Are you jumping into the crypto world in Brazil, but feeling lost with all the new rules popping up? It’s like chasing a wild goose, right, especially if you’re an investor worried about taxes, scams, or just keeping your virtual assets safe from fraud.

Many folks face this mess, scratching their heads over how anti-money laundering measures and the central bank fit into their plans for cryptocurrencies like Bitcoin or altcoins.

Brazil kicked things off by passing its first big law on virtual assets back in December 2022, called the Brazilian Virtual Assets Law, or BVAL for short. This law sets up a clear regulatory framework for virtual asset service providers, known as VASPs, who handle exchanges, custody, and transfers of digital currencies.

In this post, we’ll break down 10 ways Brazil is regulating cryptocurrency in 2025, using simple steps to guide you through taxation, token offerings, and even mining operations, so you can invest smarter and dodge those Ponzi schemes.

Get ready for the ride.

Key Takeaways

- Brazil passed Law No 14.478/2022 on December 21, 2022. It sets rules for virtual assets and starts on June 20, 2023.

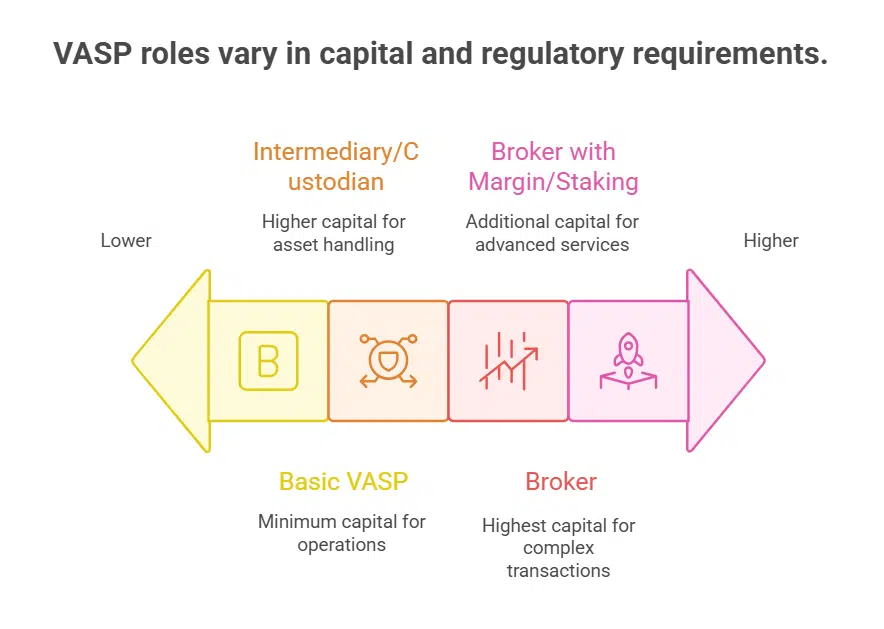

- VASPs need at least R$1 million in capital. Intermediaries or custodians require R$2 million, and brokers need R$3 million.

- The Crypto Travel Rule follows FATF guidelines. VASPs share client ID and asset type for transfers to fight money laundering.

- Cross-border transfers of virtual assets cap at US$100,000. Only BCB-authorized VASPs can handle them.

- Decree No 11,563/2023 from June 13, 2023, gives BCB power over VASPs. It focuses on exchange and custody of virtual assets.

Enactment of the Brazilian Virtual Assets Law (BVAL)

Brazil stepped up its game in the crypto world on December 21, 2022. Lawmakers passed Law No 14.478/2022, the Brazilian Virtual Assets Law, or BVAL for short. This move came after more than six years of heated talks in the Brazilian National Congress.

Imagine lawmakers hashing out details like old friends debating over coffee, and finally agreeing on rules for virtual assets. The law kicked in on June 20, 2023. It sets up a solid regulatory framework for virtual asset services.

Providers now have clear guidelines to follow.

Virtual Asset Service Providers, or VASPs, stand at the heart of this change. They handle tasks like exchange of virtual assets and custody of virtual assets. The BVAL regulates them to boost investor protection and risk management.

Think of it as a safety net in the wild crypto market. Brazil’s Central Bank keeps a close eye on things, much like a referee in a soccer match. This law tackles issues in the foreign exchange market too.

It even touches on anti-money laundering measures, known as AML. Folks in the crypto space, you now play by these new rules.

Establishment of Licensing Requirements for Virtual Asset Service Providers (VASPs)

VASPs act as legal entities in the crypto market. They offer key services, like exchange of virtual assets for national or foreign currency. Providers swap different virtual assets too.

Some handle transfers of virtual assets. Others focus on custody of virtual assets or administration. The Brazilian Central Bank sets strict rules for these virtual asset service providers.

Imagine jumping through hoops to keep things safe, like a goalie blocking bad shots in soccer. VASPs authorized by the BCB provide services as intermediaries, custodians, or brokers of virtual assets.

They must implement Know-Your-Client procedures, you know, to check who’s using the system. Registration with the Brazilian Council for Financial Activities Control comes next. Anti-money laundering measures tie into this, making sure no funny business slips through.

Think of it as a neighborhood watch for the digital asset world.

Minimum thresholds hit R$1 million for paid-in capital and net equity in these operations. Capital requirements climb higher for specific roles. Intermediaries or custodians need R$2 million.

Brokers require R$3 million to start. Add another R$2 million if intermediaries and brokers offer margin accounts and staking transactions. This setup boosts investor protection in the virtual currency space.

Risk management plays a big part, like packing an umbrella before a storm. The regulatory framework demands internal controls to fight financial crimes. Blockchain technology gets a nod here, as providers adapt to these standards.

Prudential regulation keeps everything in check, preventing wild swings in the cryptoeconomy. Decentralised finance fits into this puzzle, with VASPs leading the charge.

Implementation of the Crypto Travel Rule

Brazil steps up its game with the Crypto Travel Rule, folks. This rule comes from the Financial Action Task Force guidelines. It makes virtual asset service providers, or VASPs, share key details during transfers of virtual assets.

Think of it as a safety net, like passing notes in class but with strict rules to catch the bad guys. VASPs now fall under anti-money laundering controls from Law No 9,613/1998. They must register with the Brazilian Council for Financial Activities Control, known as COAF.

Stricter know-your-customer regs kick in to check user identities, no shortcuts here.

Providers give detailed transaction info, including client ID and asset type, for every exchange of virtual assets. This combats the financing of terrorism and keeps the crypto market clean.

Imagine your grandma’s old recipe book, full of must-follow steps to avoid a mess. Brazil’s approach protects investors and builds trust in payment systems. VASPs handle custody of virtual assets with care, following this risk-based approach.

It ties into the broader regulatory framework, making sure no funny business slips through in the foreign exchange market.

Taxation Guidelines for Cryptocurrency Transactions

Brazil develops a tax framework for virtual assets. This setup taxes cryptocurrency transactions fairly. Think of it like keeping score in a game, you track every play to stay honest.

Cryptocurrency companies report earnings and trades to tax authorities. They do this to stop tax evasion. Officials watch capital gains from these deals closely. Collaboration with international regulatory bodies happens now.

It aligns Brazil’s rules with global standards. Picture teams from different countries sharing plays to win against fraud. Proposed Resolution PC No 109 covers virtual asset service providers, or VASPs.

It sets governance measures and security protocols. These steps protect investors in the crypto market. Anti-money laundering, or AML, rules tie in here too. They fight issues like financing of terrorism.

Folks often worry about taxes on electronic currencies. Brazil makes guidelines clear for everyone. You report transactions to avoid penalties. Capital markets and banks get involved sometimes.

Equity crowdfunding and investment funds face similar checks. Officials look at intangible assets in these reports. They prevent non-compliance in the foreign exchange market. Monetary authority leads this effort.

It builds trust in payment systems. Cryptocurrency mining operations must follow too. They report earnings to stay legal. This keeps the system fair for all players.

Regulation of Tokenization and Token Offerings

Tokenization turns real-world assets into digital tokens on a blockchain, like slicing a pie into shareable pieces. Brazil handles this with care through its regulatory framework. The Brazilian Central Bank, or BCB, steps in to oversee token offerings, much like a referee in a soccer game.

They exclude certain items from rules under PC No 109. Think about non-fungible tokens, or NFTs; those stay out of BCB regulations. Financial instruments in tokenization processes get the same pass.

Instruments that give access to specific products or services, say loyalty program rewards, fall outside the virtual assets definition too. Representations of assets under existing laws, like securities under Brazilian Securities Law, avoid the virtual assets label as well.

This setup protects investors while letting innovation flow. You see, it’s like building a fence around a playground; safe play inside, wild stuff outside. Specific actions need prior approval from the BCB.

Developing new activities counts as one. Changing control in virtual asset service providers requires that nod too. This keeps the crypto market steady. Exchange-traded funds, or ETFs, might tie into this if tokenized.

Initial coin offerings, or ICOs, face scrutiny here. The goal? Solid risk management and investor protection.

Imagine tokenization as turning your grandma’s old recipe into a digital cookbook everyone can buy shares of. Brazil’s rules make sure it’s fair game. Virtual asset service providers, or VASPs, must follow guidelines on issuance and custody of virtual assets.

They handle token offerings with anti-money laundering measures in mind. Combatting the financing of terrorism fits right in. Think of it as a treasure hunt with maps checked by authorities.

Public consultation helps shape these rules, gathering input like friends voting on pizza toppings. The BCB oversees the foreign exchange market ties to tokenized assets. Brazilian capital abroad gets watched closely.

This links to payment systems and electronic money. Securities law overlaps with tokenization, especially for assets like exchange-traded funds. Initial coin offerings need to align with corporate governance standards.

Fraudulent schemes get cracked down on hard. Investments in tokenized forms face taxation guidelines. Banking and insurance sectors eye these developments. Mergers and acquisitions involving tokenized entities require BCB approval for control changes.

Financial intelligence units monitor for proliferation risks. Virtual currencies in token form aren’t legal tender, but they spark estate planning talks. Inheritance taxes might apply to tokenized holdings.

Probate law could come into play for digital estates. A master’s degree in law might help handle this, or even a master of laws degree for more in-depth exploration. Contractual agreements support token offerings.

The crypto market thrives under this watchful eye.

Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) Measures

Brazil fights dirty money in the crypto market with smart rules. The Brazilian Virtual Assets Law, or BVAL, changed Law No 9,613/1998. It added virtual asset service providers, those VASPs, to the list of groups under anti-money laundering controls.

Think of it like a watchdog sniffing out bad deals in the exchange of virtual assets. VASPs now must use Know-Your-Client procedures, you know, KYC, to check who their customers are.

They provide details on transactions, like client ID and the type of virtual asset involved. This keeps the custody of virtual assets clean and safe from criminal tricks.

Final rules from the Brazilian Central Bank aim to shield investors and boost market integrity. They also spark innovation in the regulatory framework. Picture VASPs as gatekeepers in the foreign exchange market, blocking terrorism financing through AML/CFT measures.

Brazil wants to protect Brazilian capital abroad while managing risks in payment systems. Folks, it’s like locking the barn door before the horse bolts, keeping the crypto market honest and fun for everyone.

Comissão de Valores Mobiliários watches over this too, making sure virtual assets don’t get taxed by shady moves.

Restrictions on Cross-Border Transfers of Virtual Assets

The Proposed Resolution PC No 111 sets rules for virtual asset service providers in the foreign exchange market. It covers activities like international payments and transfers using virtual assets.

View this as a gatekeeper, folks, keeping things safe in the crypto market. Only Brazilian Central Bank-authorized VASPs can handle these foreign exchange market tasks. They protect investors and manage risks in payment systems.

This setup acts like a sturdy fence around Brazilian capital abroad. VASPs face a strict limit of US$100,000 on payments or international transfers through virtual assets. Imagine trying to move a mountain with just a shovel; that cap keeps things in check.

VASPs must share detailed transaction info for cross-border transfers, boosting anti-money laundering efforts. They handle exchange of virtual assets and custody of virtual assets with care.

Think of it as spilling the beans on every deal to avoid shady business. The regulatory framework grew from public consultation, making sure voices get heard. It ties into combating financing of terrorism measures too.

Authorized providers follow these steps to trade electronic currency safely. This approach builds trust in the crypto market, like a reliable old friend watching your back.

Oversight by the Central Bank of Brazil on Crypto Activities

Brazil’s Central Bank, or BCB, now holds the reins on crypto oversight. They got this power from Decree No 11,563/2023 on June 13, 2023. This decree lets them regulate virtual asset services and virtual asset service providers, known as VASPs.

Imagine the BCB as a watchful coach, keeping the crypto game fair and safe. They focus on the exchange of virtual assets and custody of virtual assets. In November 2024, the BCB ran three public consultations on proposed rules.

Folks shared ideas, like chatting over coffee about the best plays in the crypto market. These talks aim to boost innovation and match global standards.

The BCB pushes for strong risk management in the regulatory framework. They eye anti-money laundering measures, or AML, to fight shady deals. Final rules will soon clarify paths for VASPs in payment systems.

You see, they held multiple public consultations to gather views, making sure investor protection stays top-notch. Think of it as building a sturdy fence around the foreign exchange market and Brazilian capital abroad.

This setup helps everyone play by the rules without tripping over hidden traps.

Legal Framework for Mining Operations

Brazil sets clear rules for crypto mining, folks. Think of it like planting seeds in a garden, but with computers solving puzzles to create virtual assets. The government demands that miners follow a solid regulatory framework.

They must register as virtual asset service providers, or VASPs, to keep things legit. This step boosts investor protection and cuts down risks. Miners handle the creation of these digital coins, so anti-money laundering measures kick in strong.

You see, it’s all about keeping the bad guys out, like locking your front door at night.

Picture a miner in Sao Paulo firing up rigs; now Brazil’s central bank watches close. They enforce reporting obligations for all mining ops. This ties into the foreign exchange market rules too.

Miners can’t just send virtual assets abroad without checks. Risk management becomes key here, almost like wearing a helmet on a bumpy ride. Public consultation helped shape these laws, making them fair for everyone involved.

Custody of virtual assets gets strict oversight, so no funny business slips through.

Reporting Obligations for Cryptocurrency Transactions

Cryptocurrency companies report earnings and trades to tax authorities. They do this to stop tax evasion. Virtual asset service providers, or VASPs, share detailed transaction info.

This includes client ID and asset type. Think of it like keeping a clear ledger, so no one hides in the shadows. Only Central Bank of Brazil-authorized VASPs handle foreign exchange market activities.

They keep investor protection strong.

VASPs maintain minimum thresholds for paid-in capital and net equity. These sit at R$1 million. Such rules build a solid regulatory framework. Imagine VASPs as guardians of virtual assets, watching over exchange of virtual assets and custody of virtual assets.

They focus on anti-money laundering (AML) measures too. Risk management stays key in this setup. Public consultation helped shape these steps for Brazilian capital abroad.

Takeaways

Brazil shapes the future of virtual assets with smart rules. Think of it as building a sturdy bridge over wild waters, keeping everyone safe while letting innovation flow. VASPs now follow strict guidelines, from licensing to anti-money laundering checks.

This protects investors and curbs risks in the foreign exchange market. Stay alert, folks, as these changes evolve fast.

FAQs on Ways Brazil Is Regulating Cryptocurrency

1. Hey, what’s the big idea behind Brazil regulating virtual assets in 2025?

Brazil steps up to tame the wild west of crypto by defining virtual assets as digital goodies that folks trade or hold, like hidden treasures in a vast ocean, all to keep things fair and square for everyone involved.

2. So, how are virtual asset service providers (VASPs) getting the squeeze in Brazil?

VASPs, those folks handling the exchange of virtual assets or custody of virtual assets, must now jump through hoops to register and follow strict rules. It’s like putting a leash on a frisky pup to stop it from running amok in the neighborhood.

3. Tell me, friend, does Brazil care about anti-money laundering (AML) with all this crypto buzz?

Oh, you bet; Brazil weaves anti-money laundering (AML) checks right into the fabric of crypto dealings to sniff out shady business. This move acts like a vigilant watchdog, barking at any funny money trying to slip through. Plus, it ties in with the foreign exchange market to track Brazilian capital abroad, making sure no one’s playing hide and seek with funds.

4. What about investor protection in Brazil’s crypto rules for 2025?

Investor protection stands front and center, shielding folks from crypto pitfalls like a sturdy umbrella in a storm, especially when dealing with virtual asset service providers.