High credit card interest can feel like a heavy chain on your wallet, pulling you down. You make on-time payments and yet the APR keeps climbing. Many people wish they could cut those rates.

Smart Ways To Negotiate Lower Credit Card Interest Rates can help you do just that.

The average interest rate, or APR, ran at 16.88% in late 2019. That rate can trap you in a debt loop. This post shows 15 Smart Ways To Negotiate Lower Credit Card Interest Rates. You will learn how to check your credit score and review your credit report.

You will see how to call your card issuer and ask for a lower interest rate. You will use a balance transfer offer or set up a debt management plan. These steps can cut your interest payments and free up more cash.

Keep reading.

Key Takeaways

- Review your card terms and score first. The average APR stood at 16.88% in late 2019. Pull your free FICO score. Keep your credit use under 30% and pay on time.

- Compare rival cards on Bankrate.com, CreditCards.com, WalletHub.com and issuers like Capital One, American Express, Citi, and Bank of America. Seek 0% intro APR deals (12–18 months) from cards like Discover it Balance Transfer or Wells Fargo Reflect.

- Build a strong case before you call. Note your APR, payment history, recent statements, credit score, and any hardship proof (job loss or medical bills). Mention competitor offers, use clear debt numbers, log each call, and ask politely for a 1–3 point rate cut or supervisor review.

- Leverage balance transfers or a nonprofit plan. Shift debt to a 0% APR card or join Take Charge America’s debt management plan. Use free calculators, follow a debt-avalanche method, and run on-time payments to boost your odds for a permanent rate drop.

Review Your Current Credit Card Terms

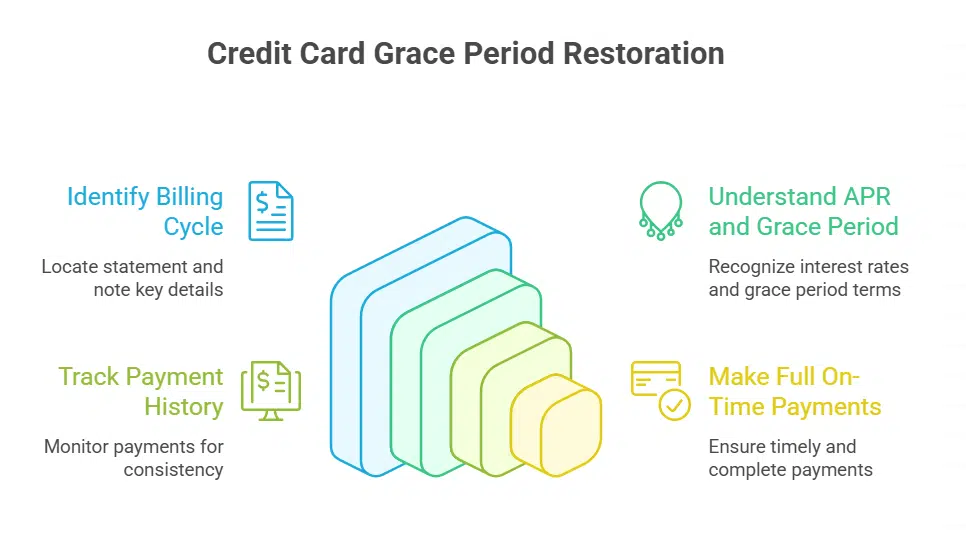

Locate the current billing cycle in your credit card statement. Note the annual percentage rate (APR), the grace period, the payment due date, and your current balance. Most card issuers give a 15 to 21 day grace period after the statement closes.

If you carry a balance past that, they drop the grace period. Typical APRs range between 15 and 25 percent, and some cards charge over 30 percent.

Link your card to your checking account portal or use a financial calculator to see how interest adds up. Track your payment history and watch for late or partial payments. Making full on-time payments for a few months can restore that grace period.

Keep in mind that rewards cards often carry higher rates than standard cards, and retail cards usually charge even more on credit card debt.

Check Your Credit Score and Improve It if Necessary

Pull your credit profile and FICO rating from a free reporting site. A higher credit score prompts credit card companies to cut your interest rate. Keep your credit utilization rate below 30 percent and pay off balances as they come due.

Use online tools or budgeting calculators to spot overspending before it hurts your score.

Make on-time payments a habit. Reliable payment history convinces a credit card company to lower your interest rate after six months of steady record. John Rampton says to negotiate an interest rate reduction every half year until you get a no.

If an issuer refuses, keep paying on time and mention your score gains on your next call.

Research Competing Offers from Other Credit Card Companies

You can shop for better deals on credit cards. Compare offers from top sites and issuers.

- Scan Bankrate.com, CreditCards.com, and WalletHub.com for current annual percentage rate, signup bonus, and grace period details.

- Review cards from Capital One, American Express, Citi, and Bank of America to spot a lower interest rate offer.

- Look for 0% intro APR cards that give you 12 to 18 months of interest-free purchases.

- Compare balance transfer fees and limits to see if you can shift credit card debt at a reduced rate.

- Check the ongoing APR that applies after the promo ends, noting the 16.88% average rate in November 2019.

- Read the fine print on annual fees, payment history rules, and cash back or travel reward terms.

Prepare a Strong Case Before Calling Your Card Issuer

Note down your annual percentage rate (APR) and payment history. Gather recent statements and your credit score from a free report. Check rival interest rates from other credit card companies.

Record a salary cut or a large medical bill as proof of financial hardship. Run numbers with a financial calculator to show savings on debt repayment.

List your on time payments over the last year. Find a competitor offer at 12 percent APR or below. Jot down figures from a balance transfer offer or a plan from a credit counseling agency.

Keep a log of the date, time, and name of every customer service representative you speak with.

Call and Request a Lower Interest Rate Directly

Pick the card you have held longest, and call the number on the back. Aim your talk at a customer service representative. State your payment history and loyalty. Point out new lower-APR offers from other card issuers.

A 20-minute call can cut your annual percentage rate. Use terms like credit utilization rate and credit card balance. Mention steady on-time payments. Show the issuer you know debt management and your repayment plan.

If the issuer says no, ask for a 1 to 3 point drop for a year. Request a temporary interest break if they cannot lower your rate permanently. Wait three to six months before you try again.

Steer clear of threats to close your card, that can harm your credit score.

Be Persistent and Ask to Speak with a Supervisor if Needed

Keep a polite tone when you call your payment network. Ask customer service representatives to transfer you to a supervisor if they reject your APR cut. Use your credit history and payment history.

Highlight your on-time payments. Cite a low credit utilization rate and a balance transfer concession.

Log each call’s date and agent name for follow-up. Call again every six months for a better APR. Mention any financial difficulties you face, and offer proof. Loop in a credit counseling agency if you need expert tips.

You can nudge your APR lower.

Mention Any Temporary Hardship or Financial Challenges

Acknowledge a recent job loss or sudden medical bills. Show your on-time payments and a higher credit score. Mention a high credit utilization rate and ask for a one to three point APR cut for a year.

Point to a debt avalanche method plan and a call to a credit counseling organization. Run a financial calculator to prove how lower interest can cut your credit card debt. Many issuers offer hardship programs or temporary rate reductions.

Leverage a Balance Transfer Offer as Negotiation Leverage

Show your credit card issuer a Discover it Balance Transfer deal that offers 0% intro APR for 14 months. Tell them you plan to move a $5,000 credit card balance to that account if they do not cut your annual percentage rate.

Mention a Wells Fargo Reflect offer with 0% intro APR for 15 months to add weight. Balance transfer cards let you consolidate multiple debts for easier debt consolidation.

Focus extra payments on cards with higher rates once you lock in a lower APR. Saved interest dollars then go toward larger credit card debt, following the debt avalanche method. Use a free financial calculator or call a credit counseling agency to chart payoff progress.

Consider Using a Debt Management Plan

Take Charge America is a nonprofit debt counseling agency that offers a debt management plan to repay your credit card debt faster. They have helped 1.6 million people since 1987. A lower annual percentage rate cuts debt repayment time and may boost your credit score.

The plan bundles multiple card balances into one payment due on the statement due date each month.

Nonprofit agencies call customer service representatives at your credit card issuer to seek a lower interest rate. They often secure an interest rate reduction on your behalf. A structured plan can shrink your APR and your total credit card balance.

You maintain on-time payments within the grace period and track your payment history and credit utilization rate. You can use financial calculators to map payoff dates and plan bigger debt consolidation moves.

You even boost a small emergency savings fund while you follow the plan.

Avoid Common Mistakes, Like Being Rude or Unprepared

Mistakes can cost you a rate cut. Stay polite and plan your call carefully.

- Speaking harshly with reps will shut down talks quickly. Smiling even over the phone can keep you in the game.

- Lacking facts when you dial means you waste time and might lose odds. Check your credit score, APR, and payment history before you call.

- Lying about your past debts can backfire when the issuer checks your statement due date and records. Stay honest so you keep trust with the customer service representative.

- Threatening to close your Visa account can hurt your credit utilization rate and knock your score down. Ask for steps you can take instead of using threats.

- Skipping credit report checks makes it hard to argue for a lower interest rate reduction. Run a file through financial calculators or get help from a free credit counseling agency.

- Ignoring grace period terms might lead to late fees and spoil repayment plans. Read your statement due date each month to spot your real window for on-time payments.

- Failing to ask for reasons after a flat rejection will stall your efforts. Request tips to improve your odds next time you seek an interest rate cut.

- Overlooking your debt management plan options may leave you stuck with higher rates. Weigh a debt consolidation loan or credit counseling support if the issuer says no.

Know When to Explore Alternative Options if Denied

Issuer may say no now. Plan to call again in three to six months. Keep paying on time, so your payment history shines. Mention a lower annual percentage rate (APR) offer from another credit card issuer.

You can ask for a balance transfer card to consolidate debt. A transfer could lower your credit card balance costs.

Compare competing credit card offers for lower-interest options. Check personalized offers, avoid random applications. Use your improved credit score and a low credit utilization rate to strengthen your ask.

Some people add a debt management plan or use a credit counseling agency. Try financial calculators to see potential savings.

Takeaways

You hold 15 smart ways to cut your credit card APR. A quick call to your card issuer may drop your rate. Checking your credit score first can boost your chance. You can run numbers on money calculators to plan debt repayment.

Loan consolidation or a chat with a credit help center can lend support. A lower rate speeds up payoff and saves cash. Pick a tactic today and make that call.

FAQs on Ways To Negotiate Lower Credit Card Interest Rates

1. How do I ask my credit card issuer for a lower interest rate?

Check your payment history, credit score, credit utilization rate, and statement due date. Call customer service representatives, or send an email or sms. Mention your on-time payments, low credit card balance, and a competing credit card offer. Keep it polite, clear, and friendly.

2. Can a better apr lead to real savings?

Yes. A lower apr cuts finance charges and speeds up debt repayment. It shrinks your credit card debt and boosts debt management. Plug numbers into a financial calculator to see how much your credit card interest rate can drop. Then pay more each month.

3. What if I missed payments or face financial difficulties?

Call the issuer, explain your situation, and ask about a grace period. They might offer debt settlement or debt consolidation, a lump sum payoff, a line of credit, or a home equity loan. You can also talk to a credit counseling agency for free financial counseling.

4. Does a competing credit card offer give me leverage?

Yes. A low rate from another credit card company can help. Compare credit card terms side by side. Mention that offer in your electronic communications, by email or sms. You might also use a debit card for some buys to show you will spend less on credit.

5. Who can guide me through complex debt rules?

A credit counseling agency or a nonprofit financial counseling group can help. They use fact-checked tips, financial calculators, and debt management plans. They will map out a path to cut your credit card debt, and teach you to watch your payment history and credit scores.

6. Do cookies, user profiles, or site accessibility matter in rate talks?

Not for your rate cut. Banks like Mastercard International may track cookies, user profiles, and internet service provider data to tailor ads. They may tweak site accessibility. But when you seek an interest rate reduction, focus on your credit scores, on-time payments, and a solid ask.