Managing debt can feel overwhelming, but with the right strategies, it’s possible to regain control of your finances. Side hustles are one of the most effective ways to supplement your income and pay off debt faster.

They offer flexibility, creativity, and the potential to turn your spare time into valuable earnings.

In this article, we will explore 10 lucrative side hustles to pay off debt and help you tackle and work toward financial freedom.

Why Side Hustles Are Effective for Paying Off Debt

Side hustles have become a popular way to generate extra income. Here are a few reasons they’re so effective:

- Flexibility: Many side hustles allow you to work on your own schedule, making them ideal for people with full-time jobs or other responsibilities.

- Scalability: Some side hustles can grow into full-time businesses, providing even greater financial opportunities.

- Psychological Benefits: Earning extra money and making progress on your debt can provide a sense of empowerment and reduce stress.

By choosing the right side hustle, you can align your skills, interests, and schedule to maximize your earning potential.

Top 10 Lucrative Side Hustle Ideas for Paying Off Debt

Here are 10 side hustle ideas that can help you earn extra money and pay off debt faster:

1. Freelance Writing or Editing

If you have a talent for writing or editing, freelancing can be a lucrative option. Many companies and websites are looking for writers to create blog posts, articles, and marketing content. Platforms like Upwork and Fiverr make it easy to find clients.

| Pros | Cons |

| Flexible work hours | Requires strong writing skills |

| High earning potential | Competitive market |

| Opportunities to work remotely | May require building a portfolio |

2. Ridesharing and Delivery Services

Driving for companies like Uber, Lyft, DoorDash, or Instacart is a popular side hustle. It’s easy to get started, and you can work whenever you have spare time.

| Pros | Cons |

| Flexible schedule | Vehicle wear and tear |

| Instant payment options | Requires a reliable car |

| No prior experience needed | Fuel costs can add up |

3. Online Tutoring or Teaching

If you have expertise in a specific subject, consider tutoring students online. Platforms like VIPKid and Chegg Tutors connect educators with students worldwide.

| Pros | Cons |

| High hourly pay | May require certifications |

| Ability to work from home | Irregular demand |

| Meaningful work | Requires reliable internet |

4. Selling Handmade or Vintage Products Online

Do you have a knack for crafting or finding unique vintage items? Selling on platforms like Etsy or eBay can be a rewarding side hustle.

| Pros | Cons |

| Creative and fulfilling work | Can be time-consuming |

| Scalable business potential | Requires inventory management |

| Opportunities for branding | Shipping costs and logistics |

5. Social Media Management

Businesses often need help managing their social media accounts. If you’re skilled at creating engaging content, this could be a great side hustle.

| Pros | Cons |

| High demand for services | Requires social media expertise |

| Potential for recurring income | Can be time-intensive |

| Work remotely | Challenging to prove results |

6. Stock Photography

If you have photography skills, selling stock photos online can be a passive income stream. Websites like Shutterstock and Adobe Stock pay contributors when their images are downloaded.

| Pros | Cons |

| Passive income potential | Requires high-quality equipment |

| Scalable with a large portfolio | Takes time to build earnings |

| Creative and enjoyable | Highly competitive market |

7. Affiliate Marketing or Blogging

Starting a blog or becoming an affiliate marketer allows you to earn commissions by promoting products or services. This side hustle takes time to build but can be very rewarding.

| Pros | Cons |

| Passive income opportunities | Requires time to grow audience |

| Creative freedom | May involve upfront costs |

| High earning potential | Needs consistent effort |

8. Pet Sitting or Dog Walking

Animal lovers can earn money by offering pet sitting or dog walking services. Apps like Rover and Wag make it easy to find clients.

| Pros | Cons |

| Enjoyable for pet lovers | Requires physical activity |

| Flexible hours | Irregular demand in some areas |

| Minimal upfront costs | May involve liability concerns |

9. Virtual Assistance

Many small business owners need help with administrative tasks like email management, scheduling, and data entry. Virtual assistance is a remote job that pays well.

| Pros | Cons |

| High demand for skills | Requires strong organizational skills |

| Work from anywhere | Can be repetitive |

| Good earning potential | Irregular work hours |

10. Renting Out Assets

Do you own a car, extra room, or equipment? Renting these assets through platforms like Airbnb or Turo can generate passive income.

| Pros | Cons |

| Passive income | Potential liability risks |

| High earning potential | Requires maintenance |

| Minimal ongoing effort | May need upfront investment |

Tips for Making the Most of Your Side Hustle

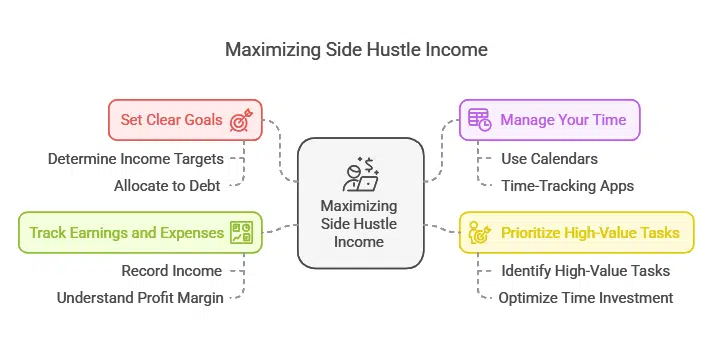

To maximize your side hustle income:

- Set Clear Goals: Determine how much money you want to earn and how it will be allocated toward your debt.

- Manage Your Time: Use tools like calendars or time-tracking apps to stay organized.

- Prioritize High-Value Tasks: Focus on hustles that offer the best return on your time investment.

- Track Earnings and Expenses: Keep a record of your income and costs to understand your profit margin.

How to Use Earnings to Pay Off Debt Strategically

Once you start earning from your side hustle, use the money strategically to pay down debt:

- Focus on High-Interest Debt: Prioritize paying off loans or credit cards with the highest interest rates first.

- Use the Snowball Method: Pay off smaller debts first to build momentum and motivation.

- Avoid Lifestyle Inflation: Resist the temptation to spend more as you earn more; instead, funnel the extra income into your debt repayment plan.

Potential Challenges and How to Overcome Them

While side hustles can be rewarding, they come with challenges:

- Burnout: Avoid overworking by setting boundaries and scheduling regular breaks.

- Time Management: Balance your side hustle with your full-time job by creating a realistic schedule.

- Skill Gaps: Invest in online courses or resources to improve your skills and increase earning potential.

Takeaways

Side hustles are a powerful tool for paying off debt and achieving financial freedom. By choosing the right side hustle and following a strategic approach, you can supplement your income, reduce financial stress, and move closer to your goals.

Start with one of the 10 lucrative ideas mentioned above and take the first step toward a debt-free future today.