Do you struggle to sort out postal box addresses and the companies behind them? Many readers face a mix-up with post office boxes. You ask, “what company is po box 55020 portland, oregon 97238”? This post aims to clear up that confusion with solid facts.

We share that Quick Collect Inc is a debt collection agency from Portland, OR. It has served consumers for 39 years. Our guide will help you learn about postal codes, consumer rights, and debt collection rules.

Read on.

Key Takeaways

- Quick Collect Inc is a debt collection agency in Portland, OR. It has worked for 39 years and is led by Mr. Jason Garner. They follow fair credit reporting and debt collection laws.

- The company is tied to PO Box 55020 in Portland, OR. Some records show PO Box 55457, so the addresses may be confused. Check your records carefully.

- Quick Collect helps recover unpaid medical bills and sends out phone calls and emails to serve consumers. They use many phone numbers for help.

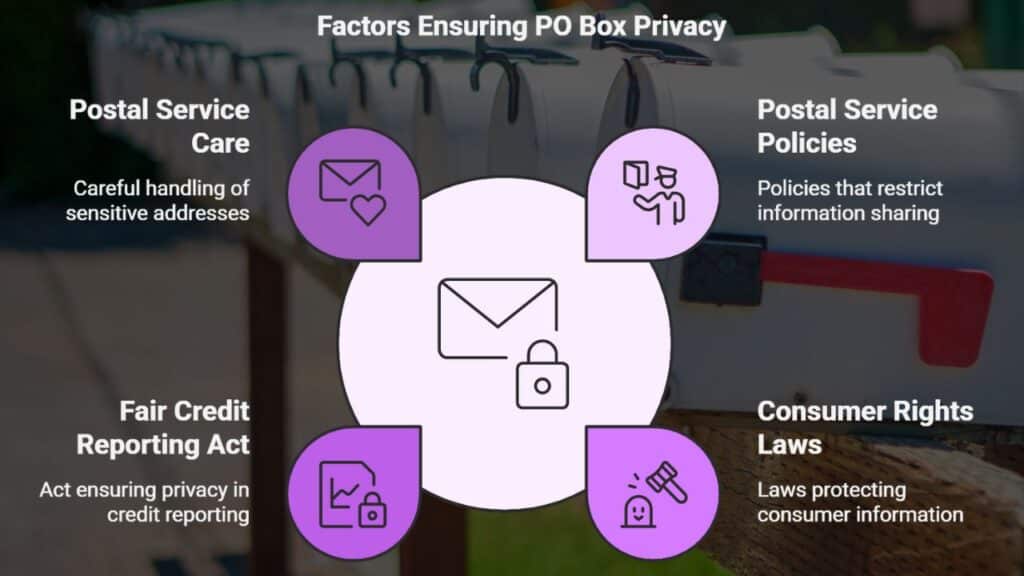

- PO Boxes keep owners’ details private. The post office does not share names or addresses, and this rule protects personal data.

Who Operates from PO Box 55020 Portland, Oregon 97238?

The discussion moves forward from the introduction. PO Box 55020 sits within ZIP Code 97238-5020 in Portland, OR. Ninety-nine boxes serve this area. The postal service runs these PO boxes in Multnomah County.

Mail delivery flows through these boxes with ease.

Quick Collect Inc works from PO Box 55457, not from PO Box 55020. Consumers may mix details about these PO boxes. Debt collection agencies and legal action seekers should note the different addresses.

This difference matters when checking consumer rights and credit reports.

About Quick Collect, Inc.

Quick Collect, Inc. is a Portland firm that aids in debt collection and supports consumer rights. The firm follows fair credit reporting laws and helps people with credit report issues.

Overview of the Company

Founded on May 21, 1985, the company set its roots with a local start on January 1, 1993. This firm also goes by the name Q C I. Mr. Jason Garner leads the team. The business has thrived for 39 years.

A Better Business Bureau file opened on October 22, 2001.

Operating from PO Box 55020 in Portland, OR, the company uses a ZIP+4 code for precise addressing. It upholds consumer rights and follows the Fair Credit Reporting act. Clients deal with credit report inquiries and debt collector responsibilities.

FAA regulations and the Telephone Consumer Protection Act guide its practices. Air traffic rules and aviation safety policies shape its services.

Services Offered by Quick Collect

Quick Collect offers vital services to help recover medical debts. Their work gives extra support to both collectors and consumers.

- Debt Collection Service: Quick Collect gathers unpaid bills from medical providers. They work under the Fair Debt Collection Practices Act.

- Medical Bills Collection: The company targets overdue medical debts. They aid in recovering household debts, loans, and other amounts.

- Legal Compliance Support: Quick Collect follows guidelines from the Fair Credit Reporting Act. They stick to consumer rights during every action.

- Payment Negotiation Service: The team works on contingency-fee arrangements. They help adjust payment plans and settle credit card claims.

- Communication Service: The firm uses e-mail and phone to reach consumers. They operate from a clean street address in Portland, OR.

- Data Accuracy Check: The company tracks credit report inquiries. They monitor details like zip+4 codes to back up their debt collection actions.

Contact Information for Quick Collect

Quick Collect uses a mailing box at P.O. Box 55020 in Portland, OR. They run active call centers that help with consumer rights and debt issues.

PO Box Address

PO Box 55457 in Portland, OR anchors the ZIP+4 code 97238-5001, which covers boxes numbered 55001 to 55116. This system supports secure general delivery and helps meet consumer rights regulations.

Debt collectors and attorneys use these addresses when handling lawsuits, bankruptcy, and identity theft claims. Firms also list this PO Box in HTML pages and advisory circulars for the national airspace system and air carrier updates.

A building at 5500 NE 107th Ave in Vancouver, WA 98662-6169 and PO Box 821330 in Vancouver, WA 98682-0030 appear on some records. The addresses serve roles in fleet post office operations and general aviation checks.

They support notifications such as temporary flight restrictions and pilot certificates. Attorney’s fees and actual damages claims sometimes rely on this mailing system.

Phone Numbers Used by the Company

After detailing the PO Box address, we now list the phone numbers used by the company. These numbers let readers connect about consumer rights, the fair credit reporting act, contingency fees, attorneys’ fees, and more.

- (360) 256-7888 helps you with general consumer questions.

- (503) 252-0083 offers direct support for service inquiries.

- Toll-free (800) 252-6322 handles broad customer service calls.

- Fax (360) 256-8890 transmits important documents.

- (314) 255-1694 supports credit report inquiries and consumer rights issues.

- (414) 390-9721 connects you with agents on legal and collection topics.

- (443) 478-4834 directs calls about contingency fee matters and attorneys’ fees.

- (800) 214-5305 takes questions on wage garnishment and debt collection concerns.

- (877) 796-2497 assists with disputes, including passenger facility charge queries.

Can You See Who Owns a PO Box?

PO boxes keep their owners’ details safe from public view. The postal service does not give out names or addresses tied to a box. Rules like consumer rights laws protect the owner’s records.

Some people in Portland, or, use PO Boxes to keep their personal data private. The system treats FPO addresses with care. Sellers or companies also use these boxes to hide sensitive details.

Sensitive info stays locked behind strict postal rules.

People try to find out who rents a PO Box, yet no list exists for the public. The post office holds all ownership data in secure files. Investigators and private parties cannot access these records easily.

Laws, including the Fair Credit Reporting Act (FCRA), support these privacy measures. Officials restrict data to protect individuals from being sued or harassed. No database displays the true owner of a sealed box.

Common Issues and Complaints Against Quick Collect

Some customers report problems with credit report checks and share complaints that spark a lively chat—read on for more details.

Credit Report Inquiries

Credit report inquiries make a mark on your credit file. The Fair Credit Reporting Act stops errors. Forty million Americans have seen mistakes on their reports. Quick Collect has faced over 110 lawsuits.

Debt collectors may skip noting disputed debts.

Inaccurate credit checks hurt your score. Wrong entries add stress and worry. Consumers in Portland, OR should review their files often. Consumer rights help you fight back and fix errors.

Consumer Complaints

Quick Collect gets many consumer complaints in Portland, or. The company saddles debtors with unwanted calls.

- They hold an F rating from the Better Business Bureau.

- They faced 16 complaints with no reply.

- They claim individuals owe money when they do not.

- They call consumers before 8:00 AM and after 9:00 PM.

- Consumers report issues with unwanted debt calls.

Legal Actions and Settlement Options

Quick Collect files lawsuits and may garnish wages if you owe them money; read on to learn about legal settlements and debt collection rules.

Can Quick Collect Sue You?

The company does not sue for judgments. Debt collectors follow the Fair Debt Collection Practices Act, which shields you from abuse. Penalties can reach $1,000 for harassment. The Telephone Consumer Protection Act also applies and sets fines of $500 per robocall and $1,500 for willful violations.

Debt collectors must stick to these laws. They face steep fines if they overstep. Penalties work as a strong deterrent. Courts back the rules to keep your rights safe.

Wage Garnishment and Debt Collection Violations

Our talk changes from suing matters to wage garnishment and debt collection actions. We list clear facts for you:

- A judge must issue a valid judgment before wage garnishment starts.

- Quick Collect has faced over 110 lawsuits.

- Unauthorized recurring charges trigger EFTA penalties.

- Consumers may claim $1,000 for harassment.

- Damages from robocalls can range from $500 to $1,500 under FCRA laws.

- Debt collectors may break rules if they ignore legal limits on wage garnishment.

Takeaways

This article showed key facts about Quick Collect Inc. You saw its main PO Box and years of work. The firm works as a debt collector and handles medical bills. Check your rights with office help and online tools.

Act today and take a small step to fix your money matters.

For more detailed insights on whether it’s possible to discover the owner of a PO Box, click here.

FAQs

1. Which firm uses PO Box 55020 in Portland, Oregon 97238?

No single company owns this mailbox. Often, firms choose a post office box for their mail. Records may show several users for the same PO Box.

2. How can I check which business acts from this address?

Try searching local listings and online directories. Sometimes, public records provide more details, too.

3. Does this address belong to one company only?

Sometimes a mailbox like this is shared by small firms. The post office box can serve more than one organization, adding extra layers to the search.

4. What should I do to contact the company using this address?

Look for additional contact information in official files or websites. You might also call local offices for a clearer response.