In a historic move that could reshape the future of cryptocurrency regulation in the United States, the Senate voted 66–22 late Monday to advance the GENIUS Act, a bipartisan bill focused on bringing structure to the often turbulent world of stablecoins—a form of digital currency tied to traditional assets like the U.S. dollar.

This vote marks a significant legislative step in the federal government’s effort to regulate digital assets, specifically targeting stablecoins, which are increasingly used in global financial transactions. While the bill garnered broad support, including from 16 Democrats such as Sen. Cory Booker (D-NJ) and Sen. Adam Schiff (D-CA), it also faced vocal criticism from lawmakers concerned about ethical conflicts—especially related to former President Donald Trump’s crypto ventures.

What Is the GENIUS Act?

The GENIUS Act, formally titled the Guiding and Establishing National Innovation for U.S. Stablecoins Act, is the first major piece of federal legislation focused exclusively on regulating stablecoins. These digital assets are designed to be less volatile than other cryptocurrencies like Bitcoin or Ethereum because their value is “pegged” to a reserve asset, such as fiat currencies (e.g., USD) or commodities like gold.

Why Stablecoins Matter

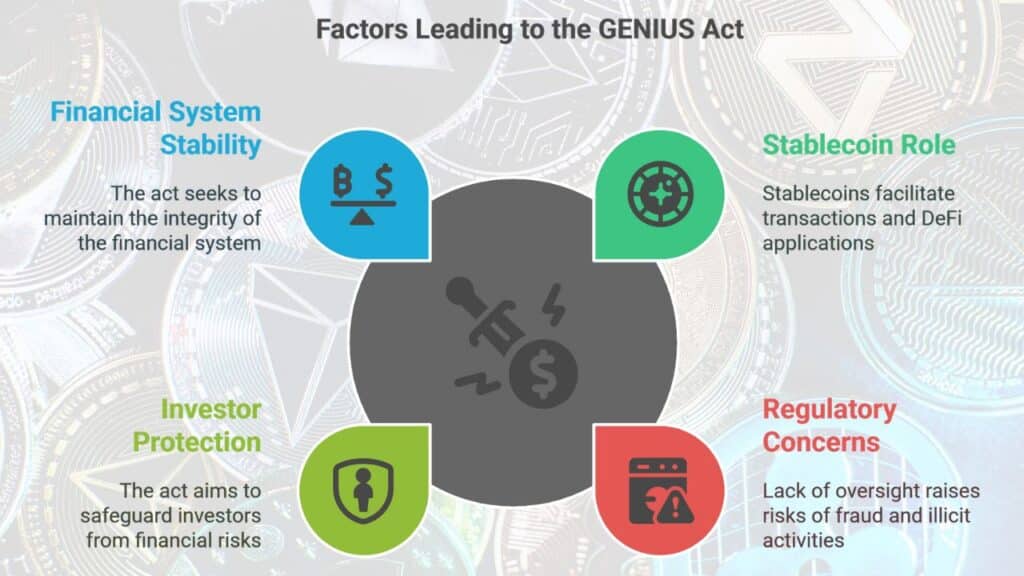

Stablecoins serve a key role in the crypto economy. They are widely used for remittances, decentralized finance (DeFi) applications, and cross-border payments. By offering price stability, they can function as a more practical medium of exchange than volatile digital currencies.

However, the lack of consistent regulatory oversight in the U.S. has raised significant concerns, including:

- Lack of asset-backed guarantees

- Exposure to fraud, insolvency, and hacks

- Use in illicit transactions like money laundering or sanctions evasion

The GENIUS Act aims to address these issues with a regulatory framework that protects both investors and the broader financial system.

What the Bill Proposes: Key Highlights

The GENIUS Act lays out a multi-faceted regulatory scheme for stablecoin issuers. Here are the central provisions:

1. Reserve Asset Requirements

Stablecoin issuers must hold reserve assets that fully back the total supply of coins in circulation. These reserves must be composed of cash or highly liquid government securities like U.S. Treasury bills. This provision seeks to eliminate the risk of insolvency during sudden market downturns or redemption waves.

2. Priority Repayment for Coin Holders

In the event of bankruptcy or insolvency, the bill mandates that stablecoin holders receive priority repayment, ensuring their ability to redeem the coins at face value is not compromised by corporate liabilities.

3. Transparency and Auditing

Issuers will be required to:

- Disclose reserve holdings monthly

- Submit to annual audits

- Maintain clear operational separation between reserve funds and company assets

These requirements are meant to enhance accountability and restore trust among users and investors.

4. Anti-Money Laundering (AML) and Anti-Terrorism Compliance

Issuers must comply with AML policies and adhere to U.S. sanctions laws. This includes conducting Know-Your-Customer (KYC) procedures and filing Suspicious Activity Reports (SARs) when necessary.

5. Conflict of Interest Restrictions

One of the more politically charged clauses prohibits members of Congress and senior executive branch officials from issuing or controlling stablecoins while in public office. This is in response to criticism over former President Trump’s involvement in crypto enterprises while still being a major political figure.

Why the Bill Is Controversial: Support vs. Opposition

Supporters Applaud the Framework

Advocates for the GENIUS Act—including experts like Christian Catalini, founder of the MIT Cryptoeconomics Lab—argue that the bill is a game-changer. They believe it will help legitimize stablecoins, attract institutional investment, and enable mainstream adoption in areas like e-commerce, international remittances, and financial inclusion.

“This sets the stage for these assets to go mainstream,” said Catalini. “Consumers will have more choices, and this will drive competition and innovation in the digital payments space.”

He added that the bill would finally shift the burden of trust from consumers to regulators and market standards, allowing users to safely engage in digital commerce without constantly worrying about fraud.

“It becomes a game of who can deliver better use-cases and features to consumers and businesses the fastest,” he explained.

Financial institutions and fintech companies are also eyeing this legislation as a foundation for integrating stablecoins into banking APIs, payment systems, and cross-border transaction platforms.

Critics Raise Red Flags Over Trump Ties and Weak Oversight

Despite the momentum, critics like Sen. Elizabeth Warren (D-MA) have voiced stern opposition. Warren argued that the bill, in its current form, lacks the teeth needed to truly safeguard consumers and instead serves industry interests.

“While a strong stablecoin bill is the best possible outcome, this weak bill is worse than no bill at all,” Warren said on the Senate floor.

Her primary concern? The bill’s failure to address existing conflicts of interest, particularly relating to Trump’s financial involvement in the crypto space.

In March 2025, World Liberty Financial, a Trump-backed crypto firm, issued a stablecoin known as USD1. Just weeks later, an Abu Dhabi-based fund used USD1 to invest $2 billion into Binance, one of the world’s largest crypto exchanges. Critics argue this could potentially allow Trump to profit from government-sanctioned currency activity, raising ethical and security alarms.

Even though the bill includes a clause to block public officials from issuing stablecoins while in office, Warren said it was not enough:

“This bill provides even more opportunities to reward buyers of Trump’s coins with favors like tariff exemptions, pardons, and government appointments.”

She pushed for stricter conflict-of-interest clauses, cooling-off periods, and more explicit financial disclosures from crypto-affiliated politicians.

Why This Matters to You

If you use, trade, or invest in stablecoins, this bill could significantly affect your digital financial activities. Here’s how:

- Greater Protection: You’ll have legal assurances that stablecoins are fully backed and redeemable, even during market crashes or company bankruptcies.

- Improved Credibility: Institutional adoption may increase, possibly leading to more merchant acceptance, crypto debit cards, and cross-border utility.

- More Regulation: As with any regulation, the cost of compliance may lead to the consolidation of stablecoin issuers, potentially reducing the number of options but increasing trust.

For crypto investors and fintech companies, this legislation may signal the maturation of the digital finance space, with stablecoins acting as a bridge between traditional finance and blockchain-based systems.

What’s Next for the GENIUS Act?

Having cleared the procedural vote, the bill now moves to full Senate debate where amendments can still be proposed. If the Senate passes the final version, it will head to the House of Representatives for another round of scrutiny and voting.

While final passage is not yet guaranteed, the strong bipartisan backing suggests that the GENIUS Act—or a slightly modified version of it—may become law before the end of 2025.

Should that happen, the U.S. would take a leading global role in setting standards for digital currency regulation—at a time when Europe, the UK, and Singapore are also rapidly formalizing their own crypto rules.

The GENIUS Act is a landmark piece of legislation that seeks to bring transparency, security, and stability to a rapidly evolving sector of the economy. While concerns remain—particularly around political influence and enforcement—its passage could be a turning point for how stablecoins operate in the U.S. and beyond.

As the world moves toward digital finance, stablecoins could become as common as debit cards or online banking. With the GENIUS Act, the U.S. is taking a significant first step in preparing for that future.

The Information is Collected from ABC and CNBC.