The cryptocurrency industry started Friday with a wave of optimism as Coinbase Global Inc. announced that the U.S. Securities and Exchange Commission (SEC) was set to dismiss a legal case against it. The news sent crypto markets soaring, with Bitcoin approaching $100,000 and Ether surging over 4%.

However, the celebration was short-lived. Just hours later, Dubai-based crypto exchange Bybit disclosed a massive security breach, resulting in the theft of nearly $1.5 billion worth of tokens. Analysts say this is the biggest crypto hack in history, shaking investor confidence and triggering panic across the market.

A Day of Highs and Lows for Crypto

The day began with a major win for Coinbase. Pending commissioner approval, the SEC was reportedly poised to permanently drop its lawsuit against the exchange for allegedly operating an unregistered exchange, brokerage, and clearing agency. Coinbase shares surged nearly 6% in premarket trading, and the broader crypto market followed suit.

But the mood quickly soured when Bybit, one of the world’s largest crypto exchanges, revealed it had been hacked. Traders noticed suspicious withdrawals of Ether from Bybit’s wallets before the exchange confirmed the breach. CEO Ben Zhou explained that a hacker had gained control of a specific Ethereum cold wallet and drained its assets.

Bybit CEO Attempts to Reassure Investors

In an attempt to calm investors, Zhou took to a livestream on X (formerly Twitter), dressed in a Bybit-branded T-shirt and sipping from a can of sugar-free Red Bull. He assured over 200,000 viewers that “your money is safe and our withdrawals are still open.” Bybit was arranging emergency bridge lending, using its own tokens as collateral, to cover the sudden wave of withdrawal requests.

Despite Zhou’s reassurances, the incident sparked fears of another major crypto collapse similar to the downfall of FTX in 2022. Bybit had approximately $16.2 billion in assets before the hack, according to CoinMarketCap data. The stolen Ether and related derivatives represented about 9% of its total holdings.

Market Chaos and Falling Prices

The Bybit hack sent shockwaves through the crypto market. Bitcoin, which had been rallying on the Coinbase news, tumbled nearly 5%, falling below $95,000. Ether, the main target of the hack, lost over 8% from its high of the day. Other cryptocurrencies, including Dogecoin, suffered even steeper declines.

Today’s events just demonstrate that crypto remains highly volatile and vulnerable to fraud and hacking,” said Benjamin Schiffrin, director of securities policy at Better Markets. Congress is considering light-touch regulation for crypto, but today is a reminder that such an approach may not be enough to protect investors.

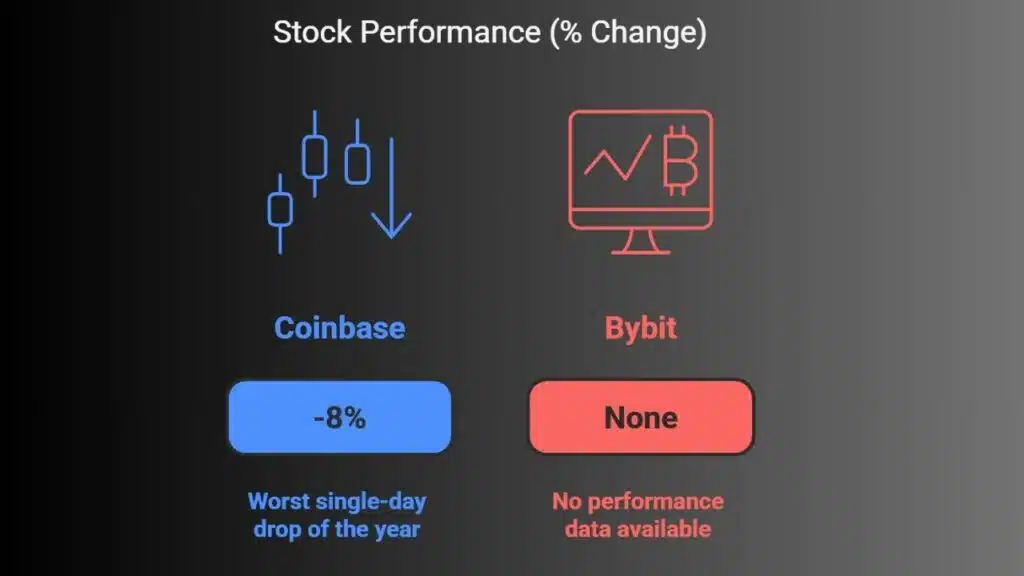

Coinbase Stock Wipes Out Gains

As crypto markets struggled, so did Coinbase’s stock. The early rally reversed, and Coinbase shares ended the day down more than 8% — their worst single-day drop of the year. The loss wiped out the excitement around the SEC case dismissal, highlighting the unpredictable nature of the crypto industry.

Reflecting on the day’s events, blockchain startup founder Shuyao Kong commented, “The scale of both the Coinbase and Bybit news on the same day is a major hit and a reminder of crypto’s systemic risks.

Regulation Debate Reignites

The Bybit hack has reignited debates over crypto regulation. Critics argue that reducing oversight, as supported by President Donald Trump, could make the industry even more vulnerable to such incidents. Deregulated markets sound good until you have this type of attack,” said Hilary Allen, a professor at American University’s Washington College of Law. “Be careful what you wish for.”

Meanwhile, Coinbase’s chief legal officer Paul Grewal criticized the SEC’s previous stance on crypto, stating, “Former SEC Chair Gary Gensler spent four years attacking a lawful industry instead of creating regulations that protect consumers. The new SEC administration understands that comprehensive legislation is the only way forward.”

A Dark Day for Crypto

The day that began as a victory lap for Coinbase ended with the industry grappling with its biggest-ever hack. As traders and investors reassess their positions, one line from Coinbase CEO Brian Armstrong‘s celebratory post on X seemed eerily fitting: “As Bane in The Dark Knight says, you merely adopted the dark; I was born in it.”

For the crypto world, Friday was a stark reminder that even on the brightest days, the shadows of risk are never far away.

The Information is Collected from Yahoo and Bloomberg.