Debt can quickly become overwhelming, especially when juggling multiple payments, high-interest rates, and due dates. If you’re struggling with managing various debts, you might be considering debt consolidation.

Debt consolidation involves combining multiple debts into a single, manageable loan, often with lower interest rates and a structured repayment plan. For many, this approach simplifies finances, reduces stress, and accelerates debt payoff.

Additionally, it helps improve budgeting, enhances cash flow, and prevents costly late fees, making it a viable option for individuals looking to regain control of their financial future.

In this article, we explore 12 reasons why consolidating debt is the right move. We’ll break down the benefits, who it’s ideal for, and how you can get started. Let’s dive in.

What is Debt Consolidation?

Debt consolidation is a financial strategy where multiple debts—such as credit card balances, personal loans, or medical bills—are merged into a single loan.

This simplifies debt management and can potentially lower your interest rates, making repayment easier and more cost-effective.

Types of Debt Consolidation

| Debt Consolidation Option | Best For | Pros | Cons |

| Balance Transfer Credit Cards | Individuals with high credit scores | 0% intro APR, quick approval | High fees, high rates after the intro period |

| Personal Loans | People with fair-to-good credit scores | Fixed payments, lower rates | Requires good credit, potential origination fees |

| Home Equity Loans (HELOCs) | Homeowners with equity | Lower interest rates, tax-deductible | Risk of losing home, long approval process |

| Debt Management Plans | Those struggling with high-interest credit card debt | Professional guidance, lower rates | Requires working with a credit counselor, impact on credit score |

By choosing the right method, debt consolidation can offer financial relief and a clear pathway to becoming debt-free.

How Does Debt Consolidation Work?

Debt consolidation involves borrowing a lump sum to pay off multiple debts. Instead of tracking multiple payments and due dates, you’ll have just one monthly payment. Here’s how it typically works:

- Assess Your Debts – List all outstanding debts, including interest rates and monthly payments.

- Choose a Consolidation Option – Determine the best method (loan, balance transfer, etc.).

- Apply for the Loan or Program – Check eligibility and apply with a lender or credit counseling service.

- Pay Off Existing Debts – Use the consolidation loan to clear current obligations.

- Follow a New Repayment Plan – Make timely payments on your consolidated debt to avoid falling back into financial trouble.

12 Reasons Why Consolidating Debt Might Be the Right Move for You

Debt consolidation can be a game-changer for individuals burdened with multiple high-interest debts.

It provides a way to streamline payments, lower overall costs, and create a more structured approach to financial management.

When executed correctly, it can help individuals avoid financial pitfalls and regain control over their economic well-being.

1. Simplifies Debt Management

Managing multiple loans with different interest rates and due dates can be confusing and overwhelming.

Debt consolidation streamlines your finances by combining all debts into one, making it easier to stay organized and reducing the chances of missing payments. This also prevents potential damage to your credit score due to late payments.

Moreover, a single payment plan eliminates the hassle of juggling various due dates, helping you focus on financial stability and planning for the future.

Key Details:

| Factor | Before Consolidation | After Consolidation |

| Number of Payments | Multiple | One |

| Risk of Missed Payments | High | Low |

| Credit Score Impact | Negative if late | Positive with on-time payments |

| Ease of Budgeting | Difficult | Simplified |

Actionable Tip: Use budgeting apps like Mint or YNAB to keep track of your consolidated loan payments.

2. Lowers Interest Rates

Most high-interest debts, like credit cards, come with APRs exceeding 20%. By consolidating debt with a lower-rate loan, you can save thousands in interest payments over time. Lower rates mean more of your money goes toward paying off the principal, helping you become debt-free faster.

Example Interest Rate Comparison:

| Debt Type | Interest Rate Before | Interest Rate After Consolidation | Savings Over 5 Years |

| Credit Card Debt | 22% | 8% | $5,000+ |

| Personal Loan | 15% | 10% | $2,500+ |

| Medical Bills | 18% | 9% | $3,000+ |

3. Reduces Monthly Payments

Consolidating debt often extends the repayment period, lowering your monthly payments. This helps free up cash for essential expenses and savings. With lower payments, you can focus on building an emergency fund or investing for the future.

Key Details:

| Factor | Before Consolidation | After Consolidation |

| Monthly Payment | $850 | $500 |

| Number of Payments | 5 | 1 |

| Loan Term | 3 Years | 5 Years |

| Available Cash Flow | Limited | Improved |

4. Boosts Your Credit Score

Debt consolidation can improve your credit score by reducing your credit utilization ratio and ensuring on-time payments. It also helps maintain a positive payment history, which is a crucial factor in credit scoring models.

A better credit score can enhance your chances of securing lower interest rates on future loans, making borrowing more affordable. Over time, responsible debt management through consolidation can contribute to long-term financial stability and improved access to credit.

Pro Tip: Keep old credit card accounts open even after consolidation to maintain a healthy credit history.

5. Eliminates Late Payment Fees

With multiple debts, it’s easy to miss a payment, leading to late fees and increased financial burden. Consolidation reduces this risk by simplifying payments into a single, manageable monthly installment.

This ensures that you pay on time, preventing unnecessary extra charges, protecting your credit score, and reducing overall financial stress.

Moreover, a structured repayment plan provides better visibility into your financial obligations, helping you regain control over your debt situation.

6. Provides a Fixed Repayment Plan

Unlike revolving credit accounts, consolidated loans typically have fixed repayment schedules, helping you stay on track to becoming debt-free.

With a clear repayment timeline, you can plan your finances effectively and avoid the uncertainty of fluctuating interest rates.

Knowing exactly how much you owe each month makes budgeting more manageable and allows you to set financial goals with confidence. Additionally, fixed repayment plans prevent the risk of accumulating more debt, providing a structured and predictable path to financial freedom.

Key Details:

| Factor | Revolving Credit Accounts | Consolidated Loans |

| Payment Amount | Varies | Fixed |

| Interest Rate | Can increase | Typically lower & fixed |

| Repayment Timeline | Uncertain | Defined schedule |

| Risk of More Debt | High | Lower |

7. Lowers Financial Stress

Managing multiple debts can be mentally exhausting and emotionally draining, often leading to financial stress and decision fatigue. A structured repayment plan eliminates uncertainty, reduces anxiety, and helps you regain control over your finances.

With just one monthly payment, you can better manage your budget, stay on track with your financial goals, and work toward a debt-free future with peace of mind.

Having a clear repayment strategy also enables better long-term financial planning and improved money management.

Key Details:

| Factor | Before Consolidation | After Consolidation |

| Number of Payments | Multiple | One |

| Stress Level | High | Lower |

| Financial Clarity | Uncertain | Improved |

| Focus on Financial Goals | Difficult | Easier |

8. Helps Pay Off Debt Faster

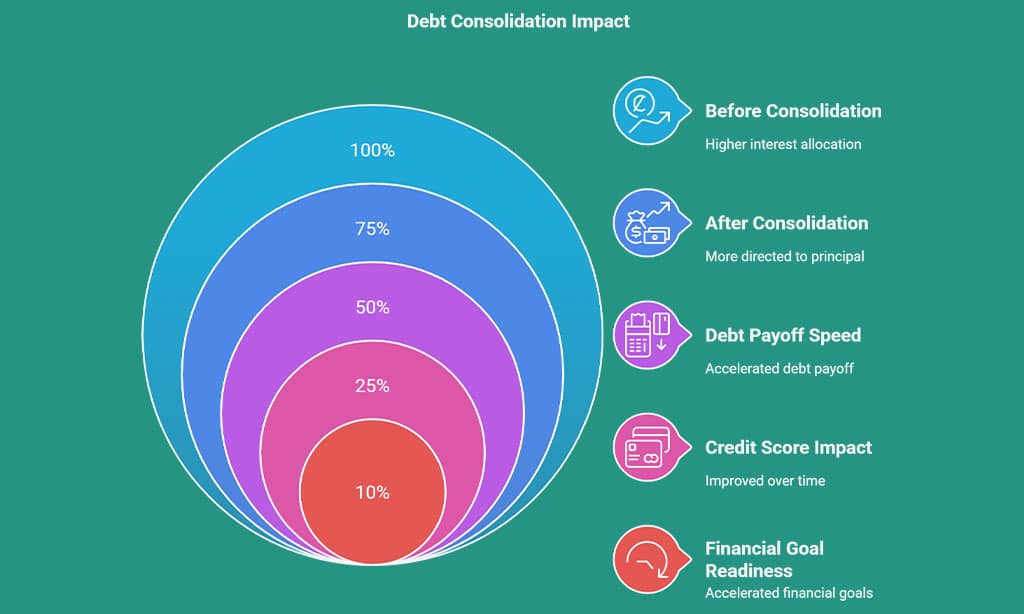

By securing lower interest rates, more of your payment goes toward the principal rather than interest, accelerating your debt payoff. The faster you eliminate your debt, the sooner you can work toward other financial goals such as homeownership, investing, or saving for retirement.

Additionally, paying off debt efficiently can help improve your credit score, making future loans more affordable.

Debt consolidation provides a structured and disciplined approach to repayment, preventing unnecessary financial strain.

Key Details:

| Factor | Before Consolidation | After Consolidation |

| Interest Allocation | Higher proportion to interest | More directed to principal |

| Debt Payoff Speed | Slower | Faster |

| Credit Score Impact | Potentially negative | Improved over time |

| Financial Goal Readiness | Delayed | Accelerated |

9. Allows for Potential Tax Deductions

Certain debt consolidation loans, like home equity loans, may offer tax-deductible interest, further reducing financial strain. This tax advantage can make repayment more manageable and cost-effective over time.

Additionally, consolidating debt through these methods can free up more disposable income, allowing you to invest in savings or other financial priorities. Consult a tax advisor to see if you qualify for this benefit and maximize your potential savings.

Key Details:

| Loan Type | Tax Deductible? | Additional Benefits |

| Home Equity Loan | Yes | Lower interest rates, possible tax deduction |

| Personal Loan | No | Fixed interest rate, predictable payments |

| Balance Transfer Card | No | 0% intro APR, short-term savings |

10. Improves Cash Flow for Savings or Investments

By consolidating debt, you can allocate funds toward emergency savings or investments instead of high-interest payments. This increased financial flexibility allows you to plan for future expenses, reduce financial stress, and enhance overall stability.

With extra cash flow, you can work on building wealth, improving your creditworthiness, and achieving long-term financial goals like homeownership or retirement.

Key Details:

| Factor | Before Consolidation | After Consolidation |

| Available Cash Flow | Limited | Improved |

| Savings Potential | Low | Higher |

| Investment Opportunities | Restricted | More options |

| Financial Flexibility | Tight | Increased |

11. Avoids Bankruptcy Risks

Debt consolidation provides a structured repayment plan, preventing the drastic financial consequences of bankruptcy. Bankruptcy can significantly impact your credit score for up to a decade, making future borrowing more difficult.

Consolidation offers a proactive approach, allowing you to manage debt responsibly without the long-term financial and emotional strain of bankruptcy. Additionally, consolidating debt can provide a sense of financial stability and a clear path toward becoming debt-free.

Key Details:

| Factor | Bankruptcy | Debt Consolidation |

| Credit Score Impact | Severe and long-term | Temporary and manageable |

| Loan Eligibility | Restricted for years | Easier access to future loans |

| Financial Stress | High | Reduced |

| Debt Repayment Structure | Court-mandated | Flexible and structured |

12. Makes Financial Planning Easier

A single debt payment simplifies budgeting, allowing better control over finances and long-term wealth building.

With fewer payments to track, you can allocate more time to financial planning, reducing the risk of missed payments and associated penalties.

Proper planning can help you avoid future financial pitfalls and create a stable future, ensuring better credit health and overall financial security.

Key Details:

| Factor | Before Consolidation | After Consolidation |

| Budget Complexity | High | Low |

| Risk of Missed Payments | Higher | Reduced |

| Long-term Financial Stability | Uncertain | Improved |

| Time Spent Managing Debt | Significant | Minimal |

Takeaways

Debt consolidation is a strategic financial tool that simplifies debt repayment, lowers interest rates, and provides a structured pathway to financial stability.

By reducing multiple payments into one, it minimizes stress, enhances budgeting, and helps individuals regain control over their finances.

While consolidation is not a one-size-fits-all solution, it can be a highly effective method for managing debt responsibly and avoiding financial pitfalls.

If approached with discipline and careful planning, it can pave the way toward a debt-free future and greater financial freedom.