Farming is tough, and without crop insurance, it’s even harder. In 2025, farmers face big risks like unpredictable weather and rising costs. Crop insurance helps protect them from these challenges, but many still go without it.

This leaves them exposed to financial losses that can ruin their livelihoods.

Farmers without crop insurance struggle with natural disasters, high-interest loans, and unstable market prices. These issues make it hard to recover from crop failures or invest in better tools and practices.

Climate change adds pressure by causing more extreme weather events that damage crops. Without a safety net, farmers face constant stress and uncertainty.

This blog explores the *10 Challenges Faced By Farmers Without Crop Insurance In 2025*. It highlights how lack of coverage impacts food security, mental health, and sustainable farming.

Understanding these problems can help us find solutions for a stronger agricultural sector. Keep reading to learn more about what’s at stake—and why action matters now.

Rising Financial Instability

Farmers without crop insurance face growing financial instability. Crop losses due to natural calamities or market fluctuations can ruin their income. Without a safety net, they struggle to recover from unexpected setbacks.

High-interest loans often become their only option, trapping them in debt cycles.

The rising cost of inputs like fertilizers and crop protection adds pressure. Farmers must pay more but earn less due to unpredictable yields. Limited access to credit further restricts their ability to invest in precision agriculture or advanced farming technologies.

Studies based on expected utility theory indicate that affordable crop insurance can reduce risk aversion among farmers in India and encourage investment in advanced agricultural machinery and crop diversification.

This lack of funding also hinders adoption of sustainable practices like water conservation and crop rotation.

Uncertain water rights make matters worse. Farmers may lose crops if irrigation becomes unreliable during droughts or conflicts over resources. Trade policy issues and volatile markets add extra risks, leaving farmers exposed to sudden price drops.

Without crop insurance, farmers are one bad season away from losing everything.

Small and marginal farmers suffer the most, as their narrow profit margins leave little room for error. The absence of government-backed schemes like Pradhan Mantri Fasal Bima Yojana (PMFBY) leaves them vulnerable to these challenges—financial instability threatens farms and entire communities dependent on agriculture for survival.

Increased Vulnerability to Natural Disasters

Natural disasters hit harder when farmers are unprepared. Many smallholder growers feel this impact deeply because they lack comprehensive coverage plans similar to traditional forms offered under schemes that insure against unforeseen events to protect livelihoods in agriculture in India.

Droughts destroy entire fields overnight; floods wash away months of hard work in cultivating land. Rural communities experience extreme weather events that damage crops and disrupt production. Shifting climatic patterns increase these threats and worsen existing vulnerabilities.

This situation makes recovery challenging and increases pressure on farmers with limited resources to manage loss and damage. Farmers find it difficult to recover fully from recurring disasters.

Difficulty in Recovering from Crop Failures

Crop failures hit farmers hard, especially without crop insurance. Losing a season’s harvest often leaves them struggling to recover financially. Without coverage, they face the full brunt of production risks like climate change and extreme weather events.

These losses can wipe out savings and push farmers into debt.

High-interest loans become their only option to restart farming. Many small and marginal farmers cannot afford essential inputs like seeds or fertilizers after a bad season. This limits their ability to replant or improve soil fertility for future crops.

Market price fluctuations add pressure, making it harder to earn enough from the next harvest. Crop diversification could help, but uninsured farmers lack the funds to invest in it. The cycle of loss and recovery becomes a constant battle — one that threatens their economic growth and food security every year.

Dependence on High-Interest Loans

Farmers without crop insurance often depend on high-interest loans to manage farming costs. These loans carry steep rates, making repayment challenging—particularly after crop failures or market losses.

With no financial safety net, they face increasing debt, restricting their ability to invest in crucial resources like seeds, fertilizers, and machinery. The lack of access to affordable credit forces many into a cycle of borrowing that burdens their economic stability.

High-interest loans also limit farmers’ ability to adopt modern farming practices or sustainable agriculture methods. Without the support of crop insurance, they struggle to handle production risks from climate change and extreme weather events.

This reliance on expensive credit affects their immediate finances and hampers long-term growth and food production stability for small farms across Indian agricultural sectors.

Market Price Fluctuations

Market price fluctuations hit uninsured farmers hard. Without crop insurance, they lack protection against sudden drops in prices. Economic viability becomes a struggle as profits shrink unexpectedly.

Trade policy issues add to the uncertainty, making it harder to predict income. High-interest loans often become their only option to cover losses.

Volatile market conditions force farmers to sell crops at low prices. They face increased financial stress due to unpredictable demand and supply chains. Input costs like fertilizer and crop protection keep rising, squeezing margins further.

Uninsured farmers miss out on risk management tools that could stabilize their earnings during tough times.

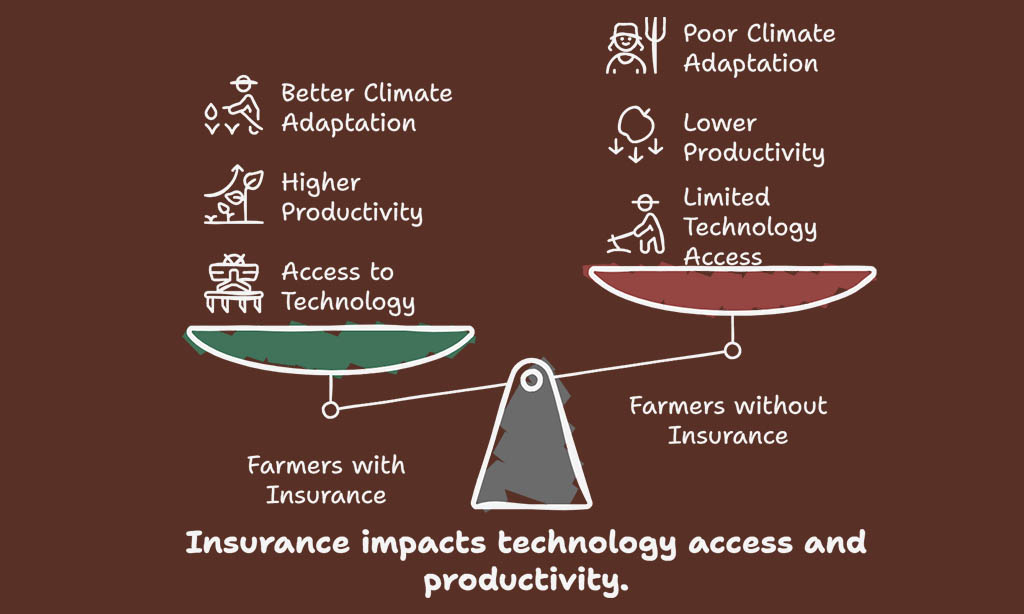

Limited Access to Advanced Farming Technologies

Farmers without crop insurance often struggle to adopt modern farming tools. Advanced technologies like precision farming and internet of things systems improve efficiency but require significant investment.

Uninsured farmers find it hard to afford such innovations, leaving them stuck with traditional methods that yield less.

Without access to these tools, productivity remains low, and climate-smart agriculture practices become out of reach. Technologies like renewable energy solutions or water conservation systems are vital for sustainable farming—yet uninsured farmers can’t invest in them.

This lack of access limits their ability to adapt to climate change and protect crops from extreme weather events.

Reduced Investment in Sustainable Farming Practices

Without crop insurance, farmers often avoid investing in sustainable farming practices. High costs and financial risks make it hard to adopt methods like no-till farming or cover cropping.

These practices improve soil health and reduce greenhouse gas emissions but require upfront spending. Uninsured farmers focus on short-term survival instead of long-term benefits.

Lack of access to credit adds to the problem. Farmers can’t afford advanced tools or regenerative agriculture techniques. Rising input prices for fertilizers and water conservation systems also limit their options.

Without financial safety nets, they stick to traditional farming methods that may harm the environment over time. This lack of investment weakens food systems and slows progress toward climate change adaptation in agriculture sectors.

Decreased Mental Health and Well-being of Farmers

Farmers without crop insurance face immense stress. Financial instability from unpredictable yields weighs heavily on their minds. Natural disasters like floods or droughts add to their worries, leaving them vulnerable to significant losses.

The constant fear of crop failures makes it hard for farmers to plan ahead or feel secure about their future.

High-interest loans become a burden when crops fail. Farmers struggle to repay debts, leading to sleepless nights and anxiety. Market price fluctuations make it even harder to predict income, adding more pressure.

Without the safety net of crop insurance, many farmers feel trapped in a cycle of uncertainty and despair. This takes a toll on their mental health, often leading to feelings of hopelessness and isolation.

Impact on Food Security and Supply Chains

Farmers without crop insurance face serious risks to food security. Crop failures and market fluctuations disrupt supply chains, leading to shortages. Uninsured farmers struggle to recover from losses, reducing their ability to produce enough food.

This instability affects local and national food systems, making prices unpredictable.

Climate change worsens the problem. Extreme weather events damage crops more often, leaving uninsured farmers with no safety net. Without proper infrastructure or access to credit, they can’t invest in sustainable farming practices like water conservation or cover crops.

These challenges ripple through agriculture industries, impacting India’s economy and global trade policies.

Food supply chains depend on consistent production. When uninsured farmers face crop loss due to natural disasters or high input costs, the entire system suffers. Limited access to advanced technologies like internet of things systems further hampers productivity.

The lack of affordable crop insurance leaves small and marginal farmers vulnerable, threatening long-term food security for millions.

Lack of Government Support and Policy Gaps

Government support and clear policies are crucial for farmers, especially those without crop insurance. Many small and marginal farmers face regulatory and legal pressures due to unclear guidelines.

Complex compliance rules make it hard for farmers to access benefits or subsidies. Policy gaps often leave these farmers struggling with uncertain water rights, affecting irrigation needs during critical cultivation periods.

Budget allocation for agriculture often falls short of addressing real challenges. Farmers lack access to affordable crop insurance schemes like the Comprehensive Crop Insurance Scheme.

Without proper risk management tools, farmers remain vulnerable to production risks from climate change economics and market fluctuations. Limited infrastructure further hinders their ability to transport or store agricultural products effectively, reducing profitability in Indian agricultural systems.

Takeaways

Farmers without crop insurance face tough times. Their struggles affect food security and the economy. To understand this better, we turn to Dr. Anil Rao, a leading expert in agricultural economics.

Dr. Rao has over 20 years of experience in farming policies and risk management. He holds a Ph.D. from Cornell University and has published numerous studies on sustainable agriculture.

His work focuses on helping small farmers thrive despite challenges.

“Crop insurance is vital for farmers,” says Dr. Rao. “It protects them from financial losses due to unpredictable weather or market changes.” He explains that without it, farmers struggle to recover from disasters like droughts or floods.

Dr. Rao highlights ethical concerns too. “Uninsured farmers often take high-interest loans,” he notes, “which traps them in debt cycles.” He stresses the need for transparent policies that support fair access to insurance.

For daily life, Dr. Rao suggests simple steps: diversify crops, use water-saving techniques, and adopt affordable technologies like IoT sensors for soil monitoring.

He also points out pros and cons of crop insurance: “While it reduces risks,” he says, “high premiums can be a barrier for small farmers.”

In his final verdict: “Crop insurance is essential but must be affordable and accessible,” concludes Dr. Rao. “It’s key to securing our food systems while supporting farmer livelihoods.”

FAQs

1. Why is crop insurance important for small and marginal farmers?

Crop insurance helps small and marginal farmers manage production risks, like crop loss or failures. Without it, they face high-interest loans and struggle to recover from losses—threatening food security and sustainable farming practices.

2. How does the lack of crop insurance affect water conservation efforts?

Farmers without crop insurance often avoid investing in water conservation methods—fearing financial risks during fallow periods or droughts. This limits their ability to adopt regenerative farming practices that protect topsoil and improve agricultural systems.

3. What role do IRDAI guidelines play in affordable crop insurance?

IRDAI guidelines ensure fair GIS-based assessment claims, making crop insurance more accessible for risk-averse farmers. Without these rules, many farmers find insurance premiums too costly—leaving them exposed to unpredictable weather and other challenges.

4. Can technology like IoT help reduce the need for crop insurance?

Yes, IoT devices can monitor soil health, predict weather patterns, and optimize irrigation—reducing production risks like weeding issues or reduced tillage needs. Technology alone cannot replace the safety net that affordable crop insurance provides against unexpected losses.

5. How does missing out on budget allocation impact local food movements?

Without proper budget allocation for programs like Kshema General Insurance’s tax-exempt plans, farmers struggle to invest in organic farming or cotton-growing initiatives. This weakens local food systems, making it harder to support green deal goals or carbon sink projects effectively.

Disclosure: This content is for informational purposes only and does not substitute for professional advice. Data and insights are based on publicly available sources and expert opinions.