab specs.

- The Ammonia Trade: Look for the first major trans-oceanic shipments of green ammonia. This will signal the start of a global hydrogen commodity market.

Final Thoughts

If the last five years were defined by irrational exuberance, 2026 is the year of the “Great Sorting.” The bubble of expectations—that green hydrogen would heat our homes and fuel our family cars—has burst. But in its place, a real, resilient, and industrial market is finally taking shape.

We are no longer debating if hydrogen is needed, but rather where it is worth the price. The verdict is clear: green hydrogen is not the “Champagne of the energy transition” to be sprinkled everywhere. It is the heavy-duty solvent required to clean up the grimiest corners of our economy—steel, shipping, and chemicals.

For investors and developers, the “powerpoint era” is over. The projects surviving 2026 aren’t the ones with the flashiest marketing, but the ones with the boring fundamentals: secured offtake agreements, high-capacity renewable power, and proximity to industrial demand. The market is shrinking in breadth but deepening in quality.

Expect to see a wave of project cancellations this year as speculative ventures hit the wall of economic reality. Do not view this as a failure of the technology, but as the necessary pruning of a maturing industry. The “hype cycle” is dead; the deployment cycle has begun.