The billion-dollar blockbuster is no longer a guarantee. As audiences fracture across platforms and technology rewrites the rules of production, the future of movie business models is shifting from selling tickets to selling ecosystems. We are witnessing the death of “business as usual” and the birth of a new era where content is fluid, interactive, and infinitely monetizable.

For decades, the industry relied on a rigid windowing system: theater, then DVD, then cable. Today, that linear path has exploded into a web of revenue streams driven by AI, blockchain, and the creator economy. The next decade belongs to agile, tech-first strategies that turn passive viewers into active participants.

Here are 15 movie business models with huge future potential that are redefining how films are funded, made, and watched in the modern era.

Key Takeaways

-

Content is no longer static: From dynamic product placement to AI dubbing, movies are becoming fluid assets that can be updated and localized instantly.

-

The middleman is dying: Creator-led studios and tokenized financing allow filmmakers to connect directly with audiences, bypassing traditional gatekeepers.

-

Niche is the new mass market: Whether it’s vertical micro-dramas or horror-specific streaming, the most profitable models are those that serve a specific community deeply, rather than a general audience broadly.

The Catalysts for Change: Why the Industry is Pivoting

Before diving into the specific opportunities, it is crucial to understand why this transformation is happening right now. For nearly a century, the film industry relied on a predictable waterfall of revenue: a massive theatrical release followed by lucrative home video sales and cable licensing. That waterfall has dried up.

Today, the future of movie business models is being forged by a “perfect storm” of three converging forces:

-

Subscription Saturation: The era of “growth at all costs” for streaming services is over. With market saturation and high churn rates, platforms are desperate for diversified revenue streams beyond the flat monthly fee.

-

The Democratization of Tech: Tools like Unreal Engine and Generative AI have obliterated the traditional barrier to entry. High-end production is no longer the exclusive domain of major studios, allowing agile creators to compete on quality with a fraction of the budget.

-

Audience Fragmentation: Gen Z and Gen Alpha do not just watch content; they play it, share it, and remix it. They demand experiences that are interactive and community-driven, forcing studios to rethink the passive “sit and watch” format.

This landscape has forced a seismic shift from a product-based economy (selling a movie ticket) to a platform-based economy (selling an ecosystem). The following 15 models represent the pioneers of this new reality.

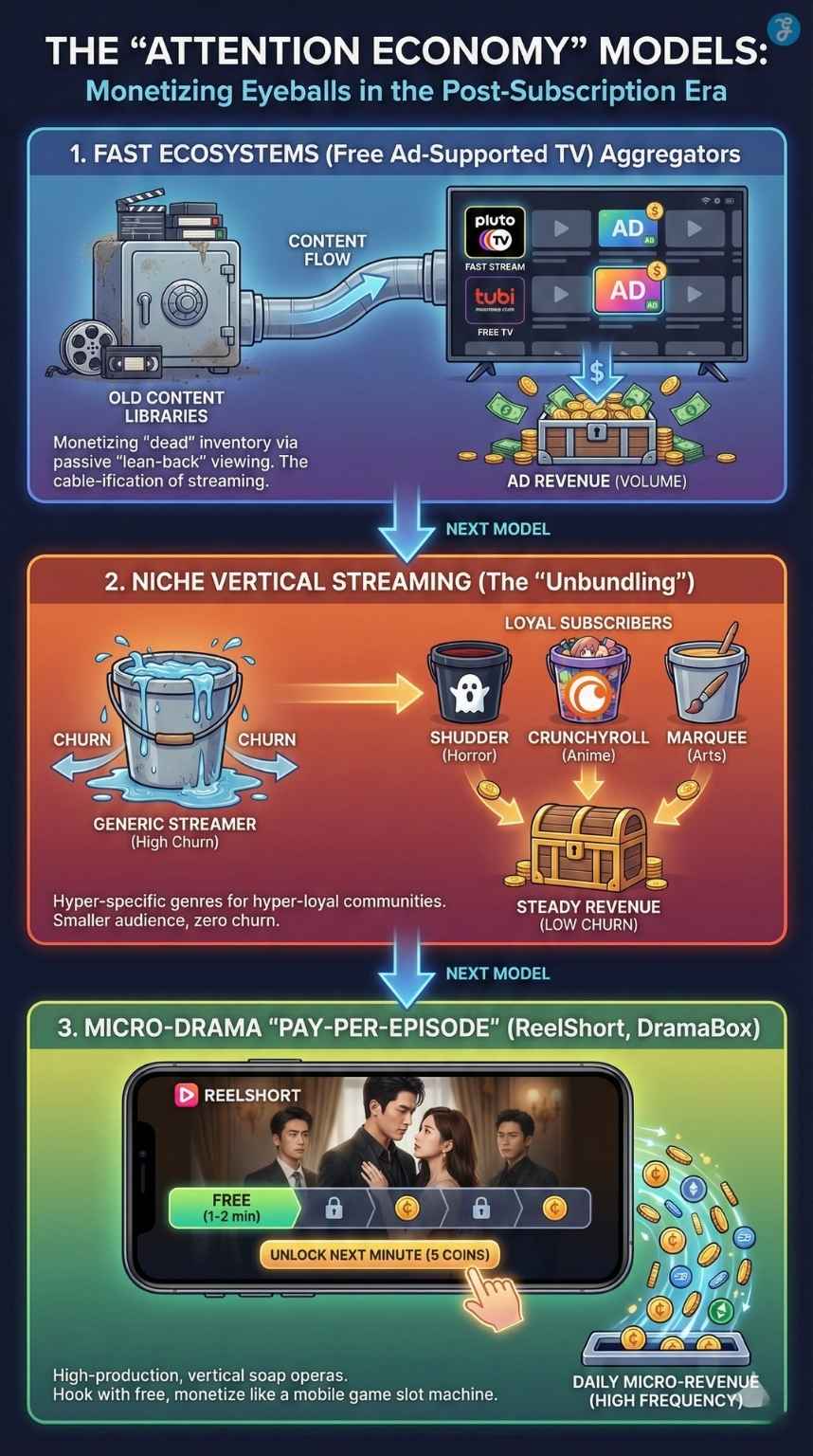

Phase 1: The “Attention Economy” Models

Monetizing the eyeballs that subscription services are losing.

1. The FAST Ecosystem (Free Ad-Supported TV) Aggregators

The subscription fatigue is real. After years of stacking $15/month charges, consumers are returning to the “lean-back” experience of linear TV—but now it’s streaming.

-

The Model: Studios license older libraries or “dead” inventory to channels like Pluto TV, Tubi, or Freevee.

-

Why It Wins: It monetizes content that has zero value on a subscription service. By 2025, FAST has evolved into a premium tier, generating billions in ad revenue by targeting specific niches (e.g., a 24/7 channel just for Baywatch or Top Gear).

-

Key Insight: This is the “cable-ification” of the internet, but with better data targeting.

2. Niche Vertical Streaming (The “Unbundling”)

While Netflix tries to be everything to everyone, smaller platforms are finding massive success by being everything to someone.

-

The Model: Platforms dedicated to hyper-specific genres—Shudder (horror), Crunchyroll (anime), or marquee arts services.

-

Why It Wins: These services have incredibly low churn rates. You don’t need 100 million subscribers; you need 1 million who will never cancel because this is their community.

-

Future Potential: Expect “micro-verticals” centered around specific hobbies (e.g., a streaming service purely for equestrian sports or aviation history).

3. The Micro-Drama “Pay-Per-Episode” Model

This is one of the fastest-growing sectors in the future of movie business models, driven by apps like ReelShort and DramaBox.

-

The Model: High-production “soap operas” shot vertically for phones, with episodes lasting only 1-2 minutes. The first few are free; then, users pay pennies to unlock the next minute.

-

Why It Wins: It captures the TikTok generation’s attention span but monetizes it like a slot machine. Some of these apps are already out-earning traditional streaming apps in daily revenue.

Phase 2: The “Retail Media” Models

Turning the screen into a shopping cart.

4. Shoppable Content (T-Commerce)

We have talked about “interactive TV” for years, but smart TV OS integration has finally made it seamless.

-

The Model: “See it, want it, buy it.” Viewers use their remote or a synced second screen (phone) to purchase outfits, gadgets, or decor seen in the movie instantly.

-

Why It Wins: It bridges the gap between entertainment and retail media. A romantic comedy is no longer just a story; it’s a 90-minute high-intent sales funnel for fashion brands.

5. Dynamic Virtual Product Placement

Traditional product placement is risky—what if the brand goes out of style? Enter AI.

-

The Model: Using AI to insert product placements into a movie after it has been filmed. A soda can on a table in a scene can be a Coke in the US, a Pepsi in the UK, and a local brand in Japan.

-

Why It Wins: It turns old films into renewable real estate. A 10-year-old movie can generate new ad revenue today by virtually inserting a 2025 car model into the background.

| Feature | Traditional Product Placement | Dynamic Virtual Placement |

| Timing | Locked during filming | Inserted post-production |

| Flexibility | Permanent | Changeable anytime |

| Targeting | One brand for all | Geo-targeted by region |

| Revenue | One-time fee | Recurring revenue stream |

Phase 3: The “Tech-Production” Models

Democratizing the blockbuster.

6. The “Gaming-First” IP Strategy

Studios are realizing that gamers are often more loyal (and spend more) than moviegoers.

-

The Model: Building the video game before or alongside the movie, using the exact same digital assets (Unreal Engine 5) for both.

-

Why It Wins: It slashes costs by sharing 3D assets across media. If you build a digital “Gotham City” for a game, you can film your movie inside that same digital file, saving millions in VFX.

7. Virtual Production (The “Volume”)

-

The Model: Shooting on massive LED walls that display photorealistic 3D backgrounds in real-time, rather than using green screens or traveling to locations.

-

Why It Wins: It eliminates travel costs, weather delays, and expensive location permits. It allows indie filmmakers to shoot “sci-fi epics” in a warehouse, drastically lowering the barrier to entry for high-concept films.

8. AI-Assisted Global Localization

-

The Model: Using AI to visually dub actors (altering lip movements to match foreign languages) and clone their voices.

-

Why It Wins: It breaks the “subtitle barrier.” A French film can be released globally on Day 1, appearing “native” to US audiences. This instantly multiplies the Total Addressable Market (TAM) for any local film.

9. Data-Driven “Greenlighting”

-

The Model: Instead of gut instinct, studios use predictive AI analytics to analyze scripts. The AI compares plot points, casting choices, and genre tropes against decades of financial data to predict box office revenue.

-

Why It Wins: It mitigates the risk of flops. While it may discourage “risky” art, it provides a safety net for mid-budget investments that investors are currently wary of.

Phase 4: The “Community & Ownership” Models

Web3 and the Creator Economy.

10. Creator-Led Studios

The future of movie business models is increasingly personal.

-

The Model: Massive YouTubers (like MrBeast or the RackaRacka brothers) bypassing Hollywood to fund and distribute feature films directly to their subscribers.

-

Why It Wins: They own the distribution. While Disney spends $100M marketing a movie, these creators spend $0 because they can tweet a link to 50 million fans instantly.

11. Tokenized Film Financing (DeFi)

Indie film financing is broken. Blockchain is fixing it.

-

The Model: Fans and investors buy “security tokens” that represent fractional ownership of a movie’s future royalties.

-

Why It Wins: It democratizes funding. Instead of one studio taking the risk, 10,000 fans chip in $100 each. If the movie succeeds, the fans get paid, turning them into a hyper-motivated marketing army.

12. The “Transmedia Universe” Loop

-

The Model: Designing a story where the movie is just one piece of the puzzle. The narrative continues in web comics, podcasts, and Alternate Reality Games (ARGs) that run between sequels.

-

Why It Wins: It solves “franchise fatigue” and keeps merchandise sales active during the “gap years” between theatrical releases.

Phase 5: The “Experiential” Models

Theaters are evolving into community hubs.

13. Cinema-as-a-Service (Subscription 2.0)

-

The Model: Theaters offering “all-you-can-watch” monthly passes (like AMC A-List), combined with VIP perks like line-skipping and food discounts.

-

Why It Wins: It stabilizes cash flow for theaters, which are usually seasonal. It also incentivizes consumers to buy high-margin concessions (popcorn/soda) since the ticket feels “free.”

14. Event Cinema (The “Eras Tour” Effect)

-

The Model: Using movie theaters to broadcast live events—concerts, e-sports finals, or theater productions—simultaneously across the country.

-

Why It Wins: It fills empty seats on Tuesday nights. It turns the theater into a “community hub” where people gather for shared energy, not just silent viewing.

15. Digital Twin Licensing

-

The Model: Actors licensing their “Digital Twin” (AI likeness) to appear in background roles, video games, or foreign commercials they don’t physically act in.

-

Why It Wins: It creates passive income for talent and allows studios to “scale” star power. An A-list actor can technically be in 50 movies a year without ever leaving their house.

Comparison: Risk vs. Reward

To help visualize where these models fit in the industry, here is a breakdown of the top contenders.

| Business Model | Risk Level | Revenue Speed | Primary Tech Driver |

| Micro-Dramas (ReelShort) | Low | Instant (Daily) | Mobile UX / Vertical Video |

| Tokenized Financing | High | Long-term (Royalties) | Blockchain / Web3 |

| FAST Ecosystems | Low | Steady (Ad Revenue) | Ad-Tech / Programmatic |

| Creator-Led Studios | Medium | High (Viral Spikes) | Social Media Distribution |

Critical Risks & Challenges

No business model is without a downside. Here are the hurdles these models face.

-

The “Digital Ownership” Void: As we move to subscription and cloud models (FAST, Cinema-as-a-Service), consumers own nothing. If a platform shuts down (like Sony erasing Discovery content), the movie disappears forever. This creates a massive preservation risk.

-

Copyright Chaos: The AI Training Licensing model is currently a legal minefield. If an AI generates a scene that looks too much like the movie it was trained on, who owns the rights? Expect massive lawsuits to define the boundaries of this model in 2025.

-

The “Split Attention” Problem: With Shoppable Content and Second-Screen experiences, the art of storytelling risks being diluted. If a viewer is busy trying to buy the protagonist’s jacket, are they actually paying attention to the plot?

The “Authenticity” Paradox: When Real Becomes Luxury

While the models above focus on efficiency and scale, a powerful counter-trend is emerging that savvy investors and creators must watch: The scarcity of the “Real.”

As Generative AI drives the cost of average content to zero, the value of verifiably human storytelling is skyrocketing. We are moving toward a two-tiered content economy:

-

The “Slop” Tier: Infinite, AI-generated background content (cartoons for kids, generic action movies, ambient TV) monetized via ads and micro-pennies.

-

The “Prestige” Tier: Verified human-made art, documentaries, and auteur-driven films. These will command premium ticket prices and subscription tiers because they offer what AI cannot: shared human vulnerability.

The Business Implication: The “Middle Class” of movies is dead. In the future, you either race to the bottom with AI efficiency (high volume, low margin) or you race to the top with radical human authenticity (low volume, ultra-high margin). The most dangerous place to be is in the middle—generic, expensive, and indistinguishable from an algorithm.

Frequently Asked Questions: The Future of Film Business

1. Will AI replace actors in the future of movie business models?

AI is unlikely to replace lead actors entirely because audiences connect with human emotion and celebrity. However, “Digital Twin” technology is already being used for background actors, stunts, and scaling an actor’s likeness for video games and ads.

2. Is the traditional box office model dead?

Not dead, but evolving. The “theatrical window” is shrinking, and theaters are shifting toward “Event Cinema” (premium formats like IMAX, concerts, and live sports) to draw crowds that can’t be replicated at home.

3. How do micro-drama apps make money?

Apps like ReelShort use a “freemium” token model. The first few episodes are free. To keep watching, users must buy digital coins (micro-transactions) or watch ads. It operates more like a mobile game economy than a Netflix subscription.

4. What is the benefit of tokenized film financing?

It allows filmmakers to raise money without giving up creative control to a studio. For investors (fans), it offers a chance to profit from a movie’s success, creating a deeper emotional and financial investment in the project.

5. Why are FAST channels growing so quickly?

Consumers are “subscribed out.” With inflation and too many streaming services, people are choosing free, ad-supported options. FAST channels replicate the ease of old-school cable TV without the monthly bill.

The Bottom Line: It’s No Longer Just About the Movie

The definition of a “movie business” has fundamentally changed. We are moving from a simple metric of opening weekend tickets to a complex web of lifetime ecosystem value.

The winners of the next decade won’t just be the studios with the best scripts, but those with the most agile infrastructure. Whether through monetizing the “Passenger Economy” in self-driving cars, licensing archives to AI, or turning theaters into community hubs, the opportunity lies in meeting the audience where they are.

The future of movie business models isn’t about replacing the art of storytelling—it’s about building a financial engine resilient enough to support it. The script is changing; make sure you’re reading the right version.