The debut of World Liberty Financial’s token, WLFI, drew global attention on September 1, 2025, as one of the most high-profile cryptocurrency launches in recent years. The project carries the Trump family’s name, making it not only a financial product but also a political and cultural flashpoint.

The launch began on a strong note, with WLFI trading above $0.30 in early sessions. But optimism quickly turned into volatility. Within hours, the token slid nearly 12–15%, dipping to $0.246 by mid-afternoon, according to real-time market data from CoinGecko. Despite the decline, WLFI still commanded a massive market capitalization of nearly $7 billion, instantly ranking it as the 31st-largest crypto token worldwide—a rare feat for a first-day listing.

Why the Token Was Allowed to Trade Now

WLFI was first distributed in 2024, but unlike typical cryptocurrencies, investors couldn’t immediately trade them on open markets. Instead, the tokens functioned as governance tools, granting holders the ability to vote on issues such as code changes and business proposals.

In July 2025, investors voted to make WLFI tradable, a move that fundamentally changed the project’s direction. The vote opened the door for exchanges to list the token and for investors to speculate on its price.

World Liberty Financial allowed early investors to sell up to 20% of their holdings on launch day. This partial unlock was designed to give liquidity without overwhelming markets, but analysts say it also created immediate selling pressure, which contributed to the price drop.

Trump Family’s Billion-Dollar Crypto Windfall

The Trump family is at the center of World Liberty Financial’s business model. According to documents reviewed by Reuters and The Wall Street Journal, President Donald Trump and his family are set to receive 75% of the project’s net revenue.

With WLFI’s public debut, the family’s paper wealth surged overnight, reaching between $5 billion and $6 billion based on circulating supply and trading price. This new valuation is in addition to an estimated $500 million the Trumps have already earned since World Liberty’s launch through token sales, partnership deals, and affiliate arrangements.

This staggering windfall makes the Trumps one of the wealthiest families in the global crypto sector. For comparison, it places them in the same wealth bracket as founders of major blockchain companies like Ethereum and Binance.

Exchanges and Backers Drive Visibility

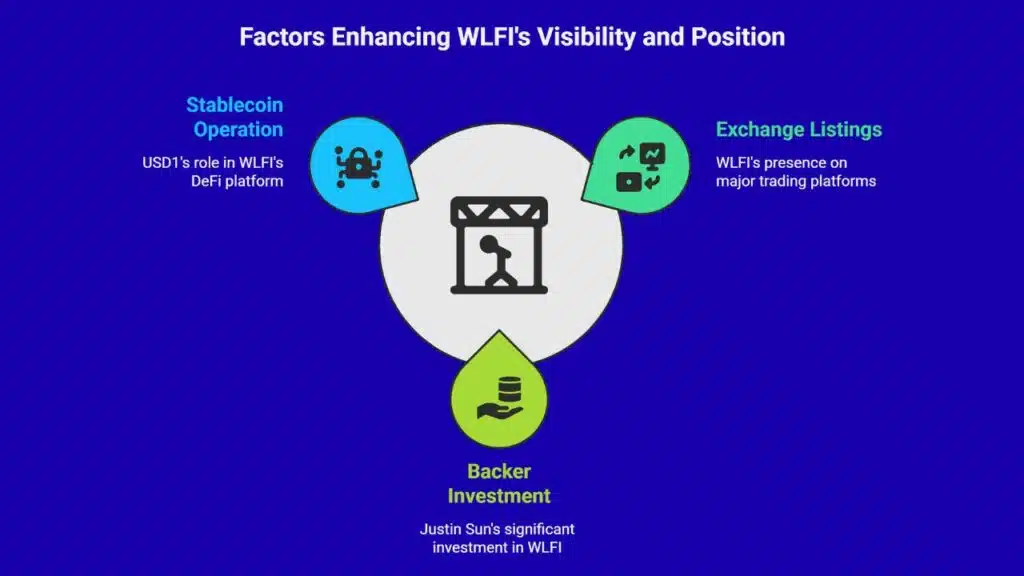

WLFI’s debut was boosted by listings on some of the world’s biggest trading platforms, including Binance, OKX, and Bybit. These exchanges bring immediate exposure to millions of retail and institutional traders.

The project also attracted backing from influential figures in the crypto community. Reports from the Financial Times highlight that Justin Sun, founder of the Tron blockchain, invested $75 million into WLFI and committed to hold rather than sell his stake—signaling long-term confidence.

World Liberty Financial also operates a stablecoin, USD1, marketed as a reliable digital currency pegged to the U.S. dollar. This combination of governance tokens and stablecoin services positions the company as a decentralized finance (DeFi) platform, offering more than just speculation.

Investor Sentiment: Betting on the Trump Brand

For many investors, WLFI’s primary appeal lies less in its technology and more in its connection to Trump. Early token buyers told Reuters that they believed the Trump name would drive adoption, influence regulation, and sustain market value.

Unlike typical crypto projects that attract investors through technical innovations, WLFI has largely thrived on the promise of political celebrity and the expectation that Trump’s involvement would raise its prestige.

Analysts note that while this brand-driven strategy has delivered initial hype, it also exposes the token to extreme volatility. Political events, legal developments, or changes in Trump’s public image could directly affect WLFI’s price.

Ethical and Regulatory Concerns

World Liberty Financial’s rapid rise has not escaped scrutiny. Democratic lawmakers and ethics watchdogs argue that the Trump family’s direct involvement in a financial venture—while Donald Trump is in office—creates serious conflicts of interest.

Critics warn that Trump’s role in shaping U.S. crypto regulations could intersect with his family’s personal financial gains. Some argue that this undermines the fairness of policymaking and raises the risk of self-enrichment through public office.

The White House, however, has pushed back strongly. Officials maintain that Trump’s assets are controlled through a family trust, managed by his children, and that there is no direct conflict of interest.

The Road Ahead: Speculation vs Sustainability

Making WLFI tradable opens a new era for the project. With price discovery now in the hands of global traders, the token will face intense speculation, generating profits and losses daily.

At the same time, the project’s success depends on whether World Liberty can evolve beyond hype and deliver sustainable products, such as its stablecoin ecosystem and DeFi services.

Crypto analysts caution that while WLFI’s $7 billion debut market cap is impressive, its long-term survival will hinge on utility, adoption, and regulatory clarity. Without those, the token risks being remembered as a political spectacle rather than a lasting innovation in digital finance.

The Information is Collected from NYTimes and CNBC.