Hey there, are you curious about making money online, but feel lost in the crazy world of digital finance? Maybe you’ve heard whispers about something called DeFi, or decentralized finance, yet you’re not sure where to start or what it even means.

Don’t worry, pal, I’ve got your back, and I’m here to break it down for you.

Here’s a cool fact to chew on: DeFi platforms let you handle money stuff, like lending or trading, without needing a bank. They run on blockchain technology, which is like a super secure digital ledger.

Pretty neat, right? In this blog, we’re gonna walk through the “10 Most Popular DeFi Projects In 2025,” showing you the top decentralized exchanges and lending tools that are making waves.

Stick around, we’ve got plenty to share!

Key Takeaways

- Uniswap, launched in 2018, leads as a top decentralized exchange with a total value locked (TVL) of $3.2 billion on blockchains like Ethereum.

- Aave, started in 2017, is a major lending platform with a TVL of $4.5 billion, operating on networks like Polygon and Avalanche.

- MakerDAO, founded in 2014, pioneered stablecoins like USDS with a TVL of $4.9 billion on Ethereum.

- Lido, established in 2020, dominates liquid staking with a massive TVL of $13.9 billion across Ethereum and Solana.

- JustLend, also launched in 2020, offers lending on the TRON blockchain with a TVL of $3.7 billion using the JST token.

Uniswap: Leading Decentralized Exchange

Moving from our broad look at DeFi, let’s zero in on a major player that’s shaping the game. Uniswap stands tall as a leading decentralized exchange, or DEX, and it’s changing how we trade crypto assets.

Launched in 2018, this platform was the first DEX to let users swap tokens using smart contracts. That’s a big deal, folks, as it cuts out middlemen and puts power in your hands.

Now, picture Uniswap as a bustling marketplace on multiple blockchains like Ethereum, Polygon, and even Binance Chain. With a massive total value locked, or TVL, of $3.2 billion, it’s a hotspot for liquidity providers.

You can earn fees based on how much liquidity you add, which is a sweet deal. Plus, their token, UNI, ties it all together, offering a stake in this vibrant ecosystem. Wanna trade without a central boss? Uniswap’s got your back.

Aave: Advanced Lending and Borrowing Platform

Aave stands tall as a leading force in decentralized finance, or DeFi, and the reasons are clear. Launched in 2017, this platform allows you to lend and borrow digital assets without intermediaries.

Built on Ethereum, it also operates on networks like Polygon, Avalanche, and Arbitrum, among others. With an impressive $4.5 billion in Total Value Locked, or TVL, Aave demonstrates its dominance in the blockchain arena.

Their token, AAVE, goes beyond being just a coin; it drives governance and provides staking rewards to users. Envision lending your crypto to earn interest or securing quick funds through flash loans, all within a single app.

Think of this as your own crypto bank, but far more innovative. Aave offers adjustable interest rates, allowing you to choose what suits your financial needs. Need funds urgently? Their flash loans enable borrowing without collateral, provided you repay swiftly.

Operating on blockchains like Optimism, Base, and Fantom, it connects with users across the globe. Plus, holding the AAVE token means you have a role in shaping the platform’s future.

It’s like joining a community where your input counts in the DeFi landscape.

MakerDAO: Pioneers of Stablecoins

Moving from Aave’s lending magic, let’s chat about another big player in decentralized finance, MakerDAO. These folks, kicking off in 2014, are the trailblazers behind stablecoins on the Ethereum blockchain.

Their setup, with a hefty total value locked at $4.9 billion, shows how much trust people put in them. They issue USDS, once called DAI, through loans backed by collateral. How cool is that? It’s like getting a steady dollar from a wild crypto world.

Digging deeper, MakerDAO offers a multi-collateral system for flexibility, letting users lock up various digital assets. Their tokens, SKY, formerly MKR, play a huge part in this DeFi protocol.

This design keeps things stable in the stormy sea of cryptos. Imagine having a boat that doesn’t rock, no matter the waves. If you’re into blockchain technology or just curious about stablecoins, MakerDAO is a name to watch in this ever-shifting financial market.

Compound: Innovating Lending Protocols

Shifting gears from MakerDAO’s stablecoin mastery, let’s talk about Compound, a major player in DeFi lending protocols. Established in 2018, Compound has secured a strong position on blockchains like Ethereum, Polygon, Base, and Arbitrum.

With a TVL of $1.8 billion, it’s a go-to place for people looking to earn or borrow using digital assets. Lenders deposit their crypto into liquidity pools and collect interest, while borrowers provide collateral to access funds.

It’s like lending a friend some money, but with smart contracts ensuring everything stays fair and transparent.

Now, here’s the exciting part, Compound’s token, COMP, isn’t just for decoration. It manages the platform and aligns user interests, ensuring everyone works together. Whether you’re aiming for passive income or need a fast loan, this DeFi platform delivers impressive returns through its lending system.

Think of it as a digital savings jar that rewards you, and more! Stay tuned as we explore other fantastic projects like this.

SushiSwap: Community-Driven DEX

Moving from Compound’s fresh take on lending protocols, let’s chat about another cool player in the DeFi game, SushiSwap. This platform, born in 2020, stands out as a community-driven decentralized exchange, or DEX, where users swap crypto tokens with ease.

It runs on multiple blockchain networks like Ethereum and Binance Smart Chain, making it super handy for folks trading digital assets. Plus, with its token called SUSHI, there’s a neat perk, you can stake it to earn rewards.

How sweet is that?

Now, picture SushiSwap as a bustling farmer’s market, but for cryptocurrencies, where the community calls the shots. Their governance model lets users have a real say in how things roll, kinda like voting for your favorite pie at the fair.

By joining in, you tap into liquidity pools and even try yield farming to grow your stash. Operating on smart contracts, this DEX keeps trades smooth and safe across the digital economy.

Stick around, and see how this platform spices up the DeFi space!

Curve Finance: Optimized for Stablecoin Trading

Curve Finance rocks the DeFi world with its focus on stablecoin trading. Established in 2020, this platform boasts a massive TVL of $2.1 billion. It’s built to give you super low-slippage trades, especially when swapping stablecoins.

Imagine slipping on a banana peel, but instead, your trade glides smoothly with barely a hiccup. That’s Curve for ya! Operating across 13 blockchains, it’s got reach like a spider’s web, connecting tons of users to decentralized finance (DeFi) magic.

Dig into its token, CRV, and you’ll see why folks love it. This governance token lets holders vote on big decisions and snag boosted staking rewards. It’s like being handed the keys to a club where you call some shots.

Curve Finance isn’t just another DeFi protocol; it’s a go-to for liquidity pools optimized for digital assets like USDT. So, if yield farming or liquidity mining is your game, jump in and see how Curve can spice up your crypto journey!

Balancer: Flexible Asset Pools for Liquidity Providers

Balancer introduces a new approach to managing digital assets since its launch in 2020. Imagine it as a large mixing bowl for your crypto funds. You can add multiple tokens, not just a few, into adjustable liquidity pools.

This system, connected to the BAL token, allows you to experiment with different combinations to suit your preferences. Also, it integrates with various DeFi protocols, making it a useful tool in the decentralized finance arena.

Have you ever wanted to generate fees simply by holding your assets? With Balancer, users receive a portion of fees depending on their pool’s performance. It’s like sowing seeds in a garden and seeing them flourish with yield farming energy.

Explore these smart contracts, diversify your portfolio, and discover how blockchain technology can benefit you. Stay with us, and let’s talk more about these exciting liquidity pools!

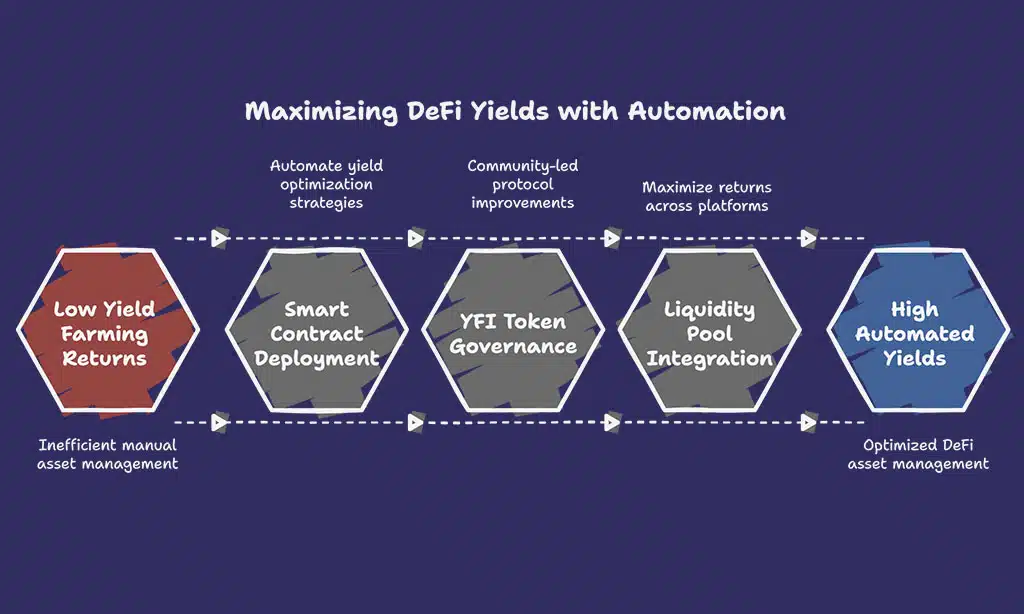

Yearn Finance: Revolutionizing Yield Aggregation

Hey there, let’s talk about Yearn Finance, a game-changer in decentralized finance, or DeFi, as we call it. Started in 2020, this platform shakes things up by pulling in yields from various DeFi protocols.

Think of it as a savvy farmer, selecting the finest crops from different fields to secure the largest harvest. Yearn uses smart contracts to make this happen, automating strategies for impressive returns.

Their token, YFI, is the core of this system, allowing users to participate and gain from high yields. It’s like having a wise friend who knows the best places to invest your digital assets for optimal gains.

Now, imagine a community steering the direction with Yearn’s governance model. Everyone has a voice in shaping how things progress, creating a real sense of collaboration. This structure gathers profits through yield farming, ensuring your money works diligently across liquidity pools.

It’s almost like a treasure quest, with Yearn identifying the prime locations for staking rewards. Want to explore DeFi without the hassle of monitoring every detail? This platform supports you with automated trading strategies.

So, let’s check out what’s happening with PancakeSwap next!

PancakeSwap: Accessible on Binance Smart Chain

Moving from Yearn Finance’s clever yield tricks, let’s talk about a different approach in the DeFi space. PancakeSwap offers a unique energy with its presence on the Binance Smart Chain, making it incredibly simple for anyone to get started with decentralized finance.

Launched in 2020, this platform has expanded quickly, achieving a TVL of over $1 billion. That’s a significant achievement, everyone!

Now, imagine PancakeSwap as your welcoming local diner, dishing out appealing choices like yield farming and staking rewards. With its token, CAKE, users can farm and stake to earn attractive returns.

Running on Binance Smart Chain, it acts as a speedy route for DeFi protocols, reducing costs compared to other blockchain technology systems. Looking to exchange digital assets or explore liquidity pools? This place has you covered, with no hassle required.

Synthetix: Expanding Synthetic Assets Market

Synthetix is revolutionizing decentralized finance, or DeFi, with an innovative approach to trading. Launched in 2018, this platform enables you to engage with synthetic assets, which are digital representations of real-world items like stocks or gold.

Envision owning a slice of Wall Street directly on your blockchain. With a substantial total value locked, or TVL, exceeding $2 billion, Synthetix demonstrates its prominence among DeFi protocols.

Users can stake their SNX token to generate these synthetic assets, creating exciting possibilities in financial markets.

Now, consider Synthetix as a versatile toolkit for digital assets. Staking SNX isn’t merely a pastime; it’s your opportunity to craft new assets and gain rewards, much like sowing seeds for a future yield.

This structure attracts a wide range of participants, from individual traders to large institutional investors, all keen to engage with derivative contracts without the typical obstacles.

Curious about the next big thing in DeFi? Let’s explore Lido and its leadership in liquid staking solutions.

Lido: Dominating Liquid Staking Solutions

Gosh, folks, let’s talk about Lido, a true innovator in decentralized finance (DeFi). Founded in 2020, this platform dominates the liquid staking arena with an impressive total value locked (TVL) of $13.9 billion.

Envision securing your digital assets on blockchains like Ethereum, Polygon, and Solana, while still having the freedom to use them. Lido makes that possible! Their liquid staking allows you to stake tokens and receive staked versions, like stETH, to engage with across DeFi protocols.

It’s like enjoying the best of both worlds, isn’t it?

Now, let’s explore why Lido shines with its LDO token. Think of it as your gateway to staking rewards without the typical challenges. You stake on leading blockchains, gain returns, and maintain asset flexibility in liquidity pools.

But, be cautious, there are risks to consider, like depegging or smart contract weaknesses. It’s a bit like balancing on a tightrope, so stay alert! As a leading DeFi platform, Lido continues to advance blockchain technology.

Ready for more? Let’s move on to Sky, reshaping DeFi governance next.

Sky (formerly MakerDAO): Redefining DeFi Governance

Sky, previously known as MakerDAO, is a prominent force in decentralized finance, or DeFi. Founded in 2014, this project operates on the Ethereum blockchain, boasting an impressive TVL of $4.9 billion.

They are the creators of stablecoins like USDS, once known as DAI, which are supported by collateral loans. What sets them apart? Their multi-collateral system allows users to secure a variety of digital assets for added versatility.

It’s akin to having a safety net with multiple supports, ready for any situation!

This platform also transforms DeFi governance with tokens like SKY, previously MKR, empowering the community. Imagine it as a town hall gathering, but on the blockchain, where your input counts.

Sky employs smart contracts to ensure fairness and transparency, leading the way in how decentralized autonomous organizations can function. Interested in lending within a different ecosystem? Let’s explore JustLend next.

JustLend: Lending Platform on TRON Ecosystem

Hey there, readers, let’s chat about JustLend, a cool player in decentralized finance on the TRON blockchain. Since starting in 2020, this platform has made waves by letting folks lend and borrow digital assets using liquidity pools.

It’s got a solid total value locked, or TVL, of $3.7 billion, which shows how much trust people put in it. Plus, its JST token runs the show, giving users a say in how things work through smart contracts.

Think of it like having a vote in your local club, pretty neat, right?

Now, imagine dipping your toes into DeFi protocols without needing a big bank. JustLend, operating on TRON, opens doors for anyone to earn staking rewards or grab quick loans like flash loans.

The JST token isn’t just a shiny coin; it’s the key to governing this lending space. So, what’s next on our DeFi journey? Let’s roll into the conclusion and wrap up our list of top projects for 2025.

Takeaways

Well, folks, we’ve walked through the top DeFi projects set to shine in 2025. From Uniswap’s trading power to Aave’s lending magic, these platforms are changing the game. Isn’t it wild how blockchain tech keeps pushing boundaries? Stick with these decentralized finance giants, and you might just find some neat opportunities.

Drop a comment if you’re excited to jump into this digital asset wave!

FAQs on Most Popular DeFi Projects

1. What exactly is decentralized finance, or DeFi, in 2025?

Hey, let’s break this down. Decentralized finance, often just called DeFi, is all about using blockchain technology to build financial systems without middlemen, like banks. Think of DeFi platforms as a way to handle digital assets, staking rewards, and more, directly on the chain.

2. Which DeFi protocols are making waves in 2025?

Well, friend, names like Uniswap Labs with their Uniswap protocol and Curve Finance with the CRV token are huge. They’re rocking the world of automated market makers and liquidity pools, helping folks trade digital currencies with ease.

3. How do smart contracts fit into DeFi projects?

Smart contracts are the backbone, my pal. They’re self-running agreements on blockchain tech that power stuff like yield farming, flash loans, and even options on DeFi platforms. No human meddling needed, just pure code doing the heavy lifting.

4. Why are institutional investors eyeing DeFi in 2025?

Big players like Goldman Sachs and JP Morgan are jumping in, and why not? They see the potential in high annual percentage rates and portfolio diversification through exchange-traded funds tied to DeFi (decentralized finance). It’s like finding a gold mine in the wild west of digital assets.

5. What’s the deal with regulatory clarity for DeFi platforms?

Ahh, it’s a bit of a tightrope walk. Compliance with rules set by bodies like the Financial Accounting Standards Board is tricky, but regulatory clarity is slowly shaping up for trading platforms and asset allocations in 2025. Without it, market sentiment could swing wilder than a pendulum.

6. Can I get into yield farming or staking rewards with DeFi?

You bet, buddy, it’s like planting seeds for cash crops. Dive into liquidity pools on platforms like Aave Token or mess with ERC20 tokens for staking rewards. Just watch out for illiquid traps and leverage risks, or you might be in a pickle.