US stocks suffered a sharp decline on Monday as investors reacted to President Donald Trump’s confirmation that tariffs on Mexico and Canada would take effect at midnight.

The Dow Jones Industrial Average tumbled 650 points, or 1.48%, to close at 43,191, after briefly plunging nearly 900 points in afternoon trading. The S&P 500 fell 1.76%, marking its worst one-day decline of the year, while the Nasdaq Composite slid 2.64%.

The stock market downturn was triggered by growing concerns over the economic impact of the tariffs. Wall Street’s fear gauge, the VIX index, surged to its highest level this year, reflecting heightened uncertainty among investors.

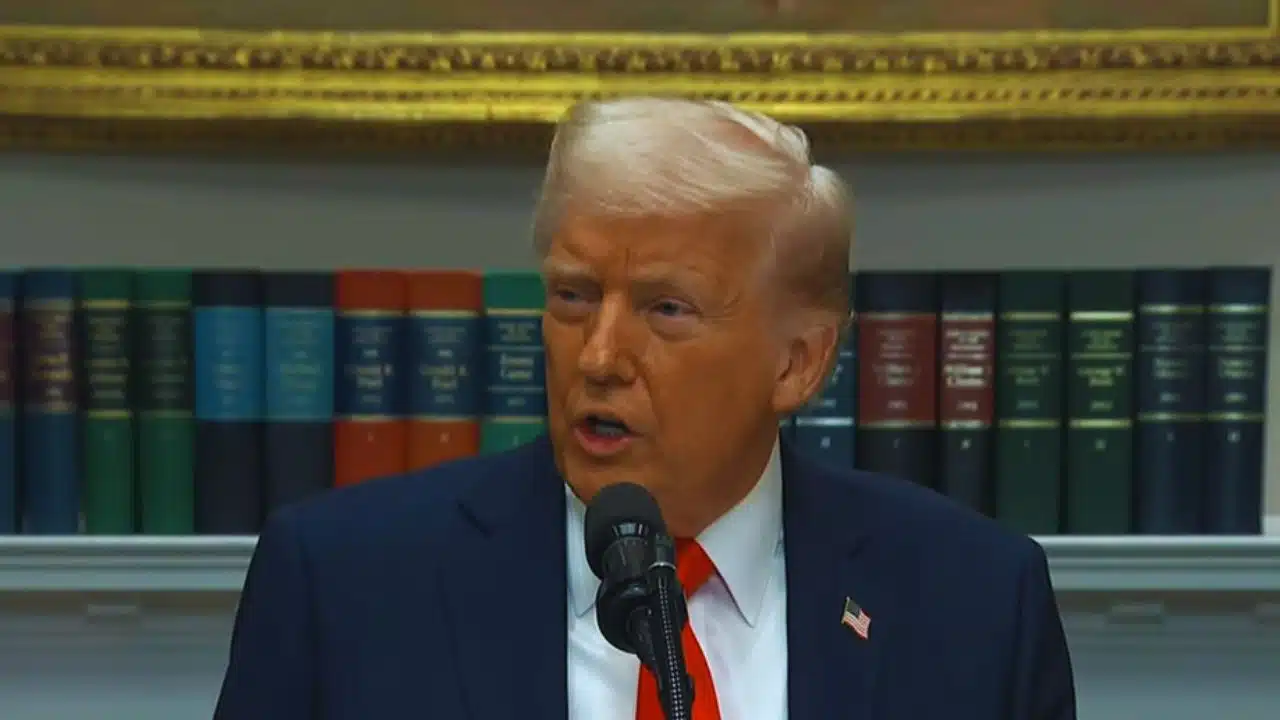

Trump Stands Firm on Tariff Decision

During a press conference at the White House, Trump confirmed that a 25% tariff on imports from Canada and Mexico would begin on Tuesday. He defended his decision, stating that these measures were necessary to encourage companies to build manufacturing plants in the United States.

“They’re all set. They go into effect tomorrow,” Trump declared. “What they have to do is build their car plants, frankly, and other things in the United States, in which case they have no tariffs.”

Trump also dismissed the possibility of further negotiations with the two neighboring nations, saying they had “no room left” to avoid the levies. He framed the tariffs as a way to “punish” countries that, in his view, were benefiting from the US economy without providing enough in return.

Canada and China Respond with Countermeasures

In response to Trump’s move, Canadian Prime Minister Justin Trudeau announced that Canada would impose retaliatory tariffs on $30 billion worth of US goods if the US tariffs proceed as planned. “Canada will not let this unjustified decision go unanswered,” Trudeau said in a statement.

Meanwhile, China also reacted strongly to Trump’s decision to increase tariffs on Chinese imports from 10% to 20%. A spokesperson for China’s Ministry of Commerce expressed the country’s “strong dissatisfaction” and warned of potential countermeasures to safeguard China’s economic interests.

Market Uncertainty and Economic Impact

The stock market’s sharp drop erased some of the gains made after Trump’s election, with the Nasdaq now down about 6.5% since his inauguration on January 20. Analysts at Goldman Sachs noted that while tariffs may boost demand for US-made goods, they could also hurt domestic producers by raising production costs and triggering foreign retaliation against US exports.

“Tariff increases will also raise production costs for some domestic producers and will likely prompt foreign retaliation against some US exports, both of which could hurt domestic production,” Goldman Sachs analysts wrote in a note.

Jason Draho, head of asset allocation for the Americas at UBS Global Wealth Management, predicted market volatility until Trump’s economic policies become more growth-focused. However, he maintained a positive medium-term outlook, stating, “2025 can still be a positive year for stocks, but it may take all year to realize gains. And they may be modest.”

Fear Grips Investors as Economic Indicators Flash Warnings

The stock market’s slide came as investors reacted to the latest manufacturing survey from the Institute for Supply Management, which showed that while economic activity in the manufacturing sector remained in expansion territory, it had slowed in the past month. Tariff concerns dominated the survey’s write-in responses.

News media Fear and Greed Index indicated that market sentiment had dipped into “extreme fear” following Trump’s announcement. Stocks such as Nvidia (NVDA) dropped 8.7%, while the yield on the 10-year Treasury note fell to 4.16%, signaling investor concerns about economic uncertainty and slowing future growth.

Bitcoin and Oil Markets Also Take a Hit

The cryptocurrency market was also affected, with Bitcoin trading around $85,600 on Monday afternoon, down 8.6% in the past day. This drop erased gains made after Trump’s recent announcement of a strategic crypto reserve that would include Bitcoin.

Meanwhile, oil prices declined, with WTI crude, the US oil benchmark, falling about 2% to its lowest level since December. The decline followed OPEC+’s decision to increase oil production starting in April, adding further pressure to the energy market.

Looking Ahead

As Trump’s tariffs go into effect, investors will closely watch how Canada, Mexico, and China respond in the coming days. While some analysts believe the US economy can still post gains in 2025, uncertainty remains high, and markets are expected to remain volatile. With further tariff policies, including reciprocal tariffs on agricultural products set to take effect on April 2, economic tensions are unlikely to ease soon.

The Information is Collected from CNN and NBC News.