The mortgage industry has traditionally been complex, time-consuming, and laden with paperwork. Many borrowers have struggled with slow approvals, hidden fees, and opaque lending processes. However, with the rise of financial technology (fintech), the mortgage landscape is undergoing a revolutionary transformation.

How Fintech Is Simplifying Mortgages is no longer a question but a reality, as cutting-edge innovations streamline and enhance the home financing experience. From AI-driven mortgage approvals to blockchain-powered security, fintech is reshaping the way people buy homes.

This article explores ten groundbreaking fintech innovations that are making mortgages faster, more transparent, and accessible to a broader audience.

The Role of Fintech in Mortgage Simplification

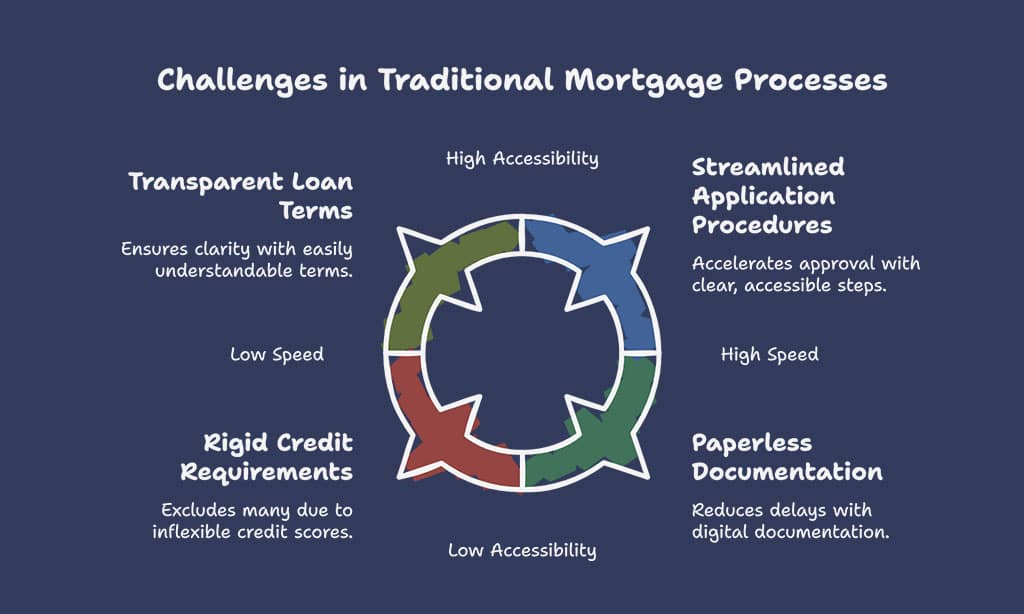

The conventional mortgage process has long been criticized for its inefficiencies, which include:

- Lengthy Application Procedures – Traditional mortgage approvals often take weeks or even months.

- Lack of Transparency – Borrowers frequently struggle to understand interest rates, loan terms, and hidden charges.

- Strict Credit Requirements – Traditional lenders rely on rigid credit scoring models that exclude many potential borrowers.

- Cumbersome Documentation – Paper-heavy processes slow down approvals and create security risks.

Fintech innovations are addressing these challenges by leveraging advanced technology to simplify and expedite the mortgage process.

How Fintech Is Revolutionizing Mortgage Lending

Fintech is introducing new technologies that enhance mortgage processing in various ways:

- Automation & AI: AI algorithms can analyze applications instantly, reducing approval times.

- Blockchain Security: Ensures secure and transparent transactions.

- Open Banking: Provides real-time financial data access for better loan assessment.

- Mobile & Digital Platforms: Allow borrowers to apply, track, and manage their mortgages with ease.

10 Key Innovations Transforming Mortgages

As fintech continues to evolve, the mortgage industry is undergoing a dramatic shift, eliminating inefficiencies and making home financing more accessible than ever before. These innovations are reshaping how lenders and borrowers interact, streamlining processes, and reducing barriers to homeownership. Below are the ten key innovations driving this transformation.

1. AI-Powered Mortgage Approvals

Artificial Intelligence (AI) is revolutionizing mortgage approvals by:

- Speeding Up Underwriting: AI assesses risk and verifies documents within minutes, significantly reducing the traditional waiting time of weeks or months.

- Predicting Loan Defaults: Machine learning analyzes vast amounts of financial data beyond conventional credit scores, making lending decisions more accurate and fair.

- Reducing Bias: AI-driven lending minimizes human error and discrimination, ensuring a more inclusive and accessible mortgage process.

- Enhancing Fraud Detection: AI identifies anomalies in mortgage applications, preventing fraudulent activities and improving lender security.

- Automating Customer Support: AI chatbots provide 24/7 assistance, helping borrowers with queries and application tracking.

Many fintech lenders now provide instant or same-day mortgage approvals, drastically reducing wait times.

| Case Study: AI in Action |

| A leading fintech company, Better.com, uses AI to streamline mortgage approvals, reducing processing time from 35 days to as little as 24 hours. AI-driven automation has also enabled them to cut costs and offer more competitive interest rates. |

2. Digital Mortgage Platforms

As fintech continues to simplify mortgages, digital mortgage platforms have become a game-changer in the lending industry. These platforms leverage advanced technology to provide borrowers with a seamless and efficient experience, eliminating the need for traditional paperwork and lengthy approval processes. By integrating AI, automation, and cloud computing, digital mortgage platforms offer faster approvals, greater transparency, and enhanced security, making homeownership more accessible to a wider audience.

Gone are the days of in-person mortgage applications. Digital platforms now offer:

- End-to-End Online Applications: No need for physical paperwork; applications can be completed entirely online, reducing delays and human errors.

- Seamless Document Uploading: Borrowers can submit digital copies instantly, ensuring faster processing times and reducing the risk of lost documents.

- Real-Time Tracking: Borrowers can monitor application progress online, receive instant updates, and make informed decisions about their mortgage status.

- Enhanced Security Measures: Advanced encryption and authentication protocols ensure the security of sensitive borrower data, reducing the risk of fraud.

- AI-Driven Customer Support: Many platforms offer chatbots and AI assistants that provide 24/7 support, answering common mortgage-related queries in real time.

- Pre-Approval Automation: Many platforms use AI to provide instant pre-approvals, helping buyers act quickly in competitive housing markets.

| Top Digital Mortgage Platforms | Key Features |

| Rocket Mortgage | Fast approvals, customizable loan options |

| Better.com | AI-driven underwriting, no hidden fees |

| Blend | Seamless integration with banking platforms |

| LoanDepot | Hybrid lending model with online and in-person support |

These platforms make it easier for borrowers to apply for and manage their loans without visiting a bank. As more fintech companies invest in mortgage technology, the process is becoming more user-friendly, reducing stress and confusion for first-time homebuyers and seasoned investors alike.

3. Blockchain for Transparent Transactions

As digital transformation continues to reshape the mortgage industry, fintech solutions like blockchain are playing a crucial role in enhancing security, transparency, and efficiency. Traditional mortgage transactions often involve multiple intermediaries, increasing processing time and costs. By leveraging blockchain technology, fintech is streamlining mortgage operations, reducing fraud, and ensuring seamless contract management.

Blockchain technology is making mortgages more secure and transparent by:

- Creating Tamper-Proof Records: Ensuring loan agreements cannot be altered.

- Reducing Fraud: Providing an immutable history of property transactions.

- Streamlining Contract Management: Smart contracts automate payment schedules and ownership transfers.

- Improving Cross-Border Transactions: Blockchain enables more efficient and secure international mortgage processing.

- Reducing Costs: Eliminates the need for intermediaries, cutting processing fees and expediting transactions.

| Real-World Example: Blockchain in Mortgages |

| Figure Technologies uses blockchain to process and record home equity loans, reducing closing times from 45 days to five days. |

4. Open Banking and Data Sharing

As fintech continues to revolutionize the mortgage industry, open banking has emerged as a game-changing innovation. By enabling financial institutions to securely share customer data with lenders, open banking enhances transparency, speeds up loan processing, and offers borrowers more personalized mortgage options. This technology is helping reshape the lending landscape, making mortgage approvals more efficient and accessible.

Open banking allows lenders to securely access borrowers’ financial data, enabling:

- Faster Income Verification: Lenders can instantly assess income and spending patterns.

- More Accurate Loan Offers: Custom-tailored mortgage rates based on real financial data.

- Simplified Documentation: Reducing the need for manual submission of bank statements.

- Enhanced Risk Assessment: Real-time data access improves lenders’ ability to evaluate borrower creditworthiness.

- Increased Competition: Open banking encourages more financial institutions to offer competitive mortgage rates and terms.

5. Robo-Advisors for Mortgage Selection

In today’s digital age, homebuyers are increasingly turning to fintech innovations to simplify the mortgage process. Robo-advisors are one such breakthrough, offering data-driven insights to help borrowers make informed decisions. By leveraging artificial intelligence and machine learning, these tools analyze vast amounts of financial data, ensuring that borrowers receive tailored mortgage recommendations based on their financial profile. Robo-advisors eliminate the need for manual research, making the home financing journey more efficient and hassle-free.

Robo-advisors leverage AI to help borrowers choose the best mortgage options by:

- Analyzing Loan Terms: Comparing thousands of mortgage products instantly.

- Offering Personalized Recommendations: Matching borrowers with loans that fit their financial situation.

- Providing 24/7 Assistance: Answering questions and providing insights anytime.

- Calculating Interest and Payments: Using AI-based tools to provide transparent mortgage payment breakdowns.

- Reducing Bias: Ensuring an objective selection process based solely on financial data.

6. Smart Contracts for Automated Processing

As fintech continues to innovate within the mortgage industry, smart contracts are revolutionizing the way agreements are executed. By leveraging blockchain technology, these self-executing contracts facilitate secure, automated, and error-free transactions. Smart contracts eliminate the need for intermediaries, reducing costs and expediting mortgage processing.

This technology ensures a more transparent, efficient, and secure lending environment, providing borrowers with peace of mind and lenders with greater operational efficiency.

Smart contracts use blockchain technology to automate mortgage agreements. Benefits include:

- Instant Loan Approvals: Automated verification reduces processing time.

- No Intermediaries: Eliminates the need for manual contract execution.

- Improved Security: Ensuring legally binding digital contracts with no room for fraud.

- Faster Property Transfers: Automating title transfers, ensuring seamless ownership changes.

- Compliance Automation: Ensuring mortgage agreements meet all regulatory requirements without manual oversight.

7. Alternative Credit Scoring Models

As fintech continues to revolutionize mortgage lending, alternative credit scoring models are emerging to provide fairer access to home loans. Traditional credit scoring methods, which primarily rely on credit history and FICO scores, often leave out millions of potential borrowers, including gig workers, freelancers, and those with limited credit history.

Fintech lenders are addressing this gap by leveraging innovative data sources and advanced analytics to create more inclusive credit assessment models.

Traditional credit scoring methods often exclude gig workers and freelancers. Fintech lenders now use:

- Rental and Utility Payment History: To assess financial responsibility.

- Bank Transaction Analysis: Evaluating income patterns rather than just credit scores.

- AI-Based Risk Assessment: Offering loans to a wider range of borrowers.

- Cash Flow Analysis: Assessing a borrower’s financial habits for a more accurate credit evaluation.

- Alternative Data Sources: Including social media behavior, digital transactions, and peer-to-peer lending history.

8. Mobile-First Mortgage Applications

In an era where digital convenience is paramount, fintech is redefining how borrowers interact with mortgage services. Mobile-first mortgage applications are streamlining the home financing process, allowing users to apply for, track, and manage their loans directly from their smartphones.

By integrating advanced AI-driven tools, lenders are making mortgage applications more accessible, efficient, and user-friendly, catering to the needs of modern homebuyers.

With smartphone adoption at an all-time high, mobile mortgage applications provide:

- On-the-Go Accessibility: Apply for a mortgage anytime, anywhere.

- Push Notifications: Real-time updates on loan status.

- E-Signatures: Complete agreements without physical paperwork.

- Mobile Document Scanning: Users can scan and upload required documents directly from their phones.

- Voice-Assisted Applications: AI-powered voice recognition allows users to complete applications using smart assistants.

9. Embedded Finance in Real Estate Platforms

As fintech continues to reshape the mortgage industry, embedded finance is creating a more seamless and efficient home-buying experience. By integrating financial services directly into property search platforms, homebuyers can access mortgage options in real time without navigating multiple applications.

This advancement is making mortgage approvals quicker and more convenient, ensuring buyers can act fast in competitive housing markets.

Embedded finance integrates mortgage services into property search platforms, allowing:

- Instant Pre-Approval Calculations: Homebuyers can see loan eligibility while browsing homes.

- Seamless Loan Application: Borrowers can apply for financing without leaving the real estate website.

- Integrated Cost Estimates: Real-time mortgage calculations within property listings.

- One-Click Financing: Users can secure funding without visiting multiple platforms.

- AI-Powered Property Valuations: Providing real-time home value estimates and affordability insights.

10. Personalized Mortgage Analytics Tools

As fintech continues to revolutionize mortgage lending, personalized mortgage analytics tools are empowering borrowers with deeper financial insights. These advanced tools leverage big data, AI, and predictive modeling to provide tailored mortgage solutions based on an individual’s financial profile.

By offering real-time affordability assessments and loan comparisons, fintech is simplifying mortgages and enabling borrowers to make well-informed decisions.

Advanced mortgage analytics tools help borrowers make informed decisions by offering:

- AI-Based Loan Comparison Tools – Comparing multiple loan options.

- Mortgage Payment Calculators – Estimating monthly payments accurately.

- Home Affordability Assessments – Providing insights based on financial history.

- Interactive Financial Dashboards: Allowing borrowers to track their mortgage status in real time.

- Predictive Analytics: Forecasting potential interest rate changes to help borrowers make better decisions.

Takeaways

Fintech is fundamentally transforming the mortgage industry, making home financing faster, more transparent, and accessible to a wider range of borrowers.

By leveraging artificial intelligence, blockchain, and big data, lenders can now offer highly personalized mortgage solutions tailored to individual financial profiles.

Borrowers benefit from quicker approval times, reduced paperwork, and enhanced security, creating a seamless and more efficient home-buying experience. As technology continues to evolve, fintech will further simplify and democratize the mortgage process, ensuring greater financial inclusion and accessibility for all.