While applying for a Personal Loan is a relatively easy process, it requires careful financial planning. Understanding details like the repayment schedule is crucial to handle the financial responsibility to clear the debt smoothly. This is where a Personal Loan EMI calculator can be your friend. It is a free tool available on loan providers’ websites that allows you to plan your loan repayment efficiently. With this accessible tool, you can simplify your decision-making process and experience peace of mind. Read to learn more about how the Personal Loan calculator helps you.

What is a Personal Loan Calculator?

A Personal Loan calculator helps you estimate the various aspects of the loan. With this tool, you can compute the equated monthly instalments and the interest component based on the amount you borrow. Typically, you need to input these three variables in the Personal Loan calculator based on the lenders’ preset parameters. This also helps you understand the offerings from different lenders. The same happens with the Personal Loan eligibility calculator where you check if you qualify for the loan and how much you can comfortably borrow.

Reasons to Use a Personal Loan EMI Calculator

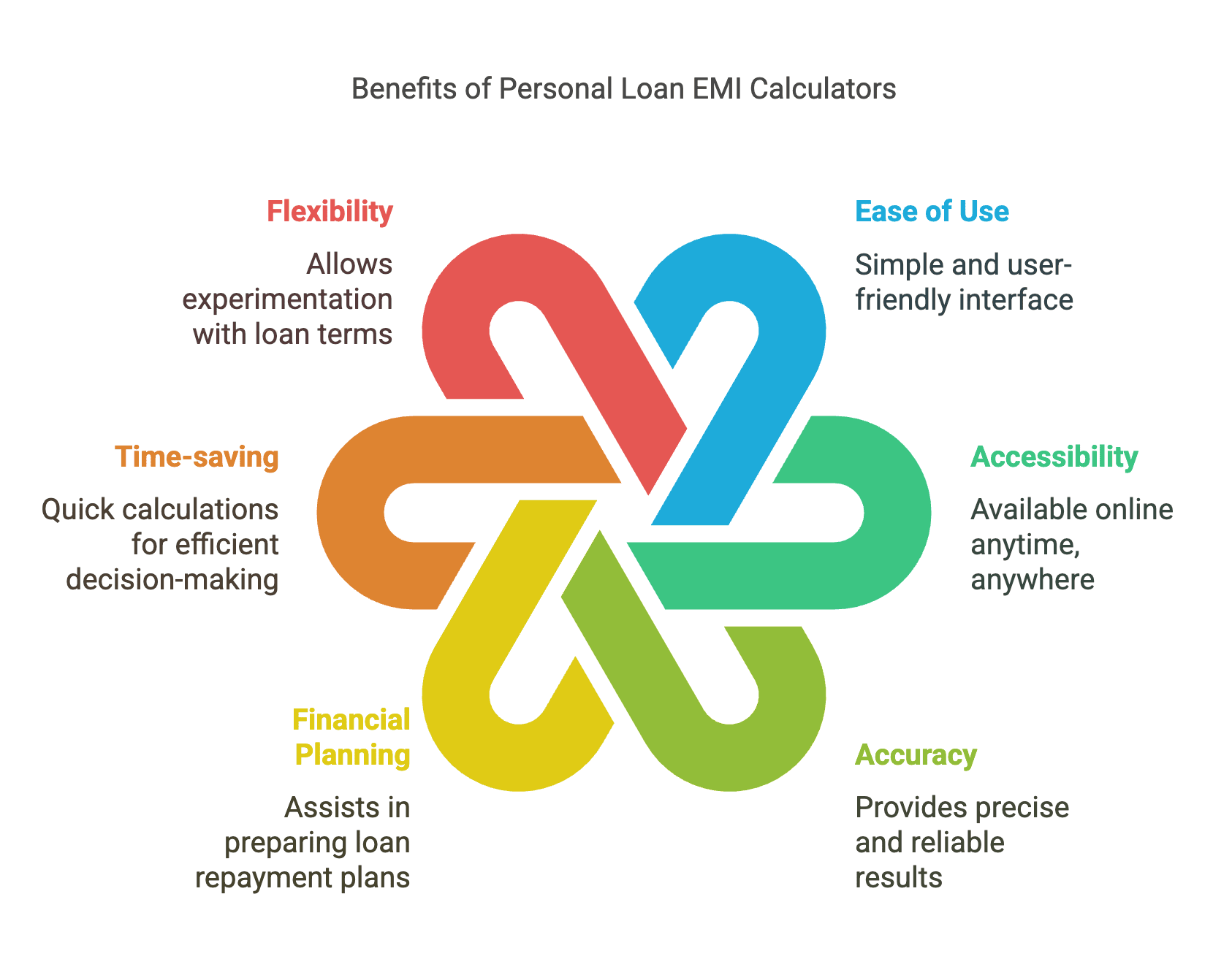

Now that you know how the Personal Loan EMI calculator works, let’s understand some of the reasons that make it an essential tool:

1. Easy to Use

The Personal Loan calculator is a simple tool, which requires zero technical knowledge to use. These tools have a user-friendly design with pre-adjusted variables as per the lenders’ policy. You simply have to input the details such as the loan amount, interest rate, and tenure. You can calculate the EMI and interest rate without any professional assistance.

2. Unrestricted Accessibility

The Personal Loan interest rate calculator is available online, which makes it accessible anywhere, anytime. There is no cost involved in using the tool. You can use it to compute loan terms innumerable times without worrying about any restrictions. You will find it on the lenders’ portal through your smartphone, tablet, or computer.

3. Accurate Output

With manual calculations, there is always a scope for errors, especially with complex interest formulas. A Personal Loan EMI calculator eliminates this risk. As it is an automated tool, it provides precise results. You can rely on the accurate data to visualize your repayment schedule and plan accordingly.

4. Assists in Financial Planning

To have a smooth repayment journey, you want to have a financial plan in place before you apply for a Personal Loan. This way, you are prepared to take on the repayment part of the loan more confidently. A Personal Loan interest rate calculation helps you with such planning. It gives you an idea of the interest rate, EMI, and tenure that works for you.

5. Timesaving

Manually computing Personal Loan EMI can seem like a cumbersome process due to complex formulas and high scope for errors. A Personal Loan calculator resolves these issues and saves you time. It requires minimal input to give you instant results. This gives you more time to evaluate your options than spending hours on calculations.

6. Allows Permutations & Combinations

You can use the calculator tool innumerable times. This gives you the flexibility to adjust loan terms and try different combinations to figure out what works best for you. For example, if borrowing a certain amount results in a higher interest rate, you can reduce the borrowable amount and other aspects like tenure and EMI to see how it affects the interest rate.

7. Helps with Repayment Schedule

You get a snapshot of your repayment schedule with a Personal Loan calculator. When you provide the necessary details, the tool gives you an estimate of your EMI, interest rate, and principal component. These details are also graphically represented in the form of a pie chart for better understanding. Some tools also visualize your repayment schedule through an amortization table.

8. Helps Compare Offers

Besides letting you plan your repayments; Personal Loan interest calculators are invaluable for comparing loan offers. As lenders preset these tools with their offers, you can identify which lender provides a desirable deal based on your financial profile. Hence, it serves a dual purpose of planning and research.

9. Reduces Financial Stress

As the Personal Loan EMI calculator lets you know the exact EMI amount with a clear breakup of the interest and the principal component, you can financially prepare. With a clear estimation using the calculator, you can reduce uncertainty and handle financial responsibility with ease.

10. Aids in Negotiation

While it is true that your eligibility determines the kind of loan terms you get. You get a fair idea about the same through the Personal Loan eligibility calculator. However, if you find yourself with unsatisfactory loan terms, you can find a way around them through negotiation. A Personal Loan interest rate calculator equips you with the data to help with this.

Plan Smart and Borrow Smarter with HDFC Bank Xpress Personal Loan

Applying for a Personal Loan is a big step, but planning makes all the difference in making your borrowing journey smooth. With a tool like the Personal Loan EMI calculator, your planning gets easier and more convenient. Having understood the numerous benefits of using this tool, you can now aptly leverage its potential and apply confidently. As for a seamless application, consider HDFC Bank Xpress Personal Loan and achieve your financial goals with ease. Also, you can use the Personal Loan EMI calculator on the portal beforehand to aid you in planning.

Disclaimer: Terms and conditions apply. The information provided in this article is generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Personal Loan at the sole discretion of HDFC Bank Limited. Loan disbursal is subject to documentation and verification as per Bank’s requirement. Interest rates are subject to change. Please check with your RM or closest bank branch for current interest rates.