Global markets rallied Monday after US and Chinese officials agree on trade deal framework over the weekend, pulling both economic superpowers back from the brink of a severe tariff escalation. The agreement, forged in Kuala Lumpur, Malaysia, averts imminent 100% US tariffs and delays Chinese controls on critical rare earth minerals.

Key Facts: The Market Reaction & Deal Framework

- Global Rally: Asian markets surged in Monday trading. Japan’s Nikkei 225 jumped 2.1%, Hong Kong’s Hang Seng Index rose 1.0%, and the Shanghai Composite gained 0.9%.

- US Futures Up: US stock futures signaled a strong open, with E-mini S&P 500 futures up 0.74% and Nasdaq 100 futures climbing 0.97% in early trading.

- Tariffs Averted: The framework prevents a threatened 100% US tariff hike on Chinese goods, which was set to activate on November 1.

- Rare Earths Delayed: China agreed to delay its planned export licensing controls on rare earth minerals—critical for tech and defense—for at least one year.

- Soybeans to Resume: China is expected to resume large-scale purchases of US soybeans, a key concession for American agricultural producers.

- Leaders to Meet: The framework sets the stage for a formal signing by President Donald Trump and President Xi Jinping at the APEC summit in South Korea later this week.

A High-Stakes Breakthrough in Kuala Lumpur

The global economy breathed a collective sigh of relief Monday after top negotiators from Washington and Beijing finalized a “substantial framework” for a trade truce. The high-level talks, held on the sidelines of the ASEAN Summit in Kuala Lumpur, Malaysia, successfully defused a rapidly escalating economic conflict.

The US delegation, led by Treasury Secretary Scott Bessent and US Trade Representative (USTR) Jamieson Greer, met with a Chinese team headed by Vice Premier He Lifeng and top negotiator Li Chenggang.

The discussions, described as “intense but constructive” by the Chinese side, centered on averting a disastrous new round of tariffs. The Trump administration had threatened to impose crippling 100% tariffs on a wide range of Chinese goods starting November 1. This move was a direct response to China’s announcement that it would expand export controls on rare earth minerals and magnets, a move that threatened to choke off supply for global tech, automotive, and defense industries.

On Sunday, US officials confirmed the breakthrough. “We have a very successful framework,” Treasury Secretary Bessent told reporters in Malaysia. Speaking on US television, Bessent confirmed the 100% tariffs were off the table. “No, I’m not [anticipating the 100% tariffs], and I’m also anticipating that we will get some kind of a deferral on the rare earth export controls,” he said.

Chinese officials were more measured. Negotiator Li Chenggang confirmed a “preliminary consensus” had been reached, but added, “The US position has been tough, while China has firmly defended its interests and rights”.

The agreement extends a fragile trade truce that was set to expire on November 10 and paves the way for a high-stakes presidential meeting. Presidents Trump and Xi are now expected to meet and finalize the deal at the APEC (Asia-Pacific Economic Cooperation) summit in Gyeongju, South Korea, on Thursday.

Global Markets Surge on Détente

Investors, who had been bracing for a trade war escalation, reacted with immediate optimism. The news of a US and Chinese officials agree on trade deal framework sent a wave of relief through Asian markets, which are highly sensitive to US-China trade relations.

Asian Indices Post Strong Gains

Trading on Monday, October 27, 2025, saw a decisive “risk-on” move across the region:

- Japan’s Nikkei 225: The index was the region’s standout performer, closing up 2.1% at 50,321.49. This rally was fueled by gains in technology and exporter stocks that are highly dependent on stable global supply chains.

- Hong Kong’s Hang Seng Index: Shares in Hong Kong climbed 1.0% to 26,425.51.

- Mainland China: The Shanghai Composite Index also advanced, rising 0.9% to close at 3,985.83.

Other regional markets, from South Korea’s Kospi (+2.0%) to Malaysia’s FBM KLCI (+0.60%), joined the rally.

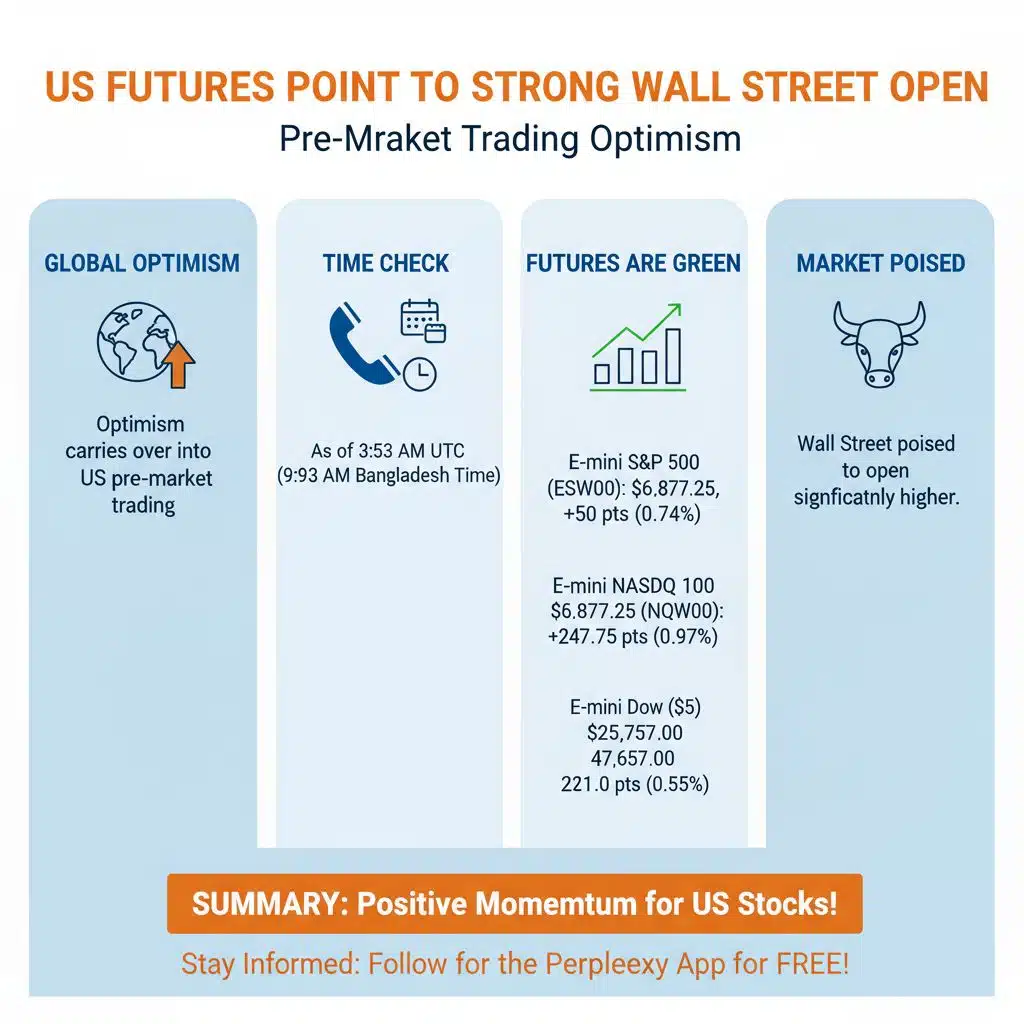

US Futures Point to Strong Wall Street Open

The optimism carried over into US pre-market trading, indicating Wall Street is poised to open significantly higher.

As of 3:53 AM UTC (9:53 AM Bangladesh Time), US stock futures were firmly in the green:

- E-mini S&P 500 (ESW00): $6,877.25, up +50.25 points (+0.74%)

- E-mini NASDAQ 100 (NQW00): $25,757.00, up +247.75 points (+0.97%)

- E-mini Dow ($5) (YMW00): $47,657.00, up +261.00 points (+0.55%)

Analysis: A Truce, Not a Treaty

While markets celebrate the immediate de-escalation, analysts caution that this framework is a temporary truce, not a comprehensive resolution to the deep structural issues between the two economic rivals.

This agreement focuses primarily on crisis prevention. The core issues—intellectual property theft, state subsidies, and market access—that plagued the 2020 “Phase One” trade deal remain largely unaddressed. That earlier deal, which included massive purchase commitments, ultimately fell short, with China failing to meet its $200 billion target for 2020-2021 by a significant margin.

The critical component of this new truce is the delay in China’s rare earth export controls. This is not a minor issue; it is a matter of strategic global security.

- China’s Rare Earth Dominance: China currently accounts for an estimated 70% of global rare earth mining and 90% of processing and refining.

- US Dependence: The United States is heavily reliant on this supply. According to 2023 data from the U.S. Geological Survey, the US imports 74% of its rare earth compounds, with 70% of those imports coming directly from China.

A full-scale export ban would have devastated US and allied production of everything from F-35 fighter jets and electric vehicle batteries to semiconductors and smartphones.

“Both sides stepped back from a mutually assured destruction scenario,” said a Singapore-based trade analyst. “This isn’t a grand bargain. It’s a pragmatic pause. The US gets supply chain security for its tech and defense sectors, and China avoids tariffs that would hammer its manufacturing exports.”

USTR Jamieson Greer signaled this pragmatic approach, telling Fox News the framework provides “a path forward where we can have more access to rare earths from China and help balance our trade deficit with stronger US exports.

Impact on People and What to Watch Next

The immediate impact of the framework will be felt by two key groups. First, US farmers, particularly soybean producers, who will see a vital export market reopen after China had paused purchases in September. Second, global manufacturers, who can now plan for the next year with more certainty, avoiding the crippling input-cost spikes a rare minerals ban would have caused.

However, the détente remains fragile. All eyes now turn to Gyeongju, South Korea, for the APEC leaders’ summit later this week.

Key items to watch:

- The Trump-Xi Meeting: The tone and substance of the formal meeting will be critical. Any unexpected disagreement could easily shatter the fragile peace.

- The Fine Print: The “framework” is not a final text. Details on the soybean purchase volumes, the exact mechanism of the rare earth “deferral,” and the future of the existing Section 301 tariffs will determine the deal’s true value.

- Other Irritants: The framework reportedly also touched on other major issues, including US demands for action on fentanyl precursors, the status of Taiwan, and the fate of jailed Hong Kong media tycoon Jimmy Lai. Progress, or lack thereof, on these fronts could influence the broader trade relationship.

In conclusion, the markets’ jubilant reaction is based on relief—relief that the worst-case scenario has been avoided. But the strategic and economic competition that has defined US-China relations for the past decade has not been resolved. This framework is a ceasefire, and as history has shown, ceasefires can be broken.