Gold prices climbed strongly on Monday, reaching their highest level since April as traders increased their bets that the U.S. Federal Reserve will reduce interest rates later this month. The market has been anticipating a shift in monetary policy after a series of signals from Fed officials suggested that a rate cut could be necessary to support the labor market.

By early trading hours in Asia, spot gold had risen nearly 0.7 percent to around $3,470 per ounce, while U.S. gold futures for December delivery advanced to over $3,540. These levels mark the strongest performance for the metal in more than four months, highlighting renewed investor interest in bullion as a hedge against economic uncertainty.

Silver Breaks a Decade-Long Ceiling

Alongside gold, silver saw a dramatic move, crossing the $40 per ounce mark for the first time since 2011. Spot silver rose by more than 1.5 percent in Monday’s session, touching about $40.31. This milestone reflects a surge in demand for the metal not only as a safe-haven asset but also as an industrial commodity, since silver plays a crucial role in electronics, solar energy, and advanced manufacturing.

Silver’s rally has been described by analysts as one of the strongest in recent years, making it one of the best-performing major assets of 2025 so far. Traders point to tight supply conditions, steady industrial consumption, and its relative affordability compared to gold as reasons for the sharp upswing.

Federal Reserve Outlook and Inflation Data

The rally in precious metals has been driven largely by expectations of U.S. monetary easing. The Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) index, rose in July by 0.2 percent month-on-month and 2.6 percent year-on-year, in line with forecasts. While inflation remains above the Fed’s 2 percent target, recent commentary from policymakers has emphasized the need to balance price stability with risks to employment.

Market tools such as the CME FedWatch show that traders currently assign nearly a 90 percent probability to a 25 basis point rate cut at the upcoming Federal Open Market Committee (FOMC) meeting. Such a move would mark the first step toward a more accommodative monetary stance, and historically, gold benefits when borrowing costs fall because lower interest rates reduce the opportunity cost of holding non-yielding assets.

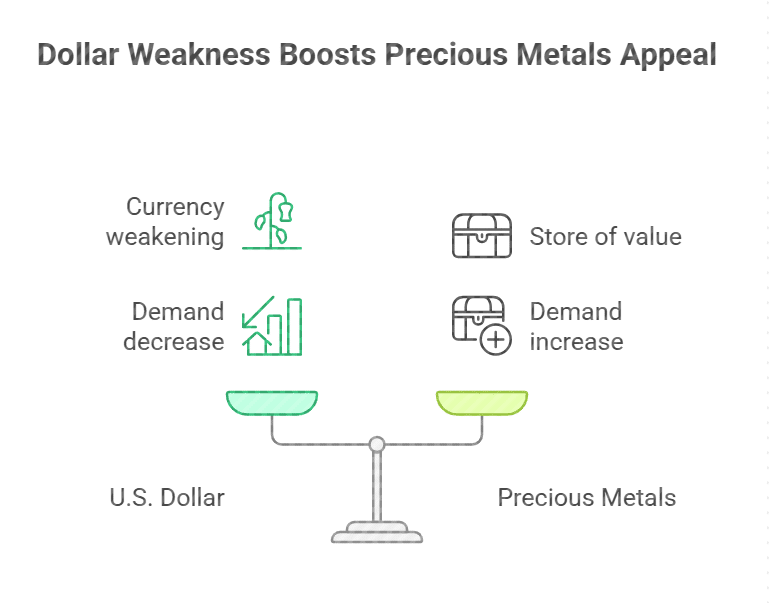

Pressure on the Dollar and Impact of Trade Rulings

Another factor boosting bullion is the performance of the U.S. dollar. A recent appeals court ruling deeming many of the Trump-era tariffs illegal has created additional downward pressure on the currency. With a softer dollar, dollar-denominated commodities like gold and silver become cheaper for investors using other currencies, which tends to drive up demand.

Trade officials in Washington continue to negotiate with international partners despite the legal setback, but the uncertainty has weighed on the greenback and strengthened the appeal of precious metals as an alternative store of value.

Market Awaits U.S. Jobs Report

Looking ahead, the release of U.S. non-farm payrolls data on Friday will be a key test for markets. A strong jobs report could reduce expectations for aggressive easing, while weaker numbers may cement the likelihood of a rate cut. Investors will be closely watching wage growth and unemployment figures to gauge the Fed’s next move.

Precious metals traders view the labor market report as a potential catalyst for even larger price swings in gold and silver. With global uncertainties already fueling safe-haven demand, any indication of U.S. economic weakness could trigger further inflows into bullion-backed funds and physical assets.

Other Precious Metals Gain Ground

The strength in gold and silver has also lifted other metals. Platinum advanced close to 1 percent, trading around $1,377 per ounce, while palladium rose by about 0.8 percent to just over $1,118. Both metals benefit from industrial demand in the automotive and manufacturing sectors, and they often follow broader sentiment in the precious metals market.

Broader Significance for Investors

The renewed rally in precious metals underscores their dual role as safe-haven assets and industrial commodities. For gold, the focus remains firmly on monetary policy and currency dynamics. For silver, both investment demand and industrial usage are contributing to a powerful rally that has pushed it to levels not seen in over a decade.

With platinum and palladium also benefiting from positive spillover, the entire precious metals complex appears to be entering a strong phase ahead of one of the most closely watched Federal Reserve meetings of the year.