Nonprofit organizations operate under unique financial circumstances that necessitate specialized accounting methods. Fund accounting is one such method tailored to meet the specific needs of these entities. But why do nonprofits rely so heavily on this system? A look into the intricacies of fund accounting reveals its significance in maintaining transparency, accountability, and financial stability.

Understanding Fund Accounting

Nonprofits differ from businesses in that they are not driven by profit-making goals but by their dedication to fulfilling a mission or purpose. They rely on fund accounting for foundations to categorize resources based on their intended use. Each fund serves as a set of accounts that helps them monitor income and expenses related to specific activities or projects.

This setup offers transparency in how nonprofits manage funds to guarantee that donations and grants are utilized for their designated purposes accurately and effectively, which builds trust among donors and stakeholders, resulting in support and confidence.

Advocating for Openness in Financial Matters

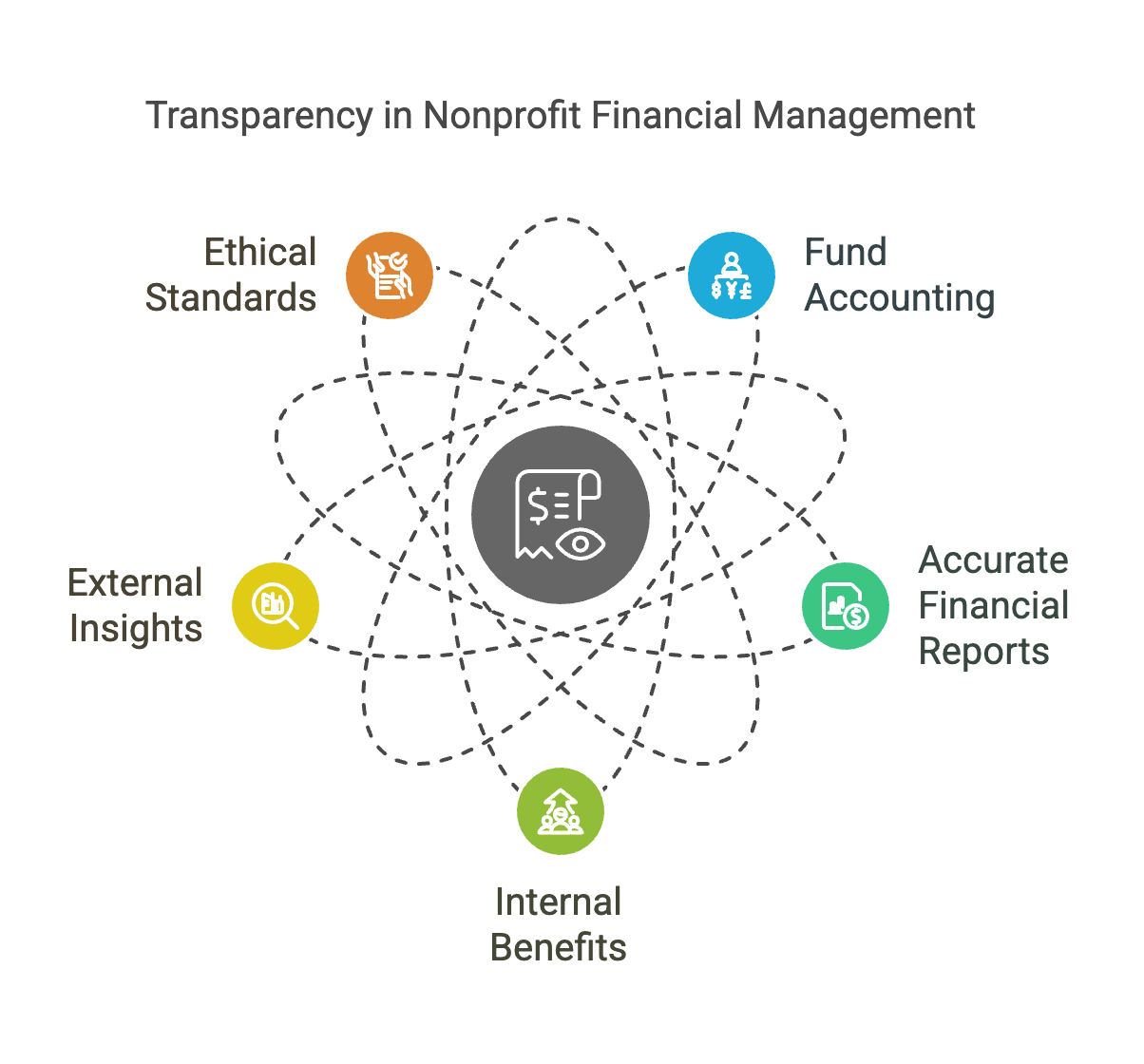

Nonprofit organizations rely heavily on transparency to uphold their integrity and trustworthiness in the community they serve. Fund accounting provides a comprehensive overview of how financial resources are handled within these entities. Maintaining accounts for activities and expenditures within the organization’s financial structure helps generate accurate financial reports that truly represent the organization’s financial health and stability.

This level of openness doesn’t just help those within the organization. It also reaches outside groups like auditors and regulatory agencies who need insight into how a company handles its finances. Accurately depicted fund allocation allows nonprofits to show their dedication to upholding ethical financial standards.

Strengthening Responsibility

Accountability plays a role in nonprofits’ operations as well. Fund accounting enhances this by monitoring the movement of resources. Through comprehensive documentation, organizations can effectively demonstrate how funds are used to meet donor restrictions and legal obligations.

It’s really important to maintain trust by being accountable for how donations are managed because it encourages donors to keep supporting the organization and shows regulatory bodies that it follows the law and ethical standards.

Assisting in Making Decisions

Making informed decisions is key to the success of every organization and nonprofits are no different in this aspect. Fund accounting plays a role in this by offering financial information. This enables decision-makers to evaluate the well-being of projects and initiatives hence enabling them to distribute resources efficiently.

When leadership teams grasp the impact of each project they undertake and prioritize those that resonate with the organization’s mission statement, they can ensure that resources are used as effectively as possible to boost the organization’s success in reaching its objectives.

Navigating through Various Funding Channels

Nonprofit organizations commonly depend on funding streams such as donations from individuals or companies and financial aid from bodies to support their operations and initiatives effectively.

This flexibility allows organizations to address the requirements linked to forms of funding effectively. Maintaining documentation enables nonprofits to showcase their capacity to handle a range of assets, which can help attract increased backing and opportunities for expansion.

Ensuring Sustainable Practices for the Long Term

Nonprofit organizations value sustainability as it ensures long-term stability and financial health. Transparency is upheld through fund accounting practices that assess individual fund performances to pinpoint strengths and weaknesses within the organization.

Leadership can utilize this information to make informed choices regarding how resources are allocated, and risks managed, as well as for strategic planning purposes. Nonprofits, with a grasp of their position, can then create plans to guarantee their longevity and achievement in the long run.

Takeaways

Nonprofit organizations rely heavily on fund accounting not only for management but also for fostering transparency and accountability while aiding in informed decision-making processes. The adoption of this accounting system enables nonprofits to efficiently handle funding channels and secure their longevity by ensuring sustainability over the term. At its core, fund accounting empowers organizations to achieve their goals and create enduring effects within the communities they support. In a world where trust and integrity are crucial, fund accounting establishes the structure that allows nonprofits to flourish.