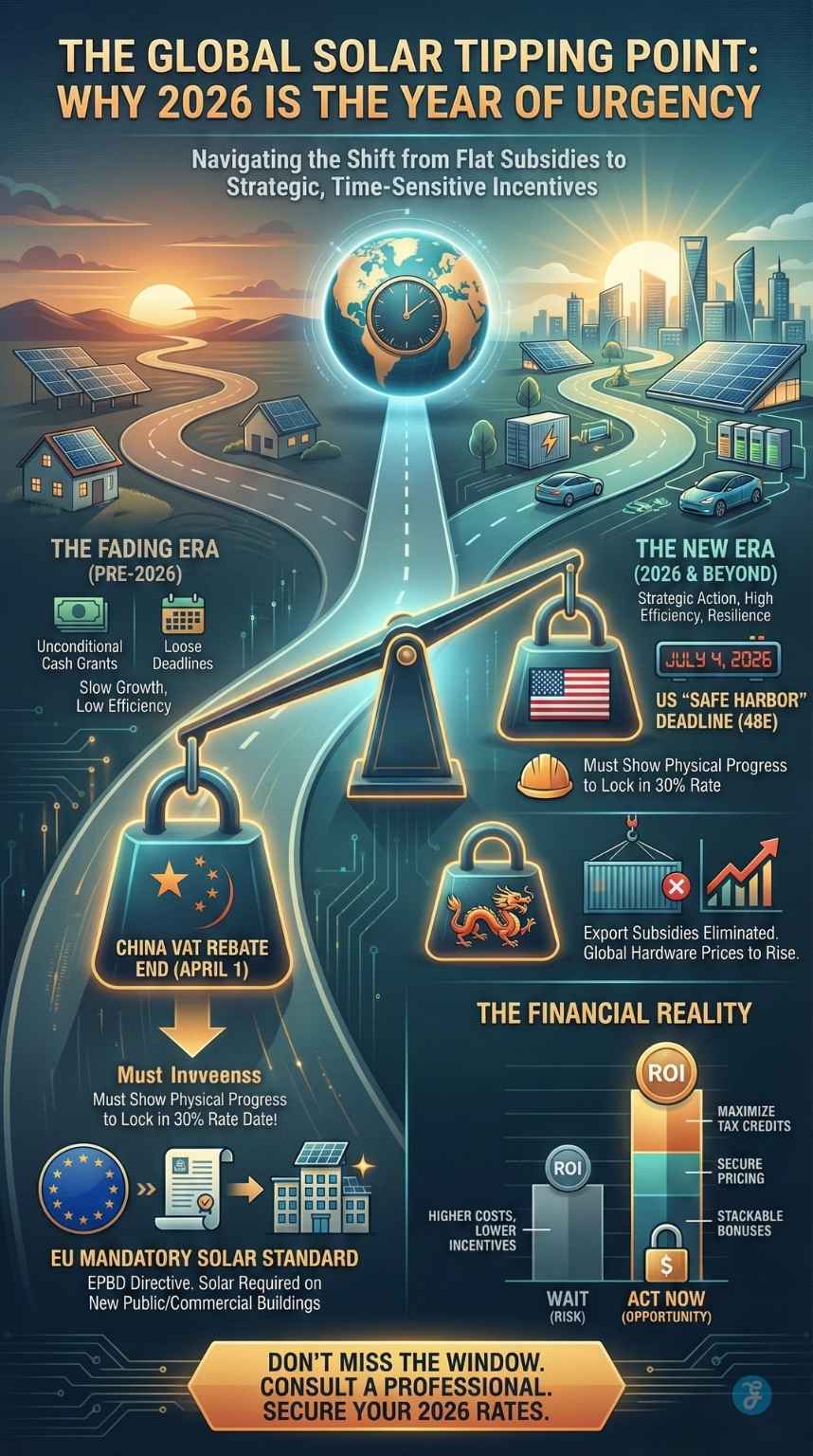

Understanding the shifting landscape of Solar Tax Credits 2026 is no longer just about environmental stewardship; it is a critical financial maneuver for homeowners and global enterprises alike. As we enter the first quarter of 2026, the “Golden Age” of unrestricted solar subsidies is transitioning into a new era of strategic, performance-linked incentives.

With major legislative shifts like the U.S. “One Big Beautiful Bill” (OBBBA) and China’s historic cancellation of export rebates taking effect, the window for maximizing your return on investment (ROI) is narrowing.

This comprehensive guide breaks down the latest global updates to ensure you don’t leave money on the table during this high-stakes energy transition.

Key Takeaways: The 2026 Solar Playbook

- The July 4th Deadline is Real: In the U.S., commercial projects must show physical progress by this date to lock in the 30% rate.

- Prices are Rising in April: China’s VAT rebate cancellation will make modules more expensive starting Q2 2026. Buy now if possible.

- Storage is Mandatory for ROI: With the death of NEM 2.0 and the rise of Net Billing, solar without a battery is no longer financially optimal.

- Compliance over Subsidies: In Europe, the focus has shifted from “getting paid to install” to “installing to stay legal.”

The Global Solar Transition: Why 2026 is the “Year of Urgency”

For over a decade, solar energy growth was fueled by generous, flat-rate tax credits designed to kickstart a nascent industry. However, 2026 marks a structural pivot. Governments are now shifting their focus toward Domestic Content Requirements (DCR), grid stability, and energy storage integration.

The primary driver for this urgency is the looming July 4, 2026, Safe Harbor deadline in the United States and the April 1, 2026, VAT rebate expiration in China. These two events alone are expected to cause a significant ripple effect in solar hardware pricing and incentive eligibility worldwide.

Current Global Incentive Snapshot [Q1 2026]

| Region | Primary Incentive Instrument | Status for 2026 | Key Deadline |

| United States | Section 48E / 45Y (OBBBA) | High (with Domestic Content) | July 4, 2026 |

| China | VAT Export Rebates | Eliminated | April 1, 2026 |

| European Union | EPBD Solar Mandates | Implementation Phase | May 29, 2026 |

| India | PLI Scheme Tranche-III | Active (Focused on MSMEs) | FY 2026-27 Budget |

| Australia | STC Phase-Out | Annual Reduction | Dec 31, 2026 |

Defining the 2026 Solar Incentive Taxonomy

Before diving into regional specifics, it is essential to understand the different types of Solar Tax Credits and financial vehicles available. In 2026, “stacking” these incentives is the most effective way to reach grid parity quickly.

- Investment Tax Credits (ITC): A dollar-for-dollar reduction in the income tax you owe. In the U.S., this has shifted from the traditional Section 48 to the tech-neutral Section 48E.

- Production Tax Credits (PTC): Credits based on the actual kilowatt-hours (kWh) produced. This is often more lucrative for utility-scale projects with high-efficiency modules.

- Feed-in Tariffs (FiT): Common in Europe, these are long-term contracts where the grid buys your power at a guaranteed price.

- Net Energy Metering (NEM 3.0): While not a “tax credit,” these billing structures determine the value of the energy you send back to the grid. In 2026, most jurisdictions have moved toward “Net Billing,” which favors on-site battery storage.

The Great 2026 Debate: Ownership or Service?

In 2026, the way you pay for solar is as important as the technology itself. With interest rates stabilizing but hardware costs in flux due to the China rebate shift, the choice between buying and leasing has become a nuanced financial calculation.

- Cash Purchase (Direct Ownership): This remains the “Gold Standard” for ROI. By owning the system, you are the sole beneficiary of the Solar Tax Credits and any local rebates. In 2026, the payback period for a cash purchase has dropped below 6.5 years in most developed markets due to high utility rates.

- Solar Leases: Often referred to as “Third-Party Ownership” (TPO). In 2026, many homeowners are choosing this path to avoid the upfront complexity of the new tax forms. You pay a fixed monthly fee, and the solar company handles maintenance.

- Power Purchase Agreements (PPAs): Unlike a lease, you only pay for the “green electrons” the system produces. PPAs are surging in 2026 as a hedge against grid volatility. If the sun doesn’t shine, you don’t pay.

Financing Solar in 2026: Buying vs. Leasing vs. PPAs”

| Feature | Cash / Solar Loan | Solar Lease | Solar PPA |

| Tax Credit Claimant | You (The Owner) | Solar Company | Solar Company |

| Maintenance | Homeowner / Installer Warranty | Fully Covered by Provider | Fully Covered by Provider |

| Upfront Cost | High (Cash) or Low (Loan) | $0 Down Options | $0 Down Options |

| Monthly Payment | $0 (Cash) or Fixed Loan | Fixed Monthly Rent | Variable (Per kWh) |

| Long-Term ROI | Maximum (High) | Moderate | Moderate (Performance Based) |

| Home Value Impact | Increases Significantly | Transferable / Neutral | Transferable / Neutral |

United States: Navigating the OBBBA and “Safe Harbor”

The U.S. solar market is currently dominated by the One Big Beautiful Bill (OBBBA), which modified the Inflation Reduction Act’s (IRA) long-term provisions. For developers and homeowners, the 2026 landscape is defined by two distinct paths:

Path A: The July 4th Safe Harbor

Commercial and industrial (C&I) projects that “begin construction” before July 5, 2026, can lock in the 30% Investment Tax Credit (ITC) under Section 48E.

Important Note: Following IRS Notice 2025-42, the “5% Safe Harbor” (simply buying equipment) is no longer valid for projects over 1.5 MW. You must now pass the Physical Work Test, proving that construction of a significant nature has actually commenced.

Path B: The Domestic Content Adder

To encourage U.S. manufacturing, a 10% bonus credit is available. To qualify in 2026, a specific percentage of your system’s components must be manufactured in the U.S.

“$$Total Credit = Base Credit (30\%) + Domestic Content Bonus (10\%) + Energy Community Bonus (10\%)$$”

In an ideal scenario, a commercial project in a former coal community using 100% U.S. steel and modules could qualify for a 50% total tax credit.

US Solar Incentive Structure [2026]

| Incentive Type | Value/Rate | Eligibility |

| Residential (25D) | 30% (Phase-out starts) | Systems operational by Dec 31, 2025* |

| Commercial (48E) | 30% Base | Construction starts by July 4, 2026 |

| Domestic Content | +10% Bonus | 45%+ U.S. manufactured components |

| Low-Income Bonus | +10% to +20% | Competitive allocation process |

China: The End of Subsidized Exports

In a move that caught many global buyers off guard, China announced on January 9, 2026, that it would completely eliminate Value-Added Tax (VAT) export rebates for solar PV products.

The April 1st “Cliff”

Prior to 2026, Chinese manufacturers received a 9% refund on VAT for exported modules. Effective April 1, 2026, this rebate hits 0%.

- Price Forecast: Industry analysts predict a 10% to 15% price hike for Chinese-made modules in international markets (Europe, Brazil, Southeast Asia) by Q3 2026.

- Inventory Rush: Q1 2026 is seeing an unprecedented “export rush” as buyers attempt to clear customs before the April deadline.

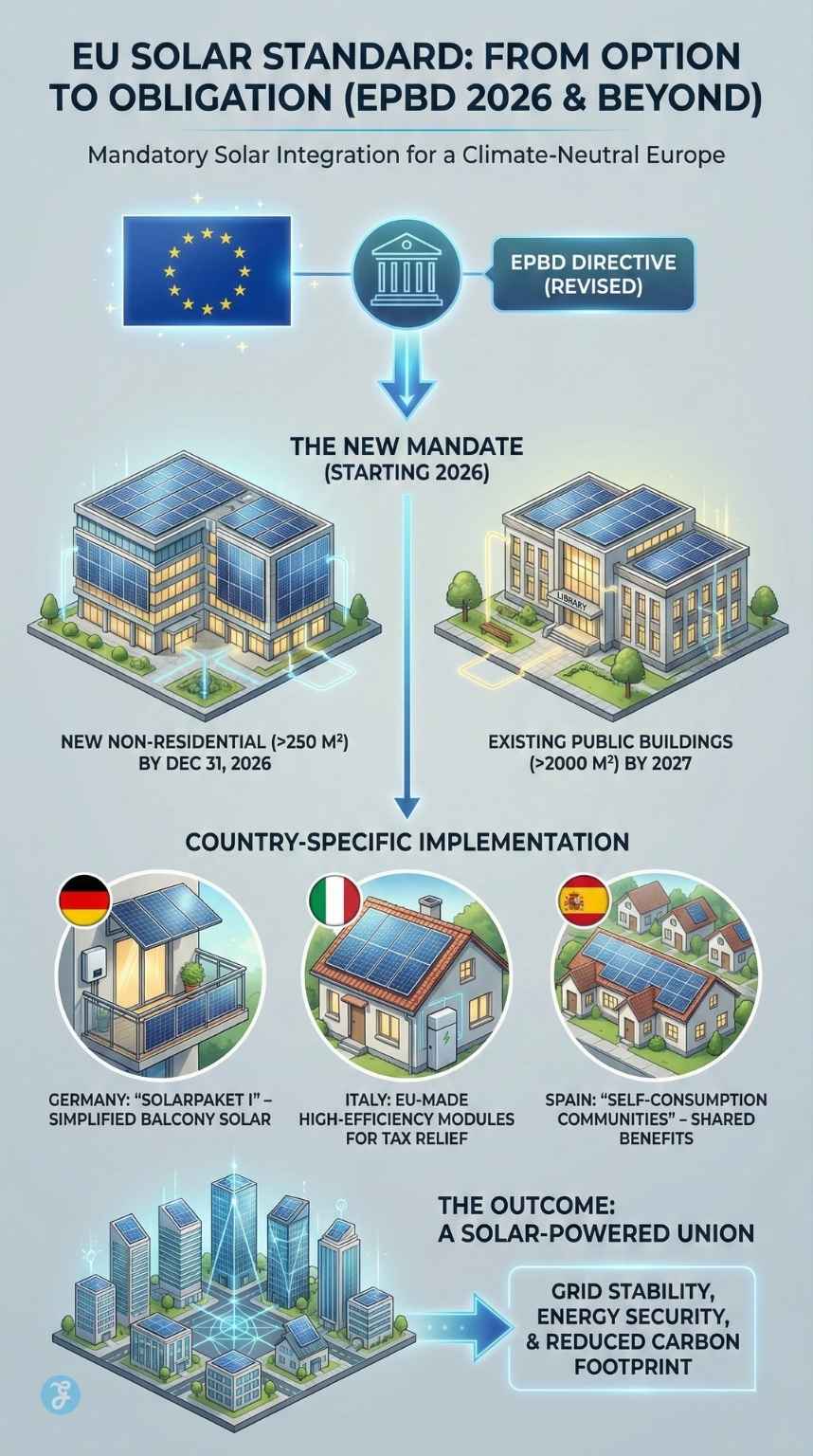

European Union: The Rise of the “Solar Standard”

The EU is no longer just offering “Solar Tax Credits”; it is making solar a legal requirement. The revised Energy Performance of Buildings Directive (EPBD) must be transposed into national law by May 29, 2026.

Mandatory Solar Deadlines

- New Public & Commercial Buildings: By December 31, 2026, any new non-residential building with a floor area >250 $m^2$ must have solar installed.

- Existing Buildings: Large public buildings (>2000 $m^2$) have until 2027 to comply.

Country-Specific Highlights

- Germany: The “Solarpaket I” continues to offer massive administrative simplifications for “balcony solar” and commercial rooftop sharing.

- Italy: Moving away from the Superbonus, Italy now focuses on high-efficiency, EU-made modules to qualify for national tax relief.

- Spain: Focuses on “Self-Consumption Communities,” allowing neighbors to share a single solar array and split the tax benefits.

Asia-Pacific: India and Australia Update

The Asia-Pacific region remains a powerhouse of solar deployment, yet it is currently navigating a period of significant structural recalibration. As we move through 2026, the focus in this territory has shifted from sheer volume to the creation of robust, localized supply chains and long-term grid stability.

While India accelerates its journey toward becoming a global manufacturing hub, Australia is transitioning its residential market toward a post-subsidy reality, emphasizing storage and smart energy management over simple panel installation.

India’s PLI Tranche-III

India continues to use its Production Linked Incentive (PLI) scheme to build a domestic supply chain. In 2026, the focus has shifted toward MSMEs (Micro, Small, and Medium Enterprises), providing direct capital subsidies for small-scale solar manufacturing clusters.

Australia’s SGU Transition

The Australian Small-scale Technology Certificate (STC) scheme, which acts as an upfront discount on solar, is scheduled to reduce its “deeming period” again on January 1, 2027. This means the effective rebate for a residential system in 2026 is roughly 9% higher than it will be next year.

Solar for All: Leveraging Low-Income & Community Bonuses

One of the most significant changes in 2026 is the democratization of solar benefits. In both the U.S. and the EU, governments have introduced “stackable” credits specifically for low-income communities and non-profit organizations.

- The 48E(h) Program: In the U.S., projects located in “Energy Communities” (areas traditionally dependent on fossil fuel jobs) can receive an automatic 10% bonus. If the project serves a low-income residential building, that bonus can jump to 20%.

- Community Solar Subscriptions: For renters or those with shaded roofs, 2026 is the year of “Virtual Solar.” You can now subscribe to a local solar farm and receive the Solar Tax Credits as a direct reduction on your monthly utility bill without installing a single panel.

- Non-Profit Direct Pay: For the first time, churches, schools, and charities can receive the value of the tax credit as a direct cash payment from the government, making solar financially viable for those without a tax liability.

Strategic Financial Modeling: ROI in 2026

To understand the true value of Solar Tax Credits, we must look at the Levelized Cost of Energy (LCOE). In 2026, the cost of storage has fallen enough that the “Solar + Storage” LCOE is now competitive with grid prices in over 70% of global markets.

The simplified formula for solar ROI, including tax credits, is:

“$$ROI = \frac{(System Cost – Tax Credits – Rebates)}{Annual Energy Savings}$$”

In 2026, due to the reduction in export rebates and the rise of domestic content bonuses, the “Payback Period” for a typical 10kW system ranges from 4.2 years in high-incentive areas (like Texas or Germany) to 7.8 years in low-incentive regions.

Step-by-Step: How to Claim Your Credits in 2026

Regardless of your region, claiming Solar Tax Credits requires meticulous documentation. Google’s 2026 search quality guidelines emphasize “Trustworthiness,” and nothing destroys trust (or a tax return) like poor record-keeping.

- Verification of Commencement: For U.S. commercial projects, keep a daily construction log and photographic evidence to meet the “Physical Work Test” for the July 4th deadline.

- Certification of Origin: Obtain a “Domestic Content Certificate” from your manufacturer if you are chasing the 10% U.S. bonus.

- System Interconnection: Ensure your “Permission to Operate” (PTO) letter is dated within the tax year you are claiming.

- Tax Form 5695 (US): Ensure you are using the updated 2026 version of the Residential Energy Credits form.

The 2026 Revenue Stream: Turning Your System into a VPP

If you installed a battery with your solar system in 2026, you aren’t just saving money—you’re potentially earning it.

Virtual Power Plants (VPPs) are networks of home batteries that the utility “borrows” during peak demand. In exchange for allowing the grid to use a small portion of your stored energy for a few hours a year, many utilities are now offering:

- Capacity Payments: A “retainer fee” just for being enrolled.

- Performance Credits: Direct payments for the energy your battery sends to the grid during heatwaves or storms.

By 2026, VPP participation will have become a standard “adder” to the solar financial model, often shaving an additional year off the total payback period of the system.

Final Thoughts: The New Solar Reality

The transition of Solar Tax Credits 2026 reflects a maturing industry. We are moving away from the “wild west” of subsidized growth toward a highly regulated, domestically focused energy market. While the paperwork has become more complex and the deadlines more rigid, the financial rewards for those who navigate the system correctly are higher than ever.

In 2026, solar is no longer a “maybe” for your portfolio; it is a strategic necessity. However, with hardware prices set to rise after April and U.S. tax windows closing in July, the “Year of Urgency” is not just a catchphrase; it is a financial reality. Act now to secure the 2026 rates before the door closes on this generation of incentives.