Do you struggle to find a credit card that fits your needs? The Torrid credit card comes from Comenity Bank and gives a 5% discount on your purchases. This guide shows you how to get a torrid credit card by teaching steps to join the free loyalty program, use a discount code, and benefit from cash back and other perks while checking your credit report and credit scores.

Read on.

Key Takeaways

- Join the free Torrid Rewards Program to earn one point for every dollar you spend.

- Apply for the card online with your name, address, and income details and wait for Comenity Bank to review your form.

- Use the email discount code for 40% off an online purchase and get a $15 coupon when you spend $50 or more.

- Boost your approval by checking your credit report, keeping credit use under 30%, and showing a steady income.

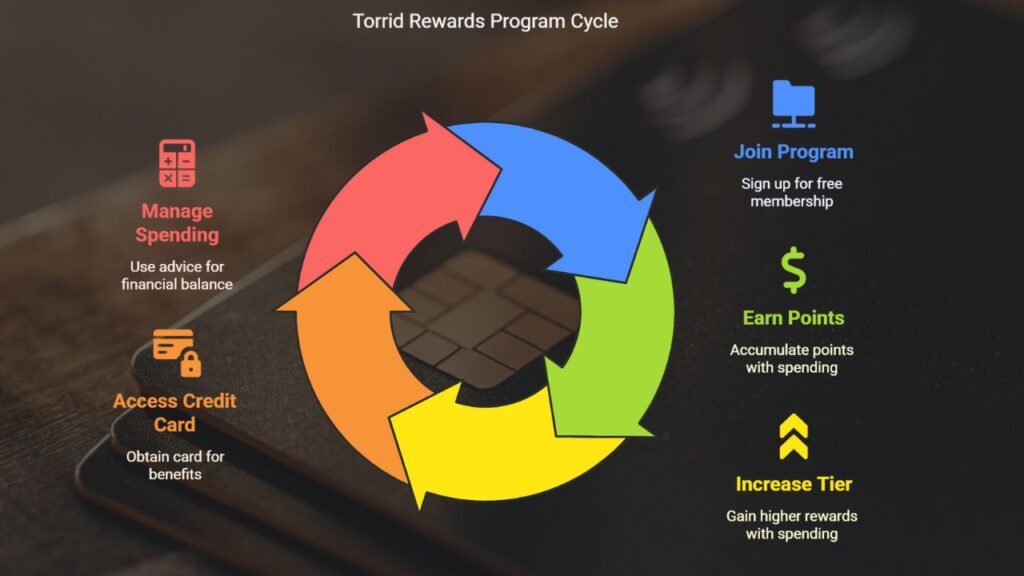

Join the Torrid Rewards Program

Join the Torrid Rewards Program for free. You earn one point for every dollar spent at Torrid. The program uses three tiers that reward more spending. Points grow faster with higher tiers and add value to your rewards program benefits.

Membership is required to get the Torrid credit card. Credit cards need this step to work with Comenity Bank. An investment adviser might guide you on managing your interest and spending.

Shop smart and earn rewards along the way.

Steps to Apply for the Torrid Credit Card

You can apply for the torrid credit card in a few quick steps. This card comes from Comenity Bank and has no annual fee.

- Visit Torrid’s credit card page to find the application form.

- Fill the form with your name, address, and income details.

- Check the details carefully and hit submit.

- Wait for Comenity Bank to review your application.

- Check your email for a 40%-off discount code for one online purchase; note it does not work on clearance or in-store items.

- Use the discount code on the day you are approved.

- Get a $15 coupon for a $50 or more purchase at Torrid, either online or in-store.

Now, see tips for increasing your approval chances.

Tips for Increasing Your Approval Chances

These tips boost your chances for a card approval. They help you get a torrid credit card without many hassles.

- Verify your credit record to spot mistakes that can hurt your score.

- Lower your credit use by paying down other balances until you stay under 30%.

- Show a steady income on your application to back up your spending power.

- Complete your application with all the required details to avoid delays.

- Pay your bills on time to keep your score high and avoid extra charges from the 35.99% APR.

Takeaways

This guide gives clear steps to get your Torrid card. Join the free rewards club and fill out the application online with care. Follow these tips to boost your approval and pay your bill on time to avoid high fees.

For more information on where you can use your card, read our detailed guide on using the Torrid Credit Card at various locations.

FAQs

1. What is a Torrid plastic?

A Torrid plastic is a card that helps you shop at Torrid. It works like any other card. Many folks use it to manage spending and build credit.

2. How do I submit an application for this card?

Visit the website and fill out the short form. Follow the steps as you see them. The guide walks you through each little step.

3. What do I need for approval?

You need a steady income and a clean credit check. The process checks your history. Follow the step-by-step guide to keep errors at bay.

4. What if my application does not get the green light?

Don’t sweat it if you hit a snag. Check your details and try again later. Sometimes, a bump on the road lets you learn and grow.