Fewer than 1% of accounting firms report being fully staffed. While most firms struggle with this crisis, some are thriving by using AI to transform their audit practices. According to CPA Practice Advisor, only 48% of accounting firms currently use AI. Yet, the 2024 Intuit QuickBooks survey found that 98% of accountants have already used AI in some capacity, primarily for data entry (69%), fraud detection (51%), and providing real-time financial insights (47%).

Marko Glisic, a partner at GreenGrowth CPAs in Los Angeles, CA, discussed on The C-SUITE EDGE Podcast how artificial intelligence amplifies human capabilities rather than replacing them. His insights offer a roadmap for firms ready to move beyond experimentation into transformation.

Documentation Over Understanding

Modern audit files contain over 100 working papers, yet staff auditors often can’t answer basic questions about their clients’ revenue streams or competitive positioning. This disconnect reveals the profession’s core problem that drives both quality issues and talent shortages.

Before 2000, auditors spent 90% of their time performing fieldwork and 10% of their time documenting. Today, those ratios have flipped. At GreenGrowth CPAs, the firm tracks audit adjustment rates, finding issues in over 60% of engagements. Glisic observed that larger firms with pristine documentation often see far fewer adjustments. Perfect paperwork doesn’t equal effective audits.

This documentation burden creates cascading problems. Senior managers spend hours reviewing working papers instead of mentoring staff. New graduates get stuck in documentation roles rather than learning the business. Partners have less time for client relationships. The entire audit ecosystem suffers when process overwhelms purpose.

Glisic observed that “The more you understand your client’s business, the more likely you are to find audit adjustments. That deep knowledge comes from spending time with them, not just looking at numbers.”

How AI Solves This Problem

AI directly addresses the documentation burden by automating the time-consuming tasks that keep auditors from understanding their clients. The technology handles routine work while auditors focus on analysis, risk assessment, and client relationships.

- Full-Population Testing replaces traditional sampling with analysis of 100% of transactions. Machine learning algorithms process millions of transactions, flagging inconsistencies or outliers that sampling might miss entirely. This shift fundamentally improves audit reliability.

- Anomaly Detection systems continuously scan datasets, assigning risk scores based on multiple factors. Advanced platforms utilize fraud detection algorithms trained on thousands of audits, identifying unusual patterns from duplicate payments to suspicious journal entries that human reviewers might overlook.

- Natural Language Processing reads and assesses contracts, board minutes, and invoices with remarkable precision. NLP technology extracts key terms, identifies compliance issues, and flags discrepancies between agreements and actual transactions, turning hours of manual reading into minutes of automated analysis.

- Document Verification compares supporting documents against thousands of legitimate templates, instantly flagging altered bank statements or fake invoices. The technology examines everything from font consistency to metadata, catching sophisticated forgeries while creating automatic documentation trails.

- Automated Testing reduces standard procedures, such as cash confirmations and fixed asset roll forwards, from 40 hours to 4 hours. Platforms like DataSnipper link significant volumes of data from distinct PDFs into one testing workbook, while AI-powered models rapidly process more than 25,000 transactions in minutes for cash flow analysis.

These applications free up hours of auditor time from documentation, allowing for a focus on understanding the business and identifying real risks. When auditors can analyze entire populations rather than samples, when AI detects anomalies that humans miss, and when NLP ensures that no critical contract term goes unnoticed, the audit opinion carries greater weight and reliability.

Solving the Talent Crisis

Beyond improving audit quality, AI helps address the talent shortage by making audit work more attractive again. New graduates enter the profession expecting digital workplaces but encounter outdated processes focused on documentation, causing many to leave for more engaging industries.

As Glisic has previously discussed regarding how AI will eliminate traditional accounting tasks, the technology eliminates aspects of audit work that drive talent away. With AI handling routine tasks like document review and anomaly detection, new auditors can immediately engage in high-value activities such as meeting with executives to understand business models, identifying operational risks that impact financial reporting, and providing recommendations that clients value.

Popular AI tools supporting this transformation include:

- AI chatbots for internal policies.

- Ask Blue J for tax research accuracy.

- AICPA’s Dynamic Audit Solution for pattern analysis.

- MindBridge AI for enhanced risk assessment.

According to Karbon research, 71% of accountants believe AI will have a significantly positive impact on their jobs, viewing it as an opportunity rather than a threat. When seniors aren’t burdened with routine tasks, they can mentor juniors effectively. This enhances the entire talent development cycle, creating a positive feedback loop that attracts more top performers.

Who Benefits the Most?

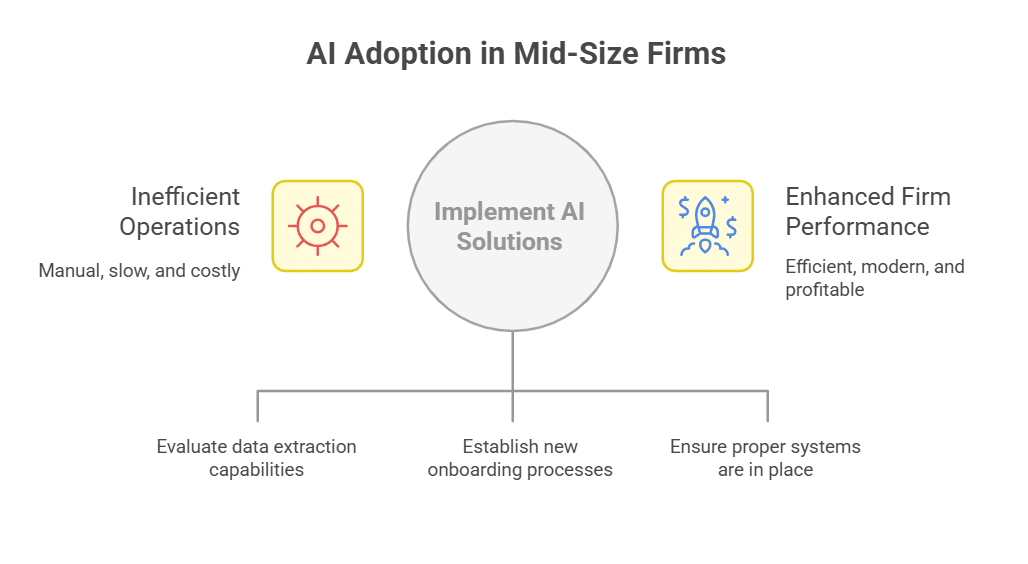

Mid-size firms occupy the sweet spot for AI adoption. They lack the bureaucratic constraints of larger firms while having more resources than sole practitioners. These firms can pivot quickly, test new technologies, and scale successful implementations across their entire practice.

Moore Global reports that mid-sized accounting firms spent $1.6 million on AI in 2023, nearly four times what legal and professional services invested. These firms are achieving measurable results: winning proposals by demonstrating technological sophistication, attracting top talent who seek firms using modern tools, achieving 20-30% better realization rates through efficiency gains, and strengthening client relationships through more frequent interactions.

However, implementation isn’t always smooth. Some firms discover that clients aren’t ready for AI-enhanced audits due to challenges in extracting usable data from their systems, requiring new onboarding processes to assess client readiness. Drawing from his expertise in internal audit components, Glisic emphasizes that proper foundational systems must be in place before AI can deliver maximum value.

Marko Glisic sees parallels to other technology adoption cycles, noting that “the firms that adopt AI early are going to be the winners, just like we saw with cloud computing and digital tools.”

Implementation Roadmap

Successful AI implementation requires strategic planning and phased execution:

- Phase 1: Foundation (Months 1-3) Begin with one high-volume, low-complexity process that has success easily measurable. Many firms start with full-population testing on accounts where they previously relied on sampling. Document current time requirements and error rates to establish baselines.

- Phase 2: Measurement and Expansion (Months 4-6) Track specific metrics including time saved per engagement, errors caught by AI versus manual review, staff satisfaction scores, and client feedback. Use concrete data to establish internal support and expand to additional processes.

- Phase 3: Cultural Integration (Months 7-9) Train teams to view AI as a collaborative tool. Address fears directly through town halls and create AI champions within each department. Develop new performance metrics that reward quality insights over hours worked.

- Phase 4: Strategic Transformation (Months 10-12) Reinvest time savings into higher-value services. Develop new offerings based on AI capabilities and adjust pricing models to reflect the value delivered, rather than the hours worked.

The Decision Point

Every week, another firm loses a promising senior executive to a private equity firm. Another manager burns out from documentation overload. Another partner turns away a good client because they can’t staff the engagement. Meanwhile, firms using AI are quietly hiring top talent, winning competitive proposals, and enjoying busy seasons.

Traditional firms often struggle with 60-hour workweeks during the busy season, whereas AI-enabled firms tend to maintain more reasonable schedules. Traditional firms see realization rates decline as fixed-fee pressure increases, while AI-enabled firms improve margins by completing audits more efficiently.

Diverse industry experience, demonstrates how professionals must adapt to technological shifts across all industries. Marko Glisic reinforces that “The ultimate goal hasn’t changed. It’s still about finding audit adjustments and ensuring the financials are accurate. AI just makes us better at achieving that goal.”

Ultimately, audit quality equals trust. AI strengthens this trust by enabling full-population testing, catching anomalies through machine learning, and ensuring nothing slips through the cracks. The tools exist. Real firms are achieving real results. The benefits extend beyond efficiency to fundamental improvements in audit quality, staff satisfaction, and client service. For more information about Glisic’s professional background and approach to modern accounting challenges, the evidence is clear: firms that act now position themselves for success in an AI-enabled future.