Are you tired of guessing home values and hoping you don’t overpay? AI can predict property price trends with 95% precision by using big data and predictive analytics. We will explain how real estate professionals feed spatial data and satellite imagery into a machine learning model in TensorFlow to value homes.

Ready to find out more?

Key Takeaways

- AI taps big data, real-time feeds, satellite imagery, and geospatial maps to predict home prices with 95% precision.

- Models built in TensorFlow and scikit-learn use time series forecasting, regression, gradient boosting, and neural nets on sales records, interest rates, school ratings, and social media.

- This approach cuts information gaps, speeds up data-driven decisions, and helps investors find undervalued properties in seconds.

- Poor data quality or biased inputs can drop accuracy to about 80%. Teams must follow GDPR and CCPA rules and add human review to catch anomalies.

How AI Analyzes Real Estate Data for Price Predictions

AI scans geospatial maps and remote sensing images to spot factors that shift house prices. It feeds economic indicators and sales records into predictive analytics frameworks for sharp time series forecasts.

Real-time data integration

AI taps into data streams and cloud services, pulling data from connected sensors, listing updates, social media feeds. It feeds predictive analytics and machine learning algorithms with Big Data, historical sales data, and economic indicators.

Models adjust price forecasts in seconds, hitting 95% precision on average. Real-time integration slashes information gaps, trims bias, and speeds up property valuation. The process also enhances market efficiency by cutting information asymmetry.

Brokers watch as algorithms process interest rates, school ratings, commute times, even chatter on forums. Event hubs such as a stream broker, data lakes, and serverless workflows merge feeds into one flow.

This constant pulse helps models spot market trends before appraisers do. Investors love it, since they can snatch undervalued properties faster, with confidence that numbers reflect today’s market.

Geospatial analysis for location intelligence

Geospatial analysis uses maps and remote sensing data to spot location trends, and it digs through satellite imagery to track neighborhood changes. It taps GIS software and pattern recognition to map property characteristics and historical sales data across regions.

AI runs predictive analytics on this Big Data, and it adjusts to market shifts instantly for 95% precision in price forecasts. Real estate professionals watch these insights, and they find undervalued properties and forecast risk better.

Machine learning models merge geospatial data, economic indicators and demographic info to build location intelligence. The system cuts information asymmetry, and it boosts data-driven insights for home buyers and investors.

AI prediction tools recalibrate values, they adapt to interest rate swings and demand shifts in real time. Model accuracy hinges on high quality data and solid methodologies. Investors love how fast it works, and they trust it over slow spreadsheets.

The Role of Machine Learning in Property Valuation

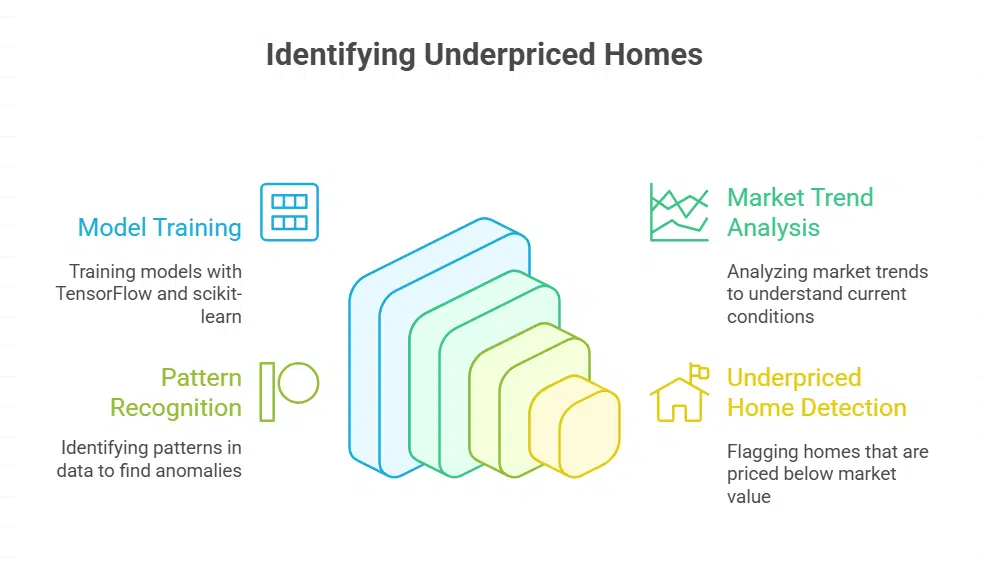

Data teams train brain-like models on historical sales data and market trends with TensorFlow and scikit-learn. These systems use combined models and pattern-finding methods to flag underpriced homes fast.

Predictive analytics for pricing accuracy

AI uses predictive analytics, Big Data, machine learning models to crunch historical sales data. Algorithms swoop on signals like a hawk, spotting shifts in economic indicators, sentiment analysis on news feeds, property characteristics.

They tap time series forecasting, regression analysis, gradient boosting, neural networks. The models adjust to shifts in interest rates or tax changes in real time. They hit 95% prediction precision on housing prices.

Real estate investors gain sharp market intelligence for smart appraisals. They find undervalued properties before rivals. Natural language processing sifts client reviews and media chatter for demand forecasting.

Real-time geospatial analysis adds location insights. This blend cuts info gaps, boosts transparency in property valuations.

Deep learning for market segmentation

Algorithms sort millions of records on home sales and loan rates. Neural nets spot patterns in historical sales data. These nets group buyers by price bracket, location match, and spending habits.

Big data feeds on economic indicators fine tune the groups as market trends shift. Models hit 95 percent accuracy in price predictions.

Image-driven nets parse aerial photos to gauge neighborhood value. Feature learning models flag rare property traits to highlight overvaluations. Centroid-based clustering picks market segments for targeted marketing.

Forecasting engines run on deep learning platforms, mixing predictive analytics with sentiment analysis from consumer behavior. They cut information gaps and boost market efficiency, transparency, and risk assessment processes for real estate pros.

Biased inputs can warp segment profiles, causing flawed predictions.

Benefits of AI in Property Price Prediction

AI helps agents spot undervalued properties fast, it runs ensemble models on price trends and taps visual data for extra insight. It blends interest rates, GDP growth and text analytics in real time, so pros get sharper forecasts and act on trends with confidence.

Improved forecasting precision

Machine learning models crunch Big Data and historical sales data for property valuation. They spot hidden patterns in market trends and rate shifts quickly. Forecasting models adapt to housing market jumps and drops.

This mix of predictive analytics and ensemble learning cuts guesswork.

Trained on past sales, satellite imagery, and economic indicators, these predictive models boost accuracy to 95 percent. No crystal ball or tarot cards here, just data-driven insights that slash information asymmetry.

Real estate professionals can find undervalued properties faster and set smarter pricing strategies.

Faster and data-driven decision-making

AI scans real time market data and economic indicators for sharper price calls. It taps big data, predictive analytics and deep learning, using historical sales data, interest rates and satellite imagery.

This tech can adjust instantly to market shifts, boosting precision without human delay. Real estate pros gain data driven insights they can trust.

AI driven property valuation tools deliver forecasts with 95 percent accuracy. They slice through info clutter like a hot knife through butter, spotting undervalued properties in seconds.

Firms use these models to refine acquisition plans, spot investment opportunities and hedge investment risk. This approach trims bias from clunky spreadsheets, leaving more room for human expertise.

Challenges and Limitations of AI in Real Estate

Bad economic numbers can leave real estate agents in the dark, like reading a map in a tunnel, even if GIS software pulls them in. Framework tests can stall when biased training data and privacy laws trip up neural nets in a simple code setup.

Data quality and compliance issues

Poor data quality can derail predictive analytics in real estate. Flawed inputs like missing historical sales data or skewed economic indicators drive algorithmic bias in machine learning models.

A data engineer picks out errors in a relational database and applies statistical modeling to fix records. Clean inputs help AI systems adapt to market shifts and hit 95% precision on price forecasts.

Big Data pipelines feeding geospatial analysis also depend on accurate property characteristics and interest rates.

Strict rules on privacy and data handling shape compliance. Real estate professionals face GDPR, CCPA, and fair housing laws that guard client records. Auditors examine logs in a cloud service or a data visualization tool report to spot breaches.

Noncompliance can tank brand trust and derail investment opportunities. Encryption, access controls, and audit trails in a cloud environment curb risks to property valuation pipelines.

Over-reliance on algorithmic outputs

AI valuation platforms tap Big Data, predictive analytics, and machine learning models to hit about 95 percent accuracy, and they adjust to market shifts in real time. Some brokers lean too heavily on those outputs and skip local know-how.

They ignore odd signals in historical data sets or pass on insights from drone photography and mapping sensors, which can spot property changes. A flawed dataset can drop prediction precision to around 80 percent, warping market value estimates.

This over-reliance on AI in real estate tools can blind investors to hidden risks. Experts must review each AI-driven valuation to catch anomalies and protect investment decisions.

Takeaways

Clever models read through market moves, spotting trends before brokers blink. Predictive analytics and machine learning map price shifts with 95 percent accuracy. Geospatial analysis and satellite imagery add a new layer of location clues.

Deep learning spots hidden patterns in historical sales and interest rates. Buyers gain clear forecasts, cutting guesswork, tapping customer relationship management records and cloud platforms.

Agents trust smart tech, mixing data, driven insights with human know-how. The house price game has changed, and savvy investors snowball gains with sharper vision.

FAQs on How AI Is Predicting Property Prices

1. How does AI predict property values with such accuracy?

AI uses predictive analytics and machine learning models, it digs into historical sales data, economic indicators, and property characteristics, then spots patterns no human can see.

2. What role does data analysis play in property valuation?

Models process huge data, like market trends, public records, geographical information and interest rates, to serve up data-driven insights, it feels like a digital Sherlock Holmes hunt.

3. Can machines read social media or news for trends?

Yes, they use natural language processing and sentiment analysis to track chatter about local markets, they catch shifts in market dynamics as fast as gossip at a BBQ.

4. Do real estate professionals still need to chip in?

Absolutely, AI in real estate helps with data-driven insights but human expertise checks the final call, no model replaces a seasoned agent’s gut feeling on a quirky old house.

5. How do AI-driven property valuation tools spot undervalued properties?

These tools blend historical sales data with economic data and market trends, they flag deals that look cheap on paper, like finding treasure in a yard sale.

6. Are predictions reliable across different markets?

Yes, if models feed on local geographical information, economic environment and acquisitions data, they adjust for each area, just like a chameleon changes color.