For the first time in four years, Chinese smartphone maker Xiaomi has climbed back to the top of Southeast Asia’s smartphone market, displacing long-standing rivals like Samsung and Oppo. According to the latest figures from Canalys, a global market research firm, Xiaomi shipped 4.7 million smartphones in the second quarter of 2025, an 8% increase year on year, securing 19% of the region’s market share.

This marks the brand’s first return to the top position since Q2 2021, underscoring how its mix of affordable models and strengthening premium line has reshaped consumer sentiment in one of the world’s most competitive mobile battlegrounds.

Xiaomi’s Winning Formula: Balancing Budget and Premium

Redmi’s enduring mass appeal

Xiaomi’s Redmi series, traditionally its volume driver, continued to resonate with Southeast Asia’s value-focused market. The Redmi brand has long been positioned as a reliable choice for young, budget-conscious buyers seeking large screens, strong batteries, and competitive specifications at affordable prices. This quarter, Redmi helped anchor Xiaomi’s lead across high-population countries like Indonesia, the Philippines, and Thailand, where mid-range and budget phones dominate.

POCO’s explosive growth

The company’s POCO sub-brand has also delivered stellar results. Shipments more than doubled compared to last year, thanks to POCO’s focus on gaming-oriented smartphones with powerful processors and high refresh-rate displays at accessible prices. This performance demonstrates how Xiaomi is carving out strong niches in youth-centric markets, particularly Vietnam and Malaysia, where gaming and e-sports have fueled demand for performance-heavy devices at affordable prices.

Xiaomi 15 series shifts perception

The premium Xiaomi 15 series recorded 54% growth year on year, an important milestone for a brand often viewed primarily as a “budget flagship” provider. This expansion into higher-priced tiers shows Xiaomi’s determination to rival Samsung and Apple in the premium segment, a critical move as Southeast Asia’s middle class grows and consumers become more willing to spend on longer-lasting, 5G-enabled devices.

Distribution power: direct-to-consumer channels

Canalys highlighted that Xiaomi’s expansion into direct-to-consumer (D2C) outlets and stronger operator partnerships have given it a wider retail footprint. By controlling more of its distribution, Xiaomi ensures better margins, higher brand visibility, and stronger loyalty—particularly important in fragmented retail markets like Indonesia and Vietnam, where traditional shops and operator deals still account for a large chunk of sales.

The Competition: A Tight Race Below the Top

Transsion rises on entry-level strength

In a sign of shifting dynamics, Transsion Holdings (parent of Tecno, Infinix, and iTel) surged to second place with 4.5 million shipments, up 17% year on year, grabbing an 18% share. Its success comes from aggressively targeting the entry-level portfolio, which resonates in countries like the Philippines, Cambodia, and Myanmar, where consumers seek affordable first smartphones. Transsion’s strong offline retail penetration and Africa-honed strategy of providing big batteries and camera-focused models at ultra-low prices has helped it rise quickly in Southeast Asia.

Samsung slips but maintains premium clout

Samsung shipped 4.3 million smartphones, ranking third with a 17% share, a slight 3% decline year on year. Despite the drop, Samsung remains a formidable player. Demand for its Galaxy A06 5G and A16 5G models grew, particularly in Vietnam and Singapore, as the company strengthened its 5G-capable mid-range lineup.

Beyond consumer sales, Samsung continues to differentiate with enterprise strategies. Its decades-long relationships with governments and large corporations in the region give it an edge in business-to-business device supply, corporate security, and integration with broader electronics ecosystems such as displays and IT solutions. This enterprise diversification may help offset slower growth in mass-market categories.

Oppo struggles amid intense competition

Oppo (excluding OnePlus) ranked fourth, shipping 3.5 million units, but saw a sharp 19% decline compared to last year. With a 14% share, Oppo’s weakness lies in the highly competitive entry-level tier, where Transsion, Infinix, and Realme have aggressively cut into its market with cheaper alternatives. Oppo’s push in premium tiers has also been overshadowed by Xiaomi’s rising 15 series and Samsung’s entrenched Galaxy S and Z foldables.

Vivo pivots to profitability

Rounding out the top five, Vivo shipped 2.8 million devices, down 21%, for an 11% share. Analysts suggest Vivo is focusing less on sheer volume and more on profitability, tightening portfolios to reduce overlap. However, this strategic pivot comes at the cost of lost ground in Southeast Asia’s fast-moving, entry-to-mid-range segment.

Notable Movers Outside the Top 5

While not among the leaders, other brands are also worth noting:

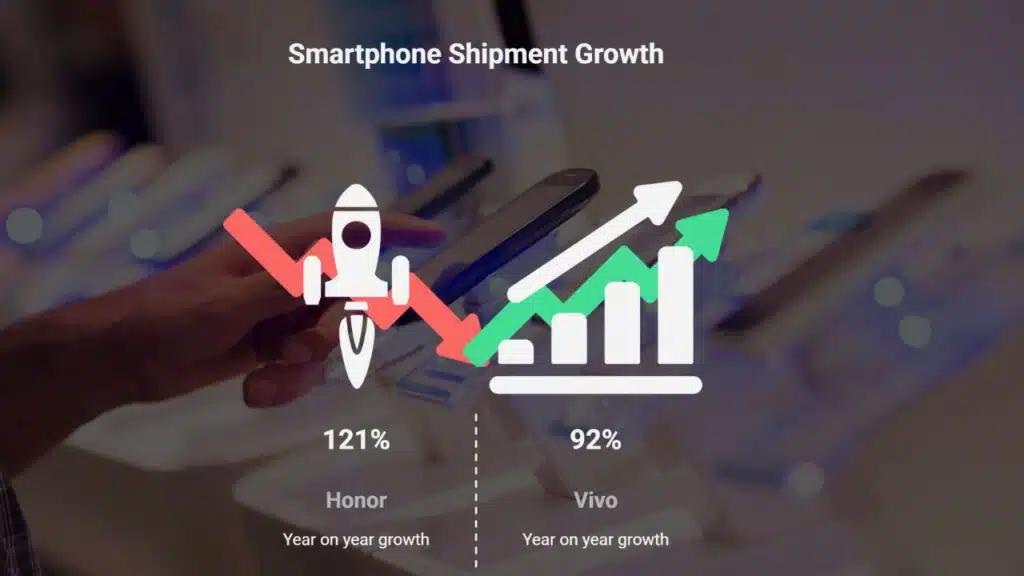

- Honor grew an astonishing 121% year on year, shipping over 1 million units. Its strong showing came from popular X9c and 400 series models, which found traction in mid-range buyers.

- Vivo’s V series shipments jumped 92%, climbing from 9% to 21% of its total portfolio, a sign that mid-range repositioning may be paying off in the long term.

Regional Smartphone Market: Slight Dip Amid Uncertainty

Overall, the Southeast Asian smartphone market shrank 1% year on year, totaling 25 million units shipped in Q2 2025. While this decline may look modest, it highlights the fragile balance of a region affected by both global and local pressures.

Trade tensions reshape supply chains

Ongoing U.S.–China trade tensions have disrupted supply chains, forcing vendors to prioritize U.S. shipments over Southeast Asia. Many production hubs—such as those in China and Vietnam—are being realigned to service U.S. demand, which has indirectly constrained inventory in Southeast Asia. This has complicated vendors’ ability to keep stable stock levels in a region where fast product launches and regular availability are key to brand loyalty.

Currency volatility hits consumer spending

The weakened U.S. dollar has also played a role, influencing local purchasing power and retail pricing. In markets like Indonesia and the Philippines, where large segments of consumers buy smartphones outright (not via contracts), small fluctuations in retail pricing can have outsized impacts on sales. Vendors have had to adjust prices, bundle deals, or offer aggressive promotions to stay competitive.

Tariff uncertainty dampens sentiment

Looming tariff risks across the global tech supply chain have cast a shadow on future planning. Consumers, particularly in the mass-market segment, are becoming more cautious, delaying upgrades in anticipation of either lower prices or new releases.

The Bigger Picture: Southeast Asia as a Strategic Battleground

Southeast Asia remains one of the most dynamic smartphone markets globally. With over 680 million people, a fast-growing internet economy, and rising demand for affordable 5G devices, the region is a crucial testing ground for global smartphone strategies.

- Xiaomi’s return to No. 1 reflects the strength of channel diversification, aggressive sub-brands, and an emerging premium presence.

- Transsion’s surge highlights how catering to first-time buyers and ultra-budget consumers remains a viable path to rapid growth.

- Samsung’s resilience shows the importance of enterprise engagement and premium ecosystem lock-in.

- Oppo and Vivo’s declines demonstrate the risks of brand overlap and the need for sharper differentiation.

Meanwhile, the rise of TikTok Shop and other e-commerce platforms is transforming how devices are marketed and sold, with live-selling and direct deals increasingly becoming key sales drivers in countries like Indonesia, Thailand, and Malaysia.

A Market in Flux

The second quarter of 2025 has redrawn the smartphone map of Southeast Asia. While the overall market contracted slightly, Xiaomi’s comeback proves that flexibility, strong brand tiers, and smart retail strategies can outmaneuver larger but slower rivals.

At the same time, competition in the entry-level and mid-range categories remains fierce, with Transsion and Infinix carving deeper inroads. Premium competition is also heating up, with Xiaomi, Honor, and Samsung all fighting for consumer attention among the region’s growing middle class.

The months ahead will likely see more shifts, especially as economic uncertainties and global trade realignments continue to reshape inventory flows. For now, however, Xiaomi can celebrate its reclaimed crown—a position it lost four years ago but has won back with patience, strategy, and timely execution.

The Information is Collected from South China Morning Post and MSN.