Why This Matters Now: As of January 2026, the “Stargate” project has evolved from a $100 billion rumour into a $500 billion geopolitical and industrial reality. The newly unveiled “Stargate Community” plan (January 21, 2026) marks a critical pivot: OpenAI and its partners are no longer just building data centers; they are effectively underwriting national energy grids to secure the 10 gigawatts of power needed for AGI, signaling that the barrier to AI supremacy is no longer code, but physics.

Contextual Background: From White House Briefings to Breaking Ground

To understand the magnitude of this week’s announcement, we must look back at the project’s public genesis. While whispered about in 2024, the project was formally codified on January 21, 2025, at a White House summit involving President Trump, Sam Altman (OpenAI), Masayoshi Son (SoftBank), and Larry Ellison (Oracle).

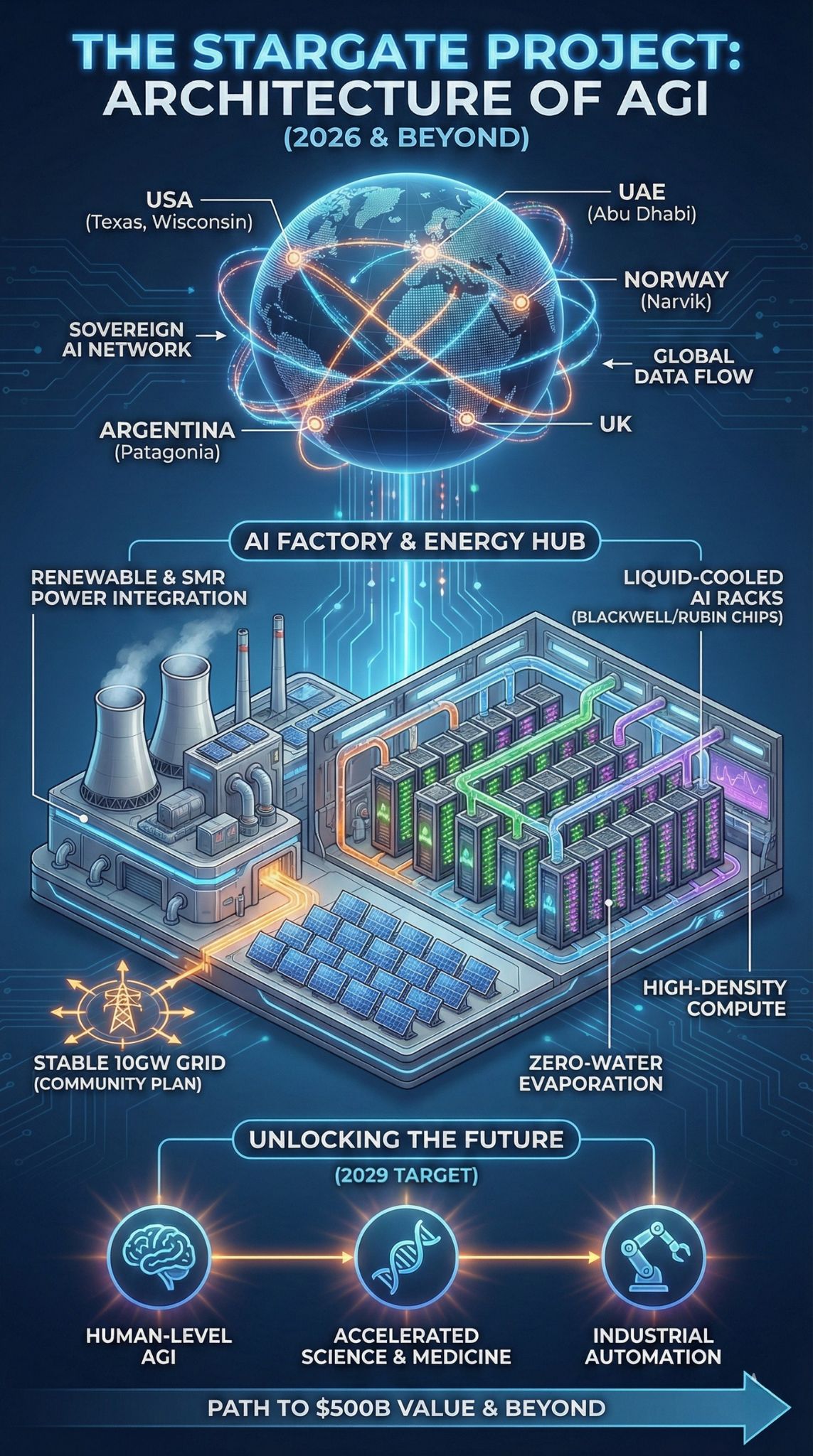

The pitch was audacious: a $500 billion infrastructure blitz (Stargate LLC) to build a network of AI supercomputers across the U.S. and allied nations. The goal was to secure American dominance in Artificial General Intelligence (AGI) by 2029. However, the sheer scale—requiring roughly 10 gigawatts (GW) of power, equivalent to the consumption of a small nation—immediately triggered skepticism regarding grid stability and financing.

Fast forward one year to January 2026: The “Stargate Community” framework addresses these growing pains directly. With facilities under construction in Texas, Wisconsin, and the UAE, the project has transitioned from “visionary” to “operational,” bringing with it a complex web of energy, financial, and geopolitical consequences.

Core Analysis: The Four Pillars of the Stargate Strategy

1. The Energy Compromise: Privatizing the Grid

The most immediate hurdle for Stargate has been the “energy wall.” The latest “Stargate Community” initiative effectively turns OpenAI and its partners into utility benefactors. By committing to “pay its way,” the consortium is funding:

- Grid Upgrades: Direct capital injection into local substations and transmission lines in places like Abilene, Texas.

- Baseload Diversity: A mix of Small Modular Reactors (SMRs), solar farms with massive battery storage, and natural gas peaking plants.

Analysis: This is a defensive maneuver. Tech giants realized that causing brownouts for voters would invite swift regulatory crackdowns. By essentially privatizing the cost of grid expansion, Stargate buys political goodwill and operational autonomy.

2. The “Sovereign AI” Archipelago

Stargate is not a monolith; it is a distributed network. The expansion into the UAE (Stargate UAE), Norway (Stargate Norway), and the UK signals a shift toward “Sovereign AI.”

- The Deal: Allied nations provide land and power (often nuclear or hydro) in exchange for guaranteed access to the resulting compute for their national services (healthcare, defense).

- The Risk: This creates a fragmented regulatory landscape. Stargate UAE, for instance, operates under a delicate U.S.-approved export license, highlighting the tension between commercial expansion and national security.

3. The Financial Tightrope: Debt vs. Revenue

The $500 billion figure is not all cash on hand; it is a capital expenditure (CapEx) target over four years.

- The SoftBank Factor: Masayoshi Son’s involvement (controlling the financial arm) relies heavily on debt leveraging.

- The Revenue Gap: While OpenAI reported ~$20 billion in annualized revenue for 2025, the gap between $20 billion in earnings and $500 billion in infrastructure spending is massive. The project is betting the house that GPT-6 (or its equivalent) will unlock trillions in economic value, not just billions.

4. The Hardware Shift: Beyond the GPU

Stargate facilities are “AI Factories” designed differently from traditional data centers.

- Liquid Cooling: The shift to “zero-water evaporation” closed-loop systems (partnering with firms like Crusoe Energy) is mandatory for the density of Nvidia’s Blackwell and Rubin chips.

- Rack Density: These facilities run hotter and denser than anything previously built, requiring custom engineering that makes them useless for anything except AI training.

5. Fortress Stargate: The Security Paradigm

As Stargate transitions from blueprint to concrete, physical and cyber security have become paramount. We are no longer talking about server farms; these are designated National Critical Infrastructure.

- The Kinetic Threat: The sheer density of high-value hardware (tens of billions of dollars in GPUs per site) has necessitated military-grade physical security. The new facilities in Texas and the UAE are reportedly designing perimeter defenses comparable to nuclear power plants, including drone-interception domes and biometric access controls managed by AI security agents.

- The Model Weights Protection: The “Crown Jewels” of Stargate are the model weights of the next-generation AGI. Cybersecurity experts note that Stargate has adopted a “Submarine Protocol”—the core training clusters are entirely air-gapped from the public internet. Data enters, and weights are updated, but the core system never touches the open web to prevent state-sponsored exfiltration efforts.

6. The “Red Mirage”: China’s Response

The formalization of the Stargate Community has accelerated the technological decoupling between the U.S. and China. Beijing views the 10GW power acquisition as an act of “computational containment.”

- The “East-West” Counter-Grid: Intelligence reports from late 2025 suggest China has accelerated its own “East-West Computing Resource Transfer” project. Unable to access the latest Nvidia silicon due to sanctions, China is pivoting to a “quantity over quality” strategy—chaining together millions of lower-end domestic chips (like those from Huawei) across vast distances to simulate the performance of a single Stargate cluster.

- The Bifurcation: We are witnessing the final split of the digital world. Stargate represents the “Western Stack”—adhering to democratic norms and copyright structures favored by the US and EU. In contrast, the opposing bloc is building a “Sovereign Control Stack,” prioritizing censorship and state stability. By 2027, the internet may effectively function as two incompatible operating systems.

7. The Labor Paradox: Blue Collar Boom, White Collar Bust?

Stargate is creating a paradoxical labor market in 2026.

- The Construction Renaissance: The immediate impact is a massive boom in skilled trades. The demand for high-voltage electricians, welders for cooling systems, and nuclear technicians has driven wages in these sectors to historic highs. Stargate LLC’s “Patriot Works” program is currently paying premiums of 40% above market rate to secure labor for the Wisconsin and Texas sites.

- The Cognitive Shadow: Conversely, the purpose of these facilities casts a long shadow over the knowledge economy. Corporations backing Stargate are effectively funding the automation of their own middle management. The unspoken ROI of the $500 billion investment relies on the ability of the resulting AGI to perform tasks—coding, legal analysis, actuarial science—at a marginal cost of near zero. The anxiety in the market is palpable: we are building the machine that makes the builders obsolete.

8. The “Intelligence Utility” Concept

Finally, the “Stargate Community” plan signifies the shift of AI from a product to a utility. Just as the 20th century saw the standardization of voltage (110V/220V) to allow appliances to work anywhere, Stargate is standardizing “Cognitive Voltage.”

The vision is that by 2030, a small business or a hospital won’t “buy software.” They will subscribe to a raw stream of intelligence from the Stargate grid. This shift dictates that the companies controlling the grid (OpenAI, Microsoft, SoftBank) will not just be tech giants, but the landlords of the global economy’s intellectual property. The concern for regulators in 2026 is no longer about preventing a monopoly on search or social media, but preventing a monopoly on reasoning itself.

Data & Visualization: The Stargate Ecosystem

The Stargate Footprint (Active & Planned Sites – Jan 2026)

| Location | Primary Partner | Energy Source | Capacity Goal | Status |

| Abilene, Texas | Oracle / Crusoe | Wind + Gas + Grid | 1 GW+ | Operational / Expanding |

| Wisconsin, USA | Microsoft / Vantage | Nuclear (SMR) / Grid | 500 MW | Construction |

| Abu Dhabi, UAE | G42 / MGX | Solar + Nuclear | 1 GW | Planning / Permitting |

| Narvik, Norway | Nscale | Hydropower | 230 MW | Announced July 2025 |

| Patagonia, Argentina | Sur Energy | Wind | 500 MW | MOU Signed Oct 2025 |

Key Stakeholders & Responsibilities

| Entity | Role | “Skin in the Game” |

| OpenAI | Operational Lead | Model development, software stack, tenant of record. |

| SoftBank | Financial Chair | Capital raising, debt structuring, visionary push. |

| Oracle | Infrastructure | Cloud backbone, database integration, physical site mgmt. |

| MGX (UAE) | Strategic Capital | Sovereign wealth funding, Middle East expansion. |

| Nvidia | Chip Supplier | Supplier of millions of GPUs (Blackwell/Rubin). |

Expert Perspectives: Bull vs. Bear

The Bull Case: “We are witnessing the re-industrialization of the West. Stargate is not just about chatbots; it’s about building the ‘electricity’ of the 21st century. The $500 billion investment will pay for itself by automating science, medicine, and engineering.” — Larry Ellison (Paraphrased from Oracle Earnings Call, Dec 2025)

The Bear Case: “The unit economics are broken. They are spending national-GDP levels of capital to chase a consumer product that has yet to show a clear path to profitability beyond subscriptions. If the ‘reasoning’ models hit a plateau, Stargate becomes the most expensive white elephant in human history.” — George Noble, Investment Analyst (Jan 2026)

Future Outlook: What to Watch in 2026

- The “Stargate Coin” or Tokenization? With capital costs soaring, watch for rumors of OpenAI or Stargate LLC floating a public offering or a tokenized bond to raise liquidity from retail investors.

- The 10GW Milestone: The consortium claims they are “halfway” to the 10GW goal. Verification of this capacity coming online in late 2026 will be the primary market mover for hardware stocks (Nvidia, AMD, Broadcom).

- Regulatory Backlash: As these data centers consume more power, expect local pushback in U.S. states to intensify, potentially leading to federal “National Security” designations to bypass local zoning laws.

Final Words

The Stargate Project has graduated from a pitch deck to a concrete industrial program. The “Why” is no longer about beating Google; it is about building the physical substrate for a post-human intelligence economy. The $500 billion price tag is high, but the cost of sitting out the race—according to the project’s architects—is irrelevance. Compute is becoming the new oil, data centers the new refineries, and nations that fail to secure sovereign AI infrastructure risk outsourcing not just innovation, but decision-making itself to foreign machine intelligence stacks.