You want health coverage—but feel stuck. You’ve heard the buzz: high premiums, confusing network rules, and promises that don’t deliver. Health insurance can feel like a maze of misinformation. From thinking it’s only for the sick to assuming you’re stuck with your plan forever, common myths keep people from getting the protection they need.

Here’s one fact: The Affordable Care Act (ACA) does not replace your doctor with a government plan. Instead, it gives you tools to shop, compare, and save. It offers no-cost preventive care and premium-cutting subsidies to millions of Americans.

In this guide, we bust the top 10 myths about health insurance, show the real risks, and help you make informed decisions that protect your health—and your wallet.

Key Takeaways

- The ACA helps you shop on HealthCare.gov. It offers free preventive care and tax credits. Four out of five people pay under $10 per month.

- One in four 20-year-olds may get a disability before retirement. An ER visit can cost thousands. Insurance pays for checkups, vaccines, and mental-health care to shield you from big bills.

- Plans with low premiums may hide narrow HMO or PPO networks and high deductibles. Group plans at work may cost more but let you see doctors with no copay. You can change your plan during open enrollment or after a major life event.

- Plans vary in networks, co-pays, deductibles, and out-of-pocket limits. The ACA and Medicare must cover essential health benefits at no extra cost. Subsidies support people with incomes from 100% to 400% of the federal poverty level.

Myth 1: Health Insurance Is Too Expensive

Most people pay less than ten dollars each month for a health plan. Subsidies trim bills for folks between 100 and 400 percent of the federal poverty level. Group health insurance plans and state health plan or children’s health plan options make coverage friendlier.

The health insurance marketplace dishes out tax credits at signup. Insurance companies must cover preventive care, with low out of pocket costs.

Employer benefits, HMO and PPO networks, also drive down health care costs. Four out of five individuals enjoy single-digit premiums each month. The affordable care act (ACA) fills gaps, offering financial protection for middle-income families too.

Health insurance can stay within reach, even if you dread a medical bill.

Myth 2: Young and Healthy People Don’t Need Health Insurance

One in four 20-year-olds will face a disability before retirement, and a single ER visit can cost thousands. Doctors use preventive care to catch small issues early, but those visits cost money without a plan.

Health insurance companies pay for check ups, mental health services, and shield you from sky high medical bills. Skipping coverage feels cheaper now, but medical expenses pile up fast.

Health insurance marketplaces under the Affordable Care Act include subsidies that lower your insurance premium and out-of-pocket expenses. Employer group health insurance plans link to a health maintenance organization (HMO) or a preferred provider organization (PPO) network to cut your costs further.

Insurers must cover preventive care, so you pay little or nothing for vaccines and screenings. Coverage acts as a financial safety net when surprise medical needs arise.

Myth 3: The Cheapest Plan Is Always the Best

After thinking youth shields you from high medical costs, some folks grab the cheapest plan. They see a low premium and smile. But that deal hides narrow networks in a health maintenance organization, preferred provider organization, or exclusive provider organization.

A tiny network can block your favorite doctor, and a high deductible can drain your savings.

Plans differ in network, costs, and features. A group health insurance plan at work might cost more, yet include preventive care with no copay. A higher deductible option could save on premiums, if your savings can handle surprise medical bills.

Talk with an insurance brokerage or financial advisor. They can match your needs to a plan that balances cost and benefits, giving you financial protection against healthcare costs.

Myth 4: Health Insurance Doesn’t Cover Preventive Care

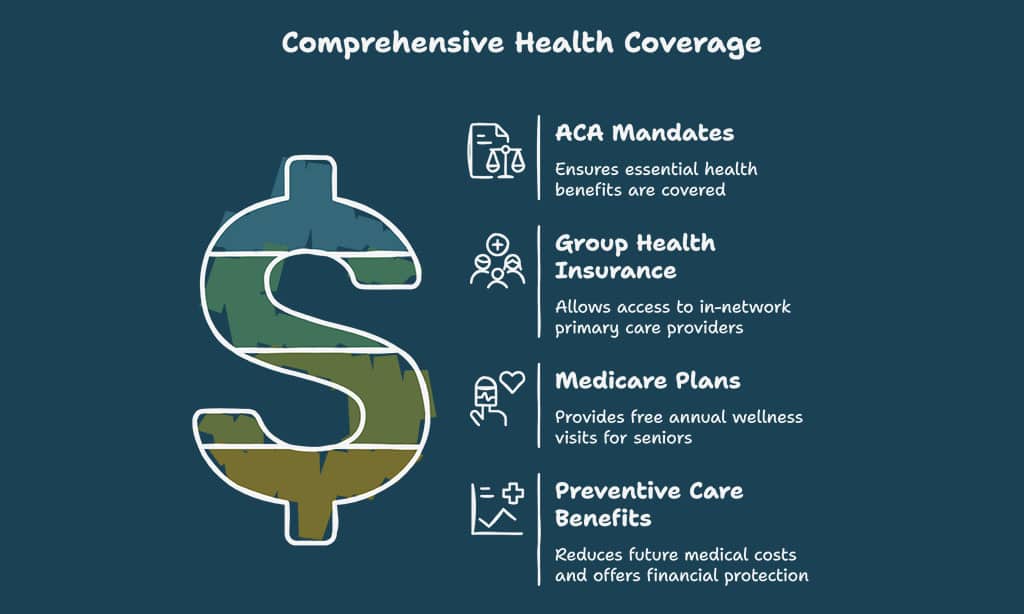

People often think health insurance stops at treating illness. The ACA mandates coverage of essential health benefits, including preventive care, at no extra cost. Group health insurance plans let members see in-network primary care providers for screenings and routine exams.

These services can cut future medical costs.

Medicare plans follow the same rules; seniors can get annual wellness visits for free. Preventive care helps catch issues early. Such screenings reduce future medical expenses and add financial protection.

Myth 5: You Can’t Change Your Plan After Enrollment

Some think they must stick with one health insurance plan all year. The Affordable Care Act lets you make changes during open enrollment. You can also switch plans after a major life event to keep your healthcare access intact.

Marriage, birth of a child, or job loss can trigger a special enrollment period. An agent can guide you through adjusting your provider network or lowering your deductible.

Good coverage depends on matching your plan to your health and budget. You get more financial protection by avoiding gaps in care. A brief call with an advisor can answer your questions.

Myth 6: All Health Insurance Plans Are the Same

Plans vary in provider network, cost-sharing, and covered services. The Health Insurance Marketplace under the Affordable Care Act lists network-based, open-access, and limited-access choices that affect affordable health insurance premiums.

Group health insurance plans at work can include preventive care at zero extra cost. Personal budgets face different deductibles, co-pays, and out-of-pocket limits. Several plans charge high co-pays for emergency room or specialist visits.

Medicaid expansion and employer options might not match an individual plan.

Choosing depends on medical costs, budget, and doctor list. A broad network helps employees who need flexible care and travel. A high-deductible plan suits healthy adults who want low premiums.

An employer mandate plan may cut premiums via payroll deductions. The individual mandate no longer triggers fines, but missing enrollment can leave huge bills. Priority Health earned four out of five stars for value and health outcomes on that exchange.

Myth 7: Only Low-Income Individuals Qualify for Subsidies

That brings us to Myth 7: Only Low-Income Individuals Qualify for Subsidies. The Affordable Care Act (ACA) gives financial protection to people with low or middle incomes. Anyone earning between 100 percent and 400 percent of the federal poverty level can get premium tax credits.

Nearly four in five people pay under ten dollars per month for affordable health insurance.

Middle-income families, single parents, and young adults often see big savings. A person using the government site calculator can see their subsidy in minutes. These discounts help cover medical costs, preventive care, and prescription medications.

Myth 8: Government Health Plans Replace Your Doctor

Reality: ACA plans help you keep your doctor—or choose a new one from approved lists.

The ACA is not a government-run doctor network. It creates a platform to compare private insurance plans, which still work with private doctors.

Use provider directories to ensure your doctor is in-network before enrolling.

Myth 9: Life Insurance Covers Medical Bills

Reality: Life insurance pays after death, not during a medical emergency.

It helps beneficiaries with funeral expenses or debts. Health insurance is what covers doctor visits, hospital stays, surgeries, and prescriptions.

If you want coverage for hospital bills or disability, look into health insurance or critical illness coverage, not life insurance.

Myth 10: Undocumented Immigrants Can’t Get Any Coverage

Reality: While they may not qualify for marketplace subsidies or Medicaid, emergency services are still available.

Children may qualify for state programs, and community health clinics offer care regardless of immigration status. It’s important to talk to bilingual insurance agents or local clinics for tailored support.

Takeaways

You can now spot real deals faster. Myth busting brought clarity to tricky terms. HealthCare.gov let you see each plan side by side. Families saved cash with premium tax credits. Annual checkup stays free with most policies.

HMO network rules now read like a guide. You hold a health shield and a wallet shield.

FAQs on Myths About Health Insurance Debunked

1. What is a common myth about health insurance?

Many think health insurance is just an extra bill to pay. In truth, plans offer financial protection. They cover preventive care, doctor visits, and more. A good plan acts like a safety net.

2. Is affordable health insurance really cheap?

I hear you, it sounds too good to be true. You can find affordable health insurance in a group health insurance plan at work. It may use a defined contribution account. You pay low premiums, but you still face some medical costs.

3. Does the Affordable Care Plan cover preventive care?

Yes. The Affordable Care Plan covers checkups, shots, and screenings. It helps you skip big medical bills later.

4. Can HMOs and flexible plan networks limit my choice?

HMOs use a tight provider network to cut costs. They keep prices low, but you pick fewer doctors. My friend switched to a flexible plan network, she said it felt like moving from a set menu to an all you can eat buffet. It fit her health needs, but her costs grew a bit.

5. Will life insurance pay my hospital bills?

No. Life insurance is not medical insurance. It pays a death benefit or builds cash value. A variable life insurance policy works like an investment vehicle, it can sway up and down. It will not cover your hospital bills.