Many homeowners want to increase home value with small fixes. They worry about high costs from big remodels. That feels tough.

In 2023, the average homeowner spent $13,667 on home improvements. Here are eight simple tips to boost curb appeal, add usable square footage, and cut energy bills. You will see how a fresh coat of paint with neutral colors, new cabinet hardware, and a small kitchen remodel can lift home value.

We also cover ceramic tile flooring, smart thermostat installs, and a home staging trick. Plus, we explore funding tools like an unsecured personal loan, a home equity line of credit, or a cash-out refinance.

Keep reading.

Key Takeaways

- In 2023, homeowners spent an average of $13,667 on improvements; simple fixes like a pro clean at $200–$225, decluttering, and neutral paint at $43 per gallon can lift home value fast.

- Converting an attic or basement adds usable space and can cost $22,200–$81,800 (average $50,000); a $12,000 patio deck also boosts appeal—fund these with a HELOC, home equity loan, or personal loan.

- New double-pane windows ($8,000–$24,000) cut heating and cooling costs by 7–15%, a smart thermostat ($175–$1,000) trims bills another 8% (about $50/year), and smart security can increase sale price by 3–5%.

- A fresh coat of neutral paint and cabinet repaint ($200–$300), plus new hardware ($50 per cabinet), give kitchens and rooms a modern feel that draws buyers.

- Small kitchen and bath tweaks—swap faucets or showerheads, add a tile backsplash ($40–$100/sq ft), and hang a framed mirror—cost little but yield big value gains.

Clean and Declutter

Clean spaces boost home value. A tidy house feels new.

- Pay HomeAdvisor pros $200 to $225 to wash a four-bedroom house top to bottom, kill dust and grime, add curb appeal.

- Toss clutter into plastic crates and pack charity bin items to free up room, save cash and improve home staging for an open house.

- Scrub walls and baseboards with a cloth rag to remove stains, show well-kept rooms and bump property value.

- Run an upright cleaner over carpets and then mop floors to cut dust, boost indoor air quality and protect home equity.

- Tackle storage areas in the garage or attic to clear old gear, highlight usable square footage and signal smart upkeep.

Add Usable Square Footage

Ripping out old plaster and adding insulation can open up your empty space, and it feels like you just added a whole room. You can turn that drafty lower level into a bright bonus area, with lighting and clean lines that wow any buyer.

Convert an attic or basement

Turning an empty attic or basement into living space can boost curb appeal and home value almost instantly. This upgrade often costs $22,200 to $81,800, with the average near $50,000.

- Scout existing attic or basement with a quick home inspection, spot wiring, joists and insulation before major home improvements.

- Gauge costs from $22,200 to $81,800, with $50,000 average, to boost home value via new usable square footage.

- Secure funds with a Bank of America HELOC for variable rates, tap a home equity loan or a Capital One personal loan for lump sum and fixed interest.

- Seek permits and meet local codes to avoid delays and bolster buyer confidence, cutting mortgage insurance hassles.

- Upgrade attic insulation to hit Energy Star levels or swap in energy-efficient windows, trim energy consumption and please eco-savvy buyers.

- Mind ceiling height, structural supports and egress requirements before framing walls, to dodge extra costs and nail safety.

- Decorate with a fresh coat of paint in neutral colors, toss in LED recessed lights to light up the new zones.

- Install egress windows and an optional half bath to skyrocket return on investment, boost curb appeal and home value.

Create functional outdoor living spaces

Following the attic or basement makeover, you can boost usable square footage outdoors. Outdoor tweaks can raise home value.

- Install a patio deck to define an entertaining zone. A $12,000 patio can lift curb appeal and spur strong returns on investment.

- Add an outdoor hearth to warm friends and extend your use into cool nights.

- Hang weatherproof lighting for safe paths and a festive vibe under the stars.

- Place durable seating near the hearth or patio to cut home staging costs and invite linger sessions.

- Build a tool locker to tuck away garden gear, free garage room and polish your curb appeal.

- Mount a pergola or awning to offer shade, reduce cooling loads and boost energy efficiency.

- Fit photo-voltaic arrays on a roof, they slash power bills and let you tap a home equity loan at a lower interest rate.

- Set up an outdoor prep station with a grill and sink, they craft a full cooking zone and tempt buyers.

Apply Fresh Paint

Fresh paint breathes new life into tired walls in a flash. Grab a paintbrush, roller, and painter’s tape, then nail crisp edges.

Use neutral colors for a modern appeal

Light grays, soft beiges, or creamy whites make rooms feel open and bright. A neutral palette lets buyers picture their own furniture and art. Paint with Behr Marquee at $43 per gallon for top coverage.

A roller and brush speed the job on wallboard. Interior painting adds curb appeal and boosts home value.

A plain backdrop makes fixtures and tile flooring pop. Neutral hues raise interest and increase home value right away. A fresh coat of paint refreshes any spot before a showing. Many sellers tap home equity loans or personal loans to fund this simple home improvement.

Repaint cabinets or furniture

Just like neutral walls, painted cabinets can set a welcoming tone in your kitchen. You can sand surfaces, wipe on primer, and roll on fresh paint in a day. A roller, brush, and cloth keep floors neat, and chalky hues make old wood sing.

Swap oak or maple for soft white or light gray, they match any style. Swivel cabinet doors open smoothly after new knobs arrive, they add a hint of luxe.

A small spend of 200 to 300 dollars covers all supplies in a DIY budget. Many tackle this job with a single weekend, and you skip costly contractors. A fresh coat of paint on cabinets can boost home value, and it draws praise from buyers.

You might pay with a credit card or tap home equity, for a simple home improvements push. New hardware like stainless steel handles can wrap up this mini kitchen remodel.

Enhance Curb Appeal

Give your front yard a facelift with a swipe from a painting tool and a trim from your yard tool. Swap in bright light bulbs and a new door accessory, and watch smiles bloom down the block.

Maintain landscaping

Mow grass every week to boost curb appeal and increase home value. Edge driveways and walkways to give a neat look. Pull weeds before they spread into beds. Spread a fresh layer of ground cover in spring.

Trim hedges to keep pathways clear. Plant perennials near your door for a lasting pop of color. Store garden tool in a small shed to protect them. You can use a home equity line of credit to add a drip irrigation line, so you save on water bills.

Update your front door and exterior lighting

Replace an old hollow door with a solid mahogany door. A fresh satin paint coat in a warm hue can lift curb appeal. Mount LED fixtures and dusk sensors around the frame, they brighten the path and boost marketability.

Visitors will stop in their tracks, they love the glow.

Many homeowners tap a home equity line of credit or a personal loan to fund this project. Others snag twelve-month, zero-interest credit cards, just check the APR first. Next we will add energy-efficient windows and smart appliances to cut costs and increase home value.

Make Your Home More Energy-Efficient

Swap old single-pane windows for double-pane glass, and you’ll cut heat loss fast. Add PV roof panels and a Wi-Fi thermostat, and watch your bills plunge.

Install energy-efficient windows

Install energy-efficient windows to seal air leaks and block heat loss. You cut energy bills by 7 to 15 percent. You invest $8,000 to $24,000 in the upgrade. Some pick models from Andersen or Marvin for lasting quality.

You fund it with a home equity line of credit or a cash out refinance from Chase or Citi.

These windows boost curb appeal and increase home value. Buyers spot a cozy winter room and a cool summer spot. The upgrade ranks high among home improvements. Many go for a home equity loan or a personal loan from American Express.

Lenders note efficient homes in the real estate market.

Replace old appliances with energy-saving models

You sealed leaks with energy-efficient windows and cut heating expenses. Swap old appliances with energy-saving models to boost home value.

Brands like Whirlpool sell Energy Star ovens, washers, and refrigerators. These units shrink electric bills and bolster curb appeal. Add a smart thermostat, such as Nest or Honeywell, for $175 to $1,000 to trim extra costs.

Upgrade the Kitchen

A kitchen tune-up can boost your home’s value, and stir up fresh buyer buzz. Pop open a home equity line of credit, grab your trusty power drill, and get ready to nail a win.

Replace outdated hardware and fixtures

Swap old knobs and faucets for sleek new pulls. That lift in style can bump home value. Choose brushed nickel or matte black for a fresh look. You need only a drill and screwdriver to install them.

This project often costs under fifty dollars per cabinet.

I helped my aunt pick handles, she felt like a designer. That small tweak felt like a facelift for her kitchen. She even earned praise from her home inspector. Appraisers spot these simple hardware swaps.

They can help you tap into home equity, boost curb appeal, and raise appraisal scores.

Add a backsplash for a fresh look

After replacing outdated hardware, add a tile backsplash for a fresh look. This small kitchen update draws attention to cabinet hardware and revamps the cooking area.

A tile backsplash runs much lower than quartz countertops, which cost $40 to $100 per square foot. You spread mortar with a trowel, press each tile, and wipe grout with a float. This simple change boosts home value and sparks buyer interest.

Install Smart Home Technology

Plug in a smart climate unit and link a mobile app for hands-free comfort. Tweak a video monitor to guard your nest and wow buyers with high-tech flair.

Add smart thermostats

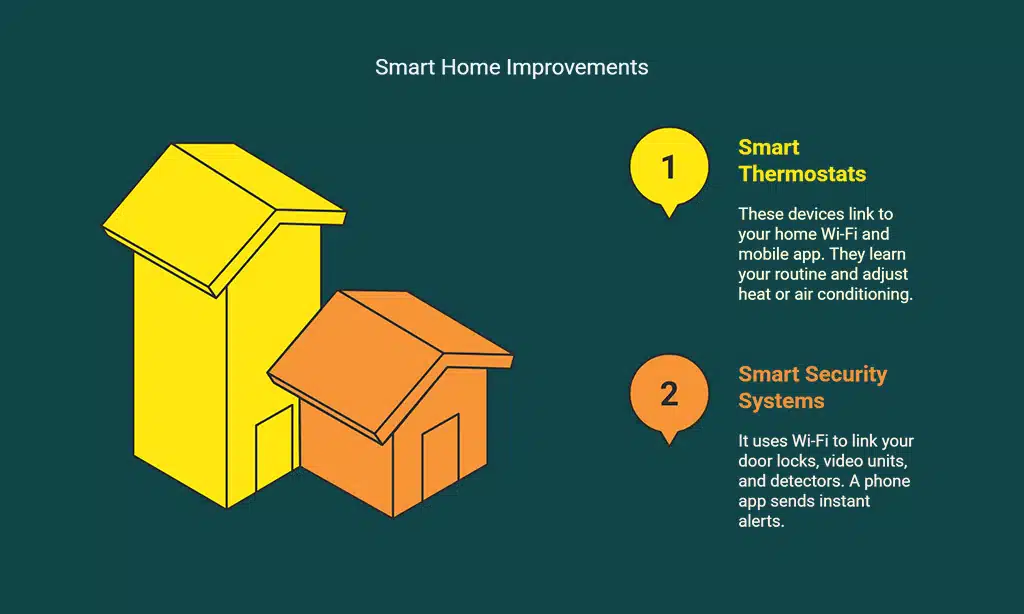

Nest and Honeywell learning thermostats cost $175 to $1,000. These devices link to your home Wi-Fi and mobile app. They learn your routine and adjust heat or air conditioning. That change cuts about 8% off your energy bill.

You save roughly $50 a year.

This small home improvement raises home equity. It also helps increase home value when you sell. You can use a home equity line of credit or a personal loan to fund the upgrade. Up next, learn how to include smart security systems.

Include smart security systems

Add a smart security package to boost home value. It uses Wi-Fi to link your door locks, video units, and detectors. A phone app sends instant alerts.

Many buyers pay more for these home improvements. Houses with smart features can sell for 3 to 5 percent more in a hot real estate market.

Update the Bathroom

Add a fresh mirror and swap your sink faucet for brushed brass, then scan top shower trends with an SEO tool like Semrush. Read on to catch LSI keywords like “spa shower” that draw in buyers.

Replace faucets or showerheads

Minor updates like faucets can refresh a bathroom. Swap out old faucets and showerheads. These home improvements can boost curb appeal and increase home value. You cut water waste with low-flow heads.

You lower heating and cooling costs. Local home inspectors give high marks to working fixtures in the real estate market.

Gather a tightening tool, a turning tool, Teflon tape and a container. Shut off the water supply at the valve. Drain the pipes, then twist off the old fixture. Wrap threads in tape, hand-thread the new piece, and snug it with the tightening tool.

Refresh with affordable upgrades like mirrors

Swap a dated vanity mirror for a framed glass model to add shine and style. That simple home staging trick opens the space and reflects light, so bathrooms feel larger. Pick a mirror with a thin metal frame and mount it with a scanner, level, and power tool.

Spend little but get a high impact boost.

Fresh reflections draw buyer eyes during open house tours and real estate listings. Local contractors command bigger bids if bathrooms look modern. Simple mirror swaps cost little, but they increase home value by adding polish.

Turn to the conclusion for final thoughts.

Takeaways

Your small tweaks can raise home value and grab buyers’ eyes. You can fund these fixes with a cash out refinance or a secured home loan, or tap a line of credit, without emptying your wallet.

You might swap old windows for insulating panes, or add a digital thermostat in the hall. Trim hedges, paint trim, and boost curb appeal in a day. These moves pay off, so make your home shine, and watch its value climb.

It won’t break your piggy bank.

FAQs on Ways to Increase Property Value with Minimal Investment

1. How can I boost home value on a budget?

Start with curb appeal, that first handshake between buyer and house. Mow the lawn, trim hedges, add a fresh paint layer outside or an eye-catching metal roof sign. Swap old handles for new cabinet hardware inside a cooking area revamp. Small home improvements like these pack big punches, and they help increase home value fast.

2. Does a fresh coat of paint or interior painting really move the needle?

Absolutely. A new paint layer on walls lifts dark rooms, it feels like sunlight on a rainy day. Interior painting costs less than major home renovations, yet it can bump up your home value in the real estate market more than you think.

3. Are energy-efficient windows and renewable power arrays worth the spend?

Yes, they are smart bets. Replace drafty panes with energy-efficient windows, boost your insulating value, add a renewable power array to your roof. You slash utility bills and buyers love low energy costs. It’s like putting money back into your pocket.

4. Can I use a personal loan or equity credit line to fund fixes?

For sure. You can tap a personal loan, a house equity loan, or a cash refinance. Home equity lines of credit, or helocs, offer flexible funds for home renovations, like ceramic floor tiles or a new digital temperature control. Just watch interest rates and private mortgage insurance, so costs don’t sneak up.

5. How does more usable square footage help my home’s worth?

More space translates to more value. Finish a basement, build a fire pit, add a storage hut in the backyard. Buyers see room to grow, and that lifts your home value in a hot real estate market. It’s like turning spare space into pure gold.