The circular economy in tech is becoming one of the most important answers to a simple problem. We buy more gadgets than ever, and we replace them faster than ever. Phones, laptops, tablets, earbuds, smartwatches, routers, and gaming devices move through our lives in short cycles, even when many could be repaired or reused.

This rapid churn creates two major costs. The first is environmental. Electronics require mined materials, energy-heavy manufacturing, and global shipping. The second is economic. Consumers lose value when devices become “obsolete” too quickly, and companies absorb reputational risk as e-waste piles up.

Buyback programs, trade-ins, refurbishment, and certified resale are the most visible parts of the circular shift. But not every program is truly circular. Some exist mostly to drive upgrades. Others genuinely extend device life, recover parts, and reduce demand for new raw materials.

This cluster guide explains how the circular economy works in tech, what a “good” buyback program looks like, where greenwashing hides, and how consumers and companies can use circular systems to cut waste without losing performance.

Why Tech Needs A Circular Economy Right Now

Electronics are a perfect storm of high value and high waste. Devices contain precious metals, rare earth elements, plastics, glass, and complex components. They also break in predictable ways, like cracked screens, degraded batteries, worn charging ports, and failing storage.

Despite that, the tech industry has long operated on a linear model. Materials get extracted, devices get built, devices get sold, and devices get discarded. That model is colliding with rising material demand, tighter regulations, and consumer backlash.

There are a few reasons circularity is moving faster now.

First, devices are reaching performance plateaus for many users. A new phone may feel only slightly better than a two-year-old phone. That makes refurbishment and reuse more attractive.

Second, governments are increasing pressure on e-waste and repairability. This includes stronger take-back expectations and right-to-repair momentum.

Third, businesses are learning that circularity can be profitable. Refurbished devices, parts harvesting, and resale programs create new revenue streams while improving brand trust.

What The Circular Economy In Tech Actually Means

The circular economy in tech is about keeping products and materials in use longer, at their highest value, before recycling what remains. It is not just “recycling.” Recycling is the last resort when reuse and repair are no longer possible.

A circular tech system aims to:

-

Extend device life through repair and maintenance

-

Enable second-life ownership through refurbishment and resale

-

Recover parts for reuse in repairs and remanufacturing

-

Recycle remaining materials with high recovery rates

The core idea is value preservation. A working phone is more valuable than its shredded materials. A functional battery module is more valuable than its melted metals. A reusable screen assembly is more valuable than its glass.

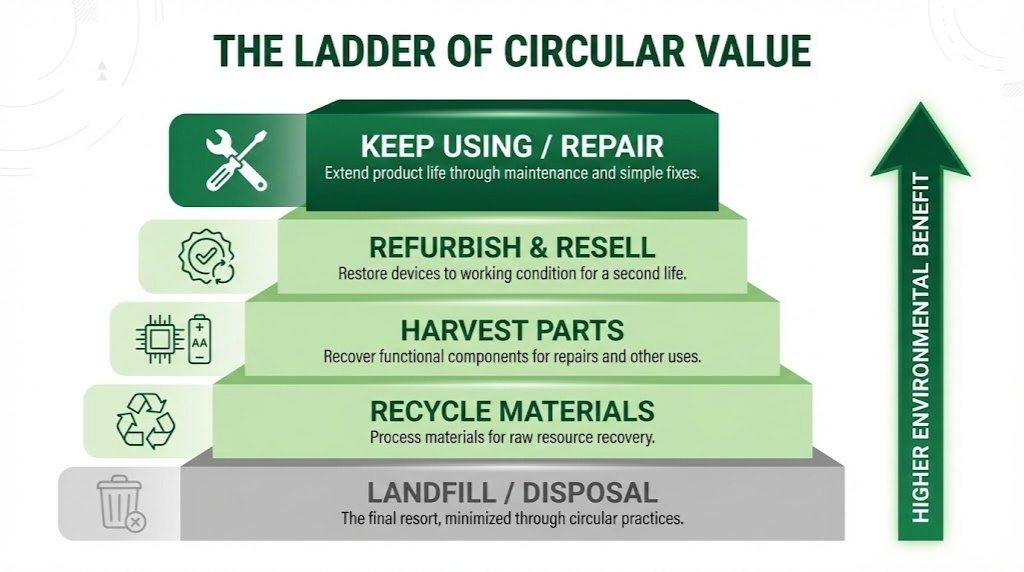

The Circular Ladder In Plain Language

You can think of circularity as a ladder where the top rungs save the most value.

-

Keep using the device longer

-

Repair it

-

Upgrade components where possible

-

Resell it as used

-

Refurbish and resell it certified

-

Harvest parts

-

Recycle materials

-

Dispose as last resort

The best circular programs push devices toward the top of this ladder.

Why Buyback Programs Exist And How They Really Work

Buyback programs often look like a simple trade. You hand in a device, and you get credit, cash, or a discount. Behind the scenes, the company decides whether that device will be resold, refurbished, harvested for parts, or recycled.

A buyback program is circular only if it does at least one of these things well:

-

Extends the device’s usable life through resale or refurbishment

-

Reuses parts to keep other devices in service

-

Recovers materials responsibly when reuse is not possible

Some programs do this. Some do not.

The Three Main Types Of Buyback Programs

-

Upgrade-focused trade-ins

These programs often prioritize selling you a new device. The trade-in is a discount mechanism. Some devices still get refurbished, but circular outcomes are not always the main goal. -

Refurbishment-focused programs

These programs prioritize returning devices to market. They invest in testing, repair, grading, and warranty-backed resale. -

Recycling-focused take-back programs

These programs emphasize safe recycling. They can be valuable, but recycling is lower on the circular ladder than repair and reuse.

A strong circular economy in tech depends on pushing as many devices as possible into refurbishment and resale.

What Happens After You Trade In A Device

Most traded-in devices follow one of four paths.

Path 1: Direct Resale As Used

If the device is in good condition, it may be wiped, tested, graded, and resold with minimal repair. This is common with newer devices.

Path 2: Refurbishment And Certified Resale

If the device has issues, it may be repaired, receive a new battery or screen, and then be sold as “refurbished.” Certified programs often include warranties and quality standards.

Path 3: Parts Harvesting

If the device is not worth refurbishing, parts may be harvested. Screens, cameras, ports, enclosures, and boards may be reused to repair other devices.

Path 4: Recycling

If the device is too damaged, too old, or not economical to recover, it goes to recycling. High-quality recycling can recover materials like gold, copper, cobalt, nickel, aluminum, and plastics.

The circular outcome depends on how often devices land in paths 1 and 2, and how responsibly paths 3 and 4 are handled.

The Business Case: Why Companies Want Your Old Devices

Many consumers assume buyback programs are pure sustainability initiatives. They can be, but they are also strategic.

Companies want trade-ins because:

-

They reduce the cost barrier for new purchases

-

They keep customers inside one ecosystem

-

They create resale inventory for secondary markets

-

They provide parts supply for repairs and refurbishing

-

They reduce regulatory and reputational risk tied to e-waste

Refurbished markets are growing because demand exists. Many buyers want a lower price and still want brand reliability. Companies that control refurbishment also control quality perception.

This is where the circular economy in tech becomes a competitive advantage, not just a compliance effort.

The Hidden Problem: Planned Obsolescence Versus Circularity

Circularity struggles when products are designed to be difficult to repair.

Common barriers include:

-

Batteries glued in and hard to replace

-

Proprietary screws and sealed assemblies

-

Paired components that require software authorization

-

Limited spare parts availability

-

Short software support windows

A buyback program can reduce waste, but it cannot fully offset a design strategy that pushes constant replacement.

A truly circular tech ecosystem needs both sides. It needs circular programs, and it needs repair-friendly design and longer software support.

How To Tell If A Buyback Program Is Truly Circular

You do not need insider access to judge whether a program is meaningful. You need a practical checklist.

The Circular Credibility Checklist

-

Does the company publish what percentage is reused, refurbished, or recycled?

-

Is there a certified refurbished store with warranty-backed devices?

-

Are repairs supported with parts availability and service options?

-

Is the data wipe process clearly described and verifiable?

-

Does the company work with credible recyclers with transparent standards?

-

Does the program accept devices even when you are not buying new?

If the program is only attractive when you upgrade, it may be more of a sales tool than a circular system.

Quick Comparison Table

| Program Feature | Strong Circular Program | Weak Circular Program |

|---|---|---|

| Transparency | Shares reuse and recycling outcomes | Vague “responsible disposal” claims |

| Repair support | Parts, manuals, and service channels | Repair discouraged or overpriced |

| Refurb resale | Certified resale with warranty | No resale channel or unclear handling |

| Data wiping | Verifiable wipe and clear steps | Unclear wipe policies |

| Access | Accepts devices without purchase | Only works as upgrade discount |

Refurbished Devices: The Most Underrated Climate Win

Refurbishment is often the highest-impact step because it keeps the full product in use. It avoids the emissions and material demand of manufacturing a new device.

A well-refurbished device can be a strong deal for consumers. It can also be a strong sustainability choice for companies and institutions.

Still, refurbished quality varies widely. “Refurbished” is not a single standard in every market. That is why reputable grading and warranty support matter.

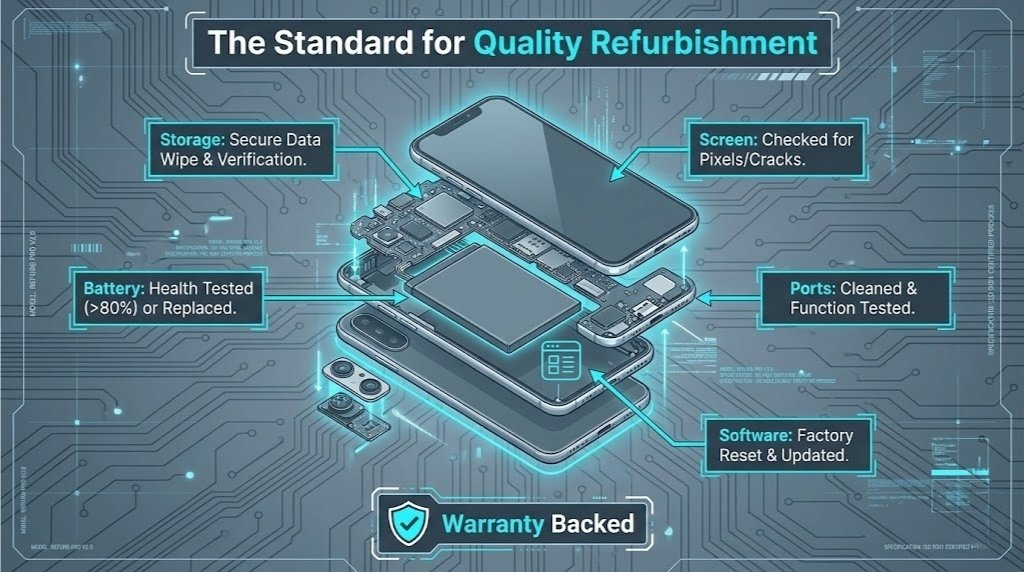

What A Proper Refurbishment Process Includes

-

Secure data wipe and verification

-

Full functional testing of key components

-

Replacement of worn parts, often the battery

-

Cosmetic grading with clear categories

-

Software resets and updates

-

Quality control checks before shipping

-

Warranty coverage and returns policy

Refurbishment Quality Table

| Area | What Good Looks Like | What To Avoid |

|---|---|---|

| Battery | Tested health or replaced | Unknown battery health |

| Screen | No major defects or replaced | Dead pixels or severe burn-in |

| Ports and buttons | Fully tested | Intermittent charging or sticky buttons |

| Warranty | Clear warranty terms | No warranty or vague terms |

| Grading | Clear cosmetic categories | “Like new” with no definition |

Around this stage, it is worth repeating the focus in context. The circular economy in tech depends heavily on refurbished markets because they keep full devices working, not just materials.

Parts Harvesting: The Repair Economy Behind The Scenes

When devices are not worth refurbishing as complete units, they can still support circularity through parts recovery. Many repairs rely on parts that are hard to source, especially for older models.

Parts harvesting can:

-

Reduce the cost of repairs

-

Keep devices in service longer

-

Reduce demand for manufacturing new parts

-

Support independent repair ecosystems

The key risk is traceability and quality. Harvested parts must be tested and tracked, especially batteries, screens, and power components.

A mature circular program treats parts harvesting as a controlled process, not an informal gray market.

Recycling: Necessary, But Lower On The Ladder

Recycling matters because not every device can be reused or repaired. But recycling should be framed correctly. It is the fallback option, not the primary goal.

Electronics recycling is complex. Devices contain mixed materials, adhesives, and components that require specialized processes. High-quality recycling can recover valuable metals, but recovery rates vary.

Why E-Waste Recycling Is Hard

-

Components are small and tightly integrated

-

Batteries create safety risks during transport and processing

-

Different material mixes require different processing steps

-

Informal recycling can create pollution and health harm

What Responsible Recycling Looks Like

-

Safe battery handling and transport

-

Certified processes with strong environmental controls

-

Transparent downstream partners

-

Documented recovery outcomes where possible

-

No dumping or exporting to unsafe informal processing

If a program only says “recycled responsibly” without any details, treat it as incomplete.

Data Security: The Barrier That Stops People From Trading In

Many people keep old devices because they worry about data. This is rational. Phones and laptops contain private photos, passwords, financial data, and account access.

A strong buyback program must treat data security as a core feature, not an afterthought.

What A Strong Data Process Includes

-

Clear instructions for user wipe steps

-

Factory reset guidance and account de-linking

-

Verification wiping at intake

-

Secure handling of storage components

-

Certificates or confirmation where possible

Consumers should still wipe devices themselves. But program quality matters because trust drives participation.

How Consumers Can Participate In The Circular Economy Without Getting Played

Consumers can benefit financially while supporting circularity, but only when choices are intentional.

High-Impact Consumer Actions

-

Keep devices longer by replacing batteries and repairing screens

-

Buy certified refurbished when it fits your needs

-

Use trade-in programs that clearly support refurbishment

-

Avoid replacing devices for minor feature gains

-

Choose brands that provide longer software support

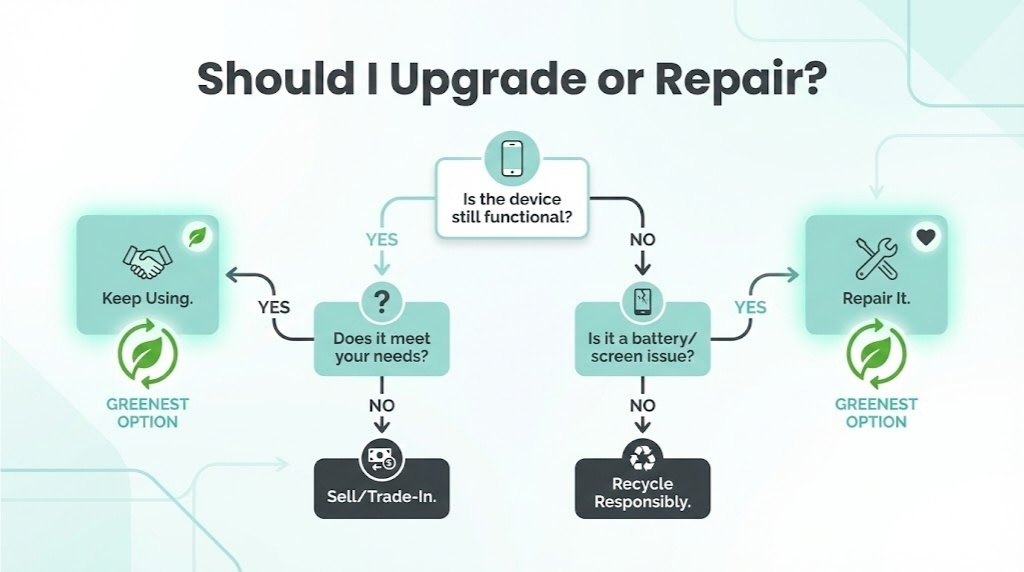

A Practical Decision Flow

-

Is the device still meeting your needs? Keep it.

-

Is the device failing due to a battery or screen? Repair it.

-

Is the device too slow because software support ended? Consider refurbished, newer models.

-

Is the device beyond repair? Use a transparent take-back or recycler.

The most circular choice is often to delay replacement. The second-best is to keep a device in use through repair or resale.

How Companies Build A Real Circular Economy Strategy

For businesses, circularity is not only a buyback program. It is a product, logistics, and customer experience strategy. The best programs are designed as systems.

Key Elements Of A Corporate Circular Strategy

-

Design devices to be repairable and modular where feasible

-

Provide spare parts and service documentation

-

Offer battery replacements at reasonable cost

-

Maintain software support longer

-

Run certified resale programs with consistent grading

-

Build reverse logistics to bring devices back efficiently

-

Partner with high-quality recyclers and auditors

-

Track outcomes and publish metrics

A circular program without design support becomes a bandage. A circular program with design support becomes a flywheel.

Reverse Logistics: The Most Underrated Part Of Circular Tech

Returning devices is harder than selling them. Devices must be collected, shipped safely, verified, graded, and routed to the right pathway. Batteries add shipping constraints and safety requirements.

Reverse logistics becomes efficient when:

-

Collection is easy, with clear instructions

-

Packaging is standardized and safe

-

Sorting happens quickly with accurate testing

-

Routing decisions are automated and auditable

-

Refurbishment centers have stable capacity

A strong reverse logistics system is what turns a buyback promise into a real circular outcome.

The Role Of Right To Repair In Making Buyback Programs Honest

Right to repair is a pressure valve. It limits how much companies can lock down repairs and still claim circular responsibility.

When repairs are accessible:

-

Consumers keep devices longer

-

Refurbishment becomes cheaper and more reliable

-

Independent repair shops can support circular outcomes

-

Parts harvesting becomes more standardized

When repairs are blocked:

-

Devices get replaced earlier

-

Buyback programs become upgrade funnels

-

E-waste grows faster than it needs to

This is why the circular economy in tech is tied closely to repair culture. Circularity needs repairability to be real.

Greenwashing Watch: Common Tricks In “Circular” Marketing

Circular marketing is attractive, so some brands overstate impact. Watch for these patterns.

Common Red Flags

-

The program emphasizes recycling but ignores reuse

-

No disclosure of what happens after collection

-

Trade-ins only available when you buy new

-

Big sustainability claims with no warranty-backed refurbished channel

-

“Eco-friendly” language without repair support or software longevity

A Greenwashing Reality Table

| Claim | What It Might Mean | What You Should Ask |

|---|---|---|

| “We recycle devices” | Materials recovery only | How much is reused or refurbished? |

| “We reduce e-waste” | Trade-ins drive upgrades | How many devices stay in use longer? |

| “Carbon-neutral program” | Offsets instead of outcomes | What is the real circular pathway? |

| “Sustainable materials” | Small recycled content | How long does the device last? |

| “Responsible disposal” | No details | Which recyclers, which standards, which metrics? |

Where Circular Tech Is Headed Next

Circular systems are evolving. You can already see new models forming around repair, subscription, and product-as-a-service approaches.

Emerging directions include:

-

Modular devices designed for component upgrades

-

Battery swapping and standardized battery modules

-

More certified resale channels, including enterprise resale

-

Stronger repair ecosystems through parts availability

-

Improved recycling methods that recover more material value

-

Policy-driven requirements for take-back and repair access

The future likely includes more accountability. Companies will need to show outcomes, not just intentions.

Around this point, it helps to anchor the discussion again. The circular economy in tech will only scale if programs make reuse easy, repairs affordable, and resale trustworthy.

A Practical Circular Economy Scorecard For Tech Brands

If you want a fast way to evaluate brands, use this scorecard. It combines product design, support policies, and circular programs into one view.

Brand Scorecard Table

| Category | Strong Signals | Weak Signals |

|---|---|---|

| Repairability | Parts available, fair repair pricing | Sealed design, repair restricted |

| Software support | Long update policy | Short support window |

| Buyback program | Accepts devices without purchase | Only an upgrade discount |

| Refurbished resale | Certified resale with warranty | No resale channel |

| Transparency | Publish outcomes and partners | Vague claims with no data |

| Recycling | Certified recycling and safe handling | Unclear downstream processing |

This scorecard helps you judge circularity quickly and consistently.

Ending Thoughts

The circular economy in tech is not a slogan. It is a system for keeping devices and materials in use longer, at higher value, before recycling what remains. Buyback programs can be part of this system, but only when they truly support reuse, refurbishment, parts recovery, and responsible recycling.

For consumers, the best circular move is often simple. Keep your device longer. Repair it when it breaks. Buy refurbished when it fits. Trade in through programs that clearly support resale and refurbishment. For companies, circularity becomes credible when product design supports repair, software support lasts longer, and circular outcomes are measured and published.

Tech will keep evolving. But waste does not have to keep growing. The brands and users who treat devices as long-life assets, not disposable trends, will define the next phase of the digital era.