In the arena of personal wealth management, family workplaces occupy a unique and exceptional area of interest. These entities are mainly designed to serve the complicated economic and personal desires of ultra-excessive-net-worth individuals (UHNWIs) and their families.

Unlike conventional wealth management firms that cater to a broader market, a circle of relatives offices provide a holistic and surprisingly personalised approach, dealing with the whole lot from investments and taxes to property making plans and life-style offerings.

But what exactly is a circle of relatives' workplace, and how does it paint? Let’s ruin the structure, capabilities, and benefits of family places of work to apprehend why they are considered the gold general in wealth management.

What Is a Family Office?

A family workplace is a non-public wealth control firm that supports one (or a small wide variety of) rich households. Its primary position is to manipulate and preserve the family’s wealth across generations at the same time as additionally addressing personal and administrative wishes.

Family places of work are available principal paperwork:

- Single-Family Office (SFO): Dedicated to coping with the affairs of 1 circle of relatives.

- Multi-Family Office (MFO): Serves multiple households, frequently imparting more cost-powerful solutions at the same time as nevertheless presenting tailored offerings.

- Regardless of the shape, the point of interest is on delivering bespoke solutions that align with the family’s lengthy-term monetary desires and middle values.

How Do Family Offices Work?

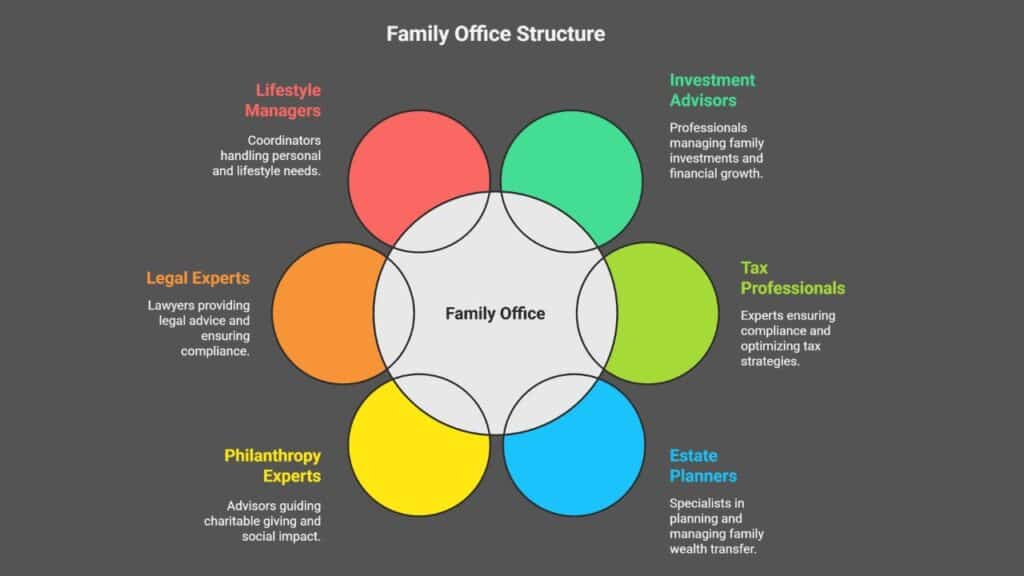

Family places of work function by means of developing a centralized group of professionals who control the circle of relatives’s entire financial life. This team may include:

- Investment advisors

- Tax professionals

- Estate planners

- Philanthropy experts

- Legal experts

- Lifestyle managers

Together, they develop a coordinated and incorporated method primarily based on the family’s precise wishes, preferences, and chance profile.

For instance, a own family workplace might not handiest oversee a various investment portfolio however additionally structure intergenerational trusts, manage actual property holdings, set up for non-public education or university placements, and even coordinate global journey or personal protection. This complete-spectrum provider model is what unites family offices other than conventional monetary advisory firms.

Key Services Provided by means of Family Offices

1. Investment Management

Family places of work are deeply concerned in managing funding portfolios, consisting of non-public equity, hedge budget, actual estate, and opportunity assets. The purpose is regularly to maintain and develop wealth over a couple of generations thru assorted, strategic making an investment.

2. Tax Planning and Compliance

Given the complexity of worldwide tax laws and the size of the belongings concerned, expert tax planning is important. Family workplaces paintings to minimize tax liabilities even as ensuring complete compliance with nearby and international guidelines.

3. Estate and Succession Planning

One of the most critical roles of a family workplace is making sure a clean transfer of wealth from one era to the subsequent. This entails establishing trusts, wills, and foundations while teaching more youthful generations approximately financial stewardship.

4. Philanthropy and Impact Investing

Many UHNW households are deeply dedicated to philanthropy. Family offices assist design and manage charitable giving techniques, set up family foundations, and explore impact investment opportunities that align financial desires with social or environmental objectives.

5. Lifestyle and Concierge Services

Family offices don’t simply manipulate money—they manipulate existence. Services might also encompass:

- Private tour preparations

- Property control

- Household staffing

- Security offerings

- Art collection management

This private component creates peace of mind, allowing households to pay attention to what matters most to them.

Why Choose a Family Office?

For households with giant wealth, complexity grows with each era. Family workplaces provide an unmarried point of coordination, lowering fragmentation and danger at the same time as improving decision-making.

Key advantages encompass:

- Personalized carrier: Tailored to own family values, dreams, and possibilities.

- Privacy and restraint: Operating with the utmost confidentiality.

- Continuity and legacy constructing: Ensuring wealth is preserved and handed on responsibly.

- Expertise in complicated matters: From worldwide tax regulation to pass-border investments and philanthropic approach.

Who Should Consider a Family Office?

While there may be nobody-length-suits-all threshold, own family workplaces are commonly perfect for those with $a hundred million or more in investable property. However, multi-own family offices regularly make bigger similar benefits to households with $20 million and up, making the model extra available.

Families who prize lengthy-time period wealth protection, wish to preserve manipulation over their monetary affairs, and need to integrate lifestyle management with wealth making plans are prime candidates for a circle of relatives workplace services.

Final Thoughts

As wealth grows, so does complexity—and with it, the need for coordinated, professional advice throughout all facets of existence and finance. A family office affords this included support, helping households now not just manage wealth, however live well and go away an enduring legacy.

By bringing together pinnacle-tier professionals and aligning monetary techniques with personal desires, own family places of work empower extremely-rich families to make knowledgeable selections these days while making plans confidently for tomorrow.