Life as a digital nomad looks simple on Instagram. In real life, your money needs to work across borders, time zones, and currencies without turning every purchase into a fee surprise.

A strong neobank can reduce friction fast. You get an app-first account, a global-friendly card, real-time controls, and easier money movement while you travel. The “best” option depends on where you can legally open an account, how you get paid, and how often you hop countries.

For this article, I’m using the focus keyword Best Neobanks For Digital Nomads In 2026 and building the structure around it. The picks below are evergreen choices that tend to stay relevant because they solve the same core nomad problems: multi-currency spending, low-cost transfers, card security, and simple account management.

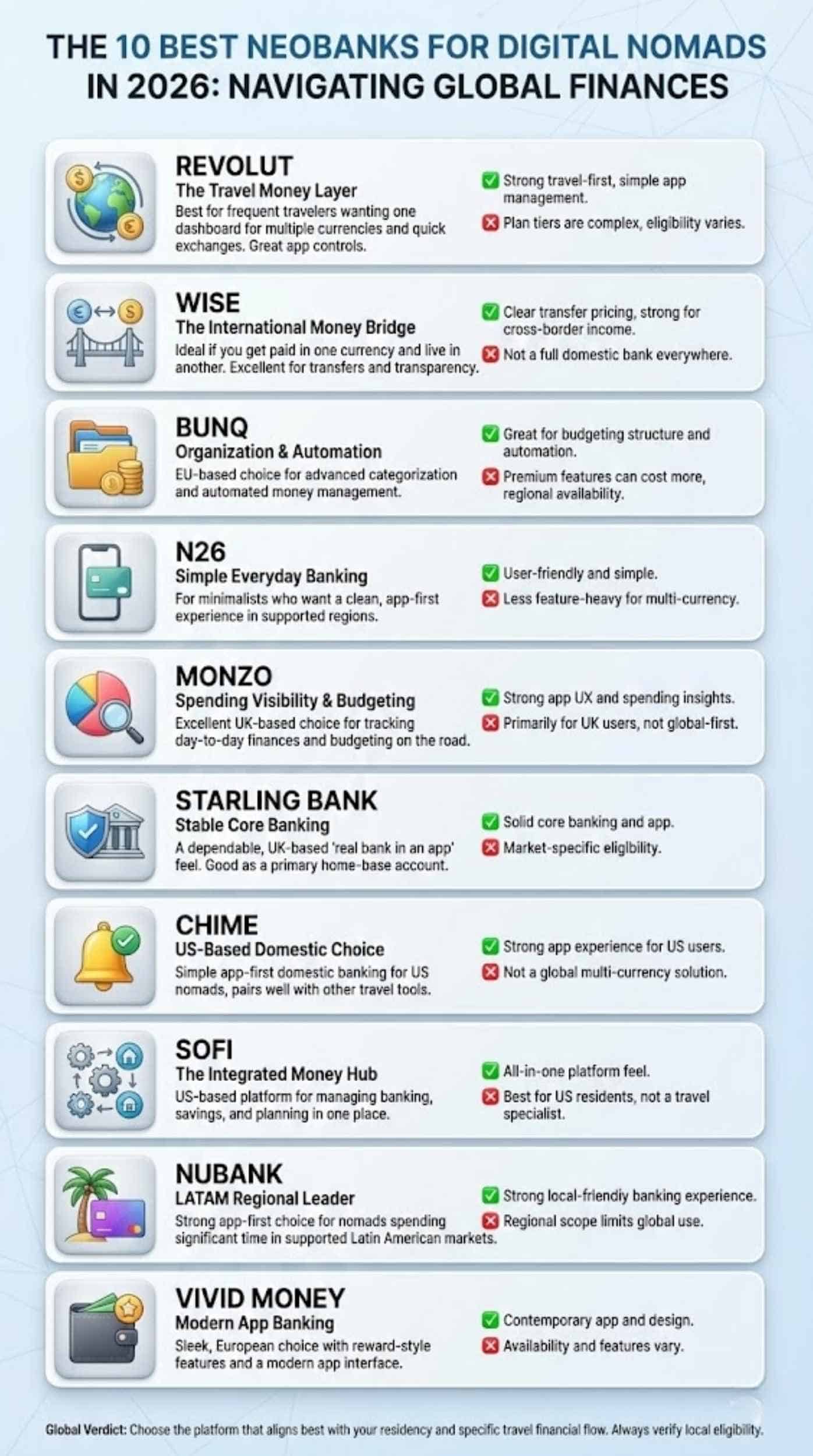

Quick Picks At A Glance

If you want a fast shortlist before the deep dive, start here:

- Revolut: Best all-in-one travel money app for frequent flyers

- Wise: Best for getting paid internationally and moving money across borders

- bunq: Best for EU nomads who want flexible account features and automation

- N26: Best minimalist neobank experience for supported European markets

- Monzo: Best budgeting-first “daily driver” for UK-based nomads

- Starling Bank: Best UK option for stability and strong app banking

- Chime: Best app-first money management for US-based nomads with a US base

- SoFi: Best US option for an all-in-one financial hub feel

- Nubank: Best LATAM powerhouse brand for regional travelers

- Vivid Money: Best modern European app banking with rewards-style angles

Availability and eligibility vary by country. Always confirm you can open and keep the account with your residency status before you commit.

How We Chose The Best Neobanks For Digital Nomads

A neobank can look perfect until you travel for two months and discover hidden limits. To keep this guide useful, the selection leans on practical nomad factors that matter after the honeymoon phase.

Scoring Criteria We Used

- Eligibility and availability: Where you can open the account, and what address rules apply

- Foreign spending and FX: How pricing works when you pay in a different currency

- ATM experience: Fees, limits, and how transparent the rules are

- Multi-currency support: Holding balances, converting, and spending from the right currency

- Transfers and getting paid: International transfers, local details where available, and speed

- Security controls: Freeze card, virtual cards, merchant controls, and alerting

- Support while abroad: In-app help quality, dispute handling, and clarity of processes

- Nomad-friendly extras: Budgeting, sub-accounts, automation, and premium perks that actually help

Who This Guide Is For

This is for remote workers and freelancers who travel for weeks or months at a time. It also fits founders and consultants who invoice internationally. If you live abroad full-time, you still need to respect residency rules for each provider.

What To Compare Before You Choose

Use this table as your decision checklist. It helps you avoid “feature shopping” and focus on what changes your day-to-day.

| Neobank | Best For | Typical Strength | Watch Outs |

| Revolut | All-in-one travel money | Multi-currency features and travel-friendly tools | Plan tiers and benefit rules can vary |

| Wise | Getting paid and moving money | Strong cross-border transfers and transparent pricing | Not a traditional bank everywhere |

| bunq | EU nomads who love automation | Flexible accounts, rules, and money organization | Many best features sit in paid plans |

| N26 | Minimalist app banking | Simple everyday banking experience | Limited availability compared to some rivals |

| Monzo | Budgeting and spending clarity | Great app UX for daily money | Best fit for UK users |

| Starling Bank | UK stability and app banking | Strong core banking feel in-app | UK residency requirements apply |

| Chime | US-based nomads | App-first spending, saving, and alerts | Not designed as a global multi-currency hub |

| SoFi | US “financial hub” users | Banking plus broader money tools | Strongest for US residents |

| Nubank | LATAM travelers | Popular regional neobank | Regional scope and eligibility vary |

| Vivid Money | Modern EU app banking | Rewards-style angles and app features | Availability and product details can change |

Now let’s break down each option the way a digital nomad actually uses it.

The 10 Best Neobanks For Digital Nomads In 2026

Revolut

Revolut is often the first name nomads hear, and for good reason. It aims to be a complete travel money layer that sits between you and the messy parts of international spending.

You typically use Revolut for day-to-day card purchases abroad, quick currency exchanges, and managing spending across trips. The app is built for movement, and it usually makes card controls easy to find when something goes wrong.

Key Features For Nomads

Revolut tends to shine when you travel often and want one dashboard for multiple currencies. It often supports holding balances in more than one currency and converting when needed. Many users also value the convenience of app-based security controls.

Fees To Watch

The pricing structure usually depends on plan tiers and usage limits. Some features become more attractive in paid plans. Pay close attention to how FX pricing works by time and by plan, and look for any rules around weekends or special cases.

Pros

You get a strong travel-first experience and simple in-app management. It works well as a spending account that you top up and use across borders.

Cons

Plan tiers can complicate comparisons. You must verify the rules that apply in your country.

Eligibility And Availability

Availability depends on your country of residence and documentation. Confirm eligibility before you rely on it as your main account.

Verdict

Choose Revolut if you want a travel-first neobank experience with broad features and you do not mind selecting a plan that matches your usage.

Wise

Wise is the default answer for “I get paid in one currency and live in another.” Many nomads use it as the bridge between clients, platforms, and life abroad.

Wise usually wins when your priority is moving money internationally with clear pricing. It also fits nomads who manage invoices, payouts, or platform earnings across currencies.

Key Features For Nomads

Wise is widely valued for international transfers and currency conversion workflows. It can simplify getting paid from clients in another country, then spending or sending onward without unnecessary friction.

Wise often feels less like a lifestyle neobank and more like a money movement tool. For many nomads, that is exactly the point.

Fees To Watch

Always review transfer costs and conversion pricing before you send. Wise usually emphasizes transparency, but you still need to confirm the exact charges for your route and currency pair.

Pros

Strong fit for cross-border income and regular transfers. Clearer transfer-first design than many neobanks.

Cons

It may not replace a full domestic bank for every user. Some features vary by market.

Eligibility And Availability

Wise availability differs by country. Confirm you can open an account and access the features you need.

Verdict

Choose Wise if you get paid internationally, send money often, or want a reliable way to manage multiple currencies with transfer efficiency.

Bunq

bunq is a strong pick for EU-based nomads who want more control and automation. It often appeals to people who love organizing money into categories and building rules that run in the background.

If you manage travel budgets, tax savings, and shared expenses, bunq’s style can feel made for you. It usually supports multiple “sub-accounts” or similar structures, which can make messy nomad finances cleaner.

Key Features For Nomads

bunq typically emphasizes flexibility. You can separate money for rent, travel, taxes, and business, then automate parts of the workflow. That matters when you juggle multiple currencies, multiple gigs, and multiple subscriptions.

Fees To Watch

bunq is commonly plan-driven. The best features may sit behind paid tiers. Review what you get at each level before you commit.

Pros

Great organization and automation for nomad budgeting. Strong fit for people who want structure.

Cons

Cost can rise if you need premium features. Availability centers on specific regions.

Eligibility And Availability

bunq is primarily positioned for European users and may require an eligible residency status.

Verdict

Choose bunq if you are EU-based and want advanced money organization, automation, and a structured approach to managing nomad life.

N26

N26 is often the “keep it simple” option in supported markets. It focuses on clean app banking, straightforward spending, and a modern interface that does not feel cluttered.

Nomads who prefer minimalism tend to like N26. You use it as a primary spending and everyday account when you are within its supported region and rules.

Key Features For Nomads

N26 usually delivers a clean, app-first experience. It can be a good choice if you want a simple account for everyday use and you do not need a heavy multi-currency toolkit.

Fees To Watch

Check foreign spending rules, ATM policies, and how premium tiers change benefits. Small differences matter when you travel for months.

Pros

Simple and user-friendly. Good everyday banking feel in-app.

Cons

Not as feature-heavy for multi-currency power users. Availability is not global.

Eligibility And Availability

N26 eligibility depends on your location and residency rules.

Verdict

Choose N26 if you want straightforward app banking in a supported region and you prefer simplicity over endless features.

Monzo

Monzo is a strong choice for nomads who want clarity in spending, budgeting, and daily money behavior. It tends to excel as a “daily driver” that keeps you aware of where your money goes.

For many UK-based nomads, Monzo becomes the account they use to run their personal finances while traveling. It often makes categories, notifications, and insights easy to use.

Key Features For Nomads

Monzo’s strength is day-to-day money management. If your biggest pain is not knowing what you spent, where you spent it, and why, Monzo can reduce that stress.

Fees To Watch

As with any travel usage, confirm foreign spending and ATM rules. Also review paid tiers if you want extra perks.

Pros

Excellent budgeting experience and strong app UX. Great for spending visibility.

Cons

Best fit for UK users. It is not designed as a global multi-currency hub first.

Eligibility And Availability

Monzo primarily serves specific markets. Confirm residency and documentation requirements.

Verdict

Choose Monzo if you are UK-based and want budgeting-first app banking that stays useful on the road.

Starling Bank

Starling is often mentioned in the same breath as Monzo, but it leans more toward a stable “real bank in an app” feel. Many users choose it because it feels robust for everyday banking and still stays modern.

For nomads, Starling can work well as a primary home-base account if you are eligible. It pairs well with a dedicated international transfer tool if you need heavy cross-border movement.

Key Features For Nomads

Starling typically focuses on a clean banking experience, strong app controls, and a dependable setup for everyday use. Nomads who want stability often prefer this style.

Fees To Watch

Confirm foreign spending rules and ATM usage policies. Also review business options if you are a freelancer.

Pros

Strong core banking feel and a solid app. Good as a primary account for eligible users.

Cons

Primarily market-specific eligibility. Not the most transfer-first option.

Eligibility And Availability

Starling eligibility is tied to residency rules and local requirements.

Verdict

Choose Starling if you want a stable UK-based account with a strong app and you plan to pair it with a transfer tool when needed.

Chime

Chime is an app-first choice many US users like for domestic money management. For digital nomads with a US base, it can function as a practical everyday account that is easy to manage from anywhere.

Chime is not built as a global multi-currency platform. Instead, it shines for straightforward spending, saving behaviors, and simple account management for eligible US customers.

Key Features For Nomads

If you keep a home base in the US and need an account that remains easy to access, Chime can be a comfortable option. Nomads often value real-time notifications and clear app controls.

Fees To Watch

Confirm how travel usage works for your specific situation. Review policies around ATM access, card replacement, and support processes while abroad.

Pros

Strong app-first domestic experience. Simple to use for US-based nomads.

Cons

Not a global multi-currency solution. International transfer workflows may require another tool.

Eligibility And Availability

Chime generally focuses on US eligibility. Confirm requirements before relying on it as your only account.

Verdict

Choose Chime if you are US-based, want simple app banking, and plan to pair it with a travel-focused multi-currency tool if needed.

SoFi

SoFi is often used as a broader “money hub” rather than a narrow neobank. It can appeal to US-based nomads who want one place to manage banking, saving, and general financial planning behaviors.

If you want fewer apps, SoFi’s platform approach can feel convenient. The fit depends on what features you actually use and what your travel patterns look like.

Key Features For Nomads

SoFi can be attractive if you want a connected experience. Some users prefer having banking plus additional money tools under one roof.

Fees To Watch

Confirm how travel spending, international use, and any premium features work. Review policies that matter when you are not physically in the US.

Pros

All-in-one platform feel for US users. Good for people who want a central dashboard.

Cons

Best for US residents. Not positioned as a dedicated nomad multi-currency specialist.

Eligibility And Availability

SoFi usually focuses on US eligibility and requirements.

Verdict

Choose SoFi if you are US-based and want a consolidated finance experience that remains manageable while you travel.

Nubank

Nubank has a major presence in parts of Latin America and a strong reputation for app-first banking in its core markets. For nomads who spend significant time in the region, it can be a practical local-friendly option.

If you travel across LATAM frequently, a regional neobank can reduce friction, especially when compared to relying solely on foreign cards.

Key Features For Nomads

Nubank can make sense when your lifestyle overlaps strongly with its supported markets. A regional account can simplify everyday payments and reduce the dependence on foreign banking.

Fees To Watch

Confirm how international use works if you travel outside the region. Also check card replacement processes if you are moving between countries.

Pros

Strong regional brand and app-first experience. Useful for travelers who spend a lot of time in LATAM.

Cons

Regional scope and eligibility can limit global usefulness.

Eligibility And Availability

Nubank’s eligibility depends on local market rules and residency requirements.

Verdict

Choose Nubank if your nomad route spends a lot of time in its supported regions and you want a strong local-friendly banking experience.

Vivid Money

Vivid Money is a modern app banking option that can appeal to European users who want a sleek experience and reward-style features. It can work well as a spending account if it is available where you live.

It fits nomads who want a contemporary interface and prefer a product that feels built for mobile life.

Key Features For Nomads

Vivid Money can be attractive for everyday spending and app-based money management. Some users value rewards-style mechanics, but the real win is usually the overall app experience.

Fees To Watch

Always review pricing, foreign usage rules, and plan differences. Reward features often come with conditions.

Pros

Modern app experience and a lifestyle-friendly design approach.

Cons

Availability and product specifics can change. It may not fit users who need deep multi-currency workflows.

Eligibility And Availability

Eligibility varies by country. Confirm access and required documentation.

Verdict

Choose Vivid Money if you are in an eligible European market and want a modern spending-focused neobank experience.

Best Neobank By Nomad Profile

A “top 10” list is useful, but most nomads need a match by lifestyle. Use these profiles to narrow your choice quickly.

Best For Multi-Currency And International Transfers

If you get paid in multiple currencies or send money across borders often, prioritize tools that handle conversion and transfers cleanly.

- Wise fits transfer-heavy workflows and cross-border income.

- Revolut can work well as a spending layer with multi-currency features, depending on your plan and country rules.

A common setup is to use Wise for getting paid and moving money, then a neobank card for daily spending and budgeting.

Best For EU-Based Nomads

If you are based in the EU or nearby supported regions, these options tend to fit the legal and practical reality of opening accounts.

- Bunq for organization and automation

- N26 for minimalist app banking

- Vivid Money for modern app experience if available

Best For UK-Based Nomads

If you are UK-based, you often want a stable core account plus strong app features.

- Monzo for budgeting and spending clarity

- Starling Bank for a dependable core banking feel

Many UK nomads pair one of these with Wise for international transfers and currency management.

Best For US-Based Nomads

If you maintain a US base, you may prioritize a reliable domestic account and then add a travel companion for international needs.

- Chime for straightforward app banking

- SoFi for a broader financial hub experience

If you travel constantly, you may still prefer a dedicated multi-currency tool alongside your US account.

What To Check Before You Open A Nomad Neobank

This section prevents most regret. Neobanks can be excellent, but only if you understand the rules that matter when you live out of a suitcase.

Residency And Address Requirements

This is the biggest deal-breaker. Many providers require you to be a resident of a supported country and provide proof. Some accounts can be opened only with local documentation or a local tax status.

Do not try to “guess” your way through onboarding. If your residency situation changes often, choose a provider that clearly explains what happens if you move.

ATM Fees, FX Pricing, And Dynamic Currency Conversion

ATM usage can quietly become expensive. Check both sides: the neobank’s fee policy and the ATM operator’s fees. Also look at withdrawal limits, since many “fee-free” claims apply only up to a cap.

When paying by card abroad, watch for dynamic currency conversion at the terminal. Always choose to pay in the local currency when possible. That single habit often saves money over time.

Card Security While Traveling

Nomads need fast controls. Prioritize apps that make these actions easy:

- Freeze and unfreeze your card instantly

- Set spend limits or create virtual cards for subscriptions

- Get instant notifications for every transaction

- Replace cards with clear international delivery rules

Security is not just fraud protection. It is peace of mind when you are far from home.

Support, Disputes, And Chargebacks

You rarely think about support until something fails. When you travel, timing matters. Check how support works inside the app, whether you can reach a human, and how disputes are handled.

Also review how the provider treats high-risk events like logins from new countries. A good neobank protects you without locking you out for weeks.

Taxes, Compliance, And Closure Risk

Neobanks must follow strict compliance rules. If your profile triggers reviews, you may get asked for extra documents. Keep invoices, contracts, and proof of income ready if you are a freelancer.

This is normal in modern finance. You reduce risk by using clear sources of funds and avoiding behavior that looks inconsistent.

Final Take: The Best Neobanks For Digital Nomads In 2026

The best neobank for digital nomads in 2026 is the one you can open legally, use confidently abroad, and manage easily from your phone. For many nomads, that means using a two-tool setup: one account optimized for international money movement and another optimized for daily spending and budgeting.

If you want a simple starting point, pick Wise when your life revolves around cross-border income and transfers. Choose Revolut if you want a travel-first “all-in-one” spending experience. If you are EU-based and love automation, look hard at bunq. If you are UK-based, Monzo and Starling remain strong choices for a home-base account with great app control.

Whatever you choose, confirm eligibility first. Then match the account to your actual travel patterns, not the marketing headline.