You worry about steep estate taxes and gift taxes when you pass on your home or savings. These fees can shrink your legacy and leave heirs with less. Here is one fact: an irrevocable trust can pull assets out of your taxable estate and cut your federal estate tax bill.

This guide shows seven ways to use revocable trusts, dynasty trusts, and charitable lead trusts to gain tax benefits. You will learn how to tap gift tax exemptions, manage trust distributions, and shield assets from creditors.

Keep reading.

Key Takeaways

- Irrevocable trusts lock assets out of your estate to cut the 40% federal estate tax. For example, moving $2 million can save $800,000 in estate taxes.

- You can gift $17,000 per person per year in 2024 without a gift tax. Gifts above that need IRS Form 709, and you can use your lifetime exemption in trusts like a SLAT.

- Generation-skipping trusts tap the GST exemption to avoid estate taxes at each generation. A dynasty trust can hold assets for decades and shield them from levies.

- Charitable remainder trusts dodge capital gains tax and give an IRS Sec. 664 income-tax deduction. A charitable lead trust can pay $25,000 a year on $500,000 at 5% to charity, then pass assets tax-free to heirs.

- An Intentionally Defective Grantor Trust (IDGT) makes you pay all trust income tax while trust assets grow outside your estate. This split cuts your estate tax on those assets.

Choose the Right Type of Trust for Tax Efficiency

Pick a living trust to tweak terms later or a fixed trust to shield assets and use your gift tax exemption. Your choice shapes estate tax planning, steers capital gains treatment, and guides your fiduciary’s role.

Revocable Trusts

A grantor names a trustee to manage assets in a revocable living trust. The grantor pays income tax on trust earnings each year. Assets stay in the taxable estate at death. This tool costs little, but adds no estate tax shield.

Many heirs dodge probate fees, thanks to this estate planning trick. Creditors can stake claims until after the grantor passes. Trust income hits your tax bracket, not a trust rate.

Lawyers call it a probate buster, not an asset protection fortress.

Irrevocable Trusts

Irrevocable trusts lock assets outside your taxable estate. They cut estate taxes by shrinking your taxable estate. Grantor pays income tax on any trust earnings. That move trims what the IRS can tax at death.

Some trusts also double as asset protection trusts. This adds a layer of creditor protection and tax benefits.

Irrevocable Life Insurance Trust holds policies outside your estate. It keeps life insurance proceeds tax-free at death. Trustees follow state code for asset protection trust rules.

Family members receive full payouts with no estate taxes. That setup speeds wealth transfer to heirs. Grantor still pays tax on trust income, but stays clear of estate tax on death benefit.

Utilize Irrevocable Trusts for Estate Tax Reduction

Wealthy families improve estate planning and slash their taxable estate when they fund an irrevocable trust. They shift rental homes, dividend stocks, or life insurance proceeds out of that taxable pile, cutting federal estate taxes at the 40% rate.

A $2 million transfer could shave about $800,000 off heirs’ tax bills.

Grantors still call many shots, steering distributions with spendthrift clauses, and they shield funds from creditors. It feels like pulling a rabbit out of a hat, as assets drop off the taxable estate while Medicaid planning trusts keep long care costs at bay.

Many advisors tap a bank or trust company as trustee, boosting protection and clean income taxation records.

Leverage the Gift Tax Exemption

IRS rules let you gift a set amount under the annual gift tax exemption. You can move assets out of your taxable estate for no tax. You can gift cash, stocks, or bonds. Gifts above that limit need Form 709.

That IRS form tracks lifetime gift amounts.

Spousal Lifetime Access Trust uses this gift tax break. High-net-worth individuals fund a SLAT with tax-free gifts to cut estate taxes and boost asset protection. That irrevocable trust still lets you take trust distributions of income and principal.

You tap both the annual and lifetime exemptions. Next, you can move into generation-skipping trusts.

Maximize Generation-Skipping Trusts for Long-Term Savings

Think of a relay baton, passed down, yet no tax stops the handoff. A generation-skipping trust taps the GST exemption, blocking estate taxes at each family link. This tactic anchors estate planning, locking up assets inside an irrevocable fund, cutting the taxable estate right away.

Scheduled payouts guide trust distributions to heirs under current tax rates near 40 percent.

Grantors feed funds with life insurance proceeds, cash gifts, or shares in stock portfolios. A dynasty trust layer adds asset protection, and holds real estate or bond accounts for decades.

Heirs watch value climb inside the shield, free from extra levy bites at each handoff, and plan smooth wealth transfer. A corporate trustee tracks filings, trust laws, and trust accounts to stay on the straight and narrow.

Use Charitable Trusts for Dual Benefits

A philanthropic remainder fund lets you avoid capital gains tax and grab an income-tax break under IRS Section 664. You file Form 5227, pick a top-rated charity on Charity Navigator, and shrink your taxable estate while charities win big.

Charitable Remainder Trusts

Charitable remainder trusts pay you or other beneficiaries a reliable income stream. You fund trusts with equities, funds or real estate. You claim an immediate charitable tax deduction based on the gift’s present value.

The plan defers capital gains tax until you receive trust distributions. Charity gets the leftover assets after the payout term ends.

Estate planning pros favor these trusts for their tax benefits and estate tax reduction. They help you dodge big taxable income spikes when you shift a brokerage account or sell property.

Next, learn how a charitable lead trust flips the payout order to benefit causes early.

Charitable Lead Trusts

A charitable lead trust pays income to a charity for a set term. Donors claim an income tax deduction right away. Estate planners use the irrevocable trust to lower a taxable estate.

The tool cuts estate taxes on future wealth.

Families set the term, say 10 or 20 years. A trust funded with $500,000 that pays 5% each year nets $25,000 for charity and trims gift taxes. The structure offers tax benefits for high-net-worth individuals.

After the term ends, remaining assets flow to heirs tax-free.

Establish an Intentionally Defective Grantor Trust (IDGT)

An Intentionally Defective Grantor Trust shifts asset growth beyond your taxable estate and fits within savvy estate planning. You transfer stocks, real estate or municipal bonds into the irrevocable trust under your gift tax exemption.

IRS treats all trust income as your personal gross income, so you shoulder every tax bill. This tax payment acts as stealth wealth boost, letting trust funds compound via dividends or rent, without erosion by estate taxes later.

It feels like planting seeds you never have to trim, as you watch them sprout beyond estate taxes. A solid trust instrument and power of substitution seal the deal. Courts see the trust as outside your estate, yet IRS still calls you the grantor for income tax.

That split slashes your taxable estate and keeps assets out of probate, while creditors face a tough climb, making wealth transfer smoother.

Optimize Income Tax Management in Trusts

Shift trust income into lower tax brackets, file IRS Form 1041, cut your tax bill, and read on.

Managing Trust-Generated Income

Trustees can cut tax bills by shifting income to beneficiaries. A simple trust can pay interest or dividends, and beneficiaries report that income on their Form 1040. That move trims taxable income inside the plan.

A $10,000 payment may save thousands in trust‐level taxes. That tactic uses trust distributions as a shield against higher trust tax rates.

Smart trustee selection can cut fees and boost compliance. A complex trust might use tax deductions for expenses like trustee fees, legal costs, and investment services. The trustee posts each share on Schedule K-1, and beneficiaries pick up their slice of income taxes.

Trustees must track each transaction, follow accounting rules, and meet IRS rules on Form 1041. Clear records speed up compliance and protect assets in a spendthrift trust.

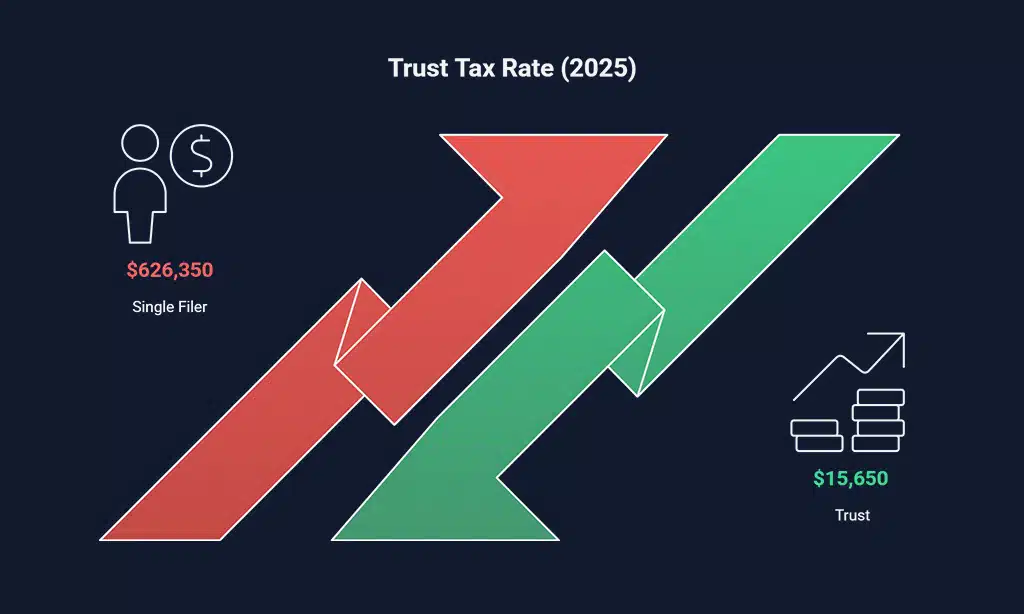

Understanding Trust Tax Rates

Many trusts hit the top federal rate at a low threshold. The Internal Revenue Service sets a 37 percent bracket for taxable income above $15,650 in 2025. A single filer needs $626,350 to reach the same 37 percent rate.

Trusts climb faster than individuals on the tax scale. Plans must account for that steep rise.

Simple trust distributions can push taxable income past that limit with a few gains. Filers must submit Form 1041 to report trust income, deductions, and credits. Tax advisors note you should track each trustee move and watch tax laws like the Tax Cuts and Jobs Act.

State income tax might add on top of the federal rate.

Avoid Probate and Save on Administrative Costs

A living trust avoids the probate process, so heirs claim assets fast. This method cuts admin fees that often run two to five percent of an estate.

High-net-worth families use a revocable living trust to keep details out of public records, it shields private data. A spendthrift trust can block creditor claims and speed up distributions, it lowers administrative costs too.

Work with Tax Professionals for Strategic Planning

Talk to a tax expert to spot chances to cut levy on your taxable estate. Regular reviews can curb estate taxes.

- Hire a certified public accountant and an estate attorney to craft your estate plan, using revocable living trust and irrevocable trust tools for asset protection.

- Consult an estate lawyer experienced with life insurance trusts at Massachusetts Mutual Life Insurance Company to remove policy proceeds from your taxable estate.

- Engage a wealth manager who works with high-net-worth individuals to set up dynasty trusts for long term wealth transfer.

- Talk over charitable remainder trust versus charitable lead trust with a planner to gain tax deductions and support a chosen cause.

- Use an advisor to apply the gift tax exemption, gifting $17,000 per person in 2024 to slim down your taxable estate.

- Let professionals audit trust distributions and compute trust-generated income, so you can manage income tax rate hits.

- Ask a trust attorney to craft domestic asset protection trust documents, adding creditor protection under state bankruptcy laws.

- Partner with a CPA to track updates from the Tax Cuts and Jobs Act of 2017 and tweak your strategy to keep income tax exemptions.

- Monitor federal estate tax thresholds, like the $13.61 million limit for 2024, and adjust your use of credit shelter and marital deduction tools.

- Check the probate process in your state and use a revocable trust to steer clear of court fees and delays.

- Note Fidelity’s disclaimer, it offers no legal or tax advice, so work with your tax team to stay compliant.

Takeaways

Give trusts a place in your tax plan. Each tool from CRT to IDGT cuts your estate tax bill. You can shift assets with a GST trust and gift tax exclusion. Those steps curb probate fees and protect assets.

Review plans with a tax pro to stay by the book and cut risk.

FAQs on Ways to Leverage Trusts for Tax Savings in USA

1. What is a revocable living trust, and can it cut estate taxes?

A revocable living trust helps you avoid the probate process, move assets fast, and change its terms. It does not cut your estate taxes, you still face taxes on your taxable estate. A simple trust gives out all income each year. A complex trust keeps income inside, it can grow money over time and help with wealth management.

2. How can taxpayers use an irrevocable trust for tax benefits?

Taxpayers can use an irrevocable trust to move assets out of the taxable estate. This can cut estate taxes right away, giving you key tax benefits. You use your gift tax exemption to fund it. This trust can help wealth transfer to heirs. It also adds creditor protection, like a shield for your money.

3. How do high-net-worth individuals use long term trusts and asset shield trust?

High-net-worth individuals can use a long term trust to pass assets down for years. It can cut inheritance taxes, so you keep more in your family. An asset shield trust adds extra asset protection. It stops creditors cold, like a strong castle wall.

4. What is a spendthrift trust and how do spendthrift provisions work?

A spendthrift trust can keep your heirs from blowing through money. Its spendthrift provisions stop creditors from grabbing trust distributions. It acts like a fence around your funds. This trust can guard funds from greedy claims.

5. How do charitable trust and donor trust lower my taxable income?

A charitable trust cuts your taxable income when you give to charity. You get tax deductions now, and feel good too. A donor trust pays a stream to charity first, then your family gets the rest. It can save taxes and help others at the same time.