Many small business owners face high interest rates on bank loans and get lost in sba.gov paperwork. The small business administration, or SBA, offers sba loan programs like 7(a) and 504 loans plus microloans to boost job creation.

This guide shows ten loan programs from secure .gov sites, like EXIM Bank and the community development financial institution fund, to ease your small business funding search. Find out more.

Key Takeaways

- SBA 7(a) loans range from $500 to $5.5 million. They fund assets, working capital, inventory, or debt. You must run a U.S. for-profit, have good credit, and seek private funds first.

- SBA 504 loans give long-term fixed rates for real estate, machinery, or furniture. You pay as little as 10 percent down. Many loans need no collateral.

- SBA Microloans give $500 to $50 000 through local lenders. They include counseling and training to help you start and grow your business.

- The SSBCI holds almost $10 billion to match $10 in private capital per federal dollar. Its Annual Report (Nov 13, 2024) and an SBA update (Nov 25, 2024) show $3.1 billion in new small business funding.

- The Small Business Lending Fund gave $4 billion to 332 community banks and CDFIs for lower-rate loans. The Treasury’s CDFI Fund uses five tools—like the New Markets Tax Credit—to back low-income areas. SBA disaster loans (EIDL and physical damage) help after floods and wildfires. Export loans via Ex-Im Bank and OPIC cover orders, inventory, and receivables.

What is the SBA 7(a) Loan Program and who qualifies?

SBA 7(a) Loans top the list of sba loan programs from the u.s. small business administration. They supply $500 up to $5.5 million in financing for fixed assets, working capital, inventory, or debt refinancing.

Applicants must run a for-profit business in the U.S. or its territories, show sound credit, and prove they tapped private funding first. Lenders use SBA guarantees to cut risk, so banks and commercial lenders approve more deals.

Owners team up with an SBA 7(a) lender or a certified development company and can try the Lender Match tool on secure websites.

What are the benefits of the SBA 504 Loan Program?

504 loans deliver long-term, fixed-rate capital for real estate, machinery, or office furniture. Certified Development Companies, often community development financial institutions, process applications under the small business administration (sba).

Borrowers pay down payments as low as 10 percent. They enjoy flexible overhead requirements and lower fees than most business loans. Certain loan amounts need no collateral, easing stress on entrepreneurs.

Firms use this program for construction, remodeling, and growth of their ventures.

Applicants track program updates on secure websites of official government organization. They find guides for small business funding and technical assistance on those portals. Local lenders often offer workshops to explain rates and margins.

Entrepreneurs gain tools for strong loan applications. This support sparks job creation in underserved communities.

How does the SBA Microloan Program support small businesses?

Microloans give up to $50,000 to small businesses and nonprofit childcare centers. U.S. Small Business Administration sends capital through intermediary lenders. This sba loan program stands as one of the three main SBA loan types.

Borrowers use funds for working capital, supplies, inventory, furniture, or fixtures.

Amounts start at $500 so new founders can tap into small business funding. The program also links borrowers to business counseling and education. Third-party lenders provide technical assistance and training to strengthen operations.

Community development financial institution partners and nonprofits join to boost job creation.

What is the State Small Business Credit Initiative (SSBCI)?

SSBCI holds almost $10 billion to fuel small business funding. The U.S. Small Business Administration runs this capital loan program. It allocates funds to states, DC, territories, and tribes.

They use loan participation, equity, guarantees, collateral support, and capital access to boost business loans. Program goals draw ten dollars in private capital for each SSBCI dollar.

States offer technical support through a Technical Assistance Grant Program and a Small Business Opportunity Program. Minority Business Development Agency staff run the Capital Readiness Program to boost underserved communities.

A Michigan maker grabbed $532,000 in SSBCI collateral support to secure a $1.3 million bank loan. Leaders post program updates on secure websites for all loan programs. The SSBCI Annual Report for 2022, released Nov 13, 2024, showed new markets for small firms.

On Nov 25, 2024, SBA officials reported that SSBCI drove $3.1 billion in new small business financing. Officials announced more Tribal Nation support on Dec 13, 2024, and $75 million in grant awards on Oct 8, 2024.

How does the Small Business Lending Fund (SBLF) help small businesses?

Small Business Lending Fund gives local banks and loan funds over $4.0 billion in capital. U.S. Department of the Treasury, the official government organization, manages SBLF. It has funded 332 community banks and CDFIs.

Entrepreneurs in underserved communities gain small business funding for lines of credit and business loans. Banks slash annual percentage rates to help startups and proprietorships.

Participating lenders use SBLF to lower costs, offer nonrecourse loans, and refinance existing debt. That drive for more favorable terms boosts job creation across Main Street. Technical assistance teams, from community development financial institution groups to sba events staff, link borrowers with secure websites and program updates.

Entrepreneurs access capital fast, hire staff, and expand ventures.

What is the Community Development Financial Institutions Fund (CDFI Fund)?

Tucked inside the Treasury Department, the CDFI Fund, a community development financial institution (CDFI), pumps cash into low-income areas. It fights predatory lenders and bridges credit gaps in underserved neighborhoods.

It runs five main tools: the Community Development Financial Institutions Program, the New Markets Tax Credit initiative, the guarantee facility, the Bank Enterprise Award, and the Native American CDFI Assistance Program.

These efforts target zip codes that big banks overlook. They spark job creation and boost small business funding.

It also backs nonprofits, mission lenders, and community banks with grants and technical assistance. It channels debt and equity into startups, cooperatives, and minority-led ventures.

Community groups often call it a secret handshake with the U.S. Small Business Administration. Capital flows, ventures grow, and local shops stay open.

What types of Disaster Assistance Loans does the SBA offer?

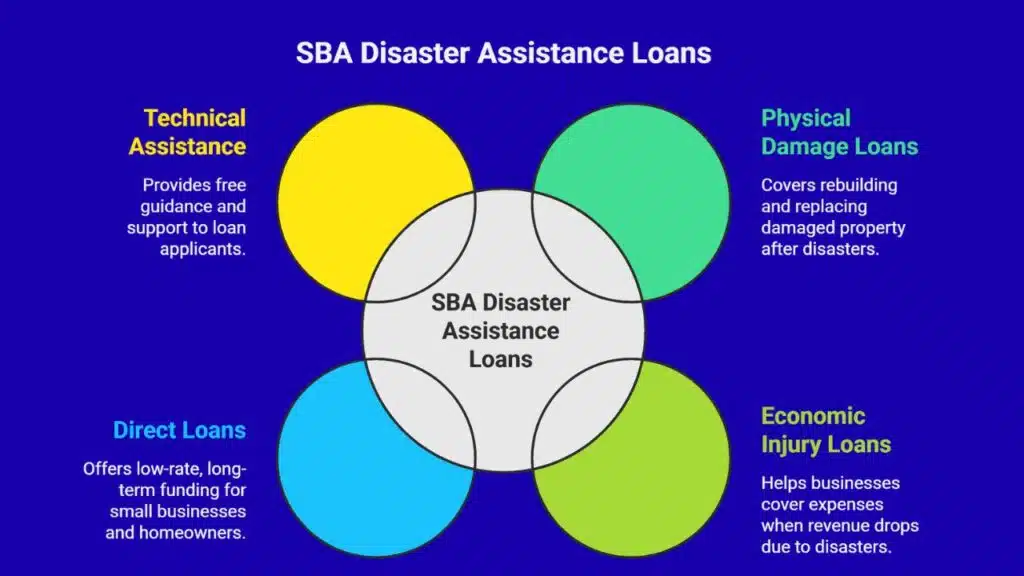

An official government organization, the small business administration (sba) issues disaster assistance loans after a federal disaster declaration. The program splits into two main tracks, physical damage loans and economic injury loans.

Physical damage support covers rebuilding or replacing real estate, equipment and inventory after floods or wildfires. Economic Injury Disaster Loans (EIDL) help small businesses pay bills, payroll and accounts receivable when revenue drops.

Direct loans offer low rates and stretch over decades for small business funding that underserved communities can tap. Homeowners also get funds to repair disaster-hit homes. The sba gives free technical assistance and guides applicants through secure websites.

These sba loan programs aim to speed recovery. They protect jobs in disaster zones and support job creation in hard-hit areas like Texas.

How can Export Loans benefit small businesses?

Export loans help small firms cover costs for export orders, inventory, production, and receivables. The Small Business Administration runs specialized export loan programs. They support working capital.

They also fund expansion into foreign markets. Firms may tap credit from the export-import bank of the united states, export credit insurance, or loans from the overseas private investment corporation.

Business owners can call their local U.S. Small Business Administration Export Finance Manager or visit the Office of Manufacturing and Trade. Staff offer guidance, technical assistance, resources, and access to small business funding.

That aid drives job creation in underserved communities. Owners may attend sba events or work with the national lgbt chamber of commerce for extra support.

Takeaways

These ten options offer clear routes to vital cash, no treasure map needed. You can tap an SBA 7(a) loan or a 504 loan for big buys, or try the microloan program when you need a quick boost.

The SSBCI and the SBLF bring funds and advice to many states, thanks to the U.S. Treasury Department. Those in underserved areas may find help through the CDFI Fund or via OPIC and Ex-Im Bank credit lines.

EIDL and other disaster loans can help firms rebound fast. Web tools like the SBA zip code finder keep you on top of program updates. Pick your fit, apply online, and watch your venture take flight.

FAQs

1. What sba loan programs can help small businesses get funding?

The small business administration (sba) is an official government organization that runs sba loan programs like 7(a), 504, and microloan. These business loans bring vital small business funding. You can visit secure websites such as sba.gov or mbda.gov. Check program updates or join sba events there.

2. How do I find the right lender using my zip code?

The SBA Lender Match tool on secure websites finds lenders near you. Just type in your zip code. It shows banks, angels investors, and venture capital firm contacts. No guessing, the info is all in one place.

3. What help is there for underserved communities and female entrepreneurs?

The SBA and nonprofit organizations give technical assistance, and charities offer hands-on support. The work opportunity tax credit can boost job creation. Groups like FoundHer or an LGBTQ business group share peer advice to tackle racial inequality. It’s like having a team of coaches on your sideline.

4. How can a start-up get a bridge loan or revolving credit?

A bridge loan or revolving credit is a short term cash boost. You can get one from the SBA or a government credit agency like opic. It is loaned capital you can use until you land your next big deal, then it can be refinanced. Some options come non-recourse or insured, so your assets stay safe.

5. Can private equity investment or vc involvement affect my eligibility?

The SBA checks if you took money from a venture fund, private equity investment, or a vc. They also look at your principal ownership stake. You must meet the rules so you do not exceed the cap. Then you can mix business loans with outside growth capital.

6. How do I avoid default and protect my principal?

Plan your cash flow, pay bills on time, track every cost, and monitor your employment records. You can even use a federal tax credit or royalty income if you have it. Talk with technical assistance or visit alpfa for advice. Good planning keeps your business afloat.