Traveling for work can be exciting and rewarding, but it also comes with its fair share of expenses. Fortunately, Malaysian tax laws offer various ways to ease this financial burden by allowing professionals and business owners to claim deductions and optimize tax savings.

Understanding how to reduce taxable income while complying with regulations can make a significant difference in your financial planning.

This guide explores ways to save on taxes while traveling for work in Malaysia, ensuring you maximize your deductions legally and efficiently.

Understanding Tax Deductions for Work Travel in Malaysia

Work-related travel expenses can be a significant part of a business’s financial planning, and understanding how to optimize these costs is crucial. By taking advantage of tax deductions, business owners and professionals can ensure that travel expenses are managed efficiently and within legal guidelines.

This section will explore the key aspects of ways to save on taxes while traveling for work in Malaysia, ensuring that you make the most of available deductions.

What Qualifies as Work-Related Travel?

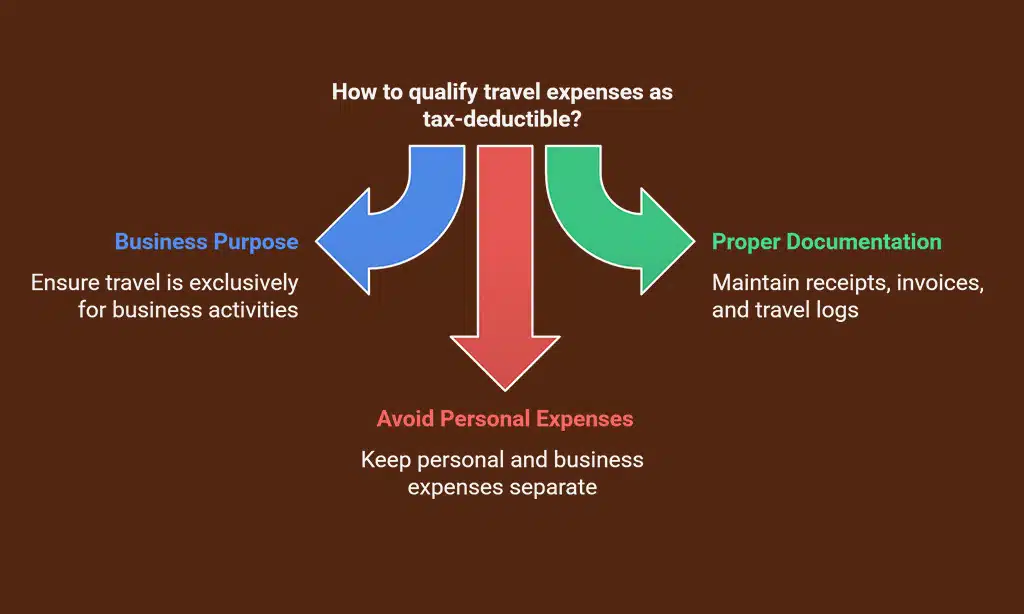

For expenses to be tax-deductible, they must be incurred wholly and exclusively for business purposes. Common types of work-related travel include:

- Business meetings with clients or partners

- Attending conferences, seminars, and training sessions

- Traveling for fieldwork or business expansion

- Inspection trips or on-site client consultations

Key Considerations:

| Criteria | Details |

| Purpose | Must be exclusively for business-related activities |

| Documentation | Receipts, invoices, and travel logs required |

| Personal Expenses | Non-deductible if mixed with business travel |

Key Tax Laws and Regulations to Consider

The Malaysian Income Tax Act 1967 outlines various deductible business expenses, including work-related travel. However, taxpayers must ensure:

- Expenses are properly documented and recorded.

- They comply with Inland Revenue Board (LHDN) guidelines.

- No personal or leisure expenses are mixed with business-related costs.

7 Ways to Save on Taxes While Traveling for Work in Malaysia

Maximizing tax savings while traveling for work is essential for business owners and employees. By leveraging legal tax deductions and strategic financial planning, you can significantly reduce travel-related expenses.

Whether you frequently visit clients, attend corporate meetings, or travel for training, understanding the best tax-saving methods can ensure you optimize your financial resources. Here are the top ways to save on taxes while traveling for work in Malaysia and how you can make the most of them.

1. Claiming Travel Expenses as Deductions

One of the most effective ways to save on taxes while traveling for work in Malaysia is to claim legitimate travel expenses. These include costs associated with airfare, accommodation, meals, transportation, and work-related incidentals. By properly documenting these expenses, businesses can significantly lower their taxable income.

What Can Be Deducted?

| Type of Expense | Deductibility |

| Flights, train, or bus fares | Fully deductible if for business purposes |

| Accommodation (hotel stays) | Deductible if necessary for work |

| Meals & entertainment | Partially deductible under certain conditions |

| Parking & toll charges | Deductible for business-related trips |

| Rental car expenses | Deductible if used for work |

Tips for Maximizing Deductions

- Always keep travel receipts and invoices.

- Use corporate accounts or credit cards for easy tracking.

- Categorize personal and business expenses separately.

- Maintain a travel log detailing business purposes.

2. Leveraging Per Diem Allowances

Per diem allowances are daily stipends provided to employees or business owners for work travel. These allowances cover meals, lodging, and incidental expenses, simplifying expense claims and ensuring tax efficiency.

How Per Diem Helps Reduce Taxable Income

| Benefit | Explanation |

| Simplified Documentation | No need to keep receipts for each expense |

| Tax-Free Payments | Per diem payments are tax-free under LHDN regulations |

| Predictable Budgeting | Employers can plan travel expenses in advance |

- Employers can pay per diem instead of reimbursing actual expenses.

- Per diem payments can be tax-free if they follow LHDN regulations.

- It simplifies record-keeping, reducing the need for excessive documentation.

3. Using Corporate Credit Cards for Business Expenses

Corporate credit cards are not only convenient but also help with tax compliance. By using a designated business credit card, professionals can easily separate work-related expenses from personal ones, ensuring better financial tracking.

Benefits of Using Corporate Credit Cards

| Advantage | Details |

| Expense Tracking | Automatically records transactions |

| Tax Compliance | Provides clear audit trails |

| Cash Flow Management | Avoids out-of-pocket expenses |

4. Keeping Detailed Travel and Expense Records

Maintaining proper documentation is crucial for tax savings. Without clear records, deductions may be disallowed, leading to higher tax liabilities.

Why Proper Documentation Matters

| Factor | Importance |

| Compliance | Ensures adherence to tax regulations |

| Audit Prevention | Reduces the risk of penalties |

| Maximized Deductions | Helps claim all eligible expenses |

Recommended Tools for Expense Tracking

| Tool | Features |

| Expensify | Receipt scanning, auto-categorization |

| QuickBooks | Expense tracking, financial reports |

| Zoho Expense | Integration with accounting systems |

5. Maximizing Tax-Free Benefits and Allowances

Many work-related reimbursements are tax-free, allowing employees to lower their taxable income without affecting their net earnings.

Common Tax-Free Benefits

| Benefit | Explanation |

| Company-Paid Flights | Fully covered without taxation |

| Accommodation Allowances | Non-taxable if directly paid by employer |

| Training & Seminar Fees | Deductible if work-related |

6. Structuring Work Travel to Optimize Tax Savings

Strategic planning can lead to better tax benefits. Organizing trips efficiently minimizes unnecessary expenses and ensures cost-effectiveness.

Key Strategies

| Strategy | Benefit |

| Combining Meetings | Reduces repeated travel costs |

| Off-Peak Scheduling | Saves on airfare and lodging |

| Loyalty Programs | Earns rewards for future business trips |

7. Consulting a Tax Professional for Strategic Planning

Seeking expert advice is one of the best ways to save on taxes while traveling for work in Malaysia. A tax consultant can provide tailored guidance, ensuring businesses maximize allowable deductions and avoid compliance issues.

Why a Tax Consultant is Valuable

| Reason | Explanation |

| Deduction Optimization | Identifies tax-saving opportunities |

| Compliance Assurance | Helps navigate legal complexities |

| Strategic Planning | Provides customized tax strategies |

Takeaways

Work-related travel expenses can be significant, but with proper planning and knowledge, you can legally reduce your tax burden.

By following these ways to save on taxes while traveling for work in Malaysia, business owners and employees can maximize deductions, minimize taxable income, and ensure compliance with tax regulations. Implement these strategies to make your business trips more cost-effective and financially beneficial.