A credit score is a three-digit number that lets lenders know the risk of extending credit to a borrower. High credit scores allow borrowers to access lower interest rates and favorable terms, while low scores may reduce the amount of loans and credit products they can get. The impact of your credit score goes beyond borrowing. Good credit may also improve your odds of success when you’re looking for a rental home or a new job (in certain specific cases). People with good credit may also enjoy lower insurance premiums. But to get access to these benefits, it helps to know what a credit score is and how you can improve yours.

What is a Credit Score?

A credit score is a three-digit number that represents an individual’s creditworthiness based on their credit history and financial habits. Lenders use this score to assess how likely a borrower is to repay debt on time. Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Credit scores fall into different ranges:

- Poor (300 – 580): People with poor scores are less likely to be approved for most personal loans and credit cards. If approved, they’ll usually face higher interest rates. Poor credit borrowers can benefit from working with lenders who specialize in bad credit loans.

- Fair (580-669): While a fair score is still considered a below average in the U.S., fair credit borrowers have better access to credit products compared to poor credit borrowers.

- Good (670-739): Lenders consider good credit borrowers to be relatively low risk. These borrowers can access many loans and credit cards with low fees.

- Very Good (740-799): A very good score is above the average of U.S. consumers. In this range, you can access most loans and credit products and secure favorable interest rates.

- Exceptional (800 to 850): Exceptional scores are considerably above average and borrowers in this category are deemed very low risk. Borrowers will usually be offered the lowest available interest rates.

Credit scores vary slightly based on the scoring model but the ranges listed above are generally accurate for FICO® scores, the most used scoring model.

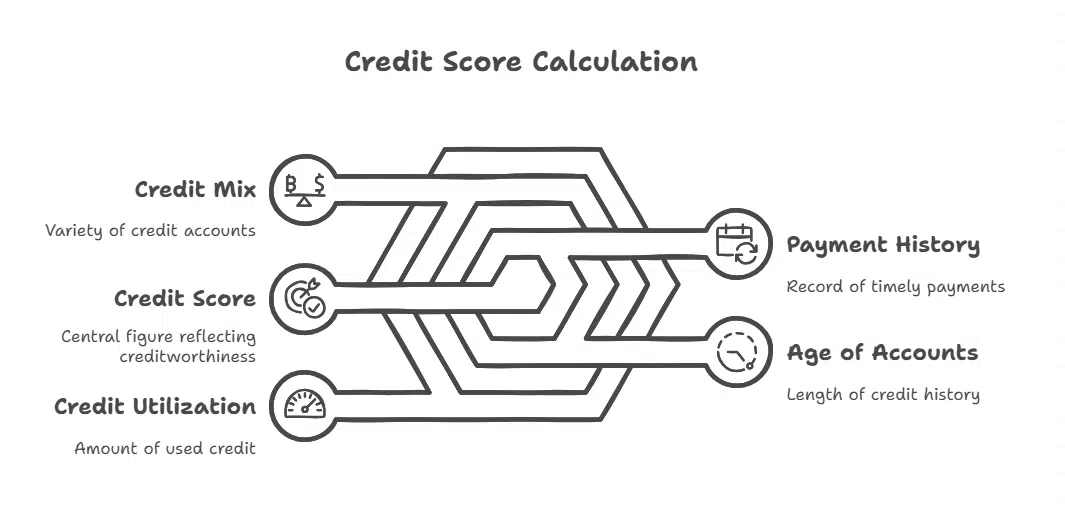

How is a Credit Score Calculated?

Credit scores are calculated by sophisticated tools called scoring models. These models use information from your credit report including your payment history, age of accounts, credit mix, credit utilization ratio, and new credit applications to arrive at a figure that captures your credit habits. Making payments in full and on time as well as keeping your credit utilization low are two impactful ways to maintain a good credit score.

Why is a Credit Score Important for Loans?

Lenders use credit scores to determine whether a borrower qualifies for a loan and what terms they will receive. A higher credit score can lead to better borrowing terms, while a lower score may make it costly through higher interest rates or reduce the odds of approval.

- Loan approval chances: A high credit score indicates that a borrower has a history of managing credit responsibly, making them more likely to receive loan approval. On the other hand, a low score may lead to loan rejections. In some cases, borrowers may need to prove they can repay the loan by providing evidence of assets like land, CDs, stocks, bonds, etc.

- Interest rates and loan terms: Lenders frequently offer better terms to borrowers with high scores because they are considered lower risk. For example, a mortgage applicant with a credit score of 750 may receive a significantly lower interest rate than someone with a score of 620, potentially saving thousands of dollars over the life of the loan.

- Loan amounts and credit limits: Borrowers with strong credit profiles may be eligible for higher loan amounts and better credit limits on credit cards, providing greater financial flexibility.

Building your credit score before you apply for a loan can lower your overall interest expenses and get you access to favorable terms. Whether you’re seeking a mortgage, a car loan, or a personal loan, it’s worth spending some time improving your credit in the lead-up to your loan application. Making timely payments and keeping your credit card balances as low as possible may improve your credit score. Remember that too many credit applications may lower your score, so look for pre-approval where possible.

Disclaimer: This content is sponsored by myFICO and is provided for informational purposes only. The information shared here is not intended to serve as financial, legal, or credit-related advice. Readers are encouraged to consult with their personal financial advisors or credit professionals to assess their specific situation. To learn more about myFICO’s services, including credit scores and monitoring tools, please visit the myFICO website or reach out to a myFICO representative.