Europe’s 2026 trade landscape is no longer defined by open borders, but by “strategic autonomy” and defensive regulatory walls. Following the pivotal 2024–2025 election cycles across the EU, UK, and US, European leadership is aggressively reshaping B2B procurement to prioritize regional security, AI compliance, and decarbonization. For businesses, the era of frictionless global sourcing is over; the era of “compliance-as-competitive-advantage” has begun. This shift reflects the realities of Post-Election Europe Trade Policy, where regulation itself has become a tool of economic strategy.

The Pivot to “Fortress Europe”

To understand the tectonic shifts in 2026, we must look at the “Triple Shock” of 2024 and 2025. First, the European Parliamentary elections shifted the center of gravity to the right, mandating a focus on industrial protectionism over pure free-market liberalism. Second, the UK’s leadership change (post-2024) initiated a pragmatic “realignment” with Brussels to stem economic bleeding. Third, and most critically, the resurgence of “America First” trade policies in late 2025 forced the EU to accelerate its “Technological Sovereignty” agenda.

We are now witnessing the operationalization of these political mandates. The European Commission’s 2025-2029 priorities—specifically the “European Preference” in procurement and the full enforcement of the AI Act—are not just bureaucratic updates; they are geopolitical shields designed to insulate the continent’s economy.

The New Rules of Engagement

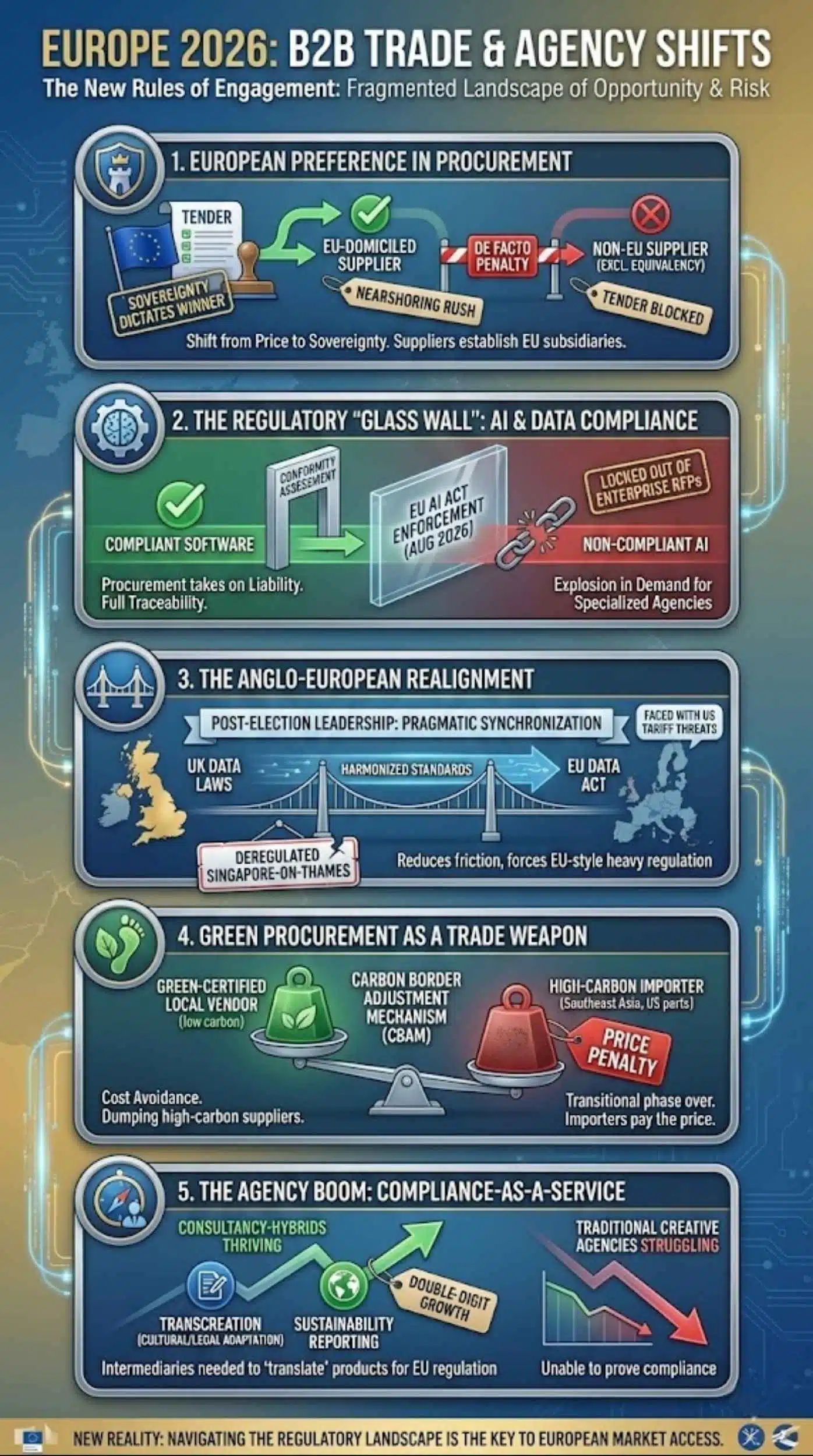

The post-election landscape has fragmented the B2B market into distinct zones of opportunity and risk. This analysis breaks down the five critical shifts driving trade and agency growth in 2026.

The Rise of “European Preference” in Procurement

The most aggressive shift in 2026 is the European Commission’s push to introduce a “European preference” clause in public procurement for strategic sectors—specifically defense, energy, and digital infrastructure.

- Why it matters: Previously, price was king. Now, “sovereignty” dictates the winner. B2B suppliers from non-EU nations (excluding those with specific equivalency deals like the UK or EEA) face a de facto penalty in tender evaluations.

- Impact: We are seeing a “nearshoring rush” where US and Asian manufacturers are frantically establishing EU-domiciled subsidiaries to bypass these new barriers.

The Regulatory “Glass Wall”: AI & Data Compliance

With the EU AI Act entering full enforcement in August 2026, the procurement process for software and digital services has fundamentally changed.

- The Shift: Procurement officers are no longer just buying software; they are taking on liability. New clauses in B2B contracts now require suppliers to provide “Conformity Assessments” and full traceability of AI models.

- The Agency Angle: This has triggered an explosion in demand for specialized agencies. Marketing agencies that can’t prove their tools are “AI Act Compliant” are being locked out of enterprise RFPs (Requests for Proposals).

The Anglo-European Realignment

Post-election leadership in the UK has abandoned the antagonistic stance of the early 2020s. Faced with US tariff threats, London and Brussels are harmonizing standards at a pace not seen since Brexit.

- Observation: In Q1 2026, we observed a synchronization of UK data laws with the EU’s Data Act to maintain cross-channel service flows. For B2B trade, this reduces friction but forces UK companies to adopt EU-style heavy regulation, effectively ending the dream of a “deregulated Singapore-on-Thames.”

Green Procurement as a Trade Weapon

The Carbon Border Adjustment Mechanism (CBAM) is now biting hard. In 2026, the transitional phase is over, and importers are paying the price.

- The Reality: European buyers are dumping high-carbon suppliers from regions like Southeast Asia and parts of the US in favor of “green-certified” local vendors. This is not altruism; it is cost avoidance.

The Agency Boom: Compliance-as-a-Service

A new breed of B2B agency is emerging. Traditional creative agencies are struggling, while “Consultancy-Hybrids” are thriving.

- Growth Driver: European firms need intermediaries who can “translate” their products into the language of EU regulation. Agencies that offer transcreation (cultural and legal adaptation) and sustainability reporting are seeing double-digit growth.

Key Statistics: The 2026 Trade Shift

The following data illustrates the sharp divergence in fortune between compliance-ready sectors and traditional exporters.

Winners vs. Losers in the 2026 Procurement Landscape

| Segment | Status | Why? |

| AI Compliance Agencies | Winner | Corporate panic over the Aug 2026 AI Act enforcement is driving massive demand for audit/consultancy services. |

| Local Defense Tech | Winner | “European Preference” policies prioritize EU-owned IP in security tenders, locking out foreign competition. |

| UK Service Exporters | Neutral/Rising | Harmonization of UK-EU data laws is slowly repairing the post-Brexit services slump. |

| High-Carbon Importers | Loser | CBAM levies have eroded the price advantage of cheap, carbon-intensive steel/cement from Asia. |

| US Data-Only Firms | Loser | Strict GDPR/Data Act enforcement is making EU firms hesitant to sign contracts with US vendors lacking EU servers. |

Critical Regulatory Milestones (2025-2027)

| Date | Event | Business Impact |

| Q1 2026 | New Procurement Thresholds | New EU thresholds (€5.4M for works) redefine which contracts engage full EU cross-border scrutiny. |

| Aug 2026 | EU AI Act Enforcement | Full ban on “unacceptable risk” AI; mandatory transparency for B2B AI tools. Non-compliant vendors face contract termination. |

| Sep 2026 | EU Data Act (Product Design) | Manufacturers of connected devices (IoT) must share data with users/third parties, disrupting “walled garden” business models. |

| Jan 2027 | Cloud Switching Rules | Removal of switching fees aims to break the dominance of US hyperscalers, favoring multi-cloud EU strategies. |

Expert Perspectives

To ensure a balanced view, we analyzed sentiments from opposing sides of the trade divide.

The Protectionist View (Brussels Think Tank)

“Strategic autonomy is not about closing doors; it is about ensuring the lock works. We cannot rely on foreign supply chains for critical digital or energy infrastructure. The 2026 procurement directives are a necessary correction to decades of naïve openness.”

The Free Market Critique (London Financial Analyst)

“The EU is effectively building a ‘Regulatory Fortress.’ While this protects local industry in the short term, it risks inflating costs for B2B buyers by 15-20% and stifling innovation. By barring non-EU tech under the guise of ‘sovereignty,’ European companies may find themselves using inferior, more expensive tools.”

Future Outlook: What Comes Next?

As we look toward the latter half of 2026 and into 2027, three major trends will define the B2B trajectory:

- The “Balkanization” of Tech Stacks: Multinational companies will increasingly run two distinct tech stacks—one for the EU (highly regulated, data-sovereign) and one for the rest of the world. This creates a massive opportunity for Systems Integrators capable of bridging this gap.

- Transatlantic Trade Friction: If the US administration pushes ahead with universal tariffs (the “Trump 2.0” scenario), expect the EU to retaliate by strictly enforcing “Green Public Procurement” rules that disproportionately target US manufacturing.

- Agency Consolidation: The boutique creative agency is an endangered species. Expect a wave of M&A where large consultancies acquire niche regulatory firms to offer an end-to-end “Growth & Governance” package to B2B clients.

Final Thoughts

The 2026 trade environment is hostile to the unprepared but lucrative for the agile. For B2B leaders, the message is clear: Your ability to navigate regulation is now just as important as the quality of your product. The “European Preference” is here to stay, and the winners will be those who can prove they belong inside the walls of the fortress.