You may feel that inflation eats away at your cash. You may doubt that U.S. dollars and bonds can protect you. You may want a stronger way to store value. Many people now turn to cryptos for a fresh approach. In 2024, U.S. Bitcoin exchange-traded funds now hold more assets than gold ETFs. We will list seven reasons why crypto is the new gold and how digital currencies could become a new gold standard. You will learn how decentralized finance and blockchain technology build trust, and why scarcity, global access, and strong security matter.

You will also see how central banks and fund managers add crypto assets to their balance sheets. Keep reading.

Key Takeaways

- In 2024, U.S. Bitcoin ETFs hold more assets than gold ETFs, as regulators approve crypto funds for retail and institutional investors.

- Bitcoin caps at 21 million coins, with 89 percent in circulation by 2024; four-year halving events cut new supply and boost scarcity like gold.

- Senator Cynthia Lummis proposed in July 2024 a Treasury-run bitcoin reserve using 200,000 seized coins (about $21 billion) to back U.S. dollars; central banks and asset managers now add crypto to their balance sheets.

- Public blockchains record every transaction on a global ledger; consensus mechanisms and tools like Chainalysis make tampering near-impossible and spot illicit moves.

- Stablecoin volume could reach $8.3 trillion in 2024, nearing Visa’s $9.9 trillion; tokenized real-world assets jumped from $2 billion in 2021 to $14 billion in 2024 and may hit $2 trillion by 2030.

Why Crypto Is the New Gold: 7 Critical Advantages

As traditional investors search for reliable stores of value, cryptocurrency is emerging as a powerful alternative to gold. From its built-in scarcity to the security of blockchain technology, crypto offers unique advantages that make it attractive for both individuals and institutions. In this section, we explore 7 critical advantages that explain why crypto is the new gold and why it could redefine the future of wealth preservation.

How Does Decentralization Build Trust in Crypto?

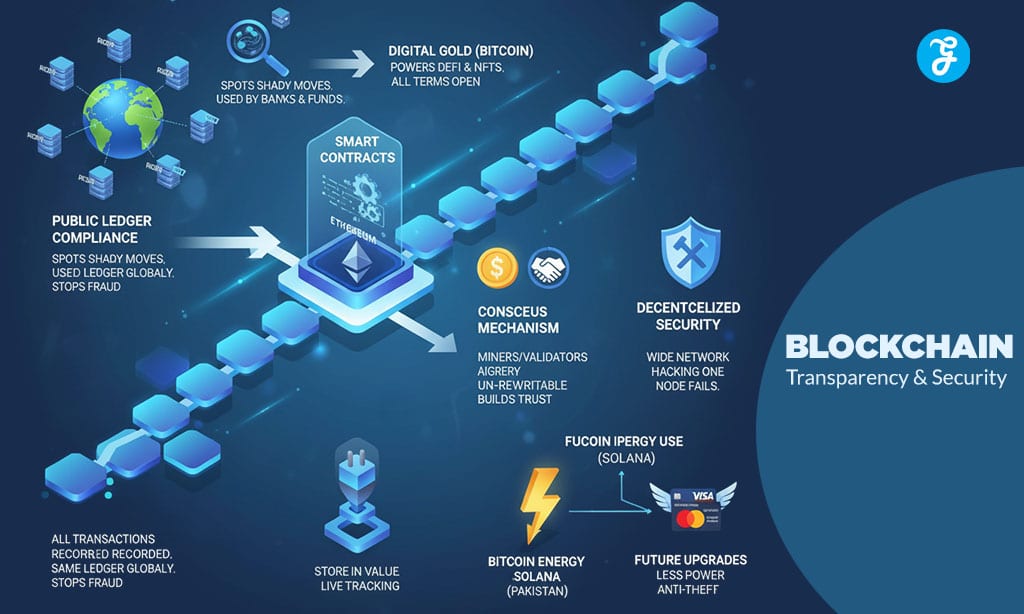

Crypto uses a public ledger that anyone can verify. This open record shows every digital cash move. No single entity runs the blockchain technology that powers bitcoins or a major network.

That independence builds confidence in digital currencies and DeFi apps.

Two thirds of bitcoins sit in wallets for speculation or long-term investment. Widespread holding creates a more balanced network. That setup also causes high volatility when view shifts.

Public blockchains make tampering tough and catch odd moves quickly.

Why Is Crypto Considered a Hedge Against Inflation?

Investors see Bitcoin as a shield from rising prices. The flagship coin caps at 21 million units. Central banks can print fiat currencies on demand, which can erode value. Digital currencies with fixed supply make a clearer store of value.

Speculators in decentralized finance aim to profit in this scarcity.

A Deutsche Bank analyst, Marion Laboure, calls it 21st century digital gold. Senator Cynthia Lummis proposed a strategic bitcoin reserve run by the Treasury in July 2024. MicroStrategy, a business intelligence firm, uses its Bitcoin Treasury to tackle inflation.

A massive 89 percent of coins now circulate, which tightens supply. Blockchain technology backs each coin, as Commodity Futures Trading Commission rules evolve. Many traders in emerging markets and the crypto market view this hedge as real value.

How Does Limited Supply Create Scarcity Like Gold?

Bitcoin caps at 21 million coins. Eighty-nine percent of bitcoins circulate by 2024. Blockchain technology records each coin release on a transparent ledger. Four-year halving events cut new issuance in half and mimic dwindling gold yields.

Marion Laboure at Deutsche Bank calls bitcoin digital gold.

U.S. central banks test a strategic bitcoin reserve like a gold vault. Bitwise predicts bitcoin at $200,000 to $500,000 if policymakers store 200,000 coins from criminal forfeitures.

Donald Trump pitched using those 200,000 bitcoins, worth about 21 billion US dollars, to back the fund. Scarcity fears fuel speculative investment in digital currencies and heat up the crypto market.

How Does Crypto Provide Borderless Financial Access?

Crypto lets people move digital currencies across borders in minutes without banks. Stripe spent $1.1 billion in 2024 to buy Bridge and build stablecoin rails. Robinhood plans a global stablecoin network for smooth cross-border payments.

More retailers began accepting crypto payments in 2024, though only El Salvador treats Bitcoin as legal tender. Decentralized finance (DeFi) apps let users borrow and earn yield without banks or fiat currencies.

U.S. approval of crypto ETFs opened the market to retail and institutional investors. Stablecoin volume could hit 8.3 trillion dollars this year, nearing Visa’s 9.9 trillion, showing true borderless reach.

Growing Institutional Adoption and Strategic Crypto Reserves

Central banks and big asset managers add digital currencies to their balance sheets. They hold bitcoin in crypto funds and use trading platforms for quick deals.

Which Institutions Are Adopting Crypto?

Institutions push into digital currencies now. They eye blockchain technology and digital assets.

- Circle filed for an IPO in January 2024 to fund its USDC stablecoin growth. It plans to tap public markets to back digital currencies and earn interest.

- Figure pursues a blockchain based public listing to raise capital. It hopes retail investors will fuel its decentralized finance services.

- Kraken has sought an IPO since 2021 to expand its cryptocurrency exchange reach. It wants to solidify its place in the crypto market.

- Anchorage Digital won a federal bank charter to offer custody and yield farming services. It now serves institutions with insured digital asset accounts.

- The blockchain compliance firm Chainalysis shows strong IPO potential with real-time intelligence tools. It gives regulators and banks clear insights into on-chain activity.

- Stripe acquired Bridge for 1.1 billion dollars to boost its stablecoin infrastructure. It aims to weave digital currencies into its global payments network.

- Robinhood develops a global stablecoin network to add borderless payment options. It expects this move to deepen retail access to digital assets.

How Are Strategic Crypto Reserves Used?

Strategic crypto reserves act like a digital toolkit for governments. They help shape policy and the crypto market.

- Governments use a strategic bitcoin reserve to back U.S. dollars and strengthen fiat currencies by pledging 200,000 confiscated bitcoins worth $21 billion.

- Central banks adopt crypto assets as a store of value similar to digital gold to hedge against inflation and stabilize monetary policy.

- A public ledger reserve built on blockchain technology signals confidence to private investors after Trump ordered agencies to support crypto innovation in 2024.

- Policy makers tap strategic digital assets to calm volatility and boost market liquidity in emerging markets and financial hubs.

- Proposals from Senator Cynthia Lummis in July 2024 aim to formalize a Treasury-operated bitcoin reserve, blending digital currencies into national reserves.

- Analysts at Bitwise project Bitcoin prices reaching $200,000 to $500,000 if the U.S. greenlights a strategic bitcoin reserve shaping global policy.

How Does Blockchain Ensure Transparency and Security?

All crypto transactions go into public blockchain technology. Nodes around the globe hold the same ledger. This open record gives digital currencies real clarity. It stops false entries and fake transfers.

Chainalysis offers a compliance service that spots shady moves. Big banks, central banks, and funds use it to track funds. The Ethereum network hosts digital contracts that lock rules into code.

Those smart agreements power DeFi and non-fungible tokens (NFTs), with all terms in the open. Investors treat Bitcoin like digital gold, a store of value they can follow live.

Miners and validators must agree on each record before it lands on the chain. That consensus mechanism makes it nearly impossible to rewrite history. It drives trust in the crypto market.

The wide network discourages hacks, since breaching one node fails to change all copies. Bitcoin’s energy use rivals that of Pakistan, a hefty cost for security. Future upgrades and lean networks, like Solana, push toward Visa and Mastercard speeds with less power.

Such platform tweaks aim to solve waste and shield funds from theft.

Innovations in Tokenization and Digital Assets

OpenSea uses smart contracts on the ETH network to turn art into NFTs, and DAOs let fans pool money like a club—read on to see how these innovations reshape finance.

What Is Tokenization in Crypto?

Tokenization in crypto turns real estate, art and other holdings into tokens on blockchain technology. It splits assets into tiny shares, so buyers claim a fraction. Smart agreements record each share on the ledger.

Non-fungible token (NFT) auctions and other digital asset platforms trade these tokens like shares.

Investors shot tokenized real-world assets from $2 billion in 2021 to $14 billion in 2024. ParaFi Ventures projects that market will climb to $2 trillion by 2030. Larry Fink of BlackRock champions this trend to modernize investment.

Tokenization adds new tools to the crypto market and digital currencies scene.

How Are Digital Assets Changing Finance?

Digital assets shake up finance with new rails. Stablecoin markets hit $400 billion after fresh US laws. They will handle $8.3 trillion in transactions this year. Visa records $9.9 trillion for context.

A fintech firm paid $1.1 billion for a stablecoin platform to build global rails. A trading app plots a world-wide network that speeds payments. AI agents use memecoins for capital and buzz.

Tether and Circle now shape digital currencies and reshape the crypto market.

Blockchain technology drives this change. Smart contract networks let users move value in seconds. DeFi teams launch Stablecoin 2.0 models with user and app rewards. Central banks pilot digital currencies on private ledgers.

Emerging markets adopt borderless blockchains for faster transfers. Crypto reserves grow too. Some investors hold strategic bitcoin reserve alongside fiat currencies. People hunt digital gold to hedge inflation.

Takeaways

Crypto took center stage this year when Bitcoin ETFs leapt past gold funds and stablecoins surged. Investors warmed up to blockchain technology as they saw a silver lining in token scarcity and clear ledgers.

Wall Street giants and central banks built strategic bitcoin reserves, eyeing a digital trove. Builders in emerging markets joined decentralized autonomous organizations to roll out apps that cut out middlemen.

This new wave could crown digital currencies as the gold standard for a fresh era.

FAQs

1. What makes crypto a digital gold?

All things considered, crypto coins, like Bitcoin, act as digital gold. They store value in a scarce form, much like a safe vault. They live on blockchain technology as reliable ledgers. They feel as solid as old school bullion.

2. How does blockchain technology back this new gold standard?

It records each move in a chain of blocks, so no one can sneak in a fake coin. It stops tampering, it builds trust. It turns digital currencies into clear, honest records.

3. Can crypto challenge fiat currencies and central banks?

Yes. Many worry about rising fiat currencies and inflation. Central banks even eye a strategic bitcoin reserve. The crypto market stirs fresh talk in economics. Some towns chase the title of crypto capital of the world to lure digital asset firms.

4. What risks lurk in the crypto market?

You face a crypto winter, speculative bubble, speculative investment hype, and wild valuations. The pipeline hack and darkside ransomware attack deepened fear. You must set clear risk tolerances before you dive in.

5. How did regulators and leaders shape crypto’s rise?

The SEC Chair and the commodity regulator voice rules, they weigh in on acquisitions. The ex-president dropped tweets that moved markets. The fund manager and the former SEC leader offered views on market sentiments. All of it changed the path of crypto-currencies.

6. Is crypto a good source of passive income in emerging markets?

Some folks pick crypto-currencies or stable coins like USDT to farm yields. They join decentralized autonomous organizations for shared projects. They hope to turn their town into the crypto capital of the world. They chase steady passive income amid global change.