Businesses are increasingly seeking methods to streamline operations, minimize expenses, and ensure compliance as they expand internationally. One of the most strategic decisions an international business can make is to outsource its accounting functions. Companies can use outsourced accounting services to increase efficiency, improve compliance, and drive growth while effectively managing their resources.

Outsourcing accounting provides substantial benefits for international companies dealing with the complexities of various currencies, tax regulations, and compliance requirements across multiple regions. Below are some key advantages that outsourcing accounting offers to global businesses.

1. Cost Savings

One of the most significant advantages of outsourced accounting is the potential for substantial cost savings. Managing an in-house accounting department can be expensive, especially for small and medium-sized enterprises [SMEs]. By outsourcing, businesses can reduce overhead costs such as salaries, benefits, office space, and equipment.

2. Access to Expertise and Technology

Outsourcing accounting allows businesses to tap into specialized expertise that would otherwise be difficult to afford in-house. Accounting firms with global reach often employ skilled professionals with experience in handling international tax laws, regulations, and financial reporting standards. This expertise can ensure that your financial practices are efficient and compliant with international standards.

Furthermore, outsourcing firms typically use advanced accounting software and technology to streamline operations, improve accuracy, and enhance reporting capabilities. For businesses operating in multiple countries, using such technology can significantly simplify the process of managing different currencies, tax regulations, and financial records.

3. Focus on Core Business Functions

Managing accounting tasks can be time-consuming, and for international businesses, the complexity of complying with various tax regulations, payroll systems, and financial laws in different countries can strain resources. Outsourcing allows businesses to free up valuable time and focus on their core competencies, such as product development, marketing, and customer service.

4. Scalability and Flexibility

Outsourcing accounting offers the flexibility to scale your financial operations based on the needs of your business. Whether your business is expanding into new markets or handling a fluctuating volume of transactions, outsourcing firms can adjust their services to suit your requirements. This flexibility helps ensure that your accounting processes are always aligned with your business’s needs, without the need to hire or lay off internal staff.

Scalability is extremely valuable in international business. It allows companies to adapt to changes in their global operations without the complexity of hiring local accountants or establishing new offices.

5. Improved Accuracy and Compliance

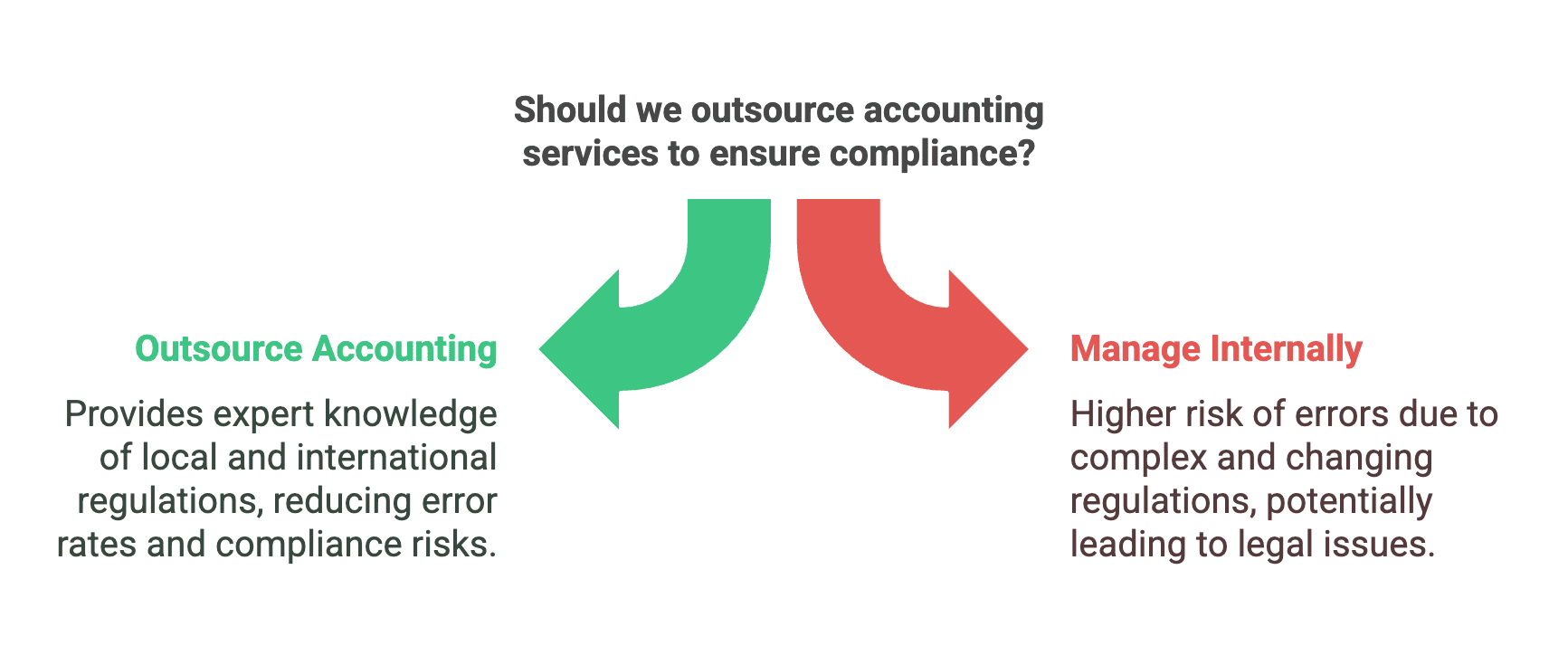

Managing accounting for a global business often requires adhering to a wide range of compliance requirements, from local tax laws to international accounting standards. Keeping track of these ever-changing regulations can be a challenging and error-prone task for internal teams. A Gartner survey found that 18% of accountants make daily financial errors, one-third make weekly mistakes, and 59% make errors monthly.

Outsourcing accounting services ensures that businesses remain compliant with regulations in various countries. Outsourcing firms employ experts who are well-versed in local tax laws, reporting standards, and compliance issues, avoiding costly penalties and legal issues.

6. Better Financial Reporting and Decision-Making

Outsourcing your accounting functions also improves the quality and timeliness of your financial reporting. Outsourcing firms provide regular, detailed financial reports that help business leaders make informed decisions. Balance sheets, income statements, and cash flow analysis are all required to understand the company’s financial health.

With more accurate and timely financial data, international businesses can make better decisions on budgeting, forecasting, and planning. This ultimately supports long-term growth and sustainability in a competitive global marketplace.

7. Enhanced Security

Handling sensitive financial data requires a high level of security. Outsourcing accounting can help businesses ensure that their financial information is protected with the latest data encryption and security technologies. Reputable outsourced accounting firms have robust systems in place to protect against cyber threats, ensuring that your company’s financial data remains secure.

Additionally, outsourcing firms often have contingency plans in place to manage potential risks, including backup systems and disaster recovery strategies. This level of security is particularly important for international businesses that may handle large volumes of financial data across multiple jurisdictions.

8. Improved Cash Flow Management

Maintaining a healthy cash flow is crucial for the survival and growth of any business, especially for international companies dealing with multiple currencies. Outsourced accounting helps businesses manage cash flow by ensuring timely invoicing, accurate accounts payable and receivable processes, and efficient expense tracking. This helps businesses avoid payment delays and ensure that there are enough funds available to cover operational costs.

Outsourced accounting offers international businesses a host of benefits, including cost savings, access to expertise, improved financial accuracy, and enhanced compliance. By outsourcing accounting functions, businesses can focus on their core operations, scale more effectively, and make informed financial decisions that drive long-term growth.

As international business environments become increasingly complex, the decision to outsource accounting services can provide a competitive edge. Whether managing cross-border operations, navigating regulatory changes, or simplifying financial processes, outsourced accounting provides the flexibility and expertise that businesses need to thrive in the global marketplace.

Outsourcing accounting is not only a cost-effective solution for companies looking to scale their operations globally but also a strategic move that can help businesses succeed and grow.