Tax-deferred accounts are powerful financial tools, enabling Australians to significantly grow their wealth by minimizing tax obligations and maximizing investment returns. Understanding how to strategically leverage these accounts can substantially enhance your financial security and retirement preparedness.

In Australia, these accounts primarily include superannuation funds, salary sacrifice schemes, and Retirement Savings Accounts [RSAs]. Each type provides distinct advantages tailored to different financial scenarios, age groups, and income levels.

Through strategic use of tax-deferred accounts, Australians can effectively manage their current taxable income, optimize investment gains, and create a robust financial plan for retirement.

In this comprehensive guide, we’ll delve into 10 Ways to Use Tax-Deferred Accounts to Your Advantage in Australia, ensuring you grasp the intricate details and practical strategies to make informed decisions and significantly boost your financial well-being.

Understanding Tax-Deferred Accounts in Australia

Tax-deferred accounts allow individuals to delay paying taxes on contributions and earnings until funds are withdrawn, often during retirement when their income tax rates may be lower. In Australia, these accounts are essential for optimizing financial planning, leveraging compound interest, and improving long-term financial stability.

Types of Tax-Deferred Accounts Available in Australia

| Account Type | Tax Benefits | Eligibility Criteria | Contribution Limits [2025] |

| Superannuation Funds | Earnings taxed at lower rates | Employed Australians aged 18–75 | $27,500 concessional |

| Salary Sacrifice Schemes | Reduces taxable income | Employees with participating employers | Included in concessional |

| Retirement Savings Accounts | Earnings taxed favorably | Anyone eligible for super contributions | Same as super limits |

10 Ways to Use Tax-Deferred Accounts to Your Advantage in Australia

Strategically utilizing tax-deferred accounts can substantially improve financial outcomes by minimizing immediate tax burdens and amplifying the potential for growth through compounding. Properly managing these accounts allows Australians to proactively control their taxable income, increase long-term financial security, and effectively plan for retirement.

By understanding key mechanisms such as superannuation contributions, salary sacrifices, and government incentives, individuals can tailor their financial strategies to suit their personal and financial circumstances, enhancing overall wealth and retirement readiness.

1. Maximize Your Superannuation Contributions

Maximizing super contributions effectively boosts retirement savings, taking advantage of significantly lower taxation rates on contributions [15% vs. higher marginal rates]. This strategic approach provides notable tax savings and allows Australians to build substantial wealth over time through compound interest and investment growth.

Consistently maximizing contributions not only reduces taxable income but also ensures long-term financial security and flexibility.

| Contribution Type | Tax Rate | Benefit |

| Concessional [Pre-tax] | 15% | Reduced current taxable income |

| Non-concessional [Post-tax] | 0% on deposit | Tax-free withdrawals in retirement |

Case Study: Jessica, earning $90,000 annually, boosted her concessional contributions to the maximum limit of $27,500, saving approximately $4,875 annually in taxes.

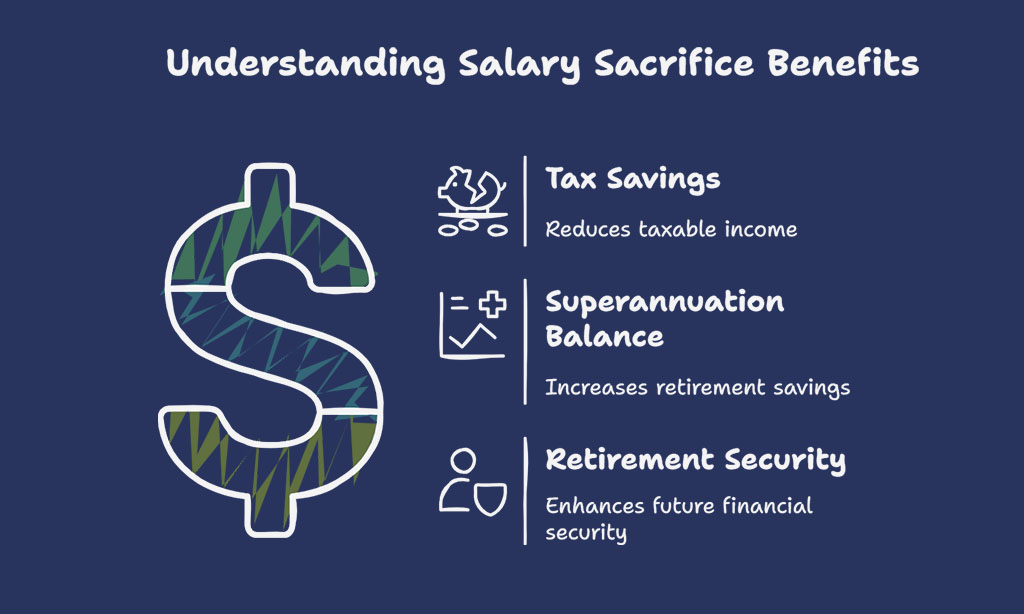

2. Leverage Salary Sacrifice Arrangements

Salary sacrificing into your super reduces taxable income, significantly enhancing overall savings. Employers direct pre-tax salary portions into super, providing dual benefits of tax savings and improved retirement security.

This arrangement allows Australians to lower their current income tax obligations, increase their super balance efficiently, and build a significant retirement nest egg with minimal lifestyle impact.

| Income without Salary Sacrifice | Income with Salary Sacrifice | Annual Tax Savings |

| $100,000 | $90,000 | ~$3,750 |

3. Utilize Government Co-Contributions

The Australian Government supports lower and middle-income earners by contributing up to $500 annually to their super for eligible after-tax contributions. This incentive encourages Australians to boost their retirement savings, particularly beneficial for individuals with moderate income, ensuring they receive additional government-backed financial support to secure their future.

| Income Bracket | Your Contribution | Government Contribution |

| Up to $43,445 | $1,000 | Up to $500 |

Example: John earns $40,000 annually and contributes $1,000 to his super fund, resulting in an additional $500 from the government annually.

4. Consider Spouse Contributions for Extra Benefits

Contributing to your spouse’s super account can result in tax offsets of up to $540 per year, significantly enhancing joint retirement planning.

This approach helps balance super balances between partners, optimizes joint retirement planning, and provides meaningful tax benefits, particularly beneficial when one spouse earns considerably less or takes career breaks.

| Spouse’s Annual Income | Contribution Amount | Maximum Tax Offset |

| Under $37,000 | $3,000 | $540 |

5. Invest Strategically Within Your Tax-Deferred Account

Strategic investment involves diversification among equities, ETFs, and managed funds to achieve optimal long-term returns.

Effective investment strategies within tax-deferred accounts enhance financial growth through targeted, risk-adjusted returns, maximizing your financial outcomes and ensuring substantial retirement savings.

| Investment Type | Risk Level | Potential Returns |

| Stocks/ETFs | Medium-High | 7-10% annually |

| Managed Funds | Medium | 5-8% annually |

| Fixed Interest | Low | 2-4% annually |

6. Take Advantage of Transition to Retirement [TTR] Strategies

Transition to Retirement [TTR] strategies enable Australians aged 55 and older to begin accessing their super while still employed. This strategy helps manage income levels and taxation more effectively, allowing older workers to reduce working hours without compromising their income.

TTR pensions can be structured to minimize income tax, allowing continued growth within the superannuation fund. It’s a flexible approach ideal for those nearing retirement age, enabling better financial management during the critical pre-retirement period.

| Age Range | Benefit Type | Key Advantage |

| 55-65 | TTR Income Stream | Reduced income tax, increased savings |

7. Utilize Catch-Up Contribution Opportunities

Catch-up contributions provide flexibility for Australians with fluctuating incomes, allowing unused concessional caps from previous financial years to be utilized within a five-year period.

This provision helps individuals who may have had lower-income years catch up on contributions in higher-earning periods, maximizing tax benefits. Catch-up contributions are particularly beneficial for self-employed individuals and those experiencing significant income variability due to career breaks, parental leave, or part-time work.

| Years Available | Max Accumulated Cap | Potential Tax Savings |

| 5 | Up to $137,500 | Potentially $20,625 in tax savings |

8. Optimize Retirement Savings Accounts [RSAs]

Retirement Savings Accounts [RSAs] offer guaranteed returns and minimal risk, making them particularly appealing for conservative investors or those nearing retirement. RSAs provide a stable and predictable growth environment, which is beneficial during market volatility.

Although offering lower returns compared to aggressive investment options, RSAs’ security ensures steady growth, safeguarding retirement savings against market fluctuations. RSAs also enjoy favorable tax treatment, boosting their appeal for cautious investors.

| RSA Features | Interest Rate | Suitable For |

| Low Risk, Stable | 2%-3% p.a. | Conservative investors near retirement |

9. Strategic Withdrawal Planning to Minimize Tax

Careful withdrawal planning from tax-deferred accounts can significantly minimize tax liabilities in retirement. Structuring withdrawals as phased income streams or tax-effective lump sums ensures optimal tax efficiency.

Strategic withdrawals consider personal income needs, market conditions, and tax brackets, significantly preserving the retirement savings balance. Effective withdrawal strategies leverage favorable tax treatments, maximizing financial longevity throughout retirement.

| Withdrawal Strategy | Tax Efficiency | Recommended Use |

| Lump Sum | Tax-free [limits apply] | Major purchases or expenses |

| Income Stream | Tax-free after age 60 | Regular living expenses |

10. Regularly Review and Adjust Your Strategy

Regularly reviewing and adjusting your tax-deferred account strategies is crucial for adapting to changing personal circumstances, investment markets, and legislative updates. Regular assessments help optimize tax efficiency, ensuring contributions and investments align with current goals and financial situations.

Proactive reviews can uncover opportunities for increased savings, reduced taxes, or improved investment performance, enhancing overall retirement readiness.

| Review Frequency | Actions Recommended |

| Annual | Adjust contributions, rebalance portfolio |

| Quarterly | Monitor investment performance |

Takeaways

Effectively leveraging these 10 ways to use tax-deferred accounts to your advantage in Australia can lead to substantial financial benefits, ensuring a comfortable and secure retirement.

By understanding and strategically employing superannuation funds, salary sacrifice arrangements, government co-contributions, spouse contributions, and TTR strategies, Australians can optimize their tax savings and investment growth.

Regularly reviewing and adjusting your strategies in line with changing circumstances, market conditions, and legislative updates is crucial for long-term financial success. Taking a proactive approach to managing tax-deferred accounts will empower you to maximize your wealth, minimize your tax burden, and secure your financial future.

![Take Advantage of Transition to Retirement [TTR] Strategies](https://editorialge.com/wp-content/uploads/2025/04/Take-Advantage-of-Transition-to-Retirement-TTR-Strategies.jpg)